When PayPal spun-off from eBay in the summer of 2015, it wasn’t obvious that it would become a $350B mega-cap in six short years.

At the time, Rebecca Borison reported on the spin-off for TheStreet.

Of PayPal, she reported:

ITG analyst Steven Weinstein is a little hesitant to get in on PayPal just yet, given the heated competition in the digital payments space. He thinks “there’s a lot of optimism already baked into the company’s outlook,” encouraging [investors] to “wait and see” how things play out.

Of eBay, she reported:

J.M.P. Securities analyst Ronald Josey noted in a research note that a “fair value” for eBay shares is in the high $20 range, meaning that today may be a good entry point for the stock. Josey rates eBay shares “Market Perform.”

Well, how have they performed?

Whoops.

By all measures PayPal has been the unquestioned winner.

On its sixth anniversary of a public company, PayPal had very clearly soared past eBay.

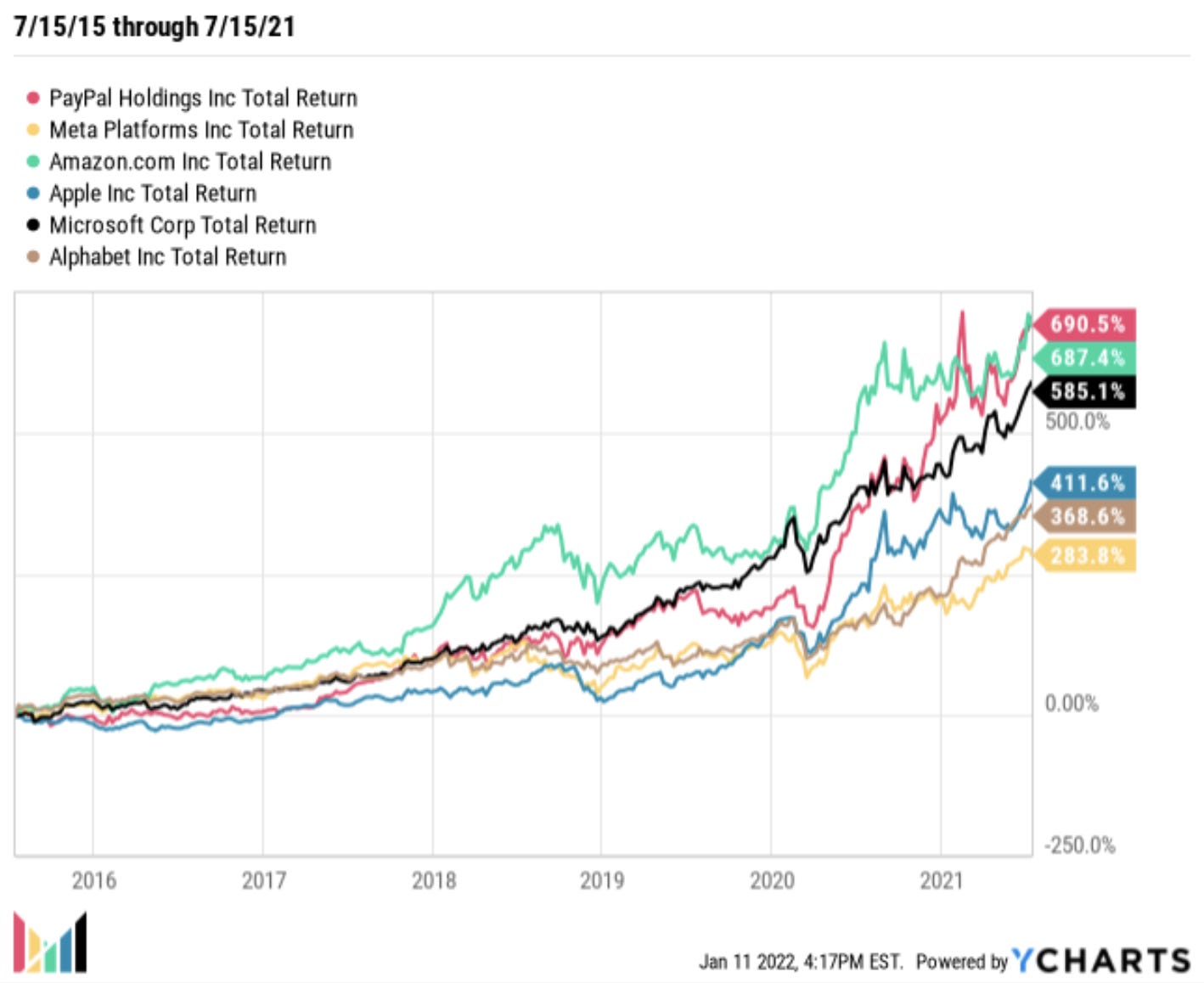

And not just eBay. PayPal also came out ahead of FAAMG.

