Happy New Year and welcome back. It’s been some time.

I listened to fellow Substacker, Thomas J Bevan, on Jim O’Shaughnessy’s Inifinite Loops podcast this week.

Thomas talks about the spirit and importance of writing:

I just think, at least for me anyway, if you have thoughts just circling your head, they effectively don’t exist… not doing anything. There’s something to do with the actual process of starting to write things down, either [from] your own thoughts, or to generate thoughts, [or] things you discover from books. That becomes a process of starting to get to know yourself and what you actually think.

Do you know yourself? Do you know what you’re thinking?

I’m not one for resolutions, but I am one for taking the arbitrary turning of the annual clock to reflect and consider what systems are working, what systems need tweaking, or even an overhaul.

Are you eating right? Tweak it. Are you treating your body right? Tweak it. Is your mind stimulated appropriately? Tweak it.

James Clear has this beautiful graph in Atomic Habits.

Compounding is not just for our investments. It’s for everything we do.

As I look to improve my systems, as I look to improve a little bit everyday, here a few ideas I’ve been pondering.

You can’t borrow conviction (See: Redfin).

Find more obvious names. Find less obvious names.

Have a well-defined process. What’s your system for breaking down a company? Every prospective company needs to be vetted by this process.

Keep track of performance. What are you measuring? What are you comparing to? Are you any good?

It’s okay to take a loss.

It’s okay to take profits, or use a stop loss if over extended (See: Snap).

Valuation matters. How do you measure valuation?

Have a buying schedule.

Have a better content filter: pay for quality/expertise.

What’s your edge? Do you even have one? Is it time? How are you leveraging it?

Don’t obsess over market timing. This hurts you. See this chart that my friend Eugene shared this week:

I’ve been thinking a lot about how to attack 2022. How to use my time well. How to feel more productive. How to be more productive. Have systems. Have processes. Stick to them. Don’t get lost in the chaos of Twitter. Don’t get caught up in the volatility of my portfolio.

Read. Write. Treat your body and mind well. Life will be good. This isn’t hard.

Here’s a list of books I grabbed from my shelf that I want to read (or in a few cases, reread) to kickstart the year.

I want to slow down. Get back to the basics. Think about investing holistically. Think about thinking, holistically.

Earlier this week, Q-Cap unearthed this Berkshire Hathaway Shareholder Letter from 1977.

One more time, for the people in the back, Buffett writes:

We select our marketable equity securities in much the same way we would evaluate a business for acquisition in its entirety. We want the business to be (1) one that we can understand, (2) with favorable long-term prospects, (3) operated by honest and competent people, and (4) available at a very attractive price. We ordinarily make no attempt to buy equities for anticipated favorable stock price behavior in the short term. In fact, if their business experience continues to satisfy us, we welcome lower market prices of stocks we own as an opportunity to acquire even more of a good thing at a better price.

As I told Q-Cap:

Stock picking certainly isn’t easy. Beating the market is hard.

