In this new journey of “Mazwood Memos,” I’m more aware of not only what to say, but how to say it.

In an article in The Long Conversation, Rachel Jepsen (Executive Editor at Every) discusses what makes a writer’s voice:

Your experiences, everything you’ve integrated into your reality, your conception of the world, how your mind goes from one place to another, the threads of your body connecting it to past iterations of the self, what you feel in your body at this moment. Your voice is everything you’ve seen and known and everything that hurts and how you feel pleasure and all that you find wonderful and everything you wonder about the world.

For better or worse, uninterrupted and unfiltered, let’s get after it.

📈 In the Market

Stocks Only Go Up, I guess

So, stocks are ripping again?

Nice little week for some cherrypicked growth names:

Holy cow, Snap!

We’ll get to Snap in a little bit, but even without it, some of these names are swimming nicely.

Here are weekly returns over the last month. (This week’s returns run through yesterday’s close price.)

Told you, it’s been a green week!

Dueling Spotify threads!

CobraGlobal fires first:

Spotify management is telegraphing the non-viability of its core music-biz by aggressively selling the ‘audio’ and podcast angle. They are spending big capex here and so far, I’m unconvinced.

I’d much rather bet on something like a Peloton that has clear profitability today, and has optionality embedded in user base… I’d prefer to get on a plane that can clearly land and take-off like Peloton vs. something that is still figuring out the landing process in mid-air like Spotify.

The entire thread:

Sleepwell fires back!

(And by fires back, I mean thoughtfully and carefully responds to each point in the thread, one by one.)

While we’re here, I enjoyed listening to Sleepwell discuss his Spotify conviction in the Money Under the Mattress podcast.

I have a tiny position in Spotify, so it’s worth understanding the bull and bear cases. Let’s just say I don’t envision it being a position for much longer (despite enjoying the very well designed embed feature here in Substack).

Uber Pricing

Huge consumer platforms interest me. As a user, as an investor, as an observer.

Doesn’t anything that has 100 million users warrant a conversation at a dinner party?

(Maybe those are just my parties).

In any event, Paul Enright poses a compelling take on Uber’s pricing this week. Are ubiquitous, albeit anecdotal price increases a good or bad sign?

(Spoiler alert: not a good sign).

