No Memo this week!

Instead, I’m excited to present my first Deep Dive of the summer. My last one, published in May, was on Dutch payments company, Adyen. Check it out here!

This week, we’ve got cloud infrastructure company, DigitalOcean.

I first came across DigitalOcean three years ago. I was hiring someone to build a site and they wanted to run it on DigitalOcean.

We ultimately built the site on Squarespace, so DigitalOcean quickly came and left my life.

It resurfaced earlier this month:

What? DigitalOcean is a public company? It’s valued at $6B and drawing comparisons to Twilio?

What do you think, Daniel?

Me:

And you, Ophir?

Too often I get excited about a stock, anchor to the current price, start my research, and before I know it, the stock has flown away.

Well, not today DigitalOcean!

I’m trying something new. I’m buying a very small position in advance of performing my typical due diligence.

Here it is:

This is obviously not a recommendation, but rather an experiment in starting positions.

Now, with it occupying a tiny spot in my portfolio, what is DigitalOcean, and does it deserve that spot and my conviction?

In the spirit of trying something new, this will be less polished than a typical Deep Dive, but rather a journey alongside me as I research the stock.

Let’s go.

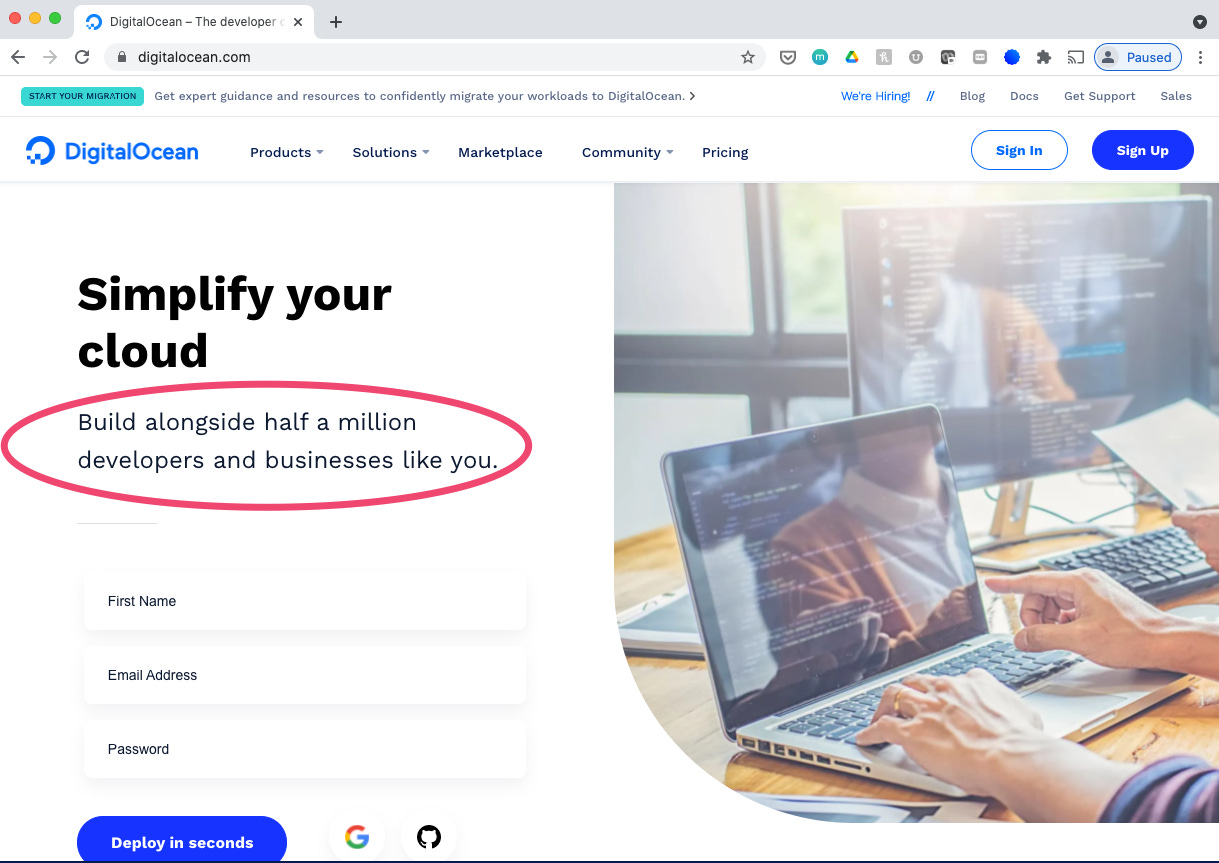

1. DigitalOcean.com

If we start with their homepage, we can already see the Twilio comparison Rihard makes, at least regarding their target customer.

