In last week’s Memo, I shared a slide from Vroom’s Investor Presentation where they show the “massive” size of the used car market.

$841B! Oh my! That’s roughly the GDP of Turkey!

But how in the world is this helpful?

I have little interest in what companies refer to as TAM—Total Addressable Market. So the used car market is big. Okay, great. Now what?

Invesquotes shared a similar sentiment earlier this week:

TAM doesn’t tell me anything I need to know about the company. In fact, the great companies are the ones that change their TAM over time.

What do you think Amazon’s TAM was when it went public in May 1997?

In their 1997 S-1, variations of “book” was mentioned 179 times.

In the company description, we read:

Amazon.com is the leading online retailer of books. Since opening for business as “Earth’s Biggest Bookstore” in July 1995, the Amazon.com bookstore has quickly become one of the most widely known, used and cited commerce sites on the World Wide Web (the “Web”).

Furthermore, it states:

The Company’s revenues depend on the number of visitors who shop on its Web site and the volume of orders it fulfills.

No mention of Prime. No mention of AWS. Amazon sold books on the internet. That’s what they did.

Guess how many times “book” was mentioned in the 2020 Annual Report.

Pretty remarkable, right?

Early Amazon didn’t care about your TAM!

You could do a similar exercise with Netflix. Think “streaming” was mentioned a lot in their S-1? No dice.

See this tweet from Corry Wang:

In 2014, Netflix Brazil’s streaming “TAM” was projected at 8 million subscribers—that is, the maximum number of subscribers possible.

There are now 15 million Netflix subscribers in Brazil. So much for TAM!

Don’t pay attention to TAM. But if you must, find companies that can smash whatever their TAM might be.

This Week:

New Position in Coinbase

A Good Time to Add to Twilio?

Searching for a Restaurant Stock

Business History Nuggets

1. New Position in Coinbase

Since Coinbase came on the market, I’ve quickly and easily put it in the “too difficult” pile. Financial institutions are complicated!

However, you could say I’m crypto curious. I have tiny positions in BTC and ETH, and even bought the tiniest bit of SOL this summer (cost basis of $28, thank you very much). But I’m a business guy. I study businesses. Betting on what currencies will survive is not my game.

So the idea of Coinbase intrigues me. A business I can study, in pole position to dominate crypto.

Since its April IPO, I’ve thought of Coinbase as a brokerage that charges high fees. Big whoop. What happens when all other brokerages offer crypto? The fees come down, and then what kind of business are you left with? E-Trade? No thanks.

Some of my favorite people on Twitter shared this sentiment with me:

But I’m starting to wonder if this might be first level thinking. (Love you guys!)

What if the bull case is a little more interesting?

Earlier this week I listened to a podcast that really opened my eyes to what Coinbase could actually become.

On “The Scoop,” Frank Chaparro hosted two big shots from Coinbase: Brett Tejpaul, Head of Institutional Sales, and Greg Tusar, Head of Institutional Product.

Here’s Brett discussing different Coinbase client profiles and what they’re seeking, essentially a company roadmap. He breaks it down into four buckets.

1. Direct Investment Activities

The first bucket is Direct Investment Activities. So that’s deploying capital directly on the Coinbase platform. And that’s the thing we’ll spend most of our time talking about. There we’ve got Hedge Funds, Pensions, Corporates, Asset Managers, Family Offices and a swath of progressively larger and larger and more sophisticated institutions that are coming to Coinbase…

2. Introducing Brokers

The second bucket (…the thing we’re lesser well known for…) is an eclectic bucket which I call Introducing Brokers. It’s the Business to Business application where a third party business wants to use Coinbase’s infrastructure to power their own crypto capabilities… It’s private banks. It’s providing our ability to act as a sub-custodian for traditional custodians. It’s payment platforms. It’s messaging services that want to use wallet infrastructure. It’s an eclectic mix, but a really important way to activate other types of institutions in the crypto space.

3. Stablecoins

The third bucket I group together: Stablecoins. There are a few people… that have arrived at our door saying “we’re an insurance company, we’re not necessarily interested in deploying capital into Bitcoin per se, but actually when we think through the utility of a Stablecoin, we could maybe collect premiums with Stablecoins…, we could distribute payments into digital wallets and we move lots of money around the world”… Stablecoins opens the world up into a lot of use cases on payment platforms and banks and people you wouldn’t necessarily associate with being bold and interested in deploying capital into crypto.

