In this week’s addition, of “what took you so long?” we’re looking at Veeva Systems.

Let’s rewind the clock.

It’s Friday, December 2, 2016, and I run a screen to see names with a Return on Capital of over 75% (I was in Joel Greenblatt phase).

I see $VEEV, but in my defense, there were lots of names here that could have been interesting.

I did nothing.

Fast forward to Monday, May 7, 2018.

$VEEV has somehow found it’s way onto a “new names I like” list:

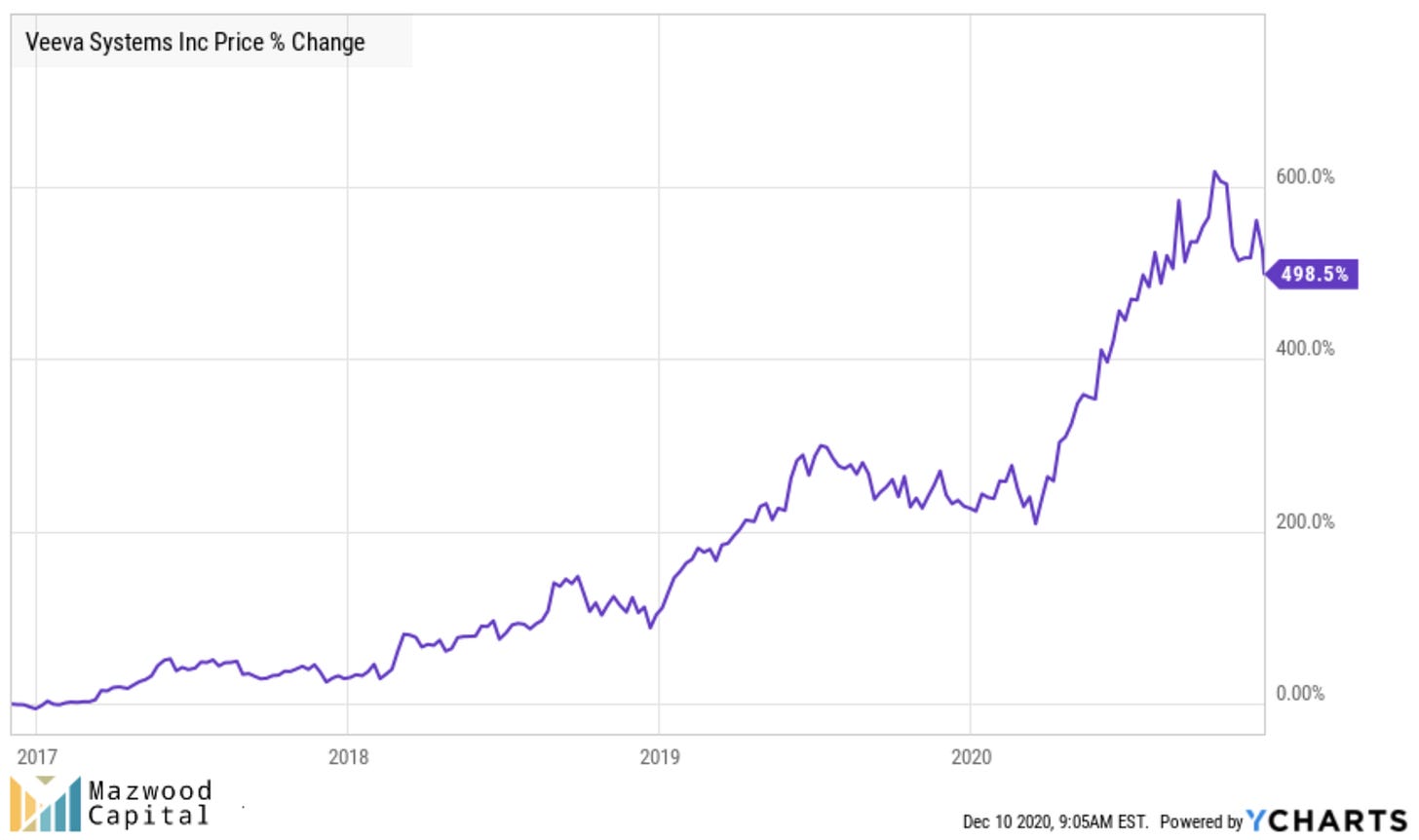

Since then:

Not bad.