In last week’s Mazwood Memo, I referenced Twilio’s Founder/CEO Jeff Lawson on the NFX podcast, where he discusses pitching developers:

We just started by treating developers like customers. It sounds really simple, but there’s a lot to it. Most companies who claim to serve developers actually don’t see developers as customers. They see them as a strategy. Developers aren’t customers for them. They’re like an audience that you try to win over in order to actually add more value to the company… Developers are the customer. Treat them like a customer. Treat them as the source of your revenue and the source of your success.

Could DigitalOcean follow the Twilio playbook?

Wouldn’t be the worst thing!

DigitalOcean’s About Page confirms the proposition:

Our mission is to simplify cloud computing so developers and businesses can spend more time creating software that changes the world.

Okay, so what does this mean?

A few points from their S-1 I’d like to point out:

DigitalOcean is a leading cloud computing platform offering on-demand infrastructure and platform tools for developers, start-ups and small and medium-sized businesses (SMBs).

[DigitalOcean was] founded with the guiding principle that the transformative benefits of the cloud should be easy to leverage, broadly accessible, reliable and affordable. [Their] platform simplifies cloud computing, enabling [their] customers to rapidly accelerate innovation and increase their productivity and agility.

Over 570,000 individual and business customers currently use [DigitalOcean] to build, deploy and scale software applications.

Cool, but what do they offer?

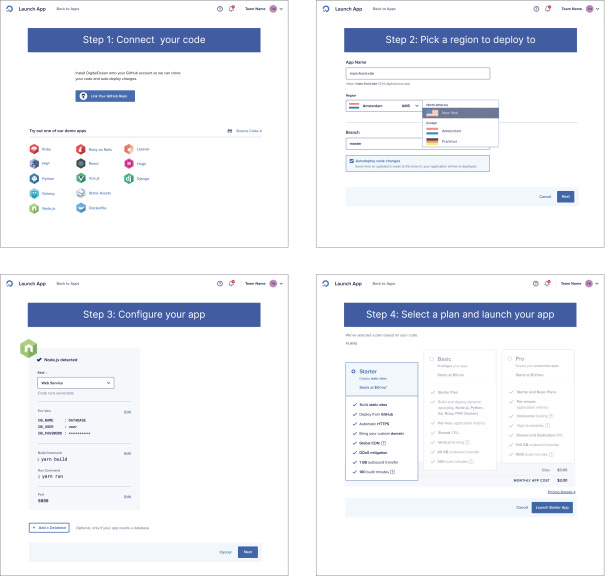

2. Product Overview

If we go to their Products Page, we see DigitalOcean offers products that fit into a few key categories.

We provide a variety of cloud products and services that are specifically designed to address the needs of individual developers, start-ups and SMBs… Our goal is to address the core needs of this underserved customer base instead of offering thousands of complex products and services that are more suited to large enterprise companies.

The four key product categories are: Compute, Storage, Managed Databases and Networking.

A. Compute

DigitalOcean’s “Compute offerings provide ‘simplicity with choice’ so that developers can build and release scalable applications faster in the cloud.”

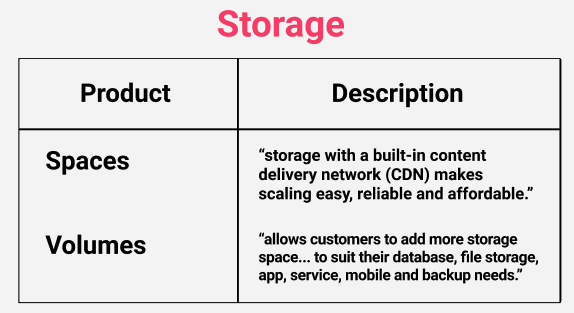

B. Storage

DigitalOcean’s “Storage solutions allow our customers to store and quickly access any amount of data reliably in the cloud.”

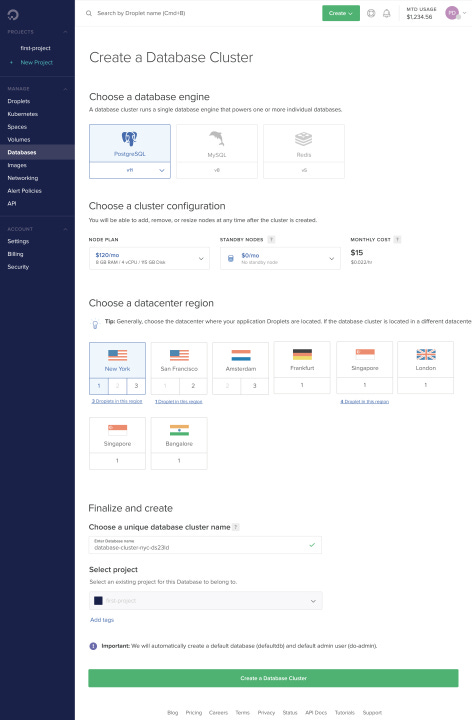

C. Managed Databases

In 2019, DigitalOcean launched Managed Databases, “[providing] our customers with the application performance they need without the operational demands that come with building and running a database server.”