4. Future of Finance / DeFi (Decentralized Finance)

The last bucket… [CEO] Brian Armtstrong wrote that blog about DeFi. We’re supporting the Future of Finance. Smart contracts. DeFi. The formation of NFTs... We have incomings that it’s hard to keep up with from sports franchises to artists to all the people… active in NFTs, so all of a sudden… because we’ve got the breadth of capability across all the things we mentioned, that’s the reason we’ve got this really super deep and super broad institutional participation.

There’s a lot to digest here!

If you’re interested, listen to the pod.

But, I think you’ll agree, they’re definitely positioning themselves as much more than a brokerage. B2B applications. Powering crypto ecosystems for other banks and institutions. Wallet infrastructure for messaging platforms. Stablecoins for insurance companies. This ain’t our parents brokerage!

The institutional numbers don’t lie. In just the last five quarters, institutions have gone from trading $17B on Coinbase to $317B. That is not a small increase.

Ultimately, Coinbase may still fall under the “too difficult to understand” pile. But I’m intrigued by the future of finance. I’m intrigued by Coinbase’s roadmap. I’m intrigued by a Founder-led business disrupting financial systems as we know them.

2. A Good Time to Add to Twilio?

I was asked this week about Twilio.

Can you advise about my adding to my small position in $TWLO? Stock has been flat, as has my position.

Advice is not my bag, but charts are! Here are some highlights of what I presented:

It’s definitely true that despite volatility, Twilio is trading at around October 2020 highs.

But if you look at the Covid lows from March 2020 at $71 to the February 2021 highs of $443, blue line below...

You get a pretty rapid and insane pull forward:

In the same time, of course, Twilio’s valuation followed suit:

So the question is really how should Twilio be valued?

Here’s Twilio’s EV to Sales since its June 2016 IPO:

Shot up out of the gate after its IPO

Crashed down to ridiculous low single digits at the end of 2017

Roared up to 20+ in early 2019

Came racing down again even Pre-Covid

High teens strikes me as a fairly reasonable valuation for a company that has a Dollar Net Retention in the mid 130s and is ideally suited for a post Covid world.

