Let’s talk about dunking and kindness.

Not that kind.

The Chris Bloomstran kind.

I’m not going to lie, I kind of enjoyed when Chris took down Chamath in May.

I even enjoyed his takedown of the Robinhood bros last month.

But his latest dunk-piece on Cathie Wood and her firm, ARK, reads unfair, mean, and childish.

I thought Sinstockpapi’s reponse sums it up well.

It’s one thing to take down those that mislead or defraud.

It’s another to publicly take someone down if you don’t like their style. I guess his performance backs it up though, right?

[Blue is Chris’ market outperformance. Pink is S&P’s outperformance.]

Oh no.

Forget Cathie and ARK for a second. My man Chris has only beat the S&P in two of the last nine years. And five of the last 18. That is not good.

I wonder how Cathie’s ARKK fund is doing compared to the S&P.

Oh.

Looking a little closer at the last six years (ARK began investing in late 2014), the data is not kind to Chris. We know he’s only outperformed the S&P twice. He’s outperformed ARKK once. I think it’s also worth noting how much he underperforms when he does. Down 138% to Cathie in 2020 or down 70% in 2017 cannot possibly make your investors happy.

I’m not here to dunk on Chris. That’s not my style. I’m just not in favor of dunking on someone publicly (or privately, for that matter). But if you must do it, have the performance to back it up, right?

I don’t care what kind of investor you are. There are countless ways to win. Just be a mensch.

Let’s go.

📈 In the Market

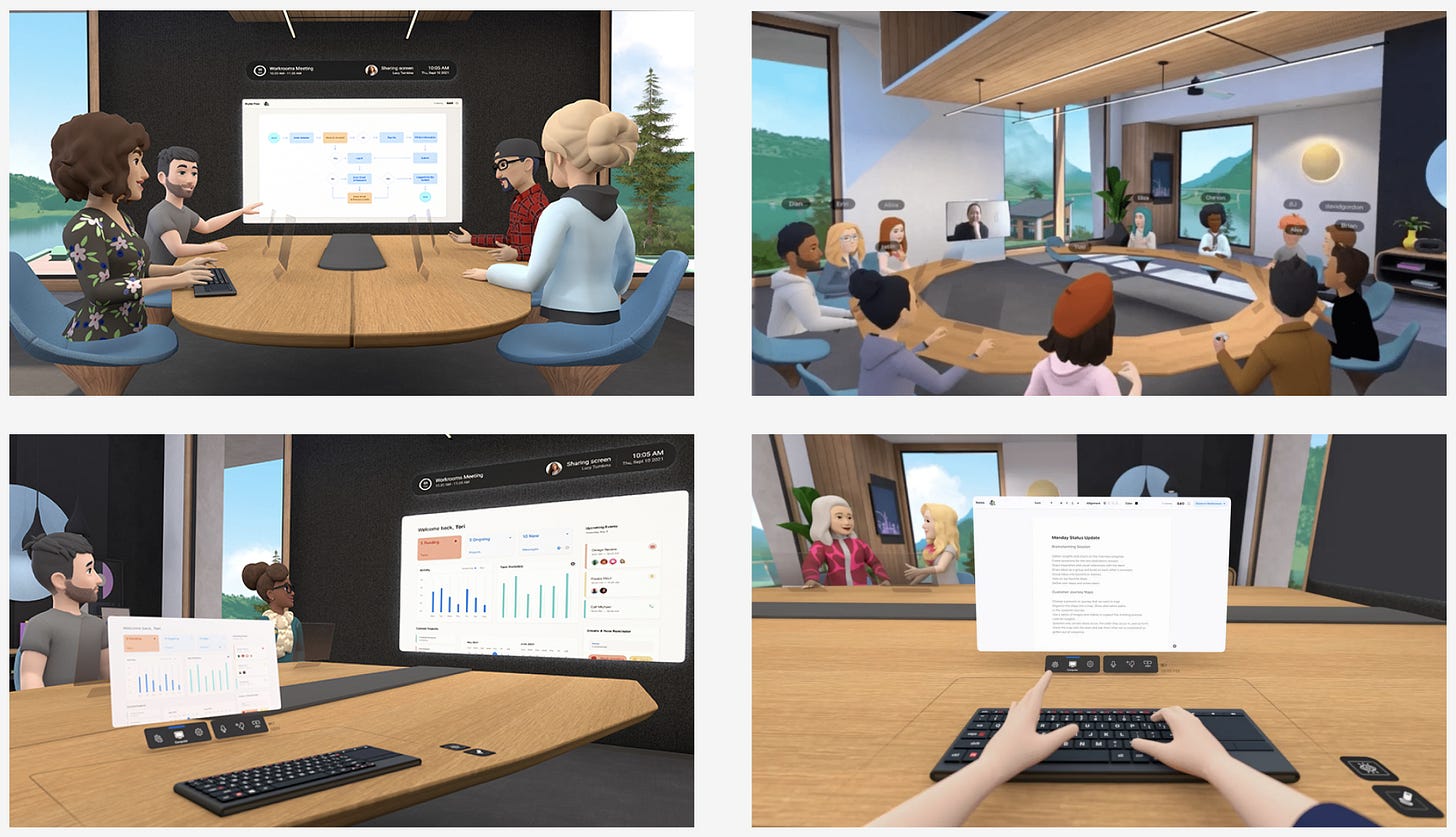

Facebook Introduces Horizon Workrooms

In my second Memo, I referenced Casey Newton’s interview with Mark Zuckerberg. In that interview, Zuckerberg said:

I think [Facebook] will effectively transition from people seeing us as… a social media company to be being a metaverse company.

