#14: Earnings Continued, Flow State, Coinbase, Housel & Sequoia's 2005 Investment Memo on YouTube

$TTD $PYPL $COIN $U

I’ve been reading about flow.

MC, of the newsletter “Flow State,” remembers Mihaly Csikszentmihalyi, “the Hungarian-American psychologist who developed the theory of psychological ‘flow.’” Csikszentmihalyi passed away three weeks ago at 87.

MC explains that:

In 1990, Csikszentmihalyi (pronounced cheek-sent-me-high) published Flow: The Psychology of Optimal Experience... The book is best known for its novel description of what it feels like to be in a flow state. A person in flow is blissfully immersed in a goldilocks activity: something not too hard but not too easy.

MC quotes Csikszentmihalyi, that flow is when:

One’s skills are adequate to cope with the challenges at hand, in a goal-directed, rule-bound action system that provides clear clues as to how well one is performing. Self-consciousness disappears, and the sense of time becomes distorted.

Flow is one of those things that might be hard to describe, but you know when you see it, or more specifically, when you’re in it.

Cutting ten positions three weeks ago has helped my flow.

Let’s cut the fat and focus on what matters.

Flow with me.

I want to take a moment and say a quick welcome to all our new subscribers! If you’re reading this but haven’t subscribed, please consider joining our curious and thoughtful corner of the internet here!

This Week:

Earnings Reactions

The Trade Desk Soars

What’s with Paypal?

Still into Coinbase

Unity to All Time Highs

Recommendations

Bankless Interviews Brian Armstrong

New Piece from Morgan Housel

Sequoia Capital’s 2005 YouTube Investment Memo

1. The Trade Desk Soars

The Trade Desk kicked the week off, reporting earnings Monday morning.

Can I interest you in the returns since?

Yield Fanatic captured it best:

But it’s not without volatility!

Eugene with a killer thread:

He finishes with:

Final Thoughts on The Trade Desk: Rare combination of a disruptor, top dog with strong management combined with rapid growth, innovation, scale, profitability and vision that continues to execute well. Remains a core and very high conviction position.

Max as well:

I’ve spoken about The Trade Desk in a few different places. I covered initiating a position here and wrote an Oral History here.

And here’s what I said when I bought shares for the first time four years ago. (Split-adjusted, the first shares have a cost basis of $5.15.)

Pretty good.

In total, here are my tranches:

Lesson: Don’t fall asleep at the wheel for three years.

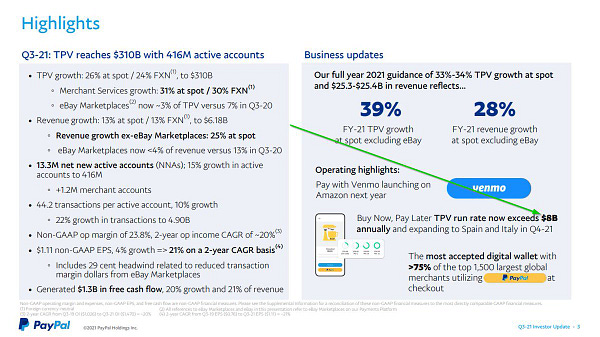

2. What’s with Paypal?

Paypal is a gnarly run, going through its largest drawdown ever.

I thought I was being savvy when it was “only” down 22% from highs when I bought a “bigger slug” three weeks ago.

Whoops.

Here are all my buys.

Nothing here is terrible (yet), but what’s going on?

John Street with a great thread on the quarter.

There are reasons to be bullish.

But not without concerns.

Is Paypal a best idea? Maybe. With StoneCo out, Paypal sits alongside Visa, Square and Coinbase in my fintech section of the portfolio.

Is that the right number of fintech? Too much? Not enough? I’m inclined to keep Paypal’s seat, but not confirmed.