But these returns only take us to July 15, 2021.

Since then, PayPal has taken a bit of a haircut.

That $350B valuation now hangs on for dear life just above $200B.

What’s going on here? Is PayPal still a winner? And does it deserve a spot in our portfolios?

Let’s get into it.

Thanks to everyone for joining me on this exploration of PayPal. If you’re new here, please feel free to sign up to receive Deep Dives, Memos and more in your inbox. If you’re a regular, thanks for being part of this journey. Feel free to forward this along to a friend!

1. The Business

PayPal is a simple business.

Grow the pie. Take a cut.

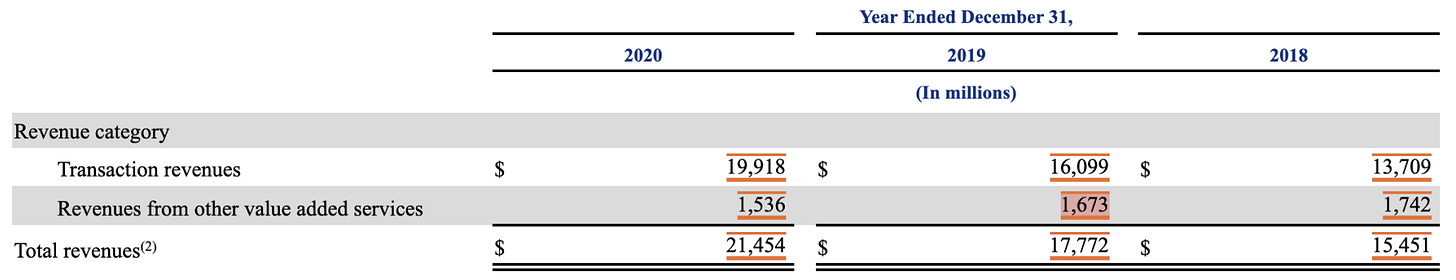

More than 90% of revenues are transaction revenues.

Transaction revenues are:

Net fees charged to merchants and consumers on a transaction basis primarily based on the Total Payment Volume (TPV) completed on our Payments Platform. Growth in TPV is directly impacted by the number of payment transactions that we enable on our Payments Platform.

Simple.

In the six full years that PayPal has reported financials, PayPal has grown TPV from $288B to $1T.

By comparison, in 2020, Square processed $112B in Gross Payment Volume. Additionally, Shopify processed “just” $120B of Gross Merchandise Volume across their stores. The point is: One Trillion Dollars is a big number.

The TPV figure is representative of a solid business, that consistently grows revenues between 15 and 20%.

Just grow the pie, and the rest will follow.

PayPal has two core levers to pull:

Grow the number of people on the platform (Active Accounts)

Grow the transactions they process (Total Payment Volume)

Again, a simple business.

In PayPal’s most recent quarterly investor update, here’s how they reported Q3 2021’s Key Metrics.

That second lever appears in good shape, as the Y/Y growth in TPV is as expected. But what about that first lever, that deceleration in Net New Active Accounts (NNAs)? Down 12% Y/Y? Not great.

PayPal broke out the last six quarters for us:

Here’s CEO Dan Schulman discussing Net New Active Accounts on November 8th’s Q3 2021 Earnings Call.

Well, let me talk a little bit about NNAs. So 13.3 million in the quarter, up about 2 million from last quarter, growing 15% year-over-year…

…We are putting on 1.5 consumers every second of the quarter, every 6 seconds we put on another merchant. It’s really unbelievable. And if I look 5 years ago… we put on 13 million Net New Actives for the year. This quarter alone [we added 13 million], and we put on 110 million Net New Actives since January of 2020. And as we said… we expect to end the year north of 430 million actives on the platform. So obviously, continued strong growth.

Now seems like a good time to mention that early last year, PayPal announced they were targeting 750 million active accounts by 2025.

Here’s CEO Dan Schulman again on the call:

…As we look forward to that 750 million… there are two places that our Net New Actives come from: One is top of the funnel, and top of the funnel is actually pretty strong right now and remains so. It’s a kind of a must-have platform for merchants and consumers, and scale begets scale in this business.

