Earlier this week, MT Capital made a mistake in a Substack post. After getting a little flack, he responded:

For those that want to hate… I’m 22, have been writing for four months and am proud of my work. In 10 years time I will be one of the best.

Twenty two!!

Like in investing, writing too, compounds.

Not only is writing a “compounding skill,” but as we read in The Joys of Compounding by Gautam Baid, it is also a “thinking tool.” He writes:

Writing, apart from being a communication tool, is a thinking tool, too. It is almost impossible to write one thing and simultaneously think something else… The more you write, the more precision of thought you build. Writing is a thinking exercise, and it acts as a shield against the rusting of our mind.

David Perrell takes it one step further and shares the wisdom behind writing in public.

I’m excited for MT.

I’m excited for us investors as writers, as thinkers. Maybe this is our edge.

Let’s get after it.

📈 In the Market

Warren Buffett & Sleepwell Capital on Conviction

Am I the only one lying awake at night thinking about portfolio diversification? How many stocks is too much? What’s the sweet spot? Is there a sweet spot?

For some time, I’ve been struggling with (what I feel) is a bloated portfolio.

Too many names. Too many low conviction ideas. Not weighted properly toward higher conviction names.

As the saying goes:

Now, I’ve always thought of Mr. Warren Buffett as “Champion of the Index Fund,” not Mr. “Concentrate to Get Rich.”

But, something is amiss. Buffett didn’t become one of the greatest investors ever by Dollar Cost Averaging into $SPY.

In an interview here, Buffett clarifies his position:

If you are not a professional investor, if your goal is not to manage money in such a way as to get a significantly better return than the world, then I believe in extreme diversification. So I believe 98 or 99%, maybe more than 99%, of people who invest should extensively diversify and not trade, so that leads them to an index fund type of decision... I don’t quarrel with that at all, that is the way they should approach it.

But, he continues (emphasis, mine)…

Once you’re in the business of evaluating businesses, and you decide you’re going to bring the effort and intensity and time involved to get that job done, then I think that diversification is a terrible mistake... If you really know businesses, you probably shouldn’t own more than six of them. If you can identify six wonderful businesses, that is all the diversification you need and you’re going to make a lot of money. And I guarantee you going into a seventh one, rather than putting more money in your first one, has got to be a terrible mistake. Very few people have gotten rich on their seventh best idea, but a lot of people have gotten rich on their best idea.

Aren’t we in the “business of evaluating businesses?”

In his post, The Raw Material of Long Term Investing: How I Build Conviction to Sleep Well at Night, Sleepwell Capital shares how he likes to evaluate businesses and his definition of conviction.

One line in particular, regarding simplicity, has stuck with me:

I prefer simpler stories where most of the value is derived from 2-3 variables instead of 10, and where I can build my assumptions related to those inputs with reasonable confidence.

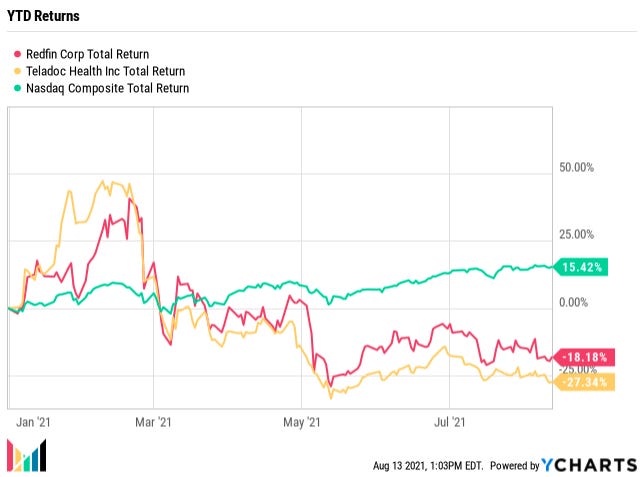

This resonates with me regarding two positions I’m concerned aren’t simple enough: Redfin & Teladoc.

I own them for different reasons, but one common thread is the opportunity for disruption. The stories are amazing! But they are not simple businesses, which is causing me to question my conviction.

Maybe the market knows something I don’t.

Do you have low conviction names in your portfolio? Why? Do they need to be there?

Let’s invest in conviction.

📓 In My Portfolio

New Position in DigitalOcean

There’s a new cat in town called DigitalOcean.