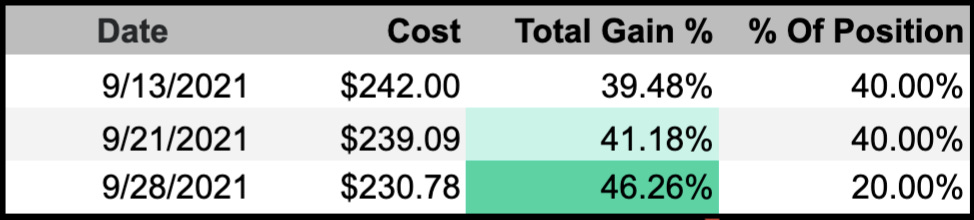

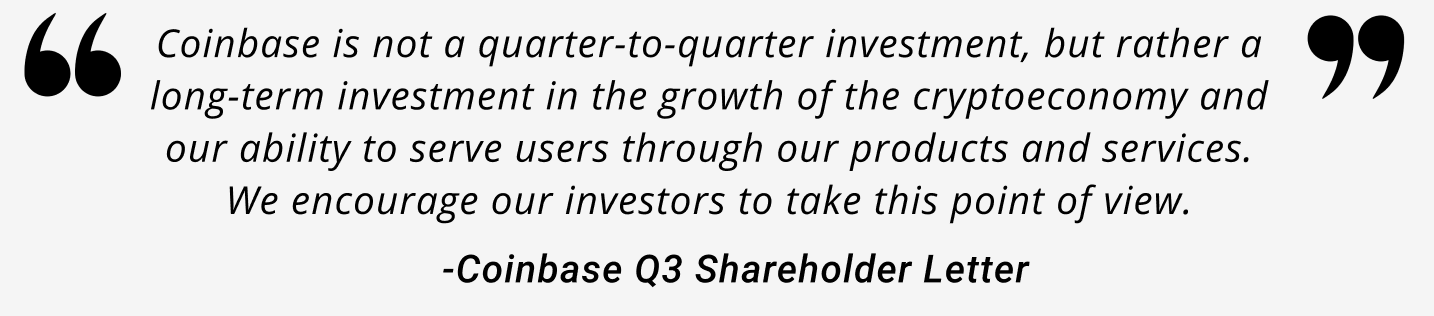

3. Still into Coinbase

Coinbase got hit after hours, but very quickly rebounded.

I got into Coinbase in September after listening to the “The Scoop” podcast with Frank Chaparro. He hosted two big dogs from Coinbase to share the company’s vision: Brett Tejpaul, Head of Institutional Sales, and Greg Tusar, Head of Institutional Product.

I wrote about starting a position in Memo #9.

It’s had a nice little run since buying that first tranche on September 13th.

Here are each of my three tranches:

Some thoughtful analysis from a few of my internet peeps:

Of course, John Street again on anything fintech.

And Nick, Austin and David:

Maybe this is pricing bias (40% return in seven weeks can do that to you), but I’m very excited about Coinbase.

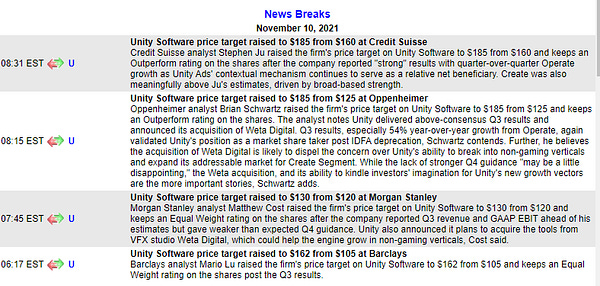

4. Unity to All Time Highs

By most accounts, Unity had a good quarter.

People are digging Unity right now!

It’s not just Jo. The market agrees! All time highs, and on a juicy run since those mid May lows.

Unity reports revenue in three segments: Create, Operate & Other.

In the simplest of terms, Create is where you build stuff. Operate is where you monetize what you’ve built.

Strategic Partnerships & Other—their Beyond Gaming—is a bucket I’ve been excited about.

But negative Y/Y growth. Huh?

In a Deep Dive on Unity, I wrote:

This is where Unity gets really interesting.

[Unity reports:]

“We continue to gain significant traction with customers and leading brands in industries beyond gaming, including architecture, engineering and construction; automotive, transportation and manufacturing; and film, animation and cinematics.”