…If we can keep a consistent top of the funnel, maybe even improve that a little bit, but reduce our churn rate, you’ll start to see Net New Actives actually accelerate going forward. And so we remain still quite confident in the 750 million.

I still don’t love the Q3 ‘20 to Q3 ‘21 deceleration in Net New Active Accounts, but it’s something we can probably throw away. Y/Y comps are generally weird when starting in 2020 (read: Covid). Of course Q2/Q3 2020 numbers were inflated! And if you zoom out, Y/Y growth in Active Accounts remains strong.

Additionally, PayPal’s Payment Transactions are still growing 20%+ Y/Y, while Transactions Per Active Account (TPA) Y/Y growth are also accelerating.

Again, if we zoom out, growing engagement has been a strength for PayPal.

Grow the pie. Take a bigger cut.

2. Products Explained

While the levers PayPal can pull are simple, in truth, the business itself is quite complicated. Here’s how PayPal illustrates their business:

There’s a lot going on here! And they’re either building or acquiring the products to support this ecosystem.

In fact, PayPal refers to themselves as a Family of Brands, laid out here:

A few highlights:

1) Braintree — Acquired in 2013 for $800M, Braintree powers the payments backend of some of your favorite apps.

As these brands grow, transactions processed and TPV grows.

2) Venmo — Braintree acquired peer to peer payments app Venmo is 2012 for $26M. Here’s Venmo’s Total Payment Volume to date:

Live shot of PayPal executives when they scooped up Venmo during the 2013 Braintree acquisition:

3) Zettle — PayPal acquired Swedish Point-of-Sale (POS) player iZettle in 2018 for a cool $2.2B. Insider Intelligence reported that “at the time, the Sweden-based startup had 500,000 merchants and operated in 12 countries throughout Latin America and Europe, where much of its business still exists today.”

Zettle just launched in the U.S. in Q2 this year.

At the time, on the Q2 Earnings Call, Dan Schulman noted:

We rolled out Zettle in the U.S. [It’s] a really beautiful full package. It doesn’t just include card reader, but inventory management, sales reads out, and allows a merchant to seamlessly load inventory in both their online and in-store locations and then across multiple channels as well.

While these acquired brands have become integral to PayPal’s success, PayPal is also building new products to hit their 2025 goals. In addition to those 750M Active Accounts by 2025, PayPal is aiming to hit $50B in revenue and $10B in Free Cash Flow.

To get there, PayPal is developing new products, like Crypto and Buy Now, Pay Later offerings.

They introduced buying and selling of crypto (just OGs like Bitcoin, Ethereum and Litecoin) in late 2020.

And then the ability to checkout using crypto in 2021.

PayPal’s “Buy Now, Pay Later” feature (dubbed “Pay in 4” in the U.S.), launched in Q3 2020.

In no time at all, in Q4 2020, it already saw meaningful traction.

At the J.P. Morgan U.S. All Stars Conference on September 23, 2021, Dan Schulman spoke about “Buy Now, Pay Later.”

On decision to build vs. buy:

We’ve spent a lot of time looking at Buy Now, Pay Later. We looked at a host of different acquisitions as well versus an internal build, which we opted to do, as opposed to spend tens of billions of dollars to buy something. Our internal development teams now are quite good and put together a product that is probably the fastest-growing introduction of any product we’ve ever had.

On engagement:

Our second quarter TPV was up 50% over our first quarter of TPV. I think we did $1.5 billion in Q2. We’ve got 7 million-plus customers, consumers using it over 20 million times. So the repeat rate is quite high.

On the customer value proposition to merchants:

One of the nice things about having scale and having a whole host of different ways that you can make money is we felt like we didn’t need to charge the merchant anything additional to install Buy Now, Pay Later. Most others can charge 2%, 3%, 4%. Ours is free to the merchant.

On the customer value proposition to consumers:

We also wanted to eliminate consumer late fees, which is a huge consumer value proposition. If you look at the business models of a lot of the other Buy Now, Pay Later players, the majority of their revenues come from that. We wanted to have a value proposition that was clearly going to be the best in the market.

On the opportunity:

I think there’s a tremendous opportunity to Buy Now, Pay Later… I really think Buy Now, Pay Later is disaggregating the purchase from the way you pay… Now you can make a purchase and you can determine post that purchase how you want to pay for it… And to me, that’s very exciting.

This all leads to PayPal’s Super App.

