Company Deep Dive: Unity Technologies

I can’t get this line from Matthew Ball out of my head. On Invest Like the Best with Patrick O’Shaughnessy from Aug 4, 2020, he says:

By some reports, and I always find this hard to believe, but it seems to be continually proven, 50% of nine to 12 year olds in the United States and Canada, New Zealand, Australia, play Roblox or Minecraft alone. And so that tells you that there’s this enormous demographic shift that’s happening, that means that each generation is adopting gaming more significantly. And as they age up, their media appetites grow.

Gaming is a thing. It may be hard for some old fogies to see it, but I promise, it’s a thing. Not only is it obvious culturally, but there’s a wealth of data to support it. I don’t want to focus on console sales or simply video game purchases. That is certainly a piece of the gaming puzzle, but also a sentence that could’ve been written in 1989.

Instead, I want to look at the broader cultural shift in video game delivery. To get us there, let’s take a look at some slides from ARK’s Big Ideas 2021 memo that dropped in January.

So in just four years (!), ARK suggests in-game monetization could represent 95% of all gaming revenue.

And again, in just four years, in-game monetization could reach $350B.

These are big numbers in a big and growing market. Those 50% of 9-12 year olds are growing up spending money not for video games, but in video games. They’ll only get older, and with age, comes income (usually). And guess what, each year, there is a new batch of 9 year olds that get sucked into the funnel.

The future of video games is here. It’s fast. It’s easy. It’s culturally relevant. And it can print money. Kids aren’t spending $50 on a new Sonic the Hedgehog game every 2 years. It’s actually different this time.

So what in the world is Unity Technologies, and how does it fit into this larger gaming ecosystem?

Let’s get into it.

1. The Business

Unity describes themselves as the “world’s leading platform for creating and operating interactive, real-time 3D content.”

And that they “provide a comprehensive set of software solutions to create, run and monetize interactive, real-time 2D and 3D content for mobile phones, tablets, PCs, consoles, and augmented and virtual reality devices.”

They have a platform that allows creators to make games. Okay cool, tell me more. What about scale? As of Q4 2020:

Games made with Unity accounted for 71% (!) of the top 1,000 mobile games

Monthly Active Users who consumed Unity-made content reached 2.7 billion (!)

Applications built with Unity were downloaded on average 5 billion times per month

Monthly active creators were 1.5 million (as of 6/30/20)

Unity is a big deal platform in a big deal industry.

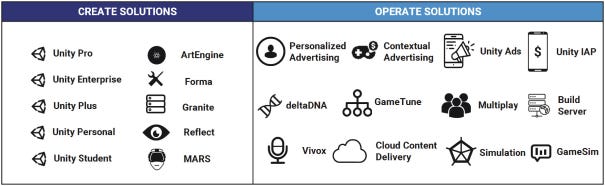

They break out their business into three separate categories: Create Solutions, Operate Solutions and Strategic Partnerships/Other.

Pretty simply, Create Solutions are used to create the games and content.

Operate Solutions allows customers grow, engage and monetize their user base.

Here’s a more detailed breakdown of how Unity positions their products:

Create Solutions utilizes an annual subscription model, while Operate Solutions utilizes a mix of revenue-sharing and usage-based pricing.

The Create Solutions package is pretty incredible if you’re a creator. Imagine being a game developer, creating one game, and being able to deploy it everywhere that matters: iOS, Android, Nintendo, Playstation, Xbox and more. More than 20 platforms in total. What an astounding value proposition to a creator.

Furthermore, Unity has a “robust and diverse partner ecosystem that includes leading hardware, operating system, device, game console and other technology providers.” It’s just an impressive list of companies to play nicely with:

2. Financials

With less than five months since Unity’s IPO (9/18/20), it’s hard to surmise meaningful conclusions from financials. But let’s take a quick stab at Q4 2020 numbers that were reported last week.

Two slides in particular stood out:

1. Revenue and growth: FY 2020 revenue was up 43% Y/Y.

2. Customers spending more than $100k and Dollar Net Expansion:

Worth noting that of these 793 customers generating $100k+:

Makes up 77% of total revenue

Represents a 32% increase from 2019

15% (121) generated more than $1M (TTM)

13% (105) were in industries beyond gaming

Wait… 105 customers that aren’t in gaming spent $100K+ with Unity. What!?

3. Beyond Gaming

Yes, you read that right. This is where Unity gets really interesting.