Measured by 2019 revenue, Unity works with:

Eight of the top 10 architecture/design firms

Nine of the top 10 auto companies

Maybe my Beyond Gaming thesis is wrong.

Daniel lays it out:

Plant tells me I am in fact wrong!

Still a compelling value proposition, no doubt.

But something I need to monitor.

Furthermore, here’s CEO John Riccitiello discussing Unity’s place in the Metaverse (h/t North Bluff Capital).

More than 50% of everything that is real-time 3D in the world, that new metaverse thesis, is built in Unity.

We’re the underlying toolset for creating the metaverse.

At the very least, Unity presents itself as a compelling Metaverse play.

1. Bankless Interviews Brian Armstrong

For those who want a bit more Coinbase, Co-Founder/CEO Brian Armstrong was interviewed by the Bankless guys this week.

Brian shares what led him to start Coinbase, how he thinks about the crypto ecosystem, and what the future could look like for his company. Great interview.

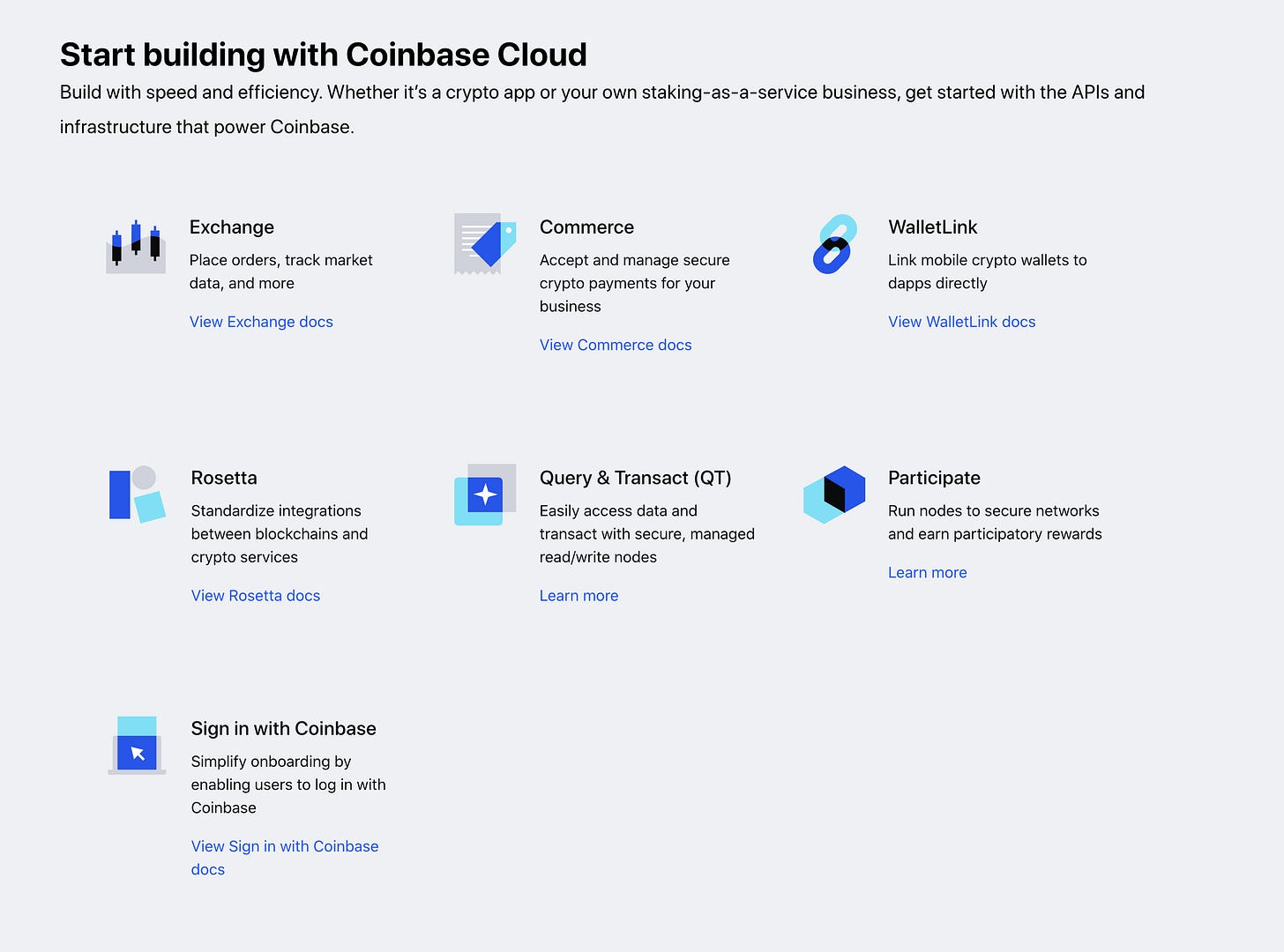

In the interview, Armstrong references Coinbase Cloud, a relatively new space where developers can start building. Think AWS for crypto.

Again, maybe this is recent pricing bias, but in Coinbase, I’ve got a thoughtful, Founder-led organization, disrupting global financial systems, with both consumer and institutional products. Let’s go, Brian!

2. New Piece from Morgan Housel

Anytime a new Morgan Housel piece drops, it’s a must read.

On Wednesday, he published his latest piece, “Experts From A World That No Longer Exists.”

Morgan writes:

The biggest risk to an evolving system is that you become bogged down by experts from a world that no longer exists. The more evolution you have, the more you should expect that expertise has a shelf life.

He continues:

Marc Andreessen explained how this has worked in tech: “All of the ideas that people had in the 1990s were basically all correct. They were just early.” The infrastructure necessary to make most tech businesses work didn’t exist in the 1990s. But it does exist today. So almost every business plan that was mocked for being a ridiculous idea that failed is now, 20 years later, a viable industry.

Boy, things can change quickly.

For more Morgan Housel, I put together an “Unbook” Review of Morgan Housel's The Psychology of Money. I also loved his piece, “The Three Sides of Risk.”