Well, this is transition is a go!

Yesterday, Facebook launched the open beta to Horizon Workrooms:

Workrooms is our flagship collaboration experience that lets people come together to work in the same virtual room, regardless of physical distance.

It works across both virtual reality and the web and is designed to improve your team’s ability to collaborate, communicate, and connect remotely, through the power of VR—whether that’s getting together to brainstorm or whiteboard an idea, work on a document, hear updates from your team, hang out and socialize, or simply have better conversations that flow more naturally.

Here is Zuckerberg on “CBS This Morning” showing off a demo. Spoiler: it’s very cool.

If technology and innovation is your bag, this has to excite you.

But it’s not without problems.

In yesterday’s Daily Update in Stratechery [Paywall], Ben Thompson writes:

[Workrooms] is obviously an enterprise product, and one can, as I did, make the case that VR is far more compelling in the enterprise, which is a problem given the fact that Facebook is not only a consumer company, but one that is monetized via data-driven targeted advertising. Enterprises, to say the least, are not very keen on their data being used for anything other than their own purposes.

With that being said, Thompson also says of the product, “let me tell you, the experience is incredible.”

In a piece earlier this month, “Metaverses” [No paywall], Thompson discusses this concept of the “enterprise metaverse,” that Microsoft mentioned in a Keynote last month.

I don’t think it is absurd that [Microsoft CEO Satya Nadella] was the first tech executive to endorse the metaverse as a strategic goal. There is likely to be good business in building private metaverses for private companies.

Regarding Facebook, Thompson continues:

Facebook’s goal is more audacious: the company already serves 3.5 billion users, which means creating a shared reality for over half of the world is a plausible goal. That reality, though, will likely sit alongside other realities, just as Facebook the app sits alongside other social networks.

Facebook’s enterprise metaverse has just begun. Microsoft’s is coming.

Who knows what other enterprise metaverses will emerge? And with 3.5 billion users, can anyone challenge Facebook’s grasp on the consumer metaverse?

Will Peloton Introduce a Rower?

Clue #1:

Clue #2:

Clue #3:

See you on the water! Uh, the gym. Err, my basement.

📓 In My Portfolio

Sea Limited Earnings

Sea Limited, the Singapore-based juggernaut, reported earnings on Tuesday.

For the initiated, Julie Young wrote a great overview of Sea last summer. Sea is led by Founder/CEO Forrest Li, who started the company in May 2009.

Sea operates three key segments:

Garena: Digital Entertainment/Gaming

Shopee: E-commerce

SeaMoney: Financial Services

Here’s how they report revenue:

Yes, growth is quite good. 10xing revenue in a four year period is not the easiest thing to do.

Sea has quietly ridden this growth to a $170B valuation, otherwise known as “big boy” company status, surrounded by the likes of McDonald’s, T-Mobile and UPS.

I first came across Sea last summer on Fintwit, and was immediately seduced by the growth, market and concept (Gaming, E-commerce, Fintech). Since then, I’ve been judiciously adding. It’s grown into a substantial position.

It’s not without concerns, however.

At some point, even with all the growth, you also have to make money. Is it as easy as turning on a switch?

Let’s look at the list of companies again, but this time with net income.

Sea is the only company here reporting negative net income. And it’s not a small number.

Of course Sea is growing at a monster clip, but so is Shopify and Moderna. This is by no means a red flag. But it’s at least a flag.

I thought of Amazon, another company that forwent profitability in the name of high growth in its infancy. What did Amazon’s profitably look like when it went public?

It’s worth noting that Amazon’s drop in its 20th Quarter (Q20) was its lowest reported net income ever. Here’s what Amazon’s net income looks like if we zoom out (with that Q20 highlighted).

Of course, Amazon’s revenues were much smaller than Sea’s in its first 6 years of business.

But as a percentage of revenue, Amazon held at a reasonable level.

Sea is not Amazon and Amazon is not Sea. I’m not suggesting otherwise.

I share all of this to say that Sea can certainly continue its juggernaut status, but at some point, you have to flip the profitability switch.

But, as of now, the market is pleased with Sea: Growth Monster.

