#12: On Finding Joy in Selling Losers

$SBUX $SPOT $JD $STNE $DIS $PINS $TWTR $TCEHY $BABA $NTDOY

I want to take a moment and say a quick welcome to all our new subscribers! If you’re reading this but haven’t subscribed, please consider joining our curious and thoughtful corner of the internet here!

Two weeks off and I’m back in the saddle.

During this period I’ve taken time to reflect. To consider how to optimize not only my returns, but more importantly, my processes.

One concept I keep returning to is the idea of decluttering.

For a while, I’ve felt that my portfolio has become an untenable garden. I’ve known this instinctively, but have been paralyzed to act.

No more!

As my homie Marie Kondo reminds us:

My gut says she wasn’t talking stocks, but the message still applies.

So I cut ten names this week. And I’m not done.

Below I’m sharing a few thoughts on when it’s okay to sell, specifically what I cut, and why.

Let’s go.

I’ve long thought of myself in the #neversell crowd.

When you log into your portfolio and see names with an initial cost basis dating back to 1997, it’s hard not to think long-term.

The problem isn’t with #neversell itself. The problem is with #neversell everything. You shouldn’t sell the best businesses in the world that continue to outperform!

But what about businesses you bought on a flier? What about businesses you don’t follow anymore? What about businesses where the thesis has changed? Or management? Or the regulatory environment?

There are many reasons where it’s okay to sell!

Unfortunately, however, I’ve developed habits where I #neversell for the wrong reasons. Hence, the untenable garden.

I aspire to have a portfolio made up of #neversell names. I’m just not there yet.

The exercise below is my attempt at decluttering my portfolio, and building toward a portfolio that sparks joy.

Without further ado, here is every position I sold this week:

Let’s go through them.

1. Starbucks

Starbucks is a fine company—not a rocket ship, nor will it kill you. Nothing wrong with fine.

I scooped up a few shares in January 2017, just a few months before current CEO Kevin Johnson took over from Howard Schultz.

At the time, I remember there being a lot written on how Starbucks was secretly a bank.

These are obviously not from 2017, but you’ll get the idea in these two quick threads:

This lay the foundation for my Starbucks thesis.

A safe name I didn’t think would hurt me

Growth prospects in China

Optionality due to its technology advancements

Sitting on $1B in free money from customers

I only added to the position once when it was putzing around post initial Covid sell-off.

But that was it. It wasn’t a meaningful position. I never cared about the position.

And since first purchase:

Why are we stock picking to achieve market returns?

So with Pumpkin Latte season upon us, it is time to say au revoir.

2. Spotify

I believe Spotify was a one-off for me because of when I bought it.

Spotify direct listed in April 2018. I had long been a customer and wanted to wait for the dust to settle before making a move. As the summer chugged along, investors appeared comfortable with the direct listing and valuation, and the stock subsequently climbed.

While not a perfect top-tick, I came pretty close when I bought shares in August 2018 at $179.95.

I was then under water for close to two years (that #neversell mentality!).

Like most of our beloved tech names, Covid finally pushed it back into the green.

But I never got comfortable adding, mainly because:

Spotify’s ability to generate profitability will always be constrained by the nature of the music business. As Kevin LaBuz noted:

And while I love podcasts, I have a hard time envisioning the audio ad market pushing Spotify to Netflix-level mega cap status.

So, as Thuderdome nudged us this week, it was time for Spotify to go.

3. JD.com, Tencent & Alibaba

Let’s just take all three China buddies together.

A. JD.com

This was the prior One Year Chart I was looking at when I first bought JD in 2018.

I was searching for modest China exposure, knew a tad about JD from some private investments, saw it dip to the bottom of this $35-$50 range, and made a small buy.

Like with the Spotify purchase, I was very quickly under water, and like with Spotify, remained there for close to two years.

Unlike with Spotify, however, I did add to JD, in a few tranches beginning at the end of last year.

