Let me just start by saying I dig the payments space.

What’s not to love? The picks and shovels of all modern economic activity.

There’s a reason Stripe’s stated mission is “to increase the GDP of the internet.”

With more emerging markets coming online, the developing world’s rising middle class, corporate revenues swelling, the rise of e-commerce, etc., consumer and business spending has never been more interesting.

But who are the players?

Visa and Mastercard are the behemoths.

Paypal has quietly become a giant.

Amex is a very much alive.

Square is the next generation.

And that’s just U.S. based.

Not to mention private players like Stripe or Plaid (sorry, Visa).

Or international ones like StoneCo.

And these are just the household names! There are many others that make up the payments ecosystem.

So what is Adyen? How does it fit in? And why am I excited about it?

All great questions!

Let’s get into it.

1. On My Radar

I first saw Adyen in this CNBC Top 50 Disruptors List of 2018.

The CNBC piece says:

Most consumers likely never heard of Adyen — and the Amsterdam-based company is just fine with that. Started in 2006, it is one of the fastest-growing companies in the online payments industry and counts Uber, eBay, Netflix and Spotify among its customers. Unlike a customer-facing payment app like Apple Pay, Adyen (Surinamese for “start over again”) works directly with merchants to give them a single-payment platform that can work in different regions around the world. It also courts brick-and-mortar retailers, selling them on the ability to use a single-payments system for both online and in-store sales.

Payments ✅

B2B ✅

Awesome clients ✅

Needless to say, I was interested.

After a brief operation where I faked Dutch identity, I was in to whatever they were offering.

🤫

2. The Business

CNBC’s description still fits like a glove.

Furthermore, Adyen explains they “provide a single payments platform globally to accept payments and grow revenue online, on mobile, and at the point of sale.” Easy enough.

The value proposition is simple. “Let your shoppers use their preferred payment types, via a personalized checkout experience, online, in app, or in store, no matter where in the world they are.”

Kamran Zaki dives a little deeper into the core business during Adyen’s virtual “Capital Markets Day” from September 29, 2020.