D. Networking

Networking has also become a key product, “providing a suite of networking capabilities to secure and control the traffic to our customers’ applications.” Here’s how the Networking products break down:

Beyond these core four product categories, DigitalOcean has also launched Developer Tools (e.g., APIs, GitHub integration) and Management Tools (e.g., Monitoring, Alerts) to further round out the product.

Ultimately, DigitalOcean provides a suite of products “[so] developers can spend less time managing their infrastructure and more time turning their ideas into innovative applications to grow their businesses.”

3. Financials & Charts

With a better understanding of the DigitalOcean product, let’s look under the hood of the business.

Let’s start with a modified income statement:

There is nothing here that will blow your socks off. This is not a rocket ship. But that doesn’t mean it can’t be a smart investment. Since DigitalOcean is such a young public company, we only have limited data to work with.

I’d like to bring in Jamin Ball, Partner at Altimeter Capital, to share some charts with us.

As he says:

DigitalOcean has decent scale (especially for an IPO), steady growth, low gross margins (but higher operating margins), and hyper efficient S&M spend / CAC payback.

All charts below are from him, benchmarked against other “Public SaaS / Cloud businesses.” Commentary is mine.

A. Revenue Growth

We’ve seen revenue growth at a steady 25%. This sits just below Jamin’s benchmarked median of 31%. Twilio is at 55%. Right off the bat, I don’t love 25% growth for a company that IPOed less than six months ago.

B. Gross Margins

DigitalOcean also won’t win any gross margin awards, sitting far below the 74% median at 54%. Perhaps that’s okay, as Shopify and Twilio also hang out in the low 50s.

C. GM Adjusted CAC Payback

A bright spot for DigitalOcean in Jamin’s charts is his Gross Margin Adjusted Customer Acquisition Cost Payback (say that three times fast), which measures the number of months it takes for a “customer to pay back the cost at which it took to acquire them.”

Gosh, does it really takes 2.5 years for Blackline, Autodesk, Workday and Dropbox to recoup their customer acquisition costs? And I don’t know New Relic, but six years!?

4. Leadership

When I started looking at DigitalOcean two weeks ago, I first went to look at who’s in charge.

Cool.

I was surprised to find out, however, that while Yancey Spruill was running the show, he didn’t start the company.

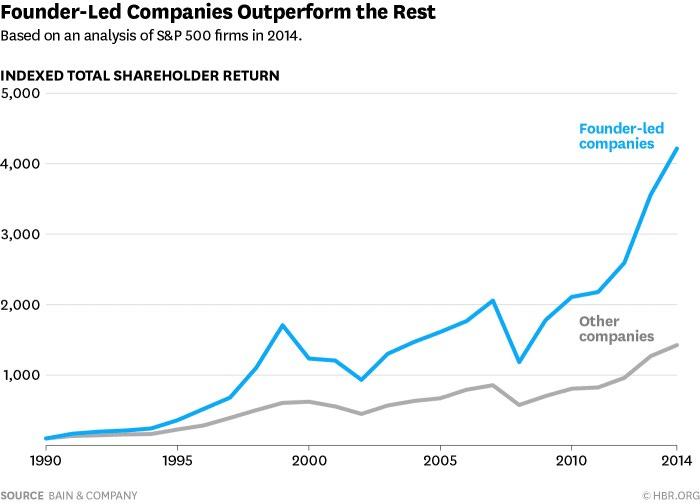

This is certainly not unprecedented, but I was disappointed. It’s not a requirement, of course, but I like investing in founder-led companies! Where are the founders?

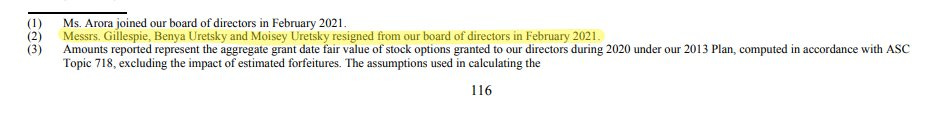

Well, tucked away at the bottom of page 116 of the S-1, we know the brothers are GONE.