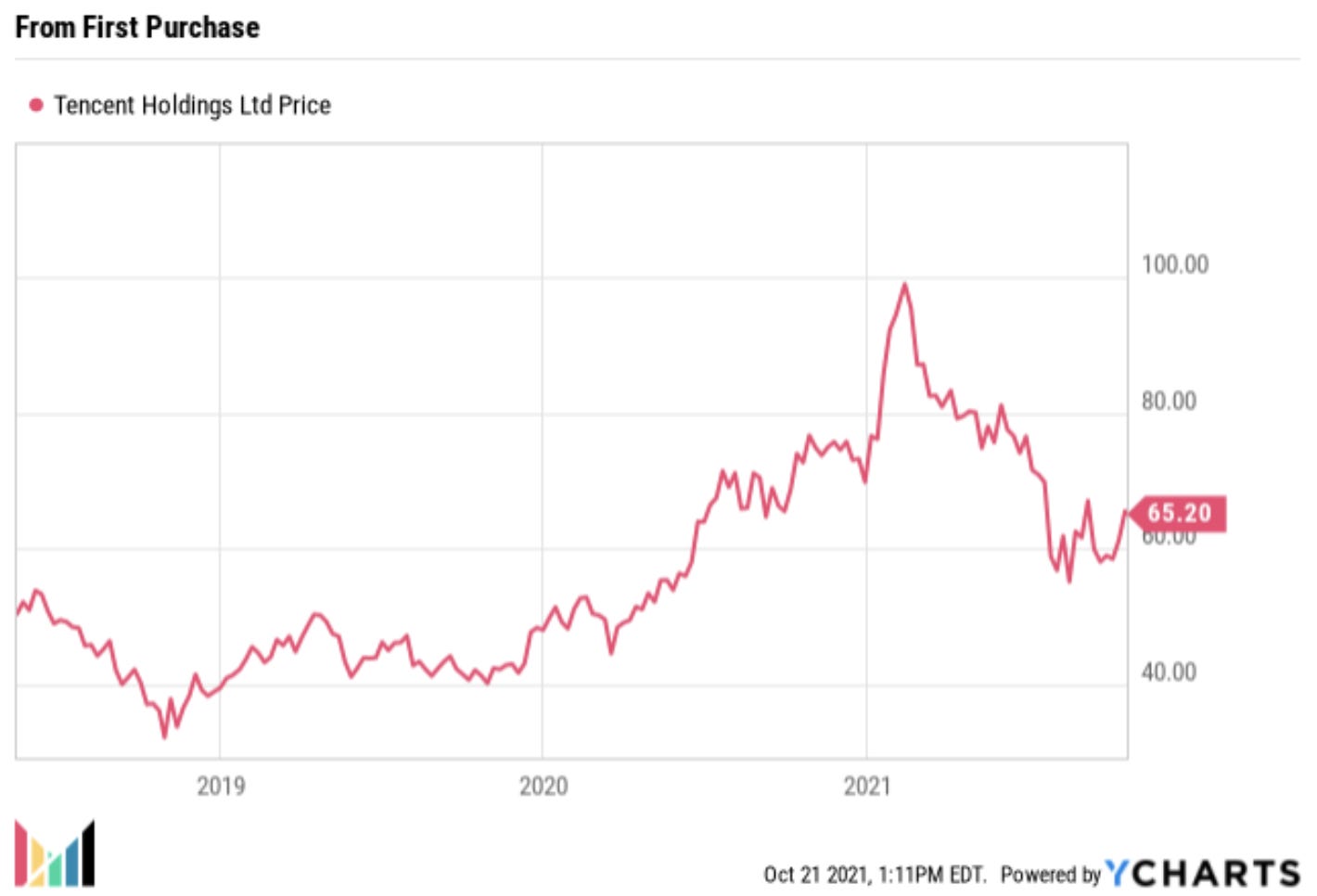

B. Tencent

After buying the first tranche of JD in April 2018, I found myself becoming China curious. Maybe you’ve heard, but it’s kind of a big place?