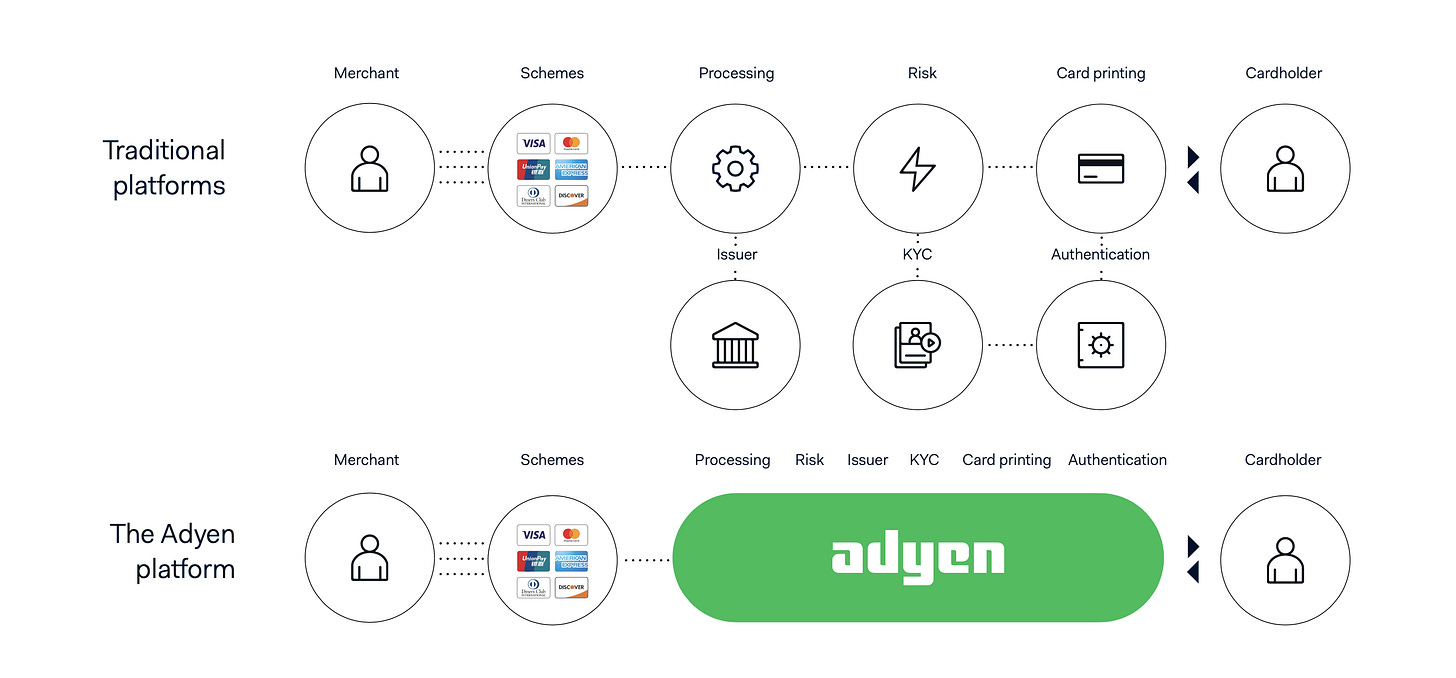

How are we really solving the complicated problems for our customers?…Typically a customer (a merchant in this illustration) would have connected into a gateway, had somebody to help them with risk management, a different person often for processing, and a different person for acquiring.

So they would have sometimes been partnering with four different providers in order to be able to accept payments, and sometimes that would’ve been per country. So we’ve had customers even in Europe that have often had a portfolio of twenty different partners that they needed to support all the different countries they were operating in, let alone as you expand globally, that number grew.

What Adyen really did is combined all those into one. So a customer just partners with Adyen—we provide all of these different capabilities and help them offer all kinds of payment methods in different parts of the world through a common interface, common reporting, reconciliation, etc.

So again, it helps them with time to market, it helps them with simplicity in terms of ongoing operational complexity and cost, and most importantly, because we offer all of these different capabilities in one platform, we’re seeing all of the data across the board, rather than handoffs between different parties. And this really helps us help our customers grow their business.

This makes up the core part of Adyen’s business, but in the last year and half, Adyen is also penetrating the “issuing side of the house.”

Here’s a similar chart that Adyen presents depicting how they help customers issuing payments.

Moreover, consider a company like Booking.com, that is both acquiring payments (from end users) and issuing payments (to travel providers). Consider how valuable a tool like Adyen becomes:

Talk about a product that solves a problem.