3. Sequoia Capital’s 2005 YouTube Investment Memo

Sequoia Capital’s Roelof Botha was on Invest like the Best last week.

In it, he shares that curiosity is the common DNA trait of great investors.

There are obviously a lot of attributes. You need analytical skills to be able to understand diligence. You need judgment of people. You need an intuition for where markets can go. You need imagination. If you go and read the YouTube memo, which is now in the public domain. It required imagination to back three people with a product that 9,000 people had registered for. That’s what YouTube was at the time we first invested, and I wrote the memo for it. So you need imagination. You need all those things. But the most important thing is curiosity.

He continues:

Are you interested in learning about new things? Are you interested in meeting new people? Are you interested in listening to their idea for a company and how they’re going to change the world? And if you lose that curiosity, then you become jaded. And then you should probably stop working as an investor.

Botha knows what he’s talking about. He was the first institutional money into YouTube! And authored the investment memo.

Well, since the internet is awesome, we can read it! Check it out here.

In it, Botha wrote:

The three entrepreneurs are scrappy and smart. They have built a very easy-to-use, fast growing service that taps several strong veins: user-generated content, online advertising, wide proliferation of inexpensive digital video capture devices, and continued broadband adoption.

He proposes:

Invest $1m in the seed stage, followed by a $4m Series A once specific milestones are met. Sequoia would own ~30% post Series A, with a pool of ~17%.

He recommends:

I first met with the company three weeks ago, and we are in pole position for the financing. Several VCs have been cold calling the company, and a few media companies have also approached YouTube. I’d like to give the company our decision on Monday.

I recommend that we proceed with the financing as proposed.

Amazing.

I recommend you have a killer weekend. Onward!

That’s it for Mazwood Memo #14. Thanks for sticking around!

We’ve written Deep Dives on DigitalOcean, Adyen, Snap, Okta, MercadoLibre, Lululemon, Veeva and Unity. And now Mazwood Memos!

Have a great weekend!

Well done as usual!