Dan Schulman spoke at length about the Super App in his remarks at last year’s Investor Day.

He explained:

What a Super App wants to do, is turn all [these] separate apps into a connected ecosystem where you can streamline and control data and information… all of your financial services can all come together where you create a simple way… to enable, to pay, and to track transactions across all touch points. Then you have this common platform and common data that allows machine learning and artificial intelligence to kick in and give personalized recommendations to those consumers.

The Super App began rolling out to U.S. users in September.

Here’s a promo video for it that dropped in October.

The Super App can look and sound great, but is it great? Will it be?

Enlightened Capital has done some excellent work on PayPal.

Here he is unearthing Tom Noyes’ post on the challenges PayPal faces with the Super App:

And again finding J.P. Morgan’s optimistic take:

We’ve been anxious to see if PayPal can address the challenges of clutter and surfacing relevant products, and we like their approach of introducing separate “tabs,” with a wallet tab (e.g., manage payment instruments including rewards and direct deposit), finance tab (e.g., savings, crypto management), deals (including BNPL), and a payments hub (P2P, bill pay, gifting, remittances, messaging), all against a personalized dashboard of a user’s PayPal account to find bills and balances.

It’t not yet clear how PayPal’s Super App will perform, but the opportunity is massive.

At the Wolfe Research Virtual Fintech Forum on March 9, 2021, Dan Schulman remarked:

We obviously are a very different company than we were three or even five years ago when we were predominantly P2P [Peer to Peer] and online checkout. We’ve got a full suite of products and services. And so we think when we look over the next five years the opportunity is clearly much greater than the past five years, which obviously have been very good for PayPal. But we’re positioned in a whole different place. Our tech stack is in a whole different place. Our talent is in a different place.

While the PayPal’s product suite is robust, there’s obviously a lot riding on the Super App to hit those 2025 goals.

3. Venmo

There’s one product that deserves special attention. Venmo, the little engine that could, lumped into the 2013 acquisition of Braintree.

In eBay’s announcement of the acquisition, they wrote:

Venmo, Braintree’s mobile application that gives people an easy way to pay each other using their mobile devices and leveraging social networks, is part of the acquisition and will help to contribute to PayPal’s mobile payments capabilities. PayPal already has a strong presence in mobile, projecting mobile payment volume of more than $20 billion this year.

Just eight years later, Venmo will do $240B in payment volume. Pretty good.

Average Revenue Per User is a metric I like a lot. It’s often used to track social media and ad-based businesses. I spoke about ARPU at length in the DigitalOcean Deep Dive.

ARPU is not a metric I’ve heard PayPal discuss specifically. Although, they clearly highlight it as an opportunity with Venmo. See this slide from last year’s Investor Day Presentation:

To date, Venmo’s ARPU significantly lags rival Square/Block’s Cash App.

Why is that?

Well, we’ve covered that PayPal has begun integrating crypto.

What about trading stocks?

Bingo.

Jason Kupferberg, Senior Equity Research Analyst at Bank of America, spoke to these new features, cited here.

We expect these features will drive continued strong growth in Venmo users, and accelerate growth in average revenue per user (ARPU) over the coming years.

The punchline is that in our base case, we estimate total active Venmo users could reach 120M in 2023 (up from 76M as of 2Q) and that ARPU for Venmo could reach $19.92, reflecting a ~30% CAGR (compound annual growth rate) from 2020-2023. That would imply total Venmo revenues of $2.4B in 2023 (6% of total revs), versus the expected ~$900M in 2021 (~3.5% of total revs).

Not bad.

Earlier in the summer, Alex also shared Credit Suisse’s Venmo ARPU model.

No matter how you slice it, the pie of users is growing. And the monetization of those users is improving.

On November 8th’s Q3 2021 Earnings Call, Dan said of Venmo:

Venmo continues to achieve milestones and break records and is on track to deliver $900 million in revenue this year. With more than 80 million customers and $240 billion in run rate TPV, Venmo’s scale is on par with PayPal’s entire U.S. franchise in 2016. Venmo’s customers are adopting more and more products, and we are seeing accelerating momentum with our new product introductions.

And what about growing that user base? In Q3’s Investor Presentation, PayPal announced two new partnerships for Venmo.

And a big one.

Here’s Dan again on the earnings call:

The big news today is that for the first time, we are teaming up with Amazon to enable customers in the U.S. to pay with Venmo at checkout. Starting next year, customers will be able to make purchases on amazon.com and the Amazon Mobile Shopping app using their Venmo accounts.