On Wednesday, I began an experiment:

Yesterday, I started digging in:

Lots more work to do here. I look forward to sharing my findings!

Earnings

Earnings season is quieting down, but still a few names to discuss.

Let’s chat:

The Trade Desk

Unity

Disney

1. The Trade Desk

Let’s start by saying, I’m a big Trade Desk guy.

Here’s what I wrote when I first purchased shares in 2017:

It became a 10 bagger for me last October.

I even put together an Oral History of the company last year.

So, we can keep this part short.

Max shares some numbers:

Brad shares some color commentary:

And Jordy shows us how Connected TV is quickly becoming the name of the game:

Lucky for us, Max, Brad and Jordy teamed up with Kris for a Spaces to discuss earnings. And they uploaded it to YouTube! Nice work, guys.

Despite my insanely low cost basis (my first tranche is up 1,562% as of this writing), it still feels like The Trade Desk story might just be starting.

2. Unity

I like Unity, but I could not have timed my purchases more poorly, grabbing most of my shares in January at around ~$150.

Joining us again from last week is Eugene with the high-level earnings breakdown:

Overall, the market was jazzed.

So was Fintwit:

I wrote a Deep Dive on Unity earlier this year. In it, I said:

As a gaming company, I am intrigued by Unity. Powering creators is certainly of the moment. But what Unity offers is much more. While the there is obvious short-term trepidation, I can’t help but want to be part of the future!

Powering creators, dominating mobile-game development, an impressive partnership list out of the gate—and this is all before we get to how Unity can transform the architecture/design, automotive and film industries. I like being a part of the future. So I’m starting small, watching and being patient.

Despite the excitement, it takes time to build the future.

I remain bullish on what Unity can mean for gaming and beyond, something I covered in the Deep Dive:

We continue to gain significant traction with customers and leading brands in industries beyond gaming, including architecture, engineering and construction; automotive, transportation and manufacturing; and film, animation and cinematics.

Measured by 2019 revenue, Unity works with:

Eight of the top 10 architecture/design firms

Nine of the top 10 auto companies [Volvo Case Study ⬇️ ]

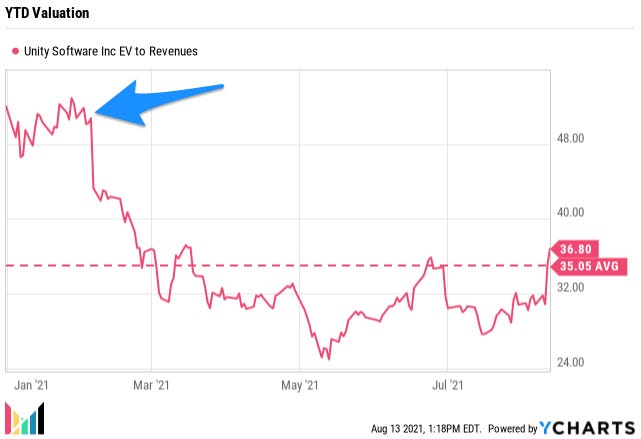

Unity is obviously exciting, but what about its valuation?

Evergreen doesn’t like it:

Francis is considering:

In the regret department, I’m happy to hold the stock.

I just wish I bought it at $90 and not $150.

And at a more palatable valuation (my purchases at the blue arrow).

3. Disney

Oh, Disney. Where do I start with you?

Over the last few years, I’ve initiated positions in two accounts.

In account A: On 3/21/2019 at a cost of $108.79.

In account B: On 2/24/2020 at a cost of $133.79.

In a weekly review last summer, when COVID was, shall we say, not so hot, I wrote:

I’m a little befuddled with Disney. I can’t for the life of me understand how it’s trading at ~$131 today. I'm on the record simultaneously loving the company, the IP, the opportunities… but also thinking it will be a drag on the portfolio for some time.

Let’s get into the weeds for a moment, if you don’t mind.

2019 Annual Report Numbers:

One by one, here we go:

Media Networks: Um, cord cutting? ESPN? Live sports? TV production schedules halted? This feels like a severely impacted category.

Parks: Uhhhh, yea.

Studio: They can't shoot movies. Or show movies. Feels like kind of a problem.

DTC: Yes, Disney+. Amazing acceleration in subscriber base. 100%. But doesn’t the other $62B worth of business matter to anyone else?