(For the record, the only other name I’ve bought from this list is $PAYC.)

But alas, at the time, I did nothing.

It took another two years, before finally dipping my toes in the water in a smaller account on June 4, 2020. At a cost basis of $206.78.

As if it needed more derisking, Veeva didn’t even make it’s way into Mazwood until Labor Day! And I’ve been slowly adding since, with an average cost basis of $277.91.

So now that I’m finally on the $VEEV train (albeit down 6.85% 😢), let’s break it down.

1. The Business

Veeva is a leading global provider of industry-specific, cloud-based software solutions for the life sciences industry. Our solutions enable pharmaceutical and other life sciences companies to realize the benefits of modern cloud-based architectures and mobile applications for their most critical business functions, without compromising industry-specific functionality or regulatory compliance.

Pretty simple. SaaS for pharma/biotech. Got it.

High-level, I like the pitch. I like enterprise software (circle of competence). I don’t have meaningful exposure to pharma/biotech (not circle of competence). Boom.

The product takes a 30,000 foot view in supporting pharma/biotech, assisting customers with everything from managing clinical data, to regulatory submissions through commercialization.

Specifically, Veeva sells products grouped into two different areas:

Veeva Commercial Cloud (49% of total revenues)

The CRM tool. Think of this as a suite of tools that “enable customer-facing employees, such as life sciences sales representatives, key account managers, and scientific liaisons, to manage, track, and optimize interactions with healthcare professionals and healthcare organizations utilizing a single, integrated solution.”

Veeva Vault (51% of total revenues)

The content management tool. Think of this as a tool “for commercial functions, including medical and sales and marketing, and key R&D functions, including clinical, regulatory, quality, and safety.“

Veeva is launching a third product group that has an announced released timeframe by the end of 2020.

Veeva Data Cloud

The data play. This “will provide U.S. patient and prescriber data for both retail and specialty distribution channels for commercial use cases.”

2. The Numbers

Basic numbers tell a nice and reasonable story.

$40B market cap

$1B in revenue

$30% revenue growth

It turns out the list of $40B+ companies still growing 30% Y/Y (by quarter) is not a long list!

That’s it. That’s the list.