We continue to gain significant traction with customers and leading brands in industries beyond gaming, including architecture, engineering and construction; automotive, transportation and manufacturing; and film, animation and cinematics.

Measured by 2019 revenue, Unity works with:

Eight of the top 10 architecture/design firms

Nine of the top 10 auto companies

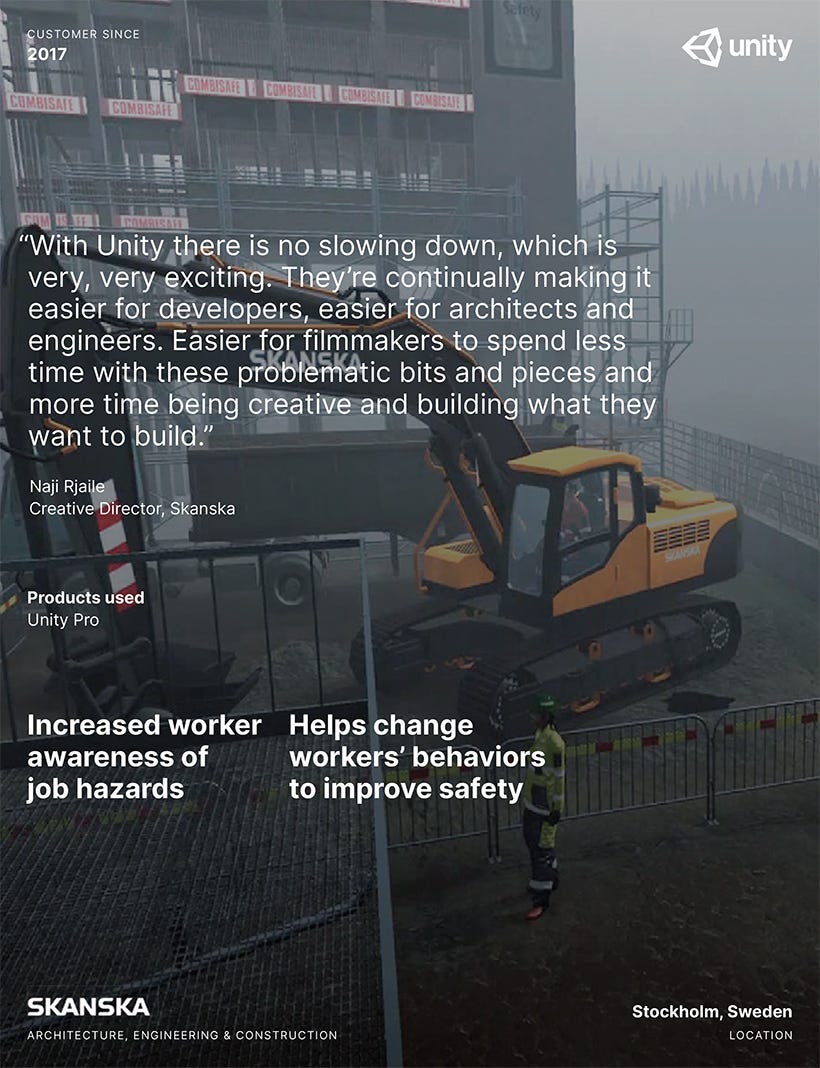

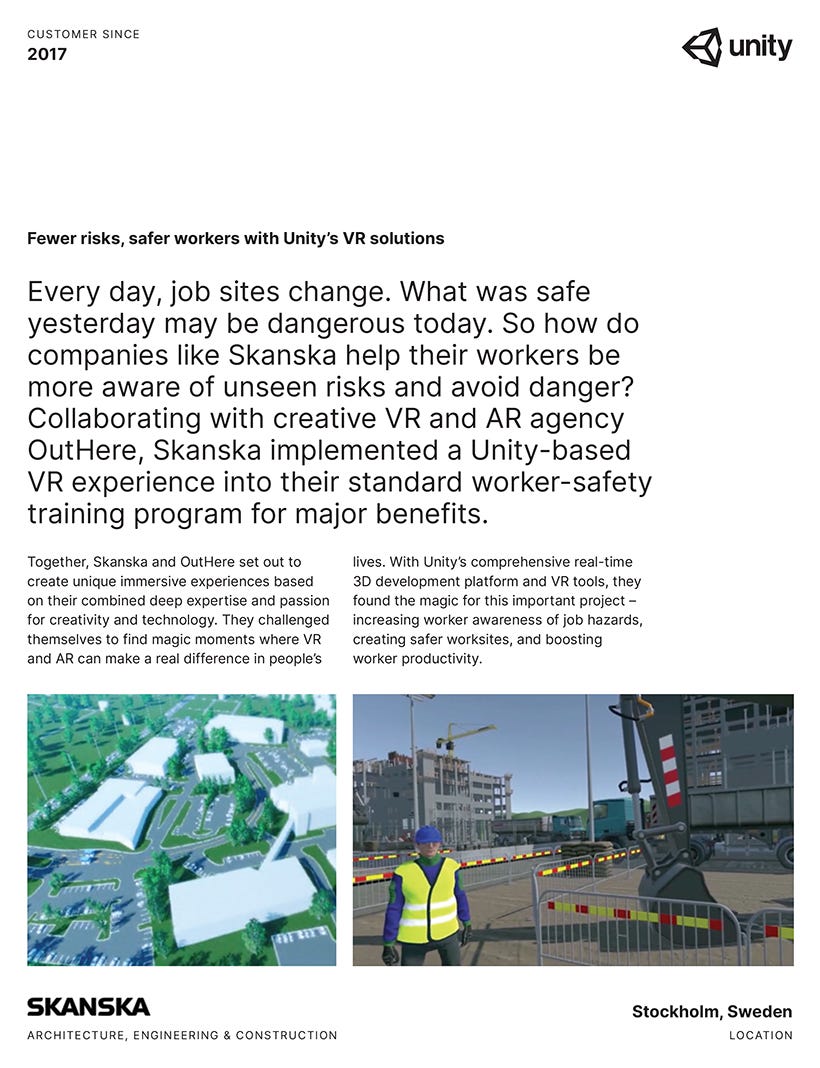

A. Architecture, Engineering and Construction 👷

Case Study:

Skanska: one of the world’s largest construction companies, uses Unity for a range of applications, from photorealistic interior mockups to coordinated pre-fab animations, 2D and 3D logistics, model management, and 4D sequencing. Additionally, Unity enables Skanska to provide safety training for workers to experience the job site before the project starts, to learn how to operate complex construction equipment, and to train on risky procedures.