3. A Quick Detour with Booking.com and Others

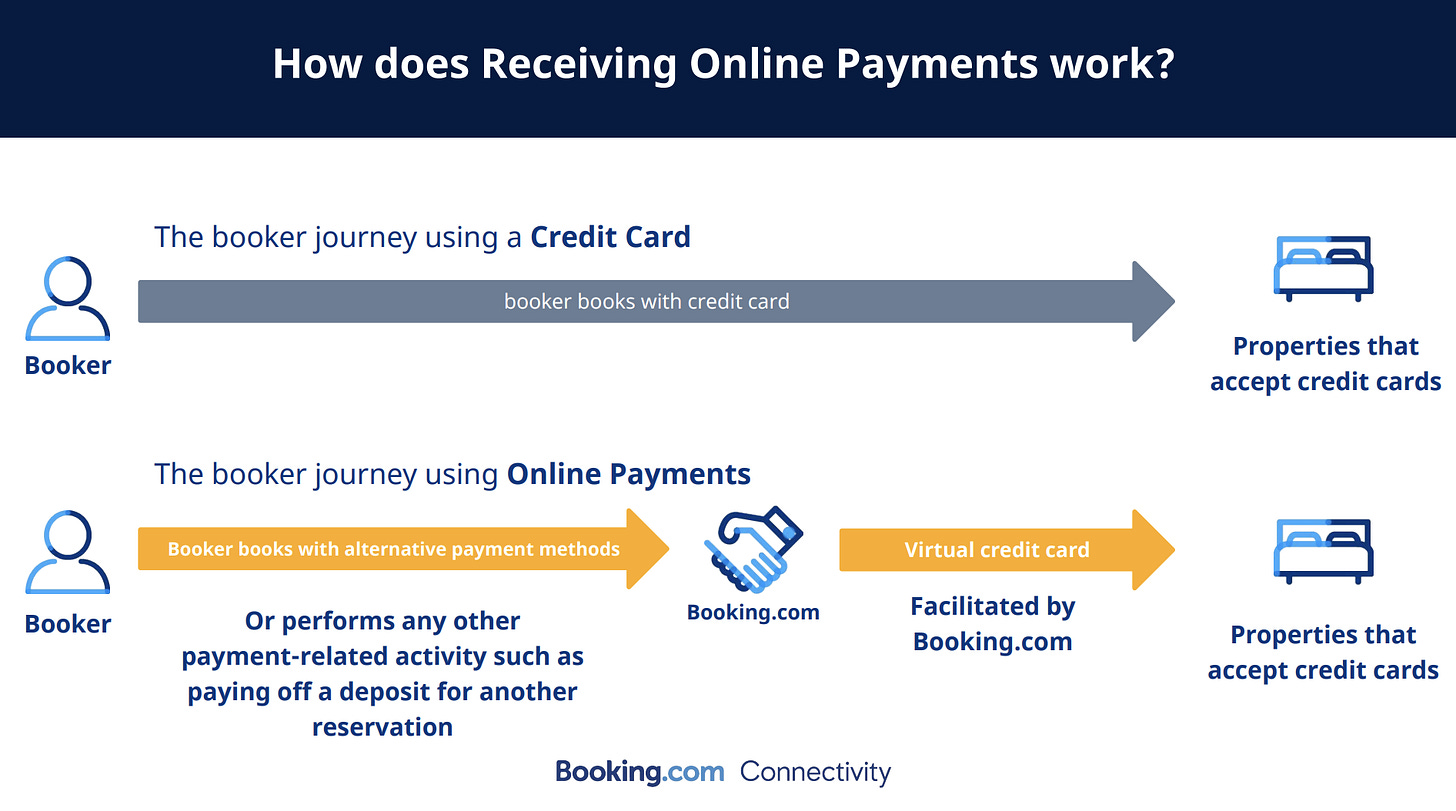

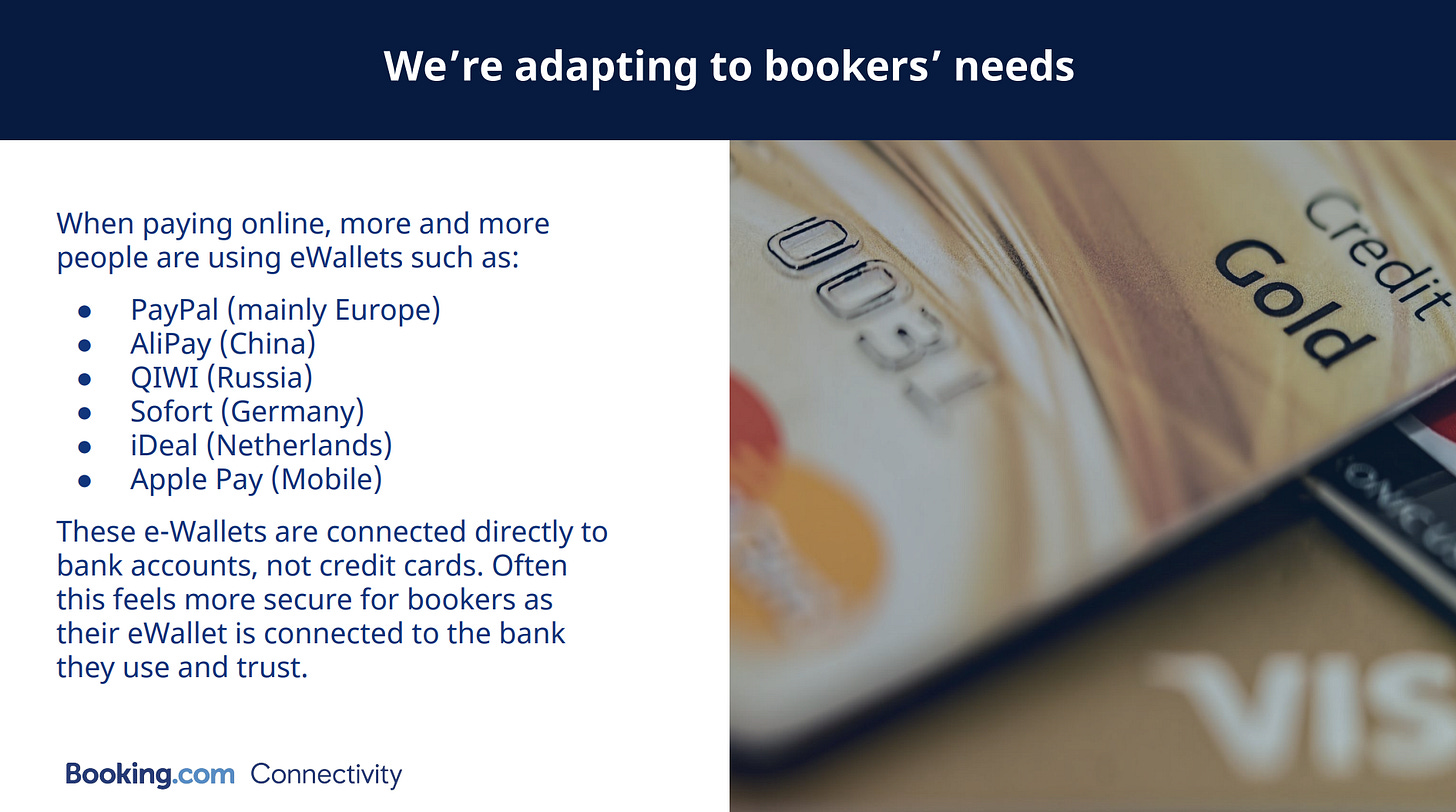

In 2019, Booking.com put out a report, “Online Payments: What and Why?”

Indeed, they were facing a problem.

A recent survey revealed that one out of five Booking.com bookers abandons the reservation process because their preferred payment method isn’t available.

That sounds insane! One out of every five users couldn’t book! That’s a lot of unhappy users. And a ton of lost revenue for Booking.com and their partner agencies. No wonder they were desperate for a solution.

Here are some slides that caught my attention:

Payments is complicated!

At its core, Booking.com is a simple business, a global platform that connects travelers to flights, hotels, car rentals, etc.

But under the hood, the payment experience can be incredibly complex. Why should Booking.com have to worry about that? This is where Adyen comes in.

And it’s not just Booking.com.

Here’s who Adyen highlights as customers in “Enterprise Platforms & Marketplaces.”

Another category where Adyen excels is “Enterprise Retail, Food & Beverage and Hospitality.”

At this point is should be fairly obvious why Adyen shines in this category.

To go from here:

To here:

I can almost feel the collective sigh of relief from finance departments all around the globe.

One last note on Adyen’s customers. It’s important to note how they view their own target:

Historically, we built the Adyen platform focused on the needs of enterprise merchants. Now, we are broadening our reach and are ready to support the growth of businesses in the next adjacent segment to enterprise, mid-market.

4. Financials & Valuation

Comps due to Covid are obviously tough, but let’s do our best to paint a picture. To help, Adyen produced this nifty chart that shows 2020 weekly retail processed volumes.