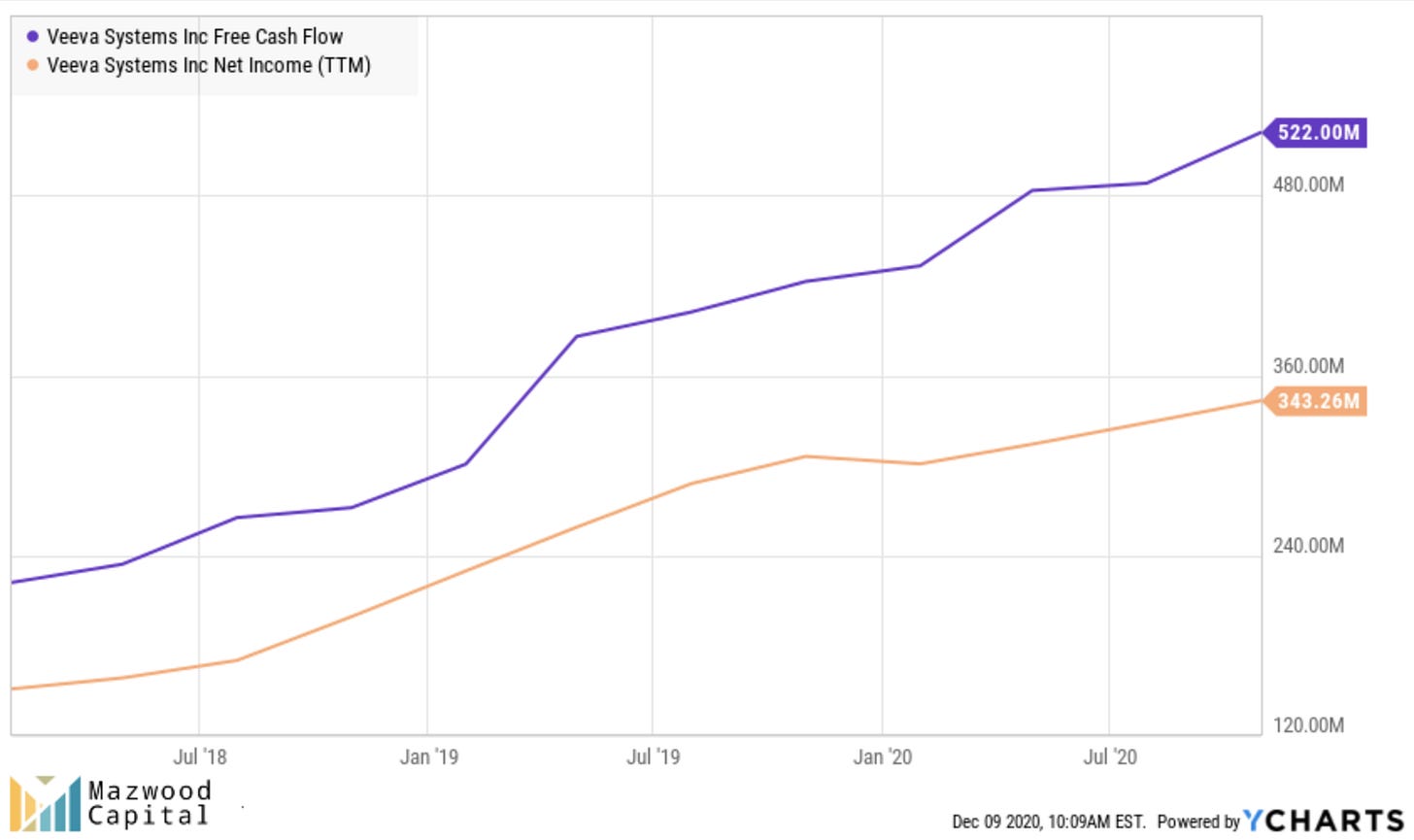

Free Cash Flow and Net Income check out.

In fact, if Jamin Ball calls you a “Free Cash Flow Machine,” I’m interested.

Let’s dig a little deeper into the financials:

Veeva further breaks down their Subscription and Professional services revenue by product type, again Commercial Cloud and Vault:

Furthermore, I was surprised to learn how international their business was. Only 55% of revenues come from North America:

On the surface, Veeva has all the makings of just a really nice SaaS business I like to own. Subscriptions and services, different product types, great growth, expanding product lines, geographic footprint. Who doesn’t like this kind of business?

Thought so.

3. Leadership

At the helm is Peter Gassner, who founded Veeva in 2007, after serving as SVP of Technology at Salesforce. Love a founder-led business, specifically someone who’s done something similar before. Reminds me of Todd McKinnon—also groomed at Salesforce before founding and leading Okta (Deep Dive on Okta here).

My friend Jessica had this to say about Gassner:

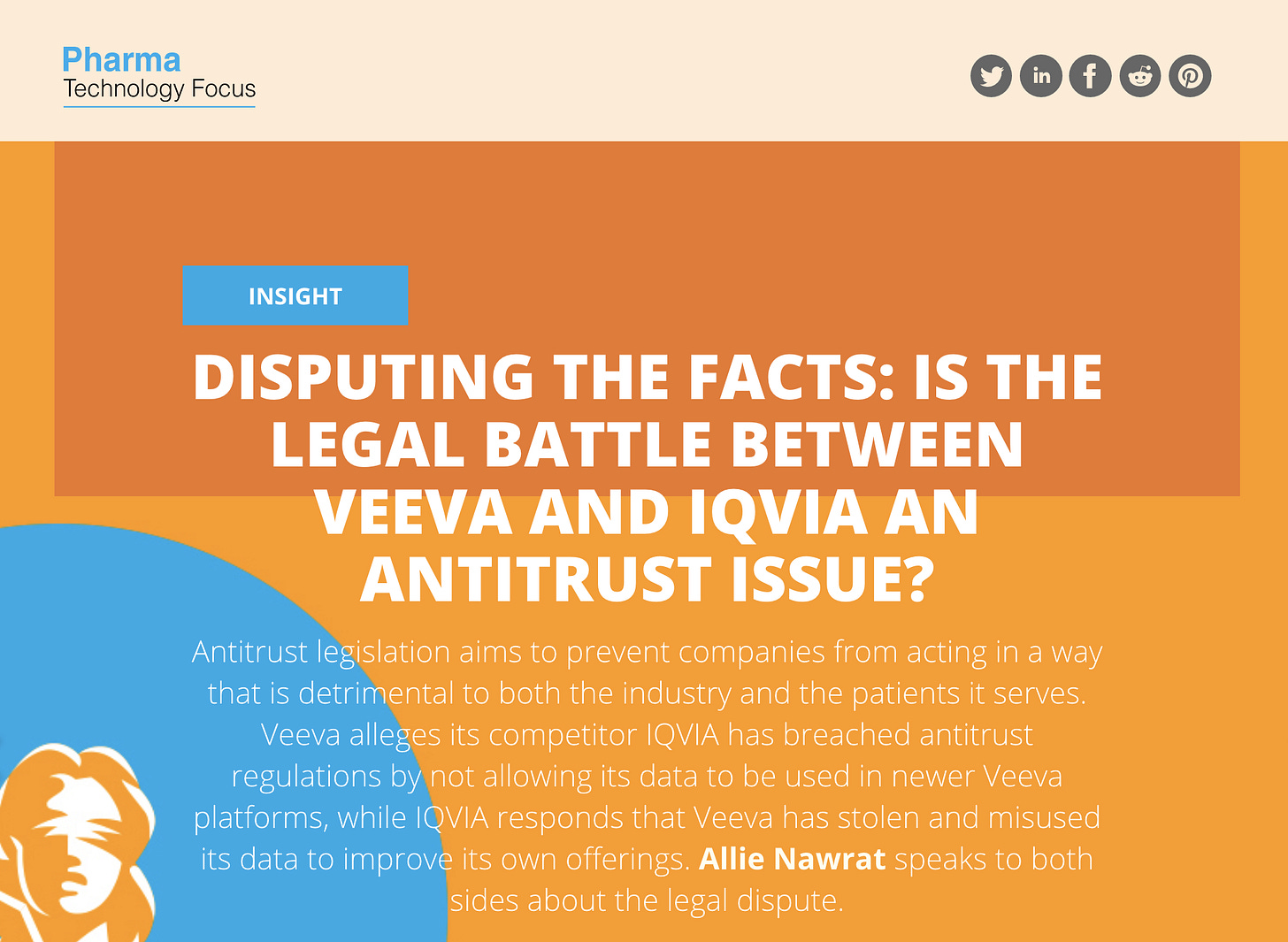

4. Competition

Since this is an industry I’m unfamiliar with, it wasn’t obvious who Veeva’s competition might be. In their 10-K, Veeva names IQVIA Inc. as their “principal competitor.” Okay, I’ll bite. Who’s IQVIA?

Well for starters, it looks they are in a fight.

Not ideal.

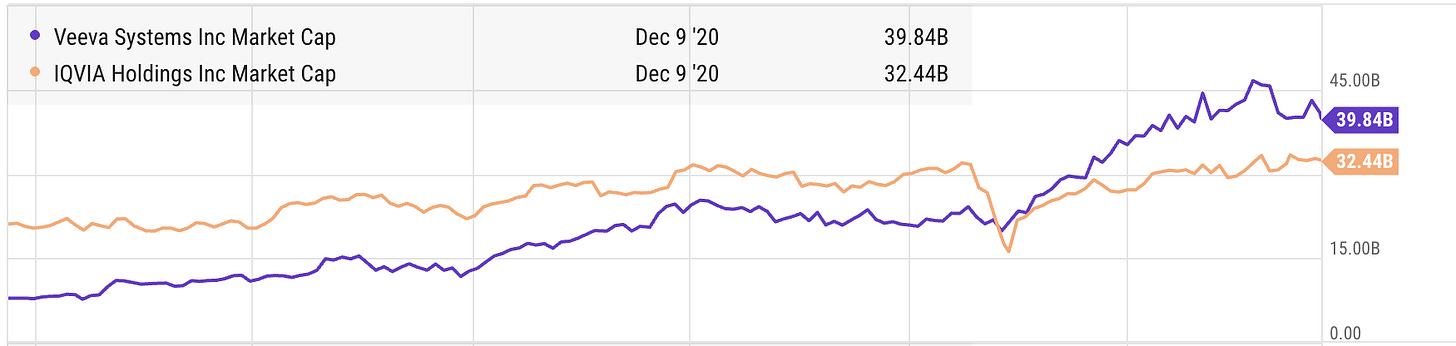

Once we get past that, let’s compare the two on numbers:

Similar sized market cap ✅

With similar profitability ✅

But, IQVIA dwarfs Veeva’s sales, 10 to 1 👀

Well, 🤢

Also, not good if you’re an IQVIA fan ❌

If Veeva’s principal competitor has no growth and similar margins to Harley-Davidson, Kraft Heinz, The Home Depot and Kellogg, I’m not terribly worried.

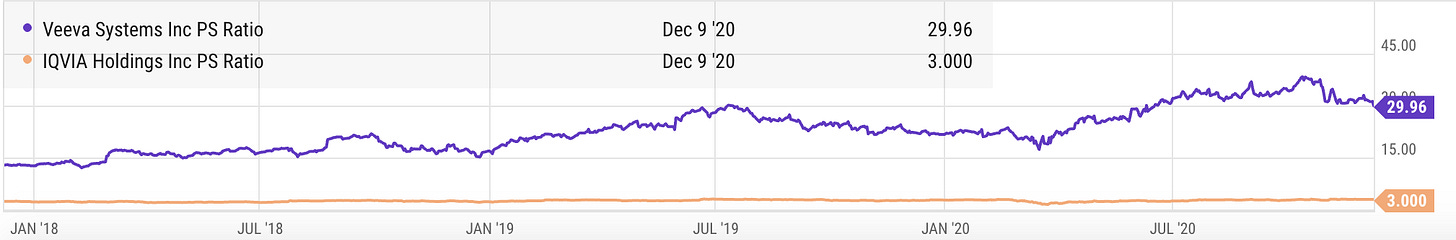

But, boy the valuation discrepancy here is wild:

5. Valuation

A quick word on valuation.

Obviously, it’s not a cheap stock. What is these days?

It’s in the same neighborhood as other MazwoodCap holdings: $TWLO, $PINS, $PAYC. It’s high, but isn’t growth worth paying for?

I think so.

But this is and continues to be a struggle. Not just with Veeva, but all these high-growth names.

What valuation is actually too high?

6. Future

While there is clearly room to run in the life sciences market:

Veeva announced they are looking to expand into consumer as well:

Not to mention, they’ve started making headway into other regulated industries like CPG, Cosmetics and Chemicals. These new business units already have 60 customers, and they’re expected to bring in $30M this year. Not bad.

In a lot ways, maybe Veeva is just getting started.

7. Extra Credit

Again, Jessica had a great big-picture thread on Veeva here:

And Simon Erickson of 7Investing broke down numbers to calculate Veeva’s cost to acquire a customer and lifetime value of a customer. Despite a year old, the analysis in this thread and accompanying google sheet is excellent. (Spoiler alert: I’m no linguist, but Simon uses the word “fantastic.”)

8. Conclusion

I certainly have trepidation that most of the gains have been made.

(It’s hard to get over missing 500% gains from the date of that first screen!)

But, moving forward, it feels as though Veeva can transition from growth juggernaut to quiet compounder, an industry-specific SaaS play in the footsteps of Autodesk.

I clearly haven’t timed this one well, but that’s okay. Money in > Money out.

Let’s go Veeva. Help your customers get this vaccine out.

Thanks to everyone for giving this Veeva Deep Dive a read. Please let us know what you think by liking/commenting/sharing!

And if you’re new here, don’t be shy! We’d love to have you subscribe to Musings by Mazwood.

We aim to be respectful of your inbox and post portfolio updates, company deep dives (like this one), and more. We hope you’ll join us!

Very well put together summary. Thanks for sharing. Own it at mid $250s so don’t worry, you’re not alone and also believe it has huge optionality and potential. Cheers