And if go back even further, we find that CEO Ben Uretsky stepped down way back in 2018.

I have no way of knowing how or why the brothers left. But I do know they still own 16% of the company!

And that they’ve moved on to a new home (forgive me), a company called Welcome Homes.

Yancey Spruill, on the other hand, came to DigitalOcean in 2019:

And by all accounts, people like him!

By digging deeper into the press release announcing Spruill’s appointment, we learn he was previously COO/CFO at the email marketing company, SendGrid, helping the company through its IPO in 2017 and sale to Twilio (!) in 2019.

Spruill strikes me as a very good, potentially great CEO. But this is a hard chart to get out my mind.

5. Some More Numbers

I wanted to see how DigitalOcean stacks up against peers that also utilize consumption-based pricing (as opposed to a more traditional SaaS model). Snowflake, Twilio, Datadog and JFrog come to mind.

These traditional metrics don’t paint a picture that DigitalOcean is anything special. It could be a very fine business, a very nice investment. But I’m not inspired.

Of course these metrics don’t tell you the entire story of a young software company in 2021.

Tim Boutillier reminds us to look at some more nouveau riche metrics.

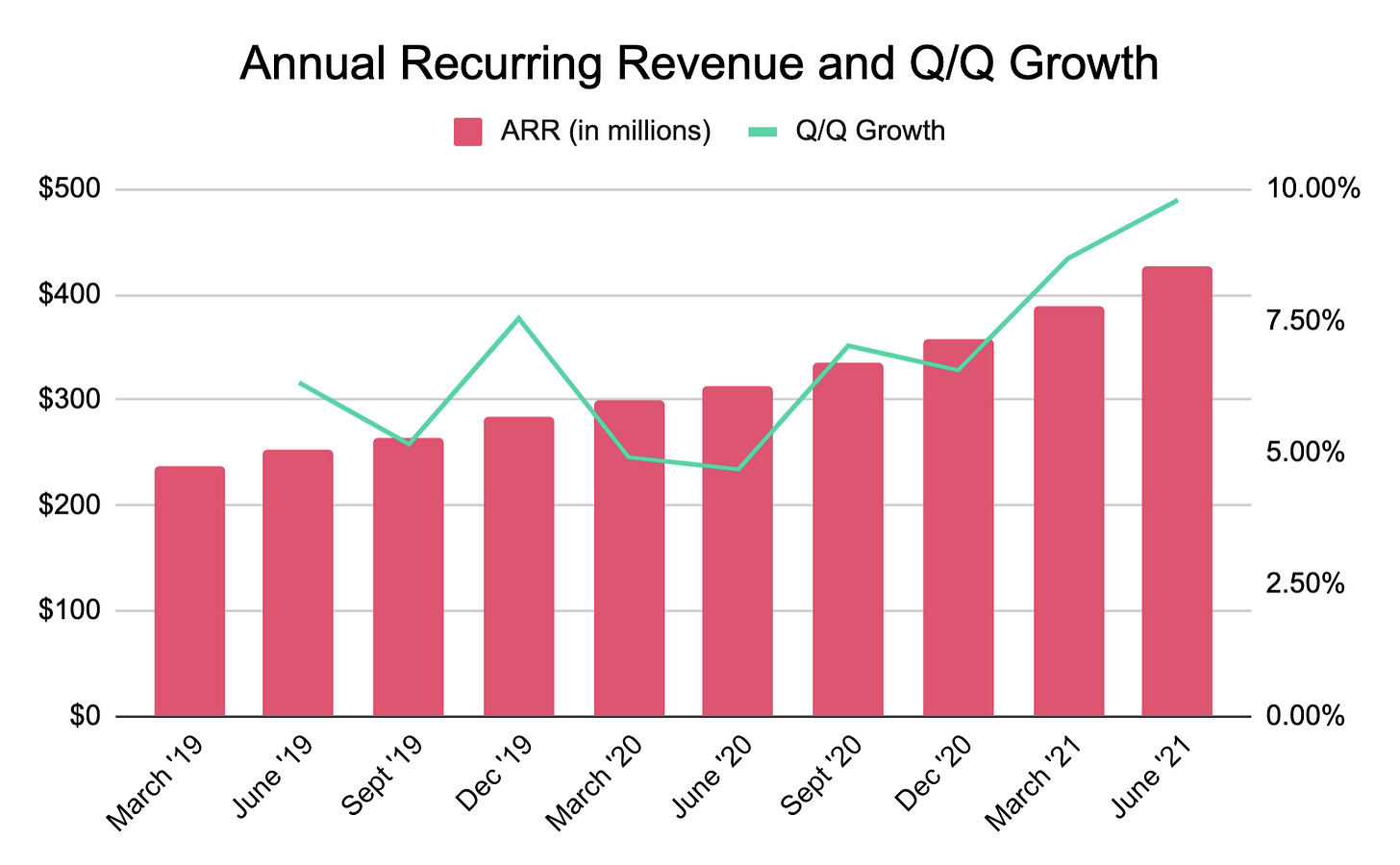

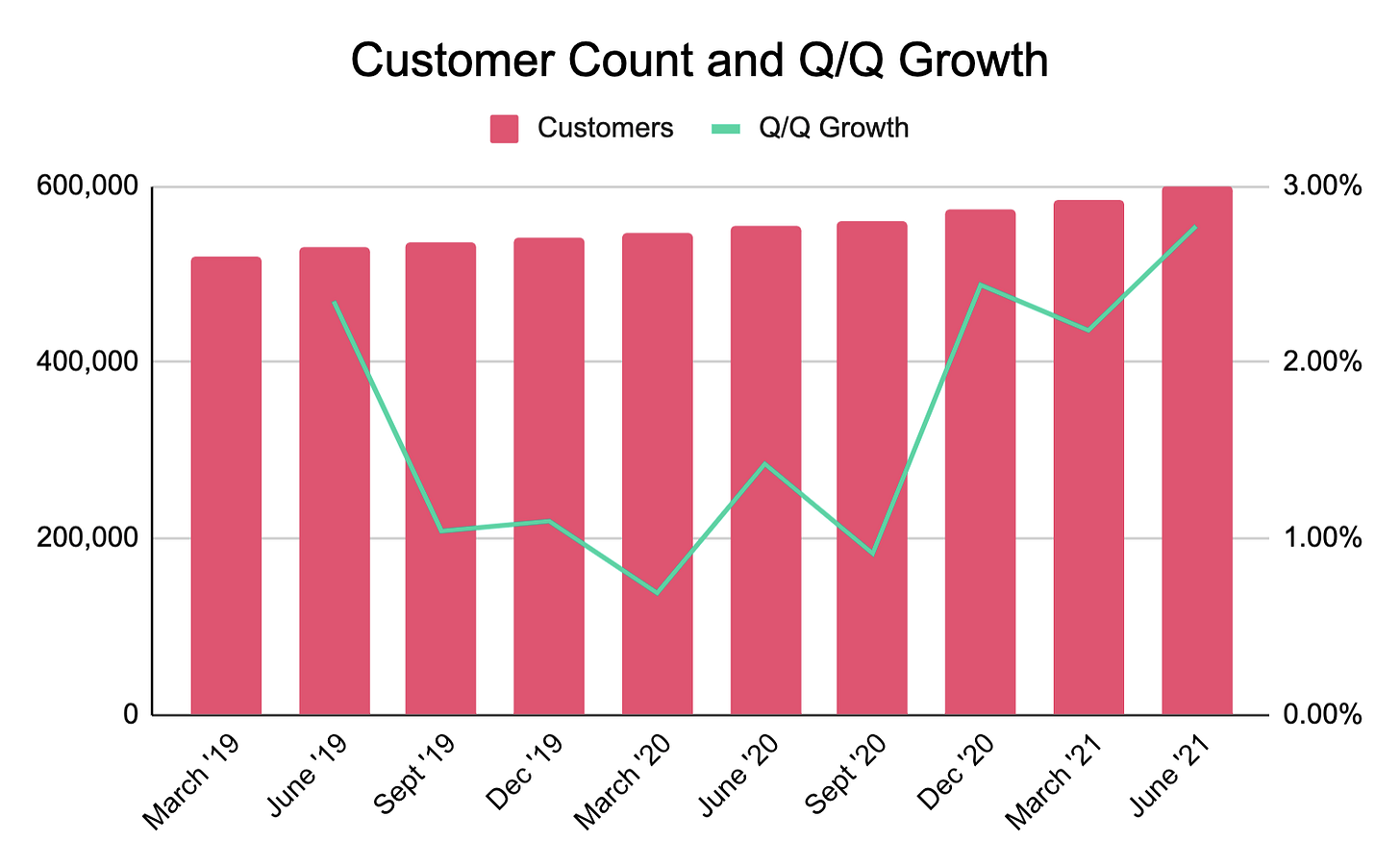

Annual Recurring Revenue. Net Dollar Retention. Average Revenue Per User. And let’s throw in Customers for good measure.

Here they are, presented with Quarter over Quarter growth, for the last ten quarters:

[Quick caveat: I prefer Year over Year growth numbers, because quarter over quarter doesn’t account for seasonality in the sales cycles or any acquisitions or bumps along the way. But alas, with limited data, we’re stuck with Q/Q.]