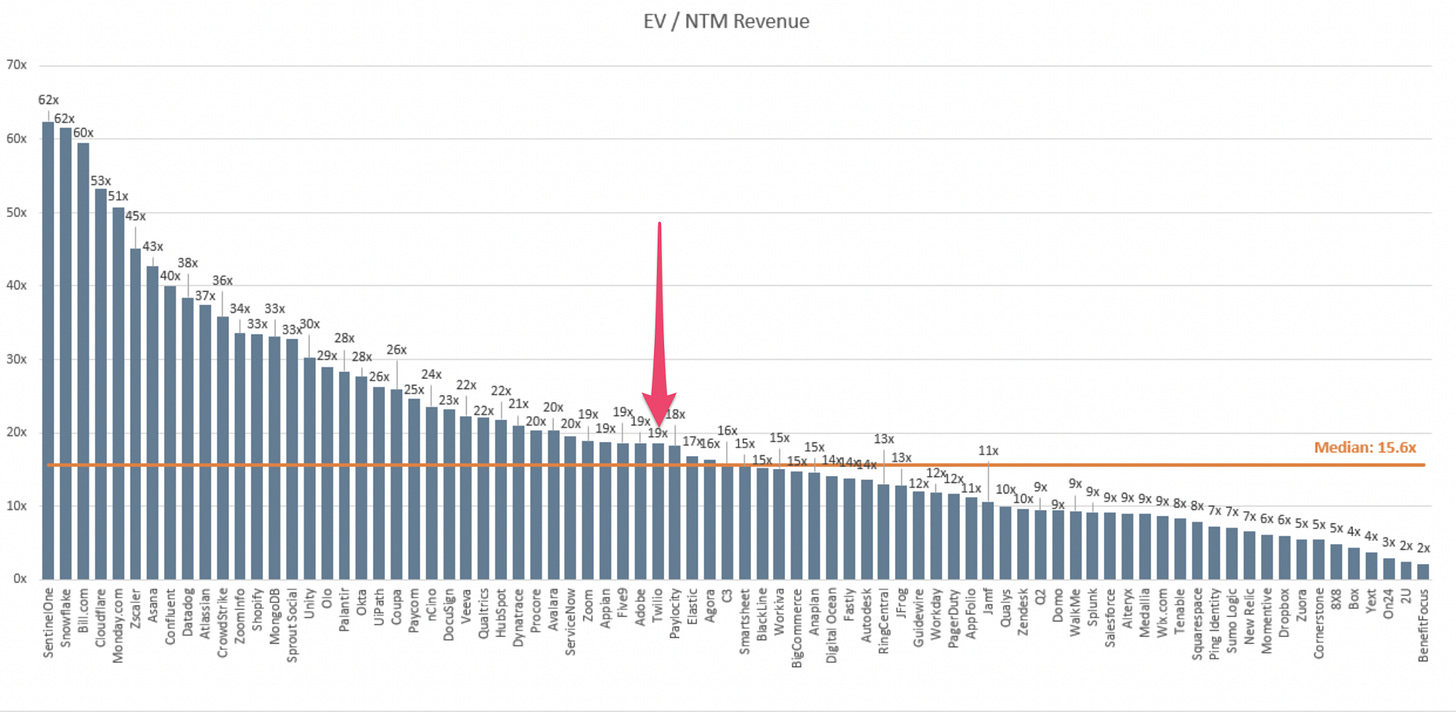

Let’s take a look at Jamin Ball’s most recent weekly report on SaaS companies.

He shows Twilio trading at 19x NTM revenue, around the middle of the pack for a lot of these high growth SaaS names.

When Jamin scatterplots the names looking at NTM revenue growth vs multiple, i.e., “how correlated is growth to valuation,” Twilio sits at a relatively favorable position.

Twilio sits even more favorably in this next chart. He explains:

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations.

Here are all my buys on Twilio.

I think if it gets to the low $300s again, I’d be a big buyer. Around these levels, I think incremental buying is prudent.

3. Searching for a Restaurant Stock

I was in a Shake Shack a few days ago and couldn’t believe how busy it was. Covid shmovid.

And I remembered posing this question late last year:

So I got to thinking, should I have a restaurant stock in the portfolio?

To be fair, I do have some very small restaurant exposure:

As you can see by the number of tranches, I never meaningfully added to these positions. They are not core positions, and I don’t consider them when thinking about the portfolios.

But there is something appealing about the stories of Chipotle and Domino’s. Food brands that appear basic, but have been able to leverage technology to produce monster returns.

Could I interest you in these returns since Chipotle’s IPO in January ‘06?

Crazy, I know.

Is there another restaurant brand lurking that could follow a similar path?

At the time I posed the question, friend of the program Blaine Capital pointed me to the following slides from Wingstop’s Investor Presentation.