One more time, Dan:

This is obviously a very significant moment in our Venmo monetization efforts and marks the beginning of an exciting journey with Amazon.

4. Behind the Numbers

Famed Billionaire and Hedge Fund Manager Leon Cooperman once said:

If you don’t have the free cash flow, you don’t have anything.

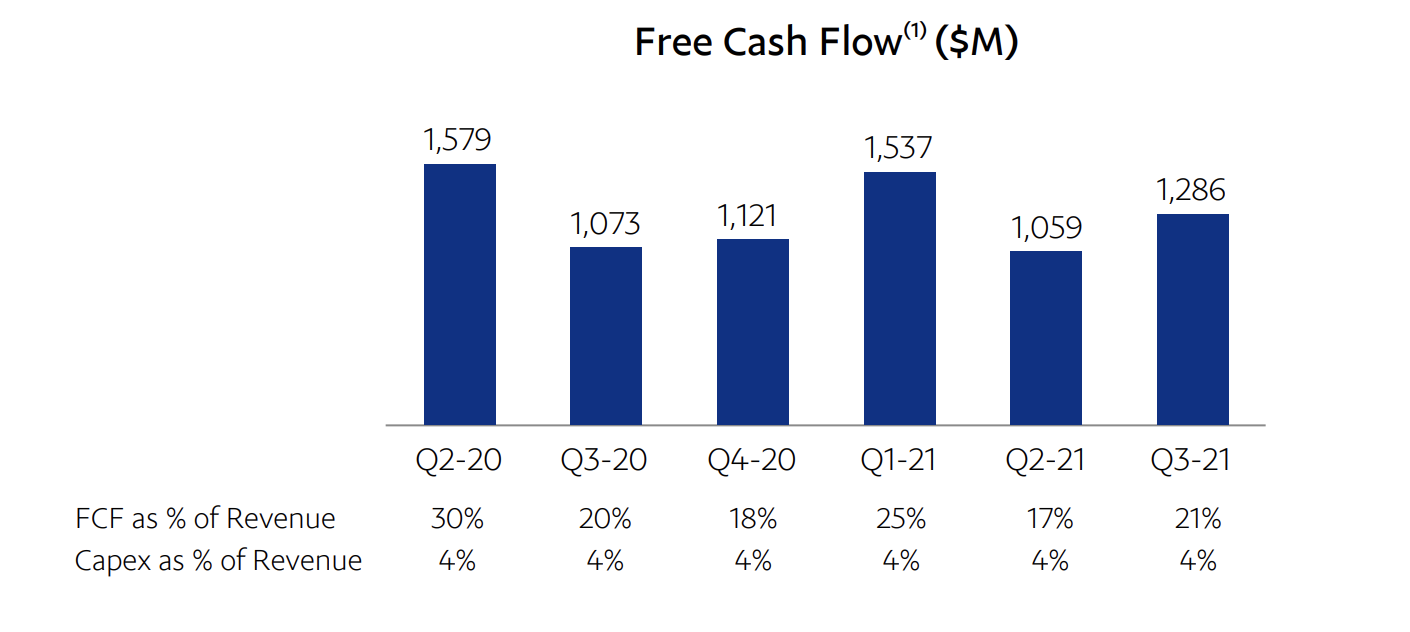

Can PayPal achieve their stated goal of $10B in Free Cash Flow by 2025?

In the last four quarters, they’ve managed to get halfway there, reaching $5.003B.

Zooming out a little further, we don’t see the kind growth that necessarily suggests $10B in FCF in such short time.

But that doesn’t mean Free Cash Flow isn’t strong. Enlightened breaks it down for us.

Additionally, FCF is consistently around 20% of revenues.

How does that compare to other payments giants?

Holy cow, Visa!

Square/Block recording Bitcoin revenue interferes with all sorts of valuation metrics. So a lot of smart people like using Enterprise Value to Gross Profit when looking at these companies.

Right now, their EV/GP are all within 15% of each other. But that’s not always the case. Square/Block is clearly the most volatile, taking the cake for the highest highs and lowest lows of the last three years.

Like all metrics, however, these have to be taken in greater context.

Enlightened is onto something. Perhaps, rather than looking at the absolute number, it could be helpful to look at the percentage change. Since hitting an all-time EV/GP high of 35.4x in February, by this metric, PayPal’s valuation has been cut in half.