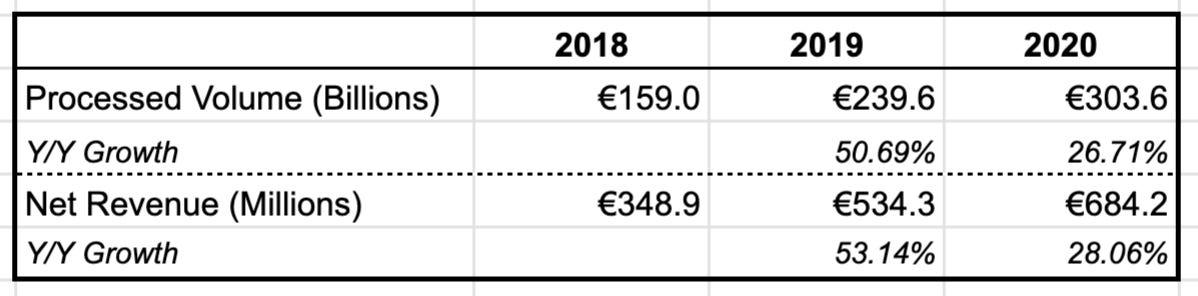

Two metrics that Adyen openly cares about are Processed Volume and Net Revenue:

Headquartered in Amsterdam, with a global footprint, Adyen’s geographic revenue mix is something I also want to monitor.

Specifically, I want to stay on top of North American growth:

Representing less than 20% of total revenues and growing 60+% Y/Y is a growth story to watch.

As my friend Liviam Capital reminds us:

Don’t forget, sometimes our high growth friends forgo profitability in the name of growth. Not here! (Cherrypicking names for effect!)

