I’m struck by this idea of “curating insights.” Of being interested and interesting. By thinking in public--working in public.

The internet is a big place. How do we make it smaller? The markets are a big place. How do we make them smaller?

It’s these ideas that are leading me to a new way of communicating. Like everything, I consider it a work in progress, an evolution of thought, effort and skill.

In this spirit, I want to communicate more regularly in pieces I’m calling Mazwood Memos.

They will be broken down into three core sections:

What’s Going On… In the Market 📈

What’s Going On… In My Portfolio 📓

What’s Going On… On the Internet 🖥️ (i.e., what I’m reading/learning about it)

Sometimes there will be a common thread connecting the sections (like this week). Sometimes, there won’t.

So let’s get after it.

📈 In the Market

E-commerce: Shopify & Etsy

E-commerce is not a zero sum game. That is, there can and will be multiple winners. Do I shop on Amazon, Etsy and via Shopify? I do. I am not alone.

But I’ve been thinking more about the differences, the nuances, between Shopify and Etsy. Not in the businesses. That I understand. But in the investment opportunities.

Personally… nay, spiritually, I am more aligned with Shopify than Etsy. Why?

Powering the universe of DTC shopping is just an insane opportunity, and

I am a sucker for recurring revenue

But is that too simplistic of a view?

Let’s see how Shopify and Etsy break down their revenues.

In one corner, Shopify:

Subscription software ✅

Tools for sellers (payment providers, shipping solutions, etc.) ✅

And in the other corner, Etsy:

A cut of all marketplace revenue ✅

Tools for sellers (promote listings, shipping solutions, etc.) ✅

They are each growing businesses, taking different parts of a growing pie. Don’t you just love, simple, easy-to-understand businesses? Me too.

Some cohorting numbers from Shopify’s most recent 40-F (Canada, I know).

I’m not a mathematician, but look up exponential growth.

And some cohorting numbers from Etsy’s most recent 10-K.

These are just beasts in the making. They are inspiring.

Is that not inspiring to you?

I’m inspired by products that consumers use and touch and interact with everyday. I’m inspired by simple businesses that are easy to understand. I’m inspired by Shopify’s Founder/CEO Tobi Lütke.

I’m inspired by Etsy’s Free Cash Flow and Margins. I’m inspired by Etsy’s Free Cash Flow as a percent of Revenue (38%!).

I’m not that inspired by Shopify’s valuation, however. In absolute terms, sure $SHOP is high. That’s not really a controversial take.

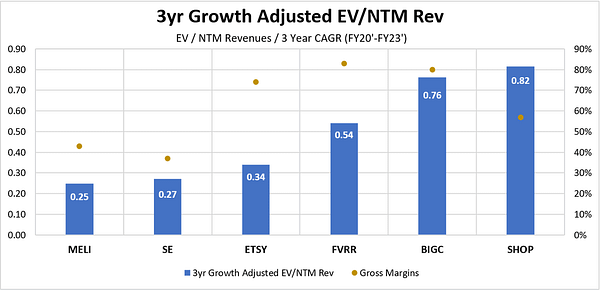

But how have the valuations of Shopify and Etsy changed over the last three years?

Holy cow, Batman.

David Marlin of the I/O fund also tweeted out an interesting take on valuations in the e-commerce universe. Shocking, I know, but $SHOP’s valuation here was also pretty, pretty high.

However you want to slice it, Shopify is expensive.

Of course, I also thought it was expensive in 2017, so maybe I’m the wrong guy to talk to.

Streaming: Netflix & Disney

In addition to e-commerce, streaming has been top of mind. Specifically, Netflix and Disney.