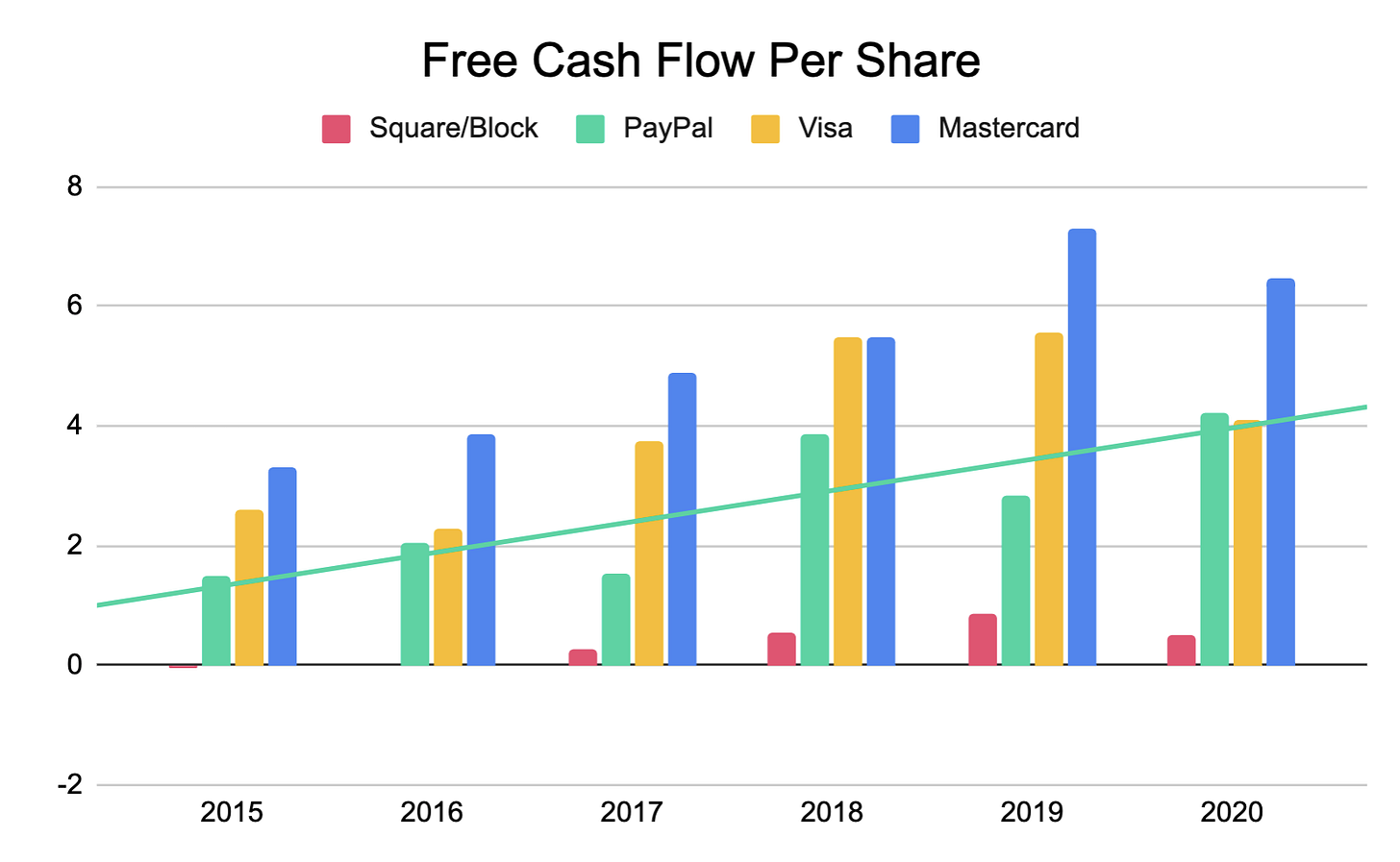

But if we continue through Enlightened Capital’s point, let’s look at simple earnings and free cash flow generation.

Over the last six years, Free Cash Flow Per Share growth is strong.

As is Earnings Per Share.

(In other news, boy are Visa and Mastercard killing it.)