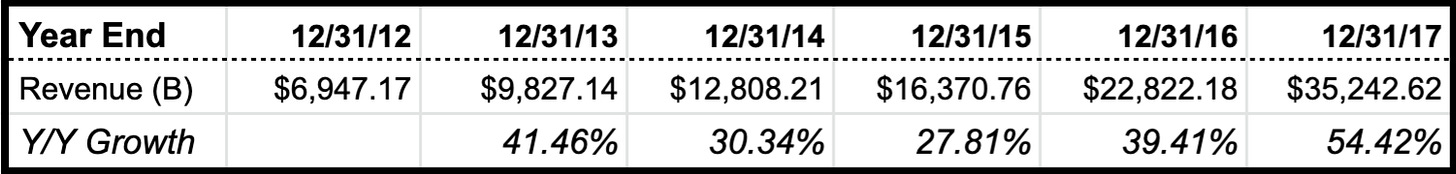

Tencent felt like a logical next step. A company doing $35B in revenue, growing 50% Y/Y, synonymous with consumer social in China. Sounds good to me!

Here are the previous five year revenue growth numbers from that time:

Stop me if you’ve heard this before, but again, after my first purchase, I was under water for two years until Covid pulled it out.

I followed the JD playbook with Tencent, adding again at the end of last year (whoops).

C. Alibaba

Oh Alibaba. What a sad puppy. The saddest of the three. Just look at it over the past year:

I think #neversell got me in trouble here.

I should’ve heard loud and clear from those like Potato Capital over the summer.

Again, for those in the back:

If you don’t have to invest in China, it’s better to put your money in US tech stocks. China’s regulatory risks are unquantifiable right now.

While thinking of my untenable garden, Alibaba has not sparked joy. I didn’t have a thesis beyond attractive valuation/huge market. Potato Capital’s right. Put your money in US Tech Stocks! Who cares if Alibaba is cheap!? The regulatory risks are unquantifiable.

Like I have an edge here? Ha!

4. StoneCo

Apart from my first buy with StoneCo, I’ve done little else right.

I spoke about StoneCo at length in Memo #7.

Here’s the ugly chart I was looking at on that date, since its February high.

Watching StoneCo collapse like a… well, like a stone, was not fun.

I should’ve bailed the moment I saw Clinton’s thread:

But selling when your position is down 50% in 6 months!? I felt like an idiot.

In the Memo, I wrote:

This feels like a name I’m holding because a) selling when something is down 50% in a few months doesn’t feel great and b) no thanks on the tax bill.

Well, how did it do in the weeks following the Memo?

Just great.

Since that low of $30 two weeks ago, it’s had a little pop.

This was my signal to exit stage right.

Overall, this was a profitable position. But selling at $38.83 when it was trading at $94 as recently as February is enough to cause some sleepless nights.

Trust your gut the first time.

5. Disney

We can keep this one short. I sold Disney in another account last November and spoke about the sale here.

I kept some Disney in this account.

I like so much about the company, and selling at $170.38 is clearly better than at $138.96. But I just don’t see it as a Top 20 Idea anymore.

I think Chapek is a downgrade from Iger. Of course Disney+ is a bright spot, but I think their Studio Entertainment business will continue to suffer. Have you been to the movies recently?

I can love the brand, but that doesn’t mean I need to own the stock.

6. Pinterest

I wasn’t planning on selling Pinterest this week.

I’ve had a few reservations about the position. First of all, did I really need Facebook, Snap, Twitter and Pinterest? Like c’mon. Grow some conviction and have a best idea.

At one point Pinterest may have been a best idea. I certainly was behaving like it, buying in twelve tranches from from June 2020 through this past April 2021.

But this has not been a well behaving stock.