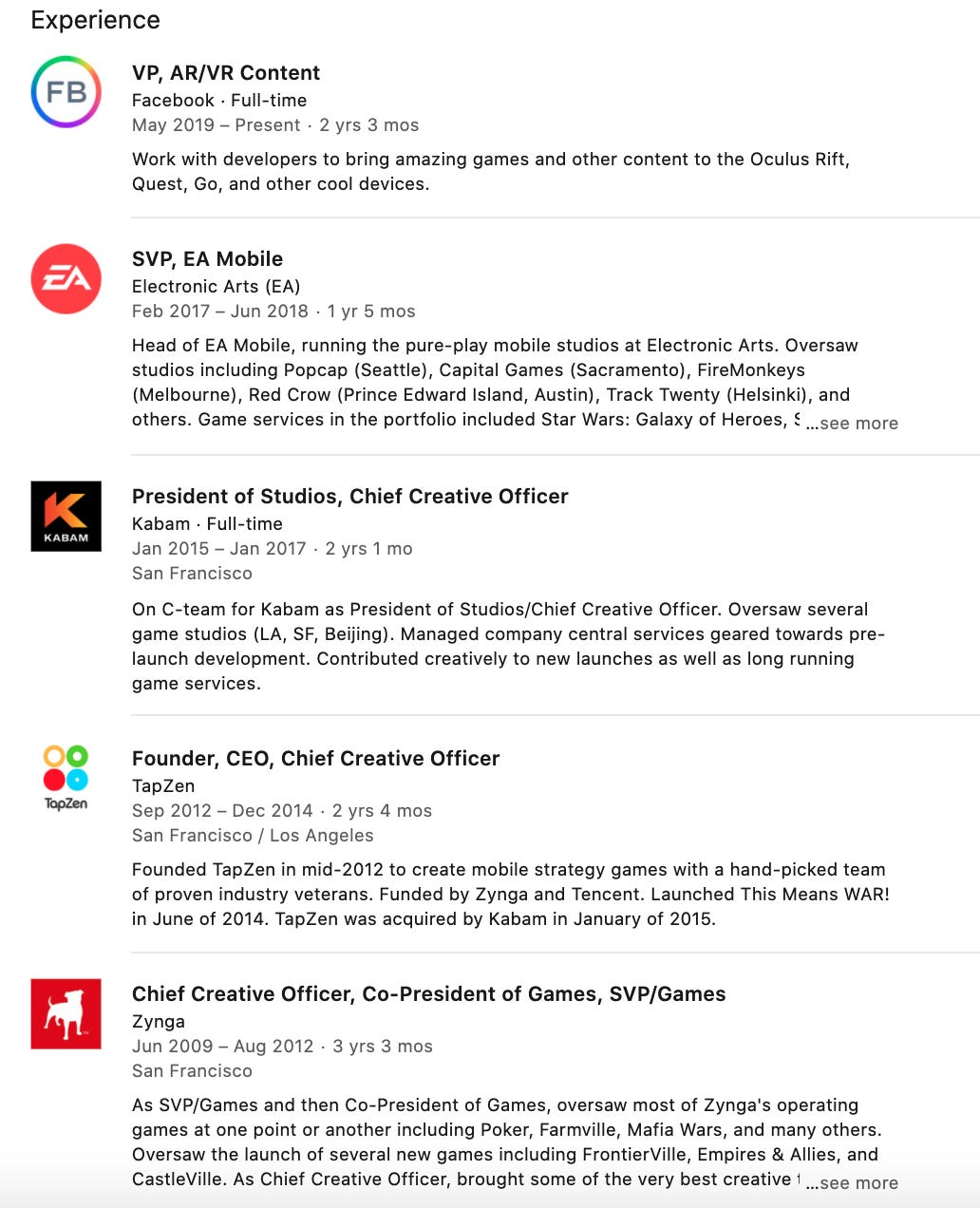

See that timestamp?

Four hours and 31 minutes later, Bloomberg breaks that Netflix has hired Mike Verdu, legit gaming executive.

How do I know he’s legit? Because Linkedin told me.

Not bad, right?

I bought Netflix in just one tranche, more than four years ago, as mentioned above.

What to do with an original (albeit maybe undeserved) FAANG member? For a while, I’ve felt the money to be made in Netflix has been made.

Netflix’s annual return, last eight years:

Pretty good.

But growth is slowing. And competition is mounting.

Will getting into gaming continue to push $NFLX alongside other mega caps? No clue. I’d like to trim some names in my portfolio, and apart from the embedded gains, Netflix feels like an early candidate to go. [Check out an “Unbook” Review I put together of Reed Hastings and Erin Meyer's Netflix book, No Rules Rules.]

Another, newly massive player in the streaming universe is of course, Disney+. I’ve got Disney in one portfolio (cost basis of $133.63). And sold it another in November.

Twitter rockstar Trung Phan had a great thread this week on how Disney was able to build Disney+ on the backs of technology provider, BAMTech.

[I had a meeting with BAMTech years ago. Very impressive group of people.]

Once Disney gets back to fully operational, it may be a hard train to stop.

📓 In My Portfolio

Shopify & Etsy

Back to our theme of e-commerce, at the end of the day, I’m long both $SHOP and $ETSY.

I’m up 136.15% in $SHOP. Here are all my buys.

I’m up 26.65% in $ETSY. Here are the buys.

My current thinking: Get bigger in Etsy soon.

[30 minutes later]

Got bigger in $ETSY.

I guess Harry has a point.

I’m also thinking I should get bigger in Shopify on a 25% pullback (it’ll happen).

There have been four such pullbacks (excluding the obvious March 2020 drop) in the last four years.

And yes, I know we’re looking at one just weeks ago. Whoops.

Evolution Gaming

I also added to a small position in Evolution Gaming ($EVVTY, $EVO).

Evolution is a very interesting company that I’m excited to study more. For the uninitiated, here’s a great starter thread:

🖥️ On the Internet

The idea for this section, like everything, is fluid. The intention had been to share what I read or watched or listened to this week that really excited me. They’ll be plenty of time for that.

But since there have been many exceptional pieces of content around Shopify and Etsy of late, I thought this would be the perfect opportunity to highlight them.

Shopify & Etsy

For a great conversation with Shopify Founder/CEO, Tobi Lutke:

For a great understanding of the Shopify business:

For an incredibly detailed deep dive into Etsy:

For a quirky take on the history of Etsy, (can it be a shameless plug if this is my own newsletter?), check out this Oral History I put together:

Bonus: Martin Scorsese, Leonardo DiCaprio & Thelma Schoonmaker

Apart from Shopify and Etsy, I watched this (since cancelled) Charlie Rose interview of Martin Scorsese and Leonardo DiCaprio from the time they were promoting The Wolf of Wall Street in 2013:

In addition to The Wolf of Wall Street, these two have worked together on Gangs of New York, The Aviator, The Departed, Shutter Island, and currently filming an adaptation of David Grann’s “Killers of the Flower Moon” (great book, by the way).

While watching this, I couldn’t believe that Scorcese has worked with the same editor, Thelma Schoonmaker, since his first feature film, Who’s That Knocking at My Door, from 1967 (!!). I loved learning more about their partnership.

Reminded me of these cool cats 😉

That’s it for Mazwood Memo #1! Thanks for sticking around.

We’ve written Deep Dives on Adyen, Snap, Okta, MercadoLibre, Lululemon, Veeva and Unity.

And now, Mazwood Memos 😀

Let’s get it Mazwood! 💪

Also, that last photo: Munger and who? Surely that can’t be Buffett 😅

Good stuff, man!