Let’s go through them.

A. Annual Recurring Revenue

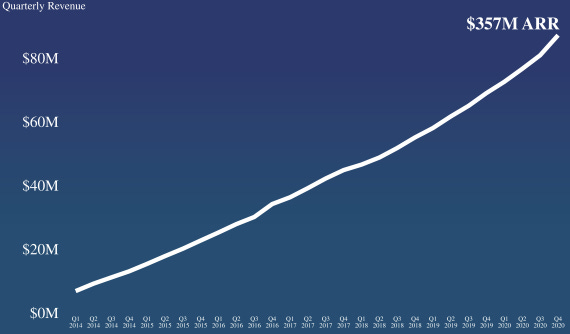

This graph from the S-1 showing ARR dating back to Q1 2014 certainly looks nice:

Digging deeper into the last ten quarters, we see consistency and steady, albeit unspectacular growth.

B. Net Dollar Retention

Net Dollar Retention will get you even less excited.

A Net Dollar Retention of around 100% tells you that customers are paying the same amount year over year. That is, in a consumption-based pricing model, in any future period, customers aren’t using any more of the current product, nor incorporating any new products.

While the last two quarters have started to move the needle, it is way too early to know if we’re looking at an aberration or a trend.

If we remove these last two quarters, Jamin Ball shows us that DigitalOcean’s Net Retention sits well below its peers, and well below what gets me excited.

Of course they are different businesses at different stages, but Twilio’s Net Retention for the last nine quarters looks a lot more compelling:

via Twilio Q2 2021 Earnings Presentation

With a Net Retention consistently in the 130s, we know that Twilio’s developer base is not only using the current product more each year, but customers are adding new products to their applications.

Is this only a reflection of Twilio’s later stage, and therefore, they’ve had time for customers to grow and incorporate new products?

Unfortunately not.

Going back further into Twilio’s history (they IPOed in June 2016), their Net Retention has always been strong:

via Twilio Q4 2019 Earnings Presentation

Why has it taken until this year for DigitalOcean’s Net Retention to really crack 100%. And will that continue to grow?

C. Customers

Like revenue growth, customer growth is fine, but again, not special.

If DigitalOcean’s stated market are start-ups and small businesses, I worry how this customer count can meaningfully grow.