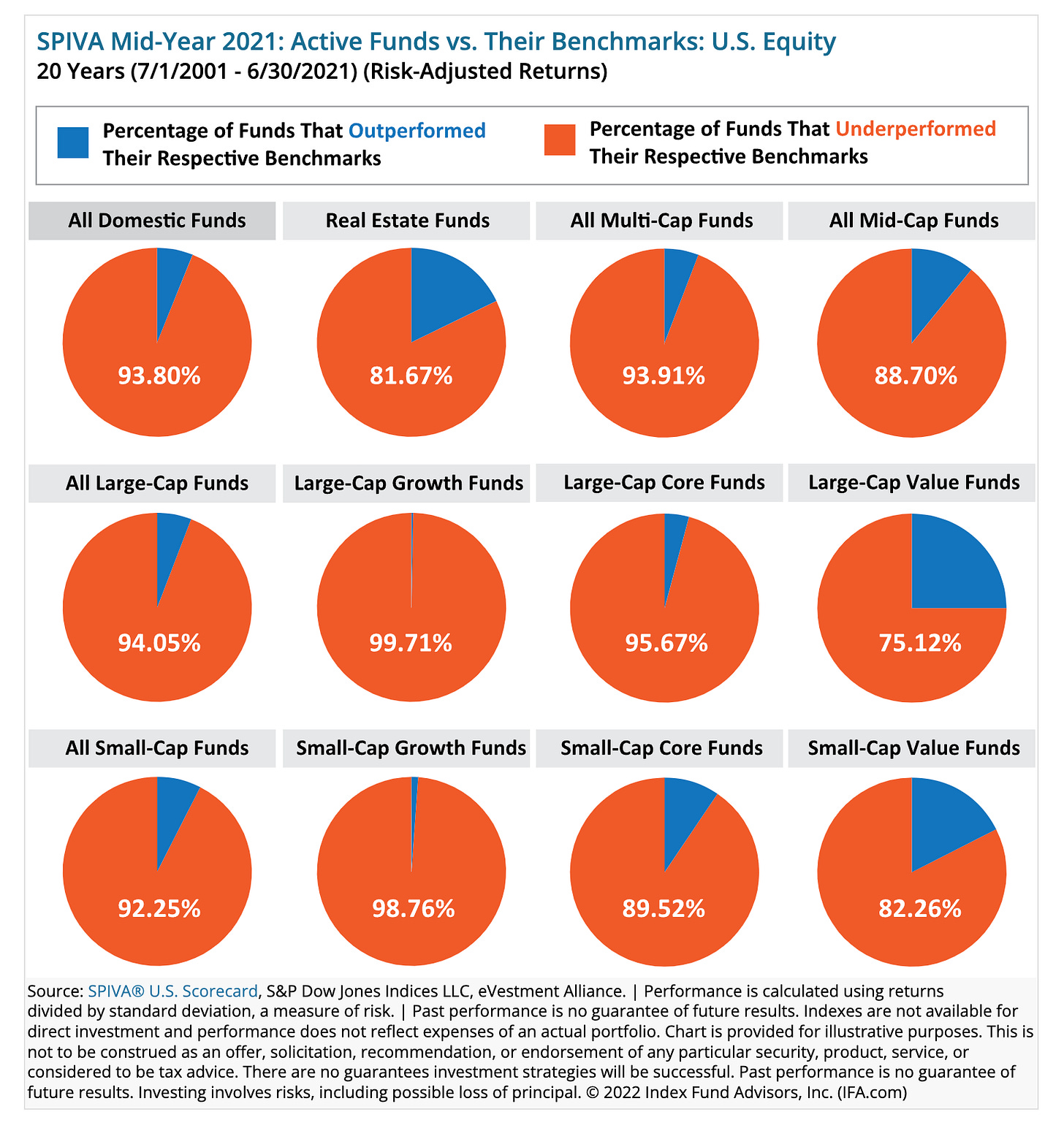

Take a look at how active funds compare against their benchmarks, according to this study from S&P Global’s SPIVA (S&P Indices Versus Active) Scorecard.

Hint: It doesn’t look great for the active funds.

This is depressing. Why are we stock picking? It can’t be for the returns. Look at the data! We will lose. It’s got to be something else.

I listened to rockstar-Substacker, LibertyRPF, on Jim O’Shaughnessy’s Inifinite Loops podcast a few weeks ago (I guess I’m on a Jim O’Shaughnessy kick!). Here’s what Liberty had to say about returns, and using investing to leverage “lifestyle design”:

Only in recent years, I realized that unlike almost what everybody else is going to say, I’m not trying to optimize for the best returns. Everybody is trying to, ‘Ah, I got to figure out how to get the most alpha. I’m going to put my name at the top of the leaderboard.’ I am trying to optimize for happiness, how fun my life is.

Later in the conversation, Liberty continues:

I invest in the things I want to learn about. To me, I get so much value from investing that’s not monetary, that I feel like even if I was underperforming the market, it may still be worth it for me. Maybe the rational thing would be to put my money in OSAM [O’Shaughnessy’s firm] and do something else, but through investing, I’m meeting great people, I’m having great conversations, I’m reading about great companies and technologies. I’m learning everyday, so that intangible stuff has so much value to me. How many percentage points of returns is that worth? If I could do 12% in an index, [but instead] I’m doing 10%, I’m having a great time, I’m meeting great people, to me, that’s worth millions, right?

I told Liberty that I liked the podcast very much, and he recommended this video of Pete Adeney to me.

I didn’t realize that Pete Adeney is Mr. Money Mustache. I remember following Mr. Money Mustache years ago, including reading his profile in The New Yorker.

Mr. Money Mustache’s vibe is about retiring early, not being guided by money, and living the life you want to live.

It’s funny watching this video years after following Pete. It’s funny seeing how much my life has changed, and how much of his presentation still resonates with me (or doesn’t).

Two particular lines from the video really struck me:

Work is good for its own sake. Work is better when you don’t need the money.

Effort and learning is the stuff that makes us happier.

Maybe this is why we pick stocks. Maybe this is why we’ve chosen this pursuit. Sure, we say it’s about the returns. Maybe that’s true. But maybe, deep down, we know that work is good for its own sake. And we know that effort and learning makes us happier.

Here’s to a year filled of good work, strong effort, and deep learning. Here’s to a year of happiness.

~Maz

Thanks for this!

Huzzah! 💚 🥃