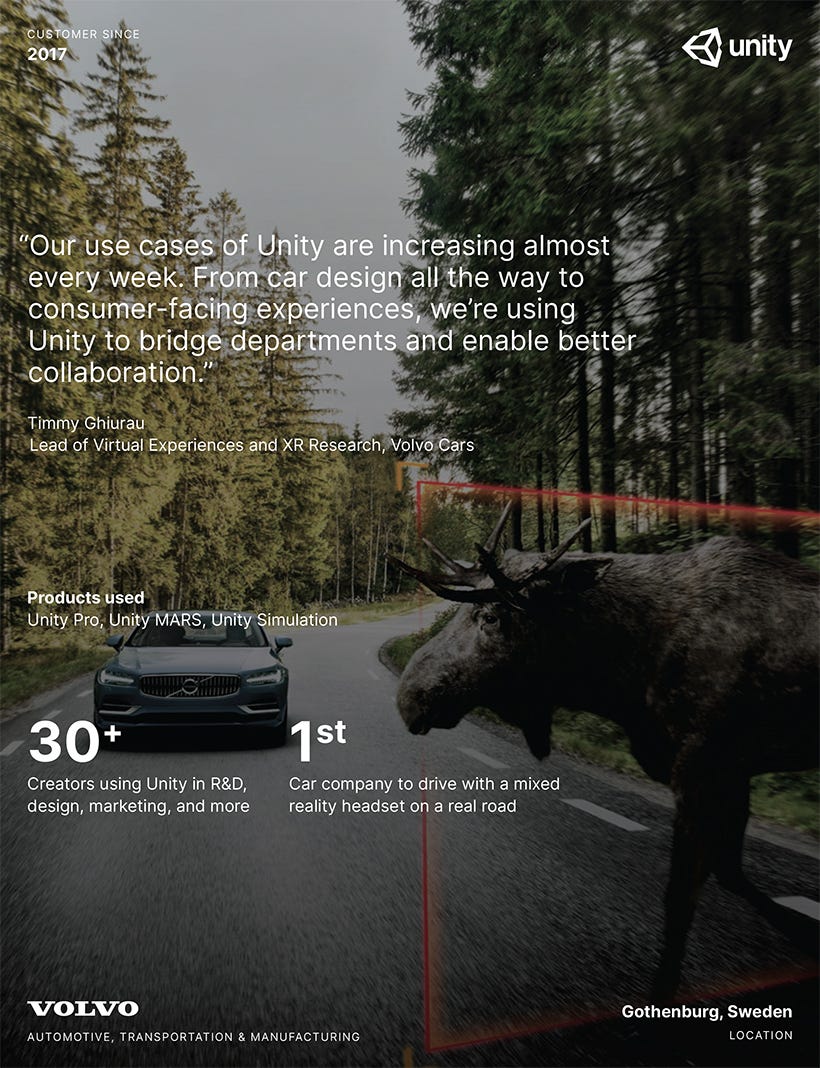

B. Automotive, Transportation and Manufacturing 🚘

Case Study:

Volvo: uses Unity to reimagine traditional processes across the lifecycle of designing, engineering, manufacturing, selling and servicing vehicles. Since initial adoption in the design studio, Volvo Cars has rapidly expanded its applications of real-time 3D to dozens of use cases and built a cross-departmental production process for virtual car experiences. With Unity, Volvo Cars improves collaboration between designers and engineers, saves money by reducing reliance on physical prototype vehicles and engages car buyers with immersive experiences.

C. Film, Animation and Cinematics 🎬

Case Study:

Moving Picture Company (MPC): used Unity on Disney’s 2019 recreation of The Lion King. It was shot in real-time, using Unity software integrated within physical-film hardware, including cameras, dollies and cranes. Footage was then rendered offline by MPC Film in collaboration with Renderman, Pixar’s 3D rendering animation software. MPC’s use of Unity allowed for real-time review and processing, minimizing the amount of re-shoots and post-production editing required.

Take a look at a short behind-the-scenes look at how MPC created The Lion King.

Unity could very well be masquerading as a gaming company as it builds out the technical infrastructure that will transform how we interact with multiple industries.