I can't figure this one out. Part of me wants to trim the position, because it feels like it should be a drag. But so far the market doesn’t agree with me. And I’m not really a trimmer.

A few months later (in November 2020) I sold the Disney position from Account A:

Up 30% from cost basis, after a rocky year, and after a quick 20% bump seemed more than reasonable at the time.

Since that fateful day last November:

Whoops.

I still hold the position in Account B.

Okay, back to earnings. What happened? Pre-market this morning, things were looking good.

Eugene, like always, take it away:

And streaming numbers, Alex?

What about Parks, KnowHow?

And you, Julia, on Parks:

Ultimately, in a world where entertainment options are fragmenting, Disney is King of IP. If the business is swimming, how do you stop it?

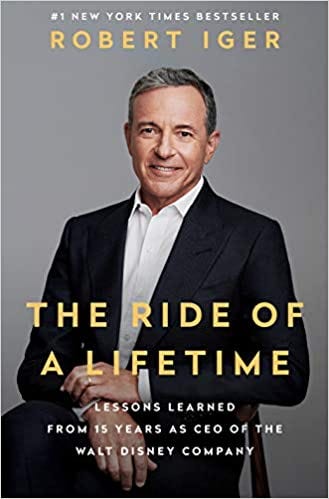

For those interested in Disney, make sure to check out Bob Iger’s 2019 autobiography, The Ride of a Lifetime: Lessons Learned from 15 Years as CEO of the Walt Disney Company:

If you’ve only got 45 minutes, these three chapters on acquiring Pixar, Marvel and Star Wars will show you the power of acquiring IP in building a behemoth entertainment company.

With Parks trending up and to the right, Disney+ not even at its second anniversary and this unparalleled IP chest, Disney might just be a “set it and forget it” kind of name.

🖥️ On the Internet

Warren Buffett on Diversification

While spending time on YouTube watching Warren Buffett wax poetic on all things concentration, conviction and diversification, I found this gem from Berkshire Hathaway’s 1996 Annual Meeting. (I went to the Annual Meeting in 2017).

The highlights:

We think diversification as practiced generally makes very little sense for anyone that knows what they’re doing.

Diversification is a protection against ignorance.

If you know how to analyze businesses and value businesses, it’s crazy to own 50 stocks or 40 stocks or 30 stocks, probably. Because there aren’t that many wonderful businesses that are understandable to a single human being.

Three wonderful businesses is more than you need in this life to do very well.

There is less risk in owning three easy-to-identify wonderful businesses than there is owning 50 well-known big businesses.

Defunctland

Sometimes, when I tell people there is amazing content on YouTube, they look at me like:

If you’re a fan of Disney (beyond its earnings) or documentaries or history or theme parks or just great content for that matter, take a look at Defunctland, a YouTube channel that dives DEEP into the history behind defunct theme park rides. Talk about niche, right?

I started with Journey into Imagination, a ride I remember so well as a kid.

With over 150 videos on the channel to date, I hope you, too, can find something awesome here.

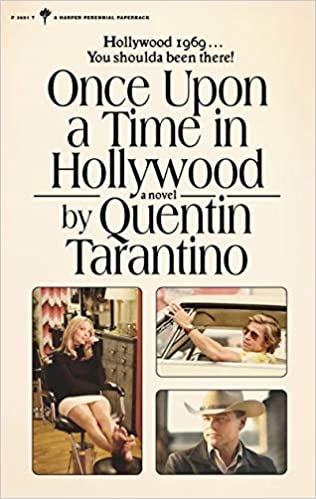

Once Upon a Time in Hollywood

Sticking with the theme of entertainment, Quentin Tarantino made the podcast rounds a few weeks ago, promoting his new book, Once Upon a Time in Hollywood: A Novel.

Yes, a novelization of his movie, Once Upon a Time… in Hollywood, his second highest grossing movie ever.

I particularly enjoyed Tarantino’s appearance on The Big Picture podcast, where he discusses why he wrote the book, how it’s different from the movie and a whole lot more.

If you like movies, and in particular moviemaking, you’ll love this thirty minute featurette, Once Upon a Time in Hollywood - A Love Letter To Making Movies:

That’s it for Mazwood Memo #5! Thanks for sticking around.

We’ve written Deep Dives on Adyen, Snap, Okta, MercadoLibre, Lululemon, Veeva and Unity. And now, Mazwood Memos! Check out last week’s post.

Have a great weekend!