I spoke about my main Pinterest concern in Memo #3. In it, I said:

I’ve been feeling a tad uneasy with some of their metrics, mainly:

Poor ARPU internationally (despite strong international growth) and

No USA growth

I referenced this tweet:

There were many reasons to overlook these concerns. But, to be be prudent, I stopped buying shares. In the Memo I wrote, “Right now, there’s just a lot to digest. No quick moves for me.”

Since that Memo through early this month, the stock continued moving in the wrong direction.

Apparently, the market shared my concerns.

Well, this past Wednesday, I may have received a lifeline.

What to do?

Ultimately, the 13% pop on a laggard was too good to pass up. If the deal goes through, and we’re looking at the rumored $70/share price, my upside is limited. If the deal doesn’t close, I can always be a buyer again if the growth and ARPU numbers improve.

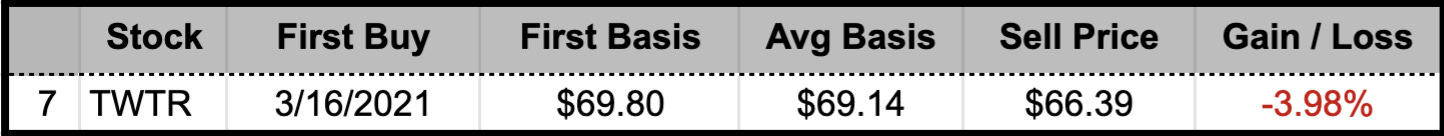

7. Twitter

This position just isn’t that interesting. I bought a few shares in two tranches in March.

I was taking a flier on a historically underperforming name that appeared poised to capitalize on new trends and finally show life.

I’ll let Ed, Q-Cap, Conor and Daniel express the sentiments:

It’s been seven months… and nothing. Which is okay!

But I’m ready to move on.

8. Nintendo

The truth of the Nintendo position is I never really belonged here.

I like gaming businesses and was searching for one.

I read a lot of great articles on the company:

• Of course, Matthew Ball in his piece, “Nintendo, Disney, and Cultural Determinism”

• Aaron Bush of Naavik in his piece, “Why Nintendo Isn't the Next Disney (And What It Will Be Instead)”

The best way to predict Nintendo’s future or help take it to the next level is to recognize that it’s not the next Disney, Tencent, or anyone else. It’s the next Nintendo, which embodies games and devices, but more importantly embodies a long-lasting culture of principles that makes Nintendo special.

• Aaron Edelheit in Mindset Value in his piece, “Mama Mia! Nintendo is 2013 Microsoft!”

I believe [what happened to Microsoft] is happening to Nintendo, a company Western investors love to bash and chronically underestimate. Due to a lack of promotion, conservative style, some stumbles in mobile gaming, a focus on perfection and ignoring investors whims, Nintendo sells for an absurdly low multiple at the beginning stages of a massive company transition to much greater profitability just like Microsoft in 2013.

I was intrigued and wanted to take a flyer. I just took a flyer at the wrong time.

Nintendo could absolutely be a monster in the future. I have no idea. I just don’t have the conviction to ride it out, and want to avoid a StoneCo situation of it falling too far. It’s my biggest loss of the list, both in terms of percentage and dollars. But it’s not catastrophic. I’m content to move on.

And play some Mario Kart.

This is just the beginning.

I will continue to cut names, that for one reason or another, don’t belong.

As Johnson’s Landscaping shows us, all it takes it a little bit of work, and soon enough, we can have a g̶a̶r̶d̶e̶n̶ portfolio that sparks joy.

That’s it for Mazwood Memo #12. Thanks for sticking around!

We’ve written Deep Dives on DigitalOcean, Adyen, Snap, Okta, MercadoLibre, Lululemon, Veeva and Unity. And now Mazwood Memos!

Have a great weekend!

Appreciate your transparency, regards!

Thanks - this was a great read.

I decided to hold onto $PINS, but I understand your logic re limited upside if the deal goes through.