4. Some Bear Thoughts

💸 Valuation

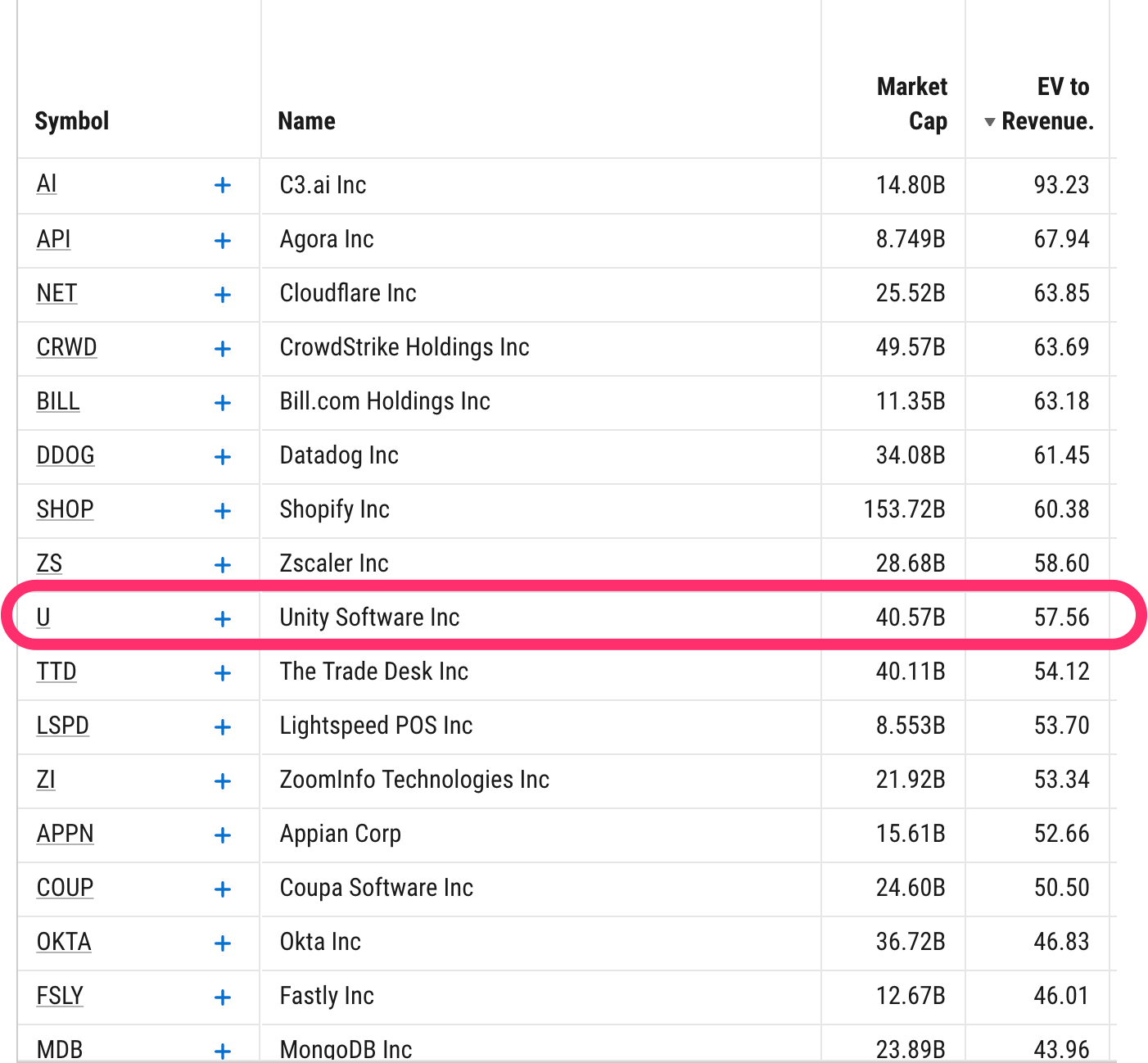

Of technology companies with a market cap of greater than $5B, $U is sandwiched right in between $ZS and $TTD. Getting into Unity now will cost you a pretty penny. Not ideal.

📈 IPO

I can’t think of another instance where I’ve bought a company so soon after its IPO. In fact, the lock-up period expires today—what timing!

Beginning at the opening of trading on Monday, February 8, 2021, the lock-up agreements that the company’s directors, executive officers, employees and holders of substantially all of the company's common stock and securities exercisable for common stock…will terminate.

There’s just too much unnecessary risk associated with getting into “hot IPOs.”

Great thread of why NOT to buy into an IPO from @FromValue from literally the week of Unity’s IPO:

📱 iOS/IDFA

Additionally, there’s this little issue Apple has introduced surrounding IDFA. To the best of my understanding, The Identifier for Advertisers is a feature that, since iOS 10, Apple has had as opt-out. That is, users could opt out of being tracked by advertisers. In a focus on privacy, this spring, in iOS 14, Apple is making IDFA opt-in, thereby making it certain that more users will not opt-in to be tracked by advertisers.

Why do we care?

This will affect any entity that show ads to iOS users. Specifically for Unity:

We expect the arrival of Apple’s iOS14’s privacy modifications on IDFA will affect the way mobile game developers acquire customers and how they optimize lifetime customer value. Although it’s difficult to estimate, our guidance assumes IDFA changes begin in the spring and will reduce our revenue by approximately $30 million, or 3% of revenue, in 2021.