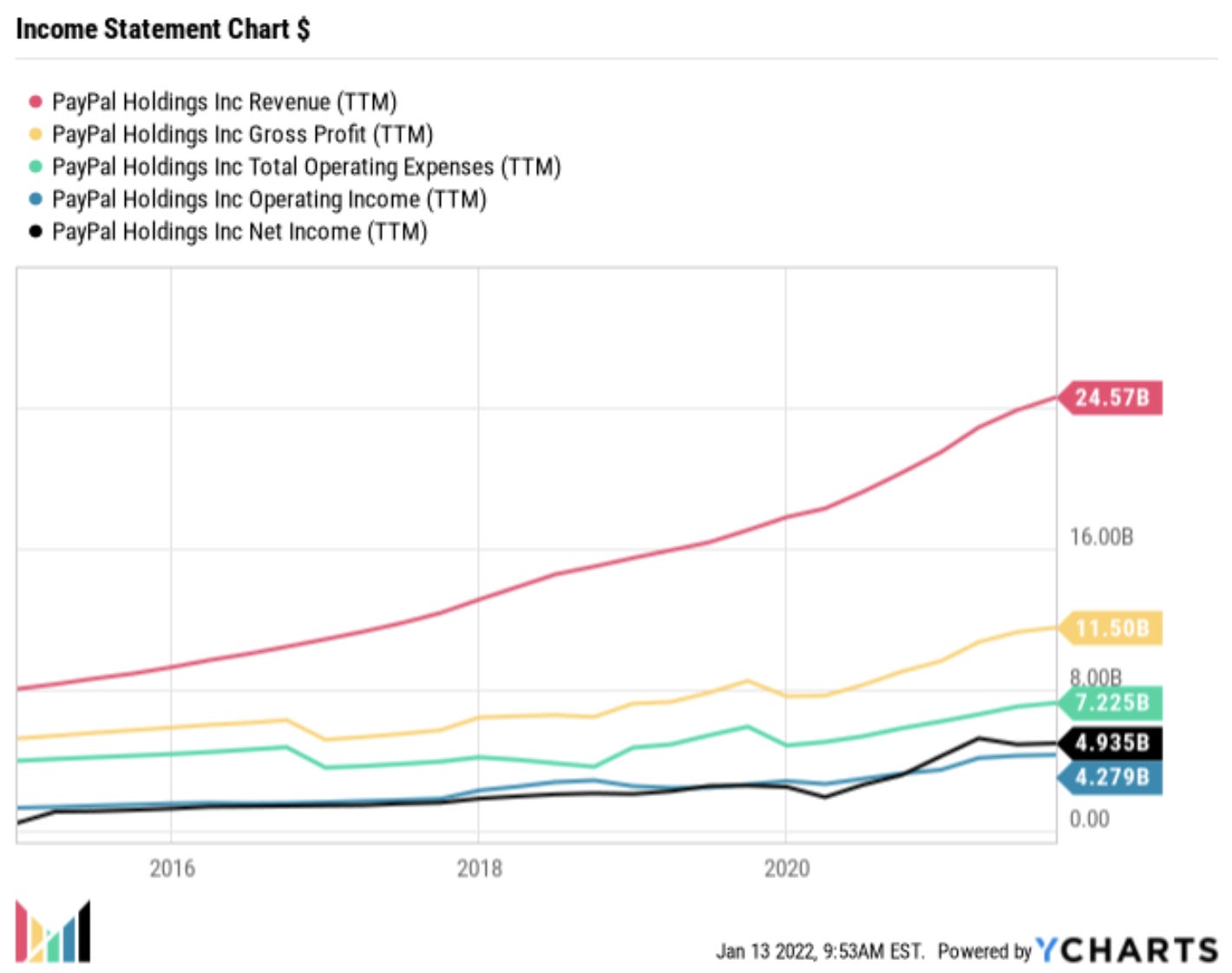

If we take a step back and chart some metrics from the Income Statement again, we see PayPal’s growth.

What I like most about this chart, however, are not the absolute numbers, but rather the percentage changes.

We see that Net Income and Operating Income are growing the fastest, far outpacing the percentage growth in expenses. That’s a healthy business. Here’s the chart again if we remove Revenue and Net Income (which is an obvious outlier, partly due to starting at a low amount).