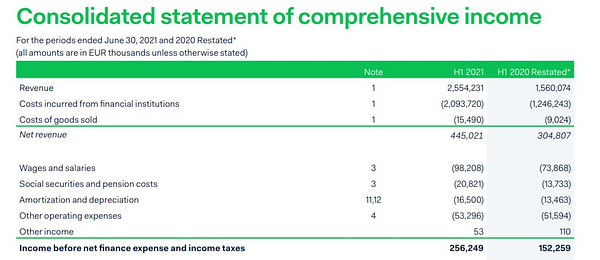

Adyen Earnings

Dutch payments company, Adyen, reported earnings yesterday.

I first saw Adyen on a CNBC Top 50 Disruptors List of 2018. While Adyen IPO’ed that summer, it didn’t become available as an ADR until 2019.1

Since then, it’s up a cool 369%.

I first bought shares in January of this year (green arrow above), and have continued to add. I missed out on the quick triple digit returns, but I can’t complain, up a total of 38.9%.

Here are my purchases to date:

I wrote a deep dive of Adyen in May. In it, I said of Adyen:

It solves a very clear problem…

In an industry I love…

Led by its Founder, Pieter van der Does...

And regarded as a leader in the space:

It’s a company I envision being a Top 10 Holding.

I don’t know when, but Payments is a core thesis of mine, and if you’re going to be a payments investor, Adyen has to have a seat at the table.

But measured Liviam brings us back to earth and reminds us of the valuation.

It’s a fair point. But as Bill Brewster chimes in:

In a piece published in February, “Why Adyen’s Valuation is Too Demanding,” Brosef presents his take on Adyen’s valuation:

Hands down, this is an amazing company. I just don’t think the current share price provides room for a particularly attractive long-term % IRR for an investor.

I’m not one to trim if names get “too expensive,” but this is certainly something to monitor. And likely a no-brainer position to add to, if and when the valuation becomes more palatable.

🖥️ On the Internet

Jeff Lawson on The NFX Podcast

On Monday, MT Capital posted a thread of the favorite CEOs of some Fintwitters. I said Jeff Lawson:

I then saw Bogdan tweet this piece, “The Insider Story of Twilio.”

It’s largely an edited transcript of Lawson on The NFX Podcast, where he describes building Twilio, treating developers like customers and more.

On building Twilio:

I started Twilio to solve a relatively simple problem: How do we bring communications into the realm of software and enable every software developer in the world to build out their ideas quickly and easily? That’s where we started.

And on treating developers like customers:

We just started by treating developers like customers. It sounds really simple, but there’s a lot to it. Most companies who claim to serve developers actually don’t see developers as customers. They see them as a strategy. Developers aren’t customers for them. They’re like an audience that you try to win over in order to actually add more value to the company… Developers are the customer. Treat them like a customer. Treat them as the source of your revenue and the source of your success.

This is a relatively quick read/listen for those interested in learning more about the origins of the company!

Dennis Hong Interview on Good Investing Talks

Gosh, doesn’t Dennis Hong sound like an awesome dude? I love his vibe, his philosophy, his optimism.

He was on the Good Investing Talks Podcast/YouTube channel this week in a great, wide-ranging interview.

Dennis on what to optimize for:

We’re trying to optimize for generating Hall of Fame returns. So, what that meant for us was a small team, a small number of investors, and a small number of investments that you know really, really well.

[Note: How great is the term “Hall of Fame returns?” Might have to steal that one.]

On looking back at the start of ShawSpring Partners:

I would encourage myself to think really, really hard about what is going to matter five years from now. Not what’s going to matter five weeks from now, five months from now or even a year from now. What’s going to really, really matter over the very, very long term and I think that if you can clarify that for yourself, you start to then narrow down the variables that are necessary to build the skills that we’ll be enduring as an investor… and hone in on the variables… that are going to result in the best long-term investments. I wish I had learned that on day one.

And on the role kindness plays in building his firm:

Kindness is free.

Let’s tell that to Chris Bloomstran.

That’s it for Mazwood Memo #6. Thanks for sticking around.

We’ve written Deep Dives on Adyen, Snap, Okta, MercadoLibre, Lululemon, Veeva and Unity. And now Mazwood Memos! Check out last week’s post.

Have a great weekend!

Via Investopedia: “An American depositary receipt (ADR) is a negotiable certificate issued by a U.S. depositary bank representing a specified number of shares—often one share—of a foreign company's stock. The ADR trades on U.S. stock markets as any domestic shares would. ADRs offer U.S. investors a way to purchase stock in overseas companies that would not be available otherwise.”

Interesting comparison regarding Sea, Ltd. and Amazon. A couple things (among many others) that Amazon developed that transformed them into the beast they became today: Amazon Web Services (AWS), and Amazon Prime. Sea, Ltd. doesn’t have either of these, but for Amazon they are now MASSIVELY profitable parts of their business.

What will Sea, Ltd. come up with to rival Amazon’s AWS and prime subscription revenue?

Thanks,

Dave

Enjoyed the analysis on ARK vs Chris. Definitely support your view.