This is a thorny subject, and who knows how it will play out. But when Apple can make a quick feature change and *just like that* your revenue is down 3%, it’s not the best.

Conclusion

As a gaming company, I am intrigued by Unity. Powering creators is certainly of the moment. But what Unity offers is much more. While the there is obvious short-term trepidation, I can’t help but want to be part of the future!

Powering creators, dominating mobile-game development, an impressive partnership list out of the gate—and this is all before we get to how Unity can transform the architecture/design, automotive and film industries. I like being a part of the future. So I’m starting small, watching and being patient.

Despite the excitement, it takes time to build the future.

Thanks to everyone for giving this Unity Deep Dive a read. Please let us know what you think by liking/commenting/sharing!

And if you’re new here, don’t be shy! We’d love to have you subscribe to Musings by Mazwood. Past Deep Dives include: Snap, Okta, MercadoLibre, Lululemon and Veeva.

We aim to be respectful of your inbox and post portfolio updates, company deep dives (like this one), and more. We hope you’ll join us!

Additional Resources:

Great threads on $U from:

Interview with Unity CEO John Riccitiello with a16z’s Andrew Chen

Chit Chat Money Podcast with Christopher Seifel

Longform articles

Unity is Manifesting the Metaverse from Mario Gabriele’s S-1 Club

Unity IPO Analysis (Parts 1 & 2) from Eric Peckham’s Monetizing Media