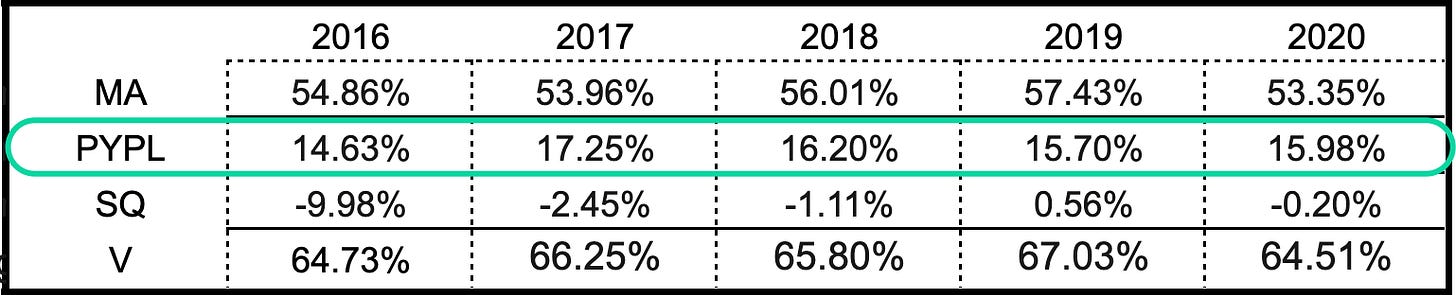

Furthermore, margins are where you might expect. Far better than Square/Block, yet not nearly as pristine as Visa and Mastercard.

Operating Margins:

Gross Margins:

In fact, PayPal is the only one of the four that showed margin improvement in the most recent Y/Y (although, again, 2020 is weird for comps).

I don’t know about you, but I can’t imagine there are too many businesses growing 20% per year, generating $1B+ in Free Cash Flow per quarter, with this margin profile.

In fact, there are just ten.

Could 38% off all-time highs be an incredible buying opportunity?

5. The End

I own Adyen (Deep Dive here). I own Visa. I own Coinbase (spoke about initiating a position in Memo #9). I own Square. I own PayPal. This feels like a lot in the Payments/Fintech basket. Can they all really be best ideas?

On the other hand, the payments ecosystem is enormous. It’s not like payments is some niche industry.

Every company touches payments in one way or another. Maybe loading up in a “Payments/Fintech” basket is the right approach.

There are also legitimate concerns. What if the Super App doesn’t work as expected? What if Net New Actives continues to decelerate? What if PayPal can’t hit their 2025 targets, specifically the $10B in Free Cash Flow?

If anything, I’ve soured a bit on Square/Block during this exercise. And have been in awe of Visa and Mastercard.

PayPal is no slouch, however. It’s been a monster compounder since 2015.

And it’s trading at its average multiple of the last four years.

This follows the same route as Visa and Mastercard.

They are all reverting to the mean.

I think it’s unlikely we see that March 23, 2020 low of EV 5.3x Revenues again anytime soon. I think we can also agree that the February 16, 2021 high of EV 16.45x Revenues was also pretty steep. I believe 8x is reasonable, if not quite good.

I’m not alone.

But it’s certainly not unanimous.

With that being said, I think there are a few bulls worth paying extra attention to: Enrique Lores, David Dorman, and John Donahoe.

(H/T to @Clueless_1337 for putting this on my radar.)

The amounts may be immaterial, but the spirit here is the point.

Apart from a purchase in 2017, relevant insider buying at PayPal kicked up in November for the first time ever.

Enrique Lores, CEO of HP, was appointed to the PayPal Board in June 2021.

David Dorman, Chairman of CVS, has been on PayPal’s Board since June 2015.

John Donahoe, CEO of Nike, has been Chair of PayPal’s Board since July 2015.

Again, the point here is not the amounts. The point is that three high-profile people, that know their way around a public company or two, have started buying shares for the first time ever. They know more about PayPal than any of us and they are buying. That has to count for something.

I see PayPal occupying this Goldilocks space in Payments: more disruptive than Visa and Mastercard, yet safer than Square/Block. I look forward to buying more at these levels (and below), and holding on for the ride.

We’ve written Deep Dives on DigitalOcean, Adyen, Snap, Okta, MercadoLibre, Lululemon, Veeva and Unity. And now Mazwood Memos! Check out last week’s post.

Have a great weekend!

I'm a Paypal holder, bought at $280 and as you can see on my portfolio - https://www.jika.io/u/Ofir I suffered a huge loss of it. I truly believed in this company back when I invested in it, as I saw their opportunity to take a big market share of the crypto industry.

Your analysis is probably one of the most thorough analysis I've seen on this company, and it really gives hope for this company.

Do you think I should HOLD then? (Not advice obviously)

By the way, I'd love to follow your portfolio, are you sharing it anywhere? jika.io or etoro maybe?

THANK YOU!

Killed it! Thank you!