Stocks only go up, right?

Trump gets COVID. Big whoop.

There is a stimulus package coming? Oh wait, it’s not. Oh, just kidding, it’s back on?

When does the craziness end? Does it? Who knows!

Let’s get to it.

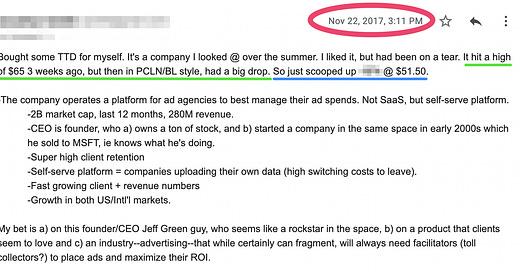

It’s Fall of 2017. I had been looking at this young company for a smaller account, interested, but concerned about it’s previous run-up. Up more than 100% in just a year since IPO. It felt like I missed the opportunity.

Would it come back to earth so I could pounce?

Waiting… waiting… waiting…

Bam! We’re in business!

Here’s what I wrote at the time. (Spoiler-alert: it’s The Trade Desk.)

Why am I talking about $TTD now? Sure, it’s sitting at all-time-highs, but what isn’t these days?

This is why:

Apart from being great for my Twitter game, seeing a name up 1,000% is pretty wild.

Some high-level takeaways:

1.

I was scared of the valuation and previous run-up. I honestly don’t think I pull the trigger at $65. I needed the 20% drop to $51 to feel secure in starting a position. Can you imagine if I missed out on $TTD because my anchor bias led me to $65 being too expensive? Don’t let past performance paralyze your ability to invest in great companies.

Case in point: Look at my time of purchase in context of all-time $TTD performance to date.

$TTD performance since IPO, 9/21/2016

2.

I did not add to the position over time: So we’ve established that I liked the investment at $51, but not at $65. Does it look like I had any opportunities to add to my position? I’m kicking myself as I write this. I don’t know why this is so complicated to understand but IT IS OKAY TO ADD TO WINNERS.

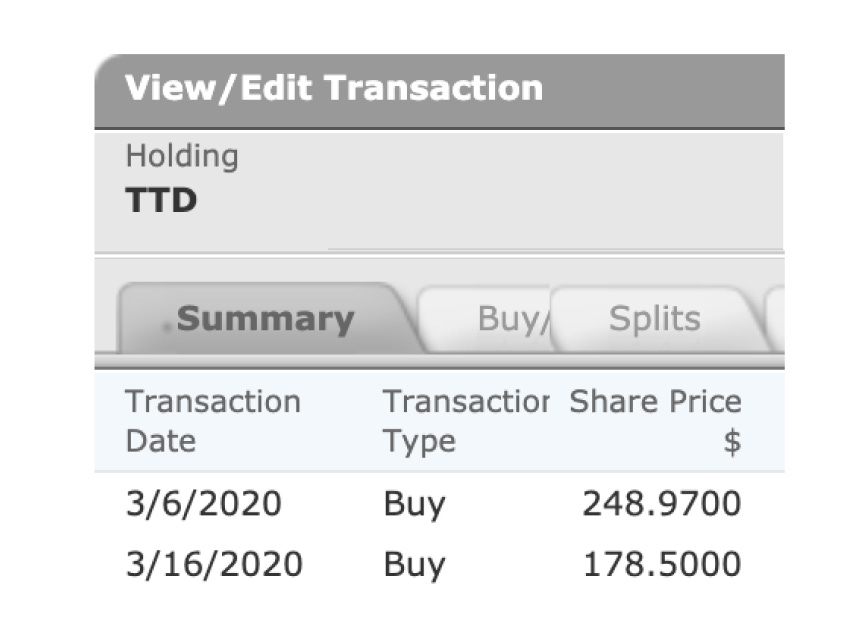

To be fair, in March, when the world started to blow up, I finally got in $TTD for Mazwood. Finally. No, it doesn’t have a cost basis of $51.50. But at least for Mazwood, it’s up 182.55%. Someone check that out for me, but I still think that’s pretty good?

One more thing on The Trade Desk. For those new here, I published an oral history on $TTD in August. It was a blast to put together, and I hope you’ll check it out here!

But don’t just take my word for it!

Quickly moving on, one more item of note from the portfolio.

Saying goodbye to Alteryx.

I don’t have strong feelings about $AYX. Maybe that’s the point. There was also enough confusion about the product to give me pause.

So after a few appearances on my “do I like you enough?” list, a 30% pop felt as good a time as any to take a bow. Alteryx can certainly have a bright future, but I’m okay saying goodbye. I was never going to have the conviction in it that I aspire to have.

Three Long(ish) Reads to Recommend

Mine Safety on “The (Not Failing) New York Times.”

How The New York Times went from a failing newspaper to a thriving digital subscription business.

What a great and thoughtful exploration into how The New York Times pivoted from a newspaper to leading digital subscription play. Great insights and storytelling, with wonderful graphs. Love the presentation.

Sriram Krishnan interviewing Daniel Ek, Founder/CEO of Spotify.

Daniel does things very differently from other business leaders and was generous to go deep with us on his leadership style, time management, decision making, Spotify's impact on the world and much, much more.

A peak into how Daniel runs Spotify and thinks about how to run Spotify. For those that are looking for more Daniel Ek first person content, his interview on Invest Like the Best from last year was also excellent (shocker, I know).

Mostly Borrowed Ideas with a deep-dive on Etsy.

A Handmade Giant in the Passion Economy.

An incredibly thorough starter read on $ETSY. I know a little bit about the product, but less so about the company as a potential investment. Its lack of recurring revenue structure has kept me from taking is seriously. Maybe I should. MBI makes a very compelling case, both qualitatively and quantitatively, that Etsy could have a place in outperforming portfolios.

Thanks to everyone for giving this weekly review a read. Please like/comment/share and have a great weekend!

~MazwoodCap

And if you’re new here, don’t be shy! We’d love to have you subscribe to Musings by Mazwood.

We aim to be respectful of your inbox and post portfolio updates, market commentaries, company deep dives, and more. We hope you’ll join us!

Always entertaining

Good read, thanks!