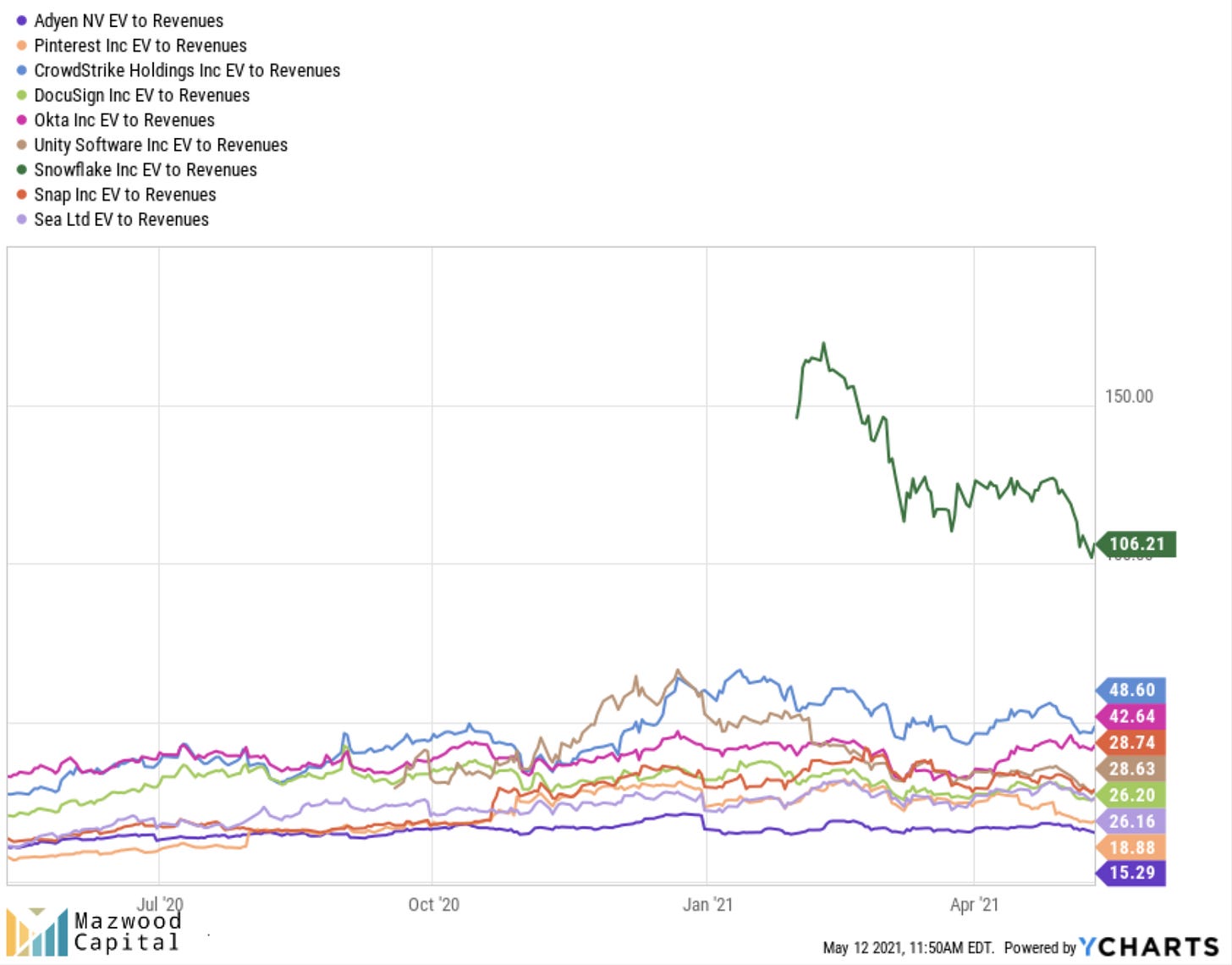

Now, if we cherrypick the same names, Adyen comes in with a reasonable valuation.

(Lol, Snowflake).

But revenues here don’t make sense. Adyen’s “revenues” are not really theirs. Net revenue is theirs.

So let’s use Enterprise Value to EBITDA as a better (albeit still flawed) metric. Of course, since the names above have negative earnings, EBITDA won’t get us anywhere.

A better comp set anyhow are companies in payments (duh). How does Adyen stack up here?

Ouch.

Of course, Adyen is a different business and growing at a much faster clip than PYPL, V, and MA. But your eyes do not deceive you—that is a healthy jump!

By itself, its valuation is approaching “average.”

But it may not be good enough.

JBY wrote a killer piece on Adyen’s valuation in February, Why Adyen's Valuation is Too Demanding. He writes:

Hands down, this is an amazing company. I just don’t think the current share price provides room for a particularly attractive long-term % IRR for an investor. But I will continue monitoring and look for periods of meaningful share price weakness where I can reassess. And longer-term, it is possible that Adyen’s management could surprise and introduce new products / services that monetize in different ways and expand Adyen’s addressable market beyond the current core business.

Time will tell what a great entry point will look like. Buyer beware.