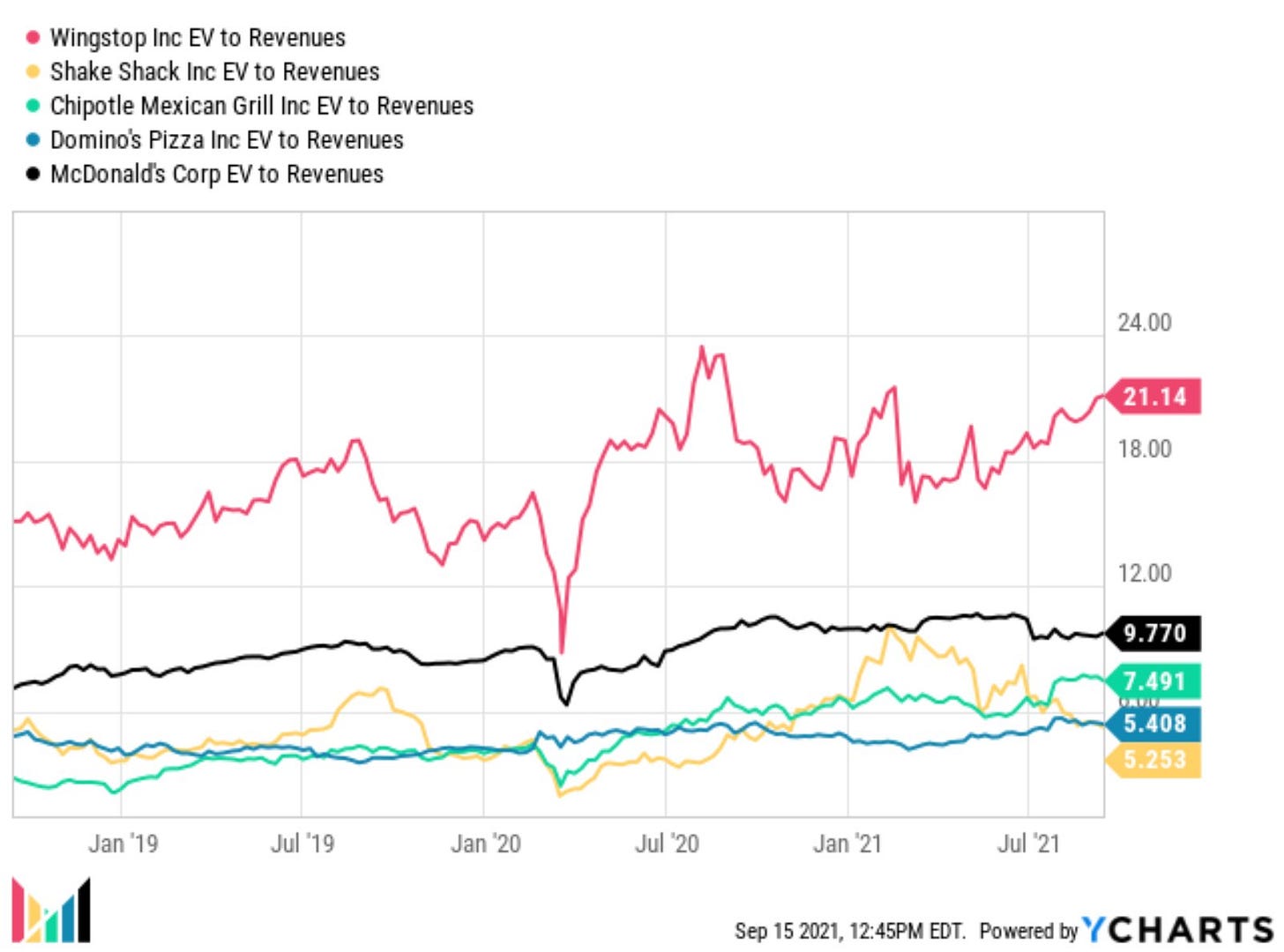

But does it explain such a premium in valuation over other restaurant stocks?

I don’t know. But it certainly has me thinking!

4. Business History Nuggets

A. Roaring 20s by Tate

Late last week Substack promoted a newsletter, Roaring 20s by Tate.

In an interview with the author, James Tate, he explains his newsletter in one sentence:

I’m reading the Financial Times and Wall Street Journal from 100 years ago each week leading up to 1929.

In the newsletter’s About Page, Tate explains:

The 1920s was the first decade where markets went mainstream, and both promise and wonderment beguiled the general public. This is the world of Jay Gatsby and Josephine Baker. New inventions and relaxed attitudes towards financial instruments gradually coalesced into a toxic cocktail at the end of the decade.

The intention of this newsletter is to explore how markets moved and journalists reacted between 1921 and 1929: the Roaring 20s.

Cool!

B. Neckar Value Interviews Gary Hooper

I also enjoyed Neckar Value’s recent interview with Gary Hooper, who among many titles, Founded the American Business History Center.

Here’s a brief snippet.

Necker Value:

With the Internet disrupting one industry after another and software “eating the world,” why should one study business history? What lessons endure despite the radical changes in the economy?

Gary Hooper:

The whole history of business and the economy is a story of one technological disruption after the other. Steam, electricity, aviation, the automobile, the telephone, the computer, the microchip, the Internet, and many more in the future. These innovations tend to follow patterns, have similar growth rates, similar obstacles to growth, and so on. Cars at first had no highways and gas stations, the Internet had no broadband, telegraphs had no poles and wires. So there is a tremendous amount to be learned by studying how entrepreneurs and corporations dealt with such challenges, how technologies evolve, and how they die or are replaced with newer ideas.

C. Alex Rampell on Credit Cards

On this week’s Animal Spirits podcast, Michael Batnick references a recent Alex Rampell thread on “Buy Now, Pay Later.”

In the thread, Rampell, a General Partner at Andreessen Horowitz, shares a short video he made a few years ago, A Brief History of Credit Cards, where he explains how there are five parties that touch every credit card transaction.

Do you know other business history nuggets? Let me know!

That’s it for Mazwood Memo #9. Thanks for sticking around!

We’ve written Deep Dives on DigitalOcean, Adyen, Snap, Okta, MercadoLibre, Lululemon, Veeva and Unity. And now Mazwood Memos!

Have a great weekend!

Love this, keep up the great work!