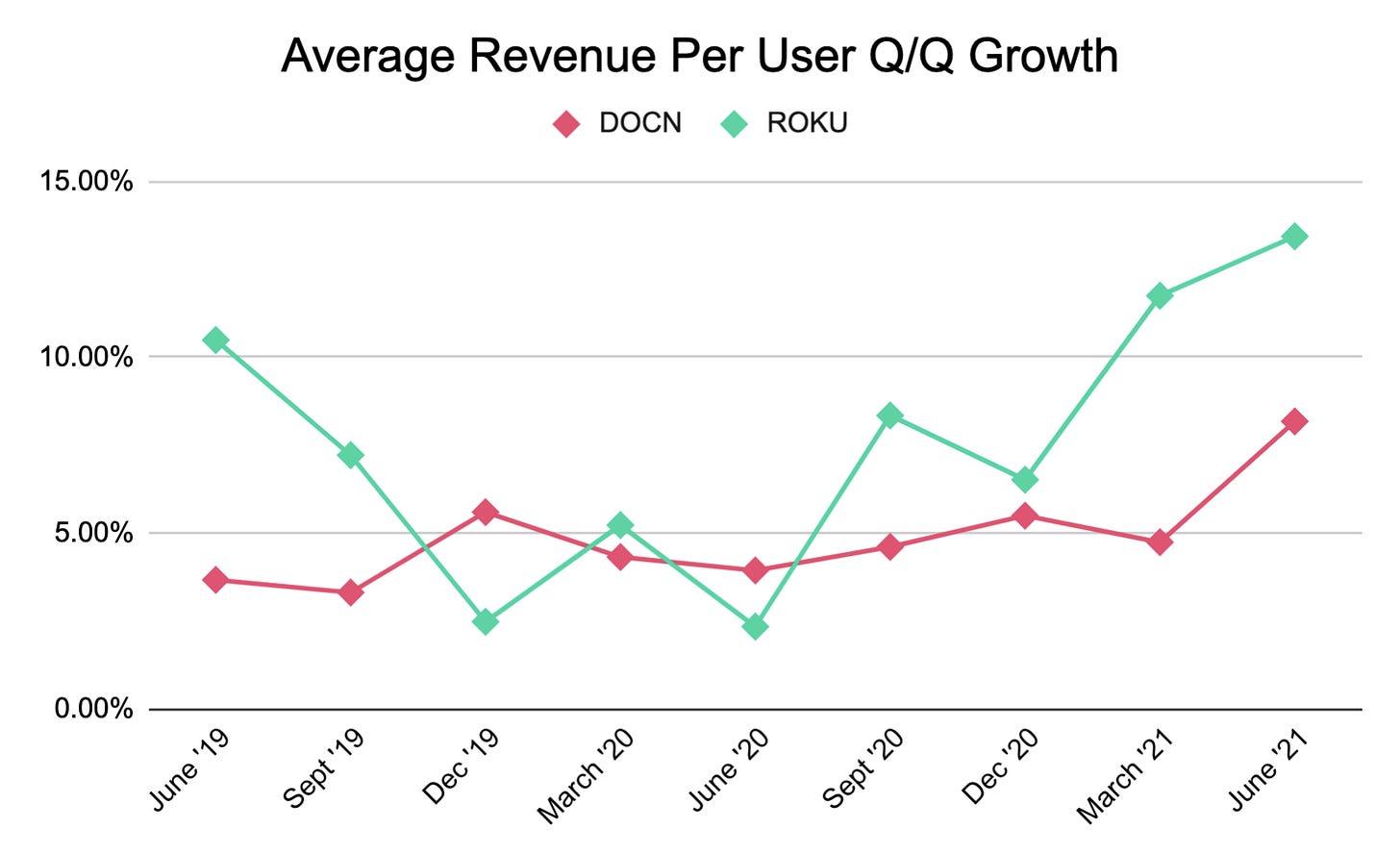

D. Average Revenue Per User

While I’m underwhelmed by DigitalOcean’s customer growth and Net Retention, I’m very pleased with their Average Revenue Per User.

So is Ophir:

Over the last six quarters, Year over Year, ARPU is consistently growing 20%.

I see why Ophir is excited.

This strong ARPU reminds me of looking at Roku’s Average Revenue Per User in Mazwood Memo #4.

Ophir has been similarly excited about Roku’s ARPU.

So I wanted to look at the two side by side.

DigitalOcean ARPU metrics looks great.

But when you look at ARPU growth, DigitalOcean has been lagging Roku.

Of course DigitalOcean and Roku are wildly different businesses. I’m not comparing them to each other. I’m just trying to determine if DigitalOcean is a best idea, and if it deserves that spot in my portfolio.

If new customers can find your product, current customers spend more, and average revenue per user climbs, you can have a great business.

DigitalOcean has a nice business, certainly. But do they have a great business?

6. Valuation

Here’s where DigitalOcean could be interesting. It’s priced well!

Wiseman Capital shares this chart (as part of a very well-researched, informative thread).

The attractive valuation is further confirmed against our other consumption-based pricing names:

Pulling back a little more, let’s look at some other names that YCharts categorizes as “Software - Infrastructure.”

Some observations:

DigitalOcean is priced like BlackLine, but lacks in profit margin and free cash flow.

DigitalOcean is priced better than Okta (Deep Dive here!), but lacks Okta’s growth, profitability and free free cash flow.

DigitalOcean is growing like SquareSpace, but lacks in profit margin, free cash flow and valuation.

The argument that DigitalOcean is priced well (using vanilla Enterprise Value to Revenues) is fair.

I’m just not that inspired. Of course this is just a tiny snapshot, but does DigitalOcean move you?

7. Competitive Landscape

I like rooting for the little guy. I like owning smaller companies that can 10x.

Twilio currently sits at a market cap of $63B. Do I really think Twilio is going to 10x?

DigitalOcean, on the other hand, sits at $6B. Can it 10x?

I like their focus as an easy-to-use solution for developers in start-ups and SMBs. But, by their own admission:

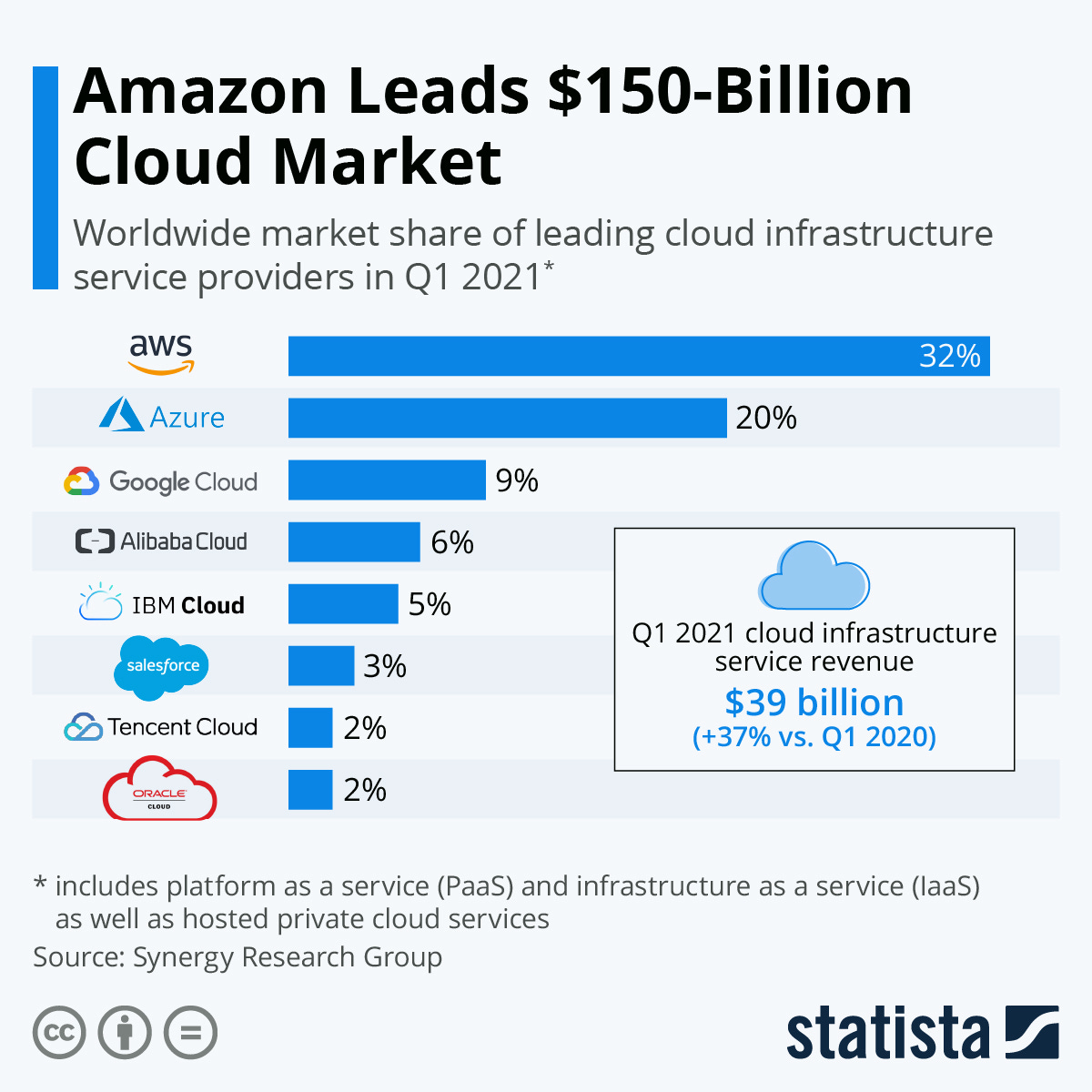

We compete primarily with large, diversified technology companies that focus on large enterprise customers and provide cloud computing as just a portion of the services and products that they offer. The primary vendors in this category include Amazon (AWS), Microsoft (Azure), Google (GCP), IBM and Oracle.

Do you want to be competing against Amazon, Microsoft and Google in the cloud business?

Again, I like startups and disruptors. But I’m having trouble getting excited about a company that can’t crack the list.

8. Decision Time

For my previous Deep Dives, I’ve written about companies after deciding to invest in them. This Deep Dive, however, has been a real-time exercise in decision making. And honestly, I’m a little stumped.

Sometimes I like to think of myself as a VC of the public markets. What early stage companies are available to me as an investor, with a product I like, that I can understand, with long runway, with management I can trust? I get some of these vibes here!

You could see yourself hearing this pitch at a Techstars Demo Day and thinking they could be onto something.

You could further see this as a slow and steady player that continually gains market share, builds new products, increases that Net Retention and ARPU. I think that can happen!

But, ultimately, at this time, it just doesn’t feel like a best idea.

As WB told us in Mazwood Memo #5: “Very few people have gotten rich on their seventh best idea.”

So, for now, DigitalOcean is not for me. I wish Rihard and Daniel and Ophir well. I hope DigitalOcean does well.

A decision today is not a decision forever.

We’ve written Deep Dives on Adyen, Snap, Okta, MercadoLibre, Lululemon, Veeva and Unity. And now Mazwood Memos! Check out last week’s post.

Have a great weekend!

Gotta agree with you on this one. $OLO actually good based on Jamin’s charts, and it’s really been moving. No $DOCN for me, and I’m currently long a few shares :)