5. My Position

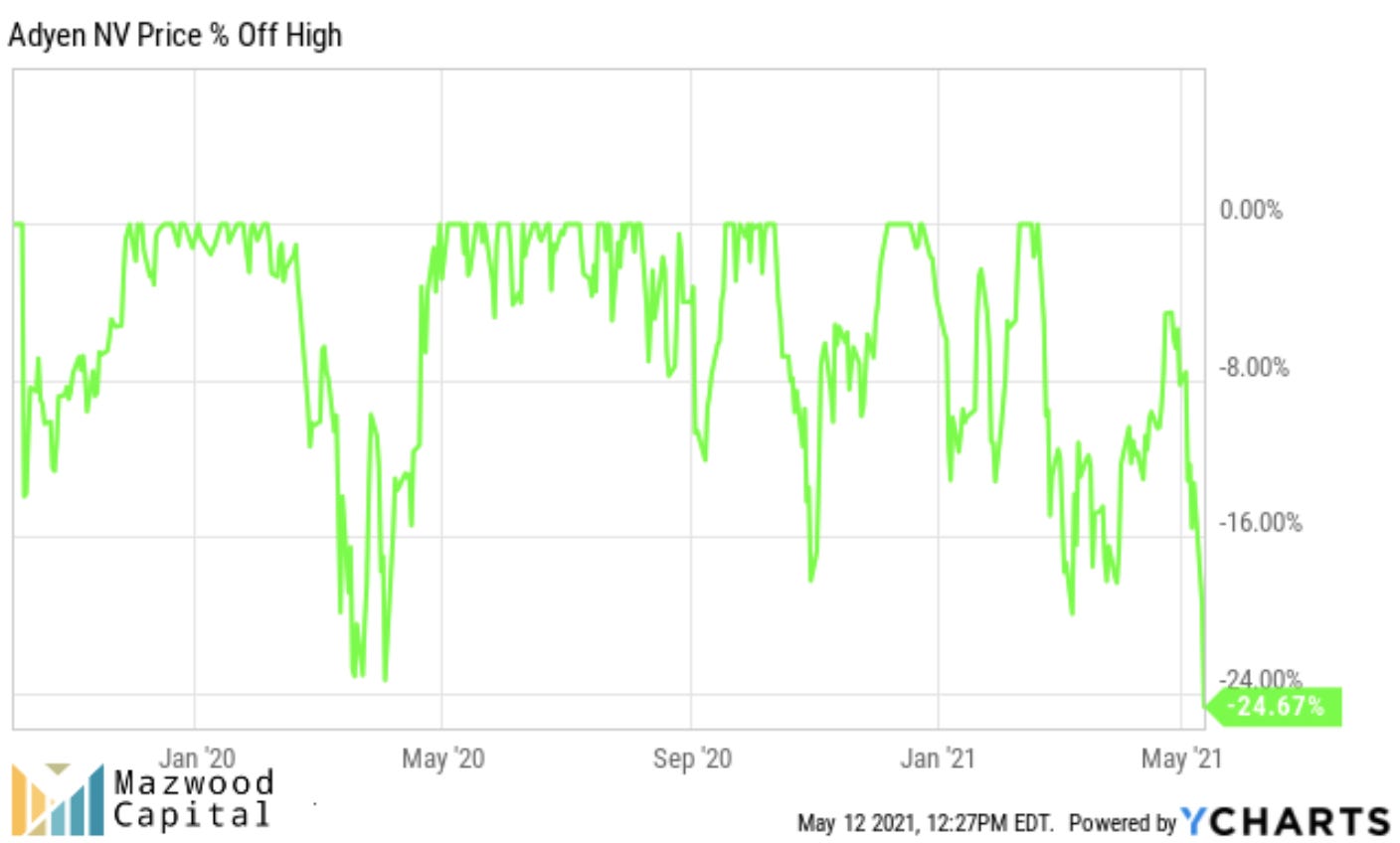

In Mazwood, I first bought a tranche on 1/27/21, and then a smaller bite two days later, taking advantage (or so I thought at the time) of a 10% mini drawdown.

But after hitting ~$53 per share on 2/19, we’re 25% off the highs, and our position in the red (😬).

But I still like the company!

It solves a very clear problem…

In an industry I love…

Led by its Founder, Pieter van der Does...

And regarded as a leader in the space:

It’s a company I envision being a Top 10 Holding.

I don’t know when, but Payments is a core thesis of mine, and if you’re going to be a payments investor, Adyen has to have a seat at the table.

Thanks to everyone for giving this Adyen Deep Dive a read!

If you’re new here, we’d love to have you subscribe to Musings by Mazwood. Past Deep Dives include: Snap, Okta, MercadoLibre, Lululemon, Veeva and Unity.

We aim to be respectful of your inbox and post portfolio updates, company deep dives (like this one), and more. We hope you’ll join us!

P.S.:

I was struck by how beautifully Adyen displayed their Income Statement in the most recent H2 2020 Shareholder Letter.

Cool, right?

So I did a little digging. Well done, Nadieh! 👏

Additional Resources:

Interview with Founder/CEO Pieter van der Does:

Great threads on $ADYEY from:

Longform articles

Adyen And The Virtual Economy Boom from Benchmark

How Adyen is Disrupting Payment Processing from Ivey Fintech Club

Money Often Costs Too much – A Look at Adyen from Monetary Musings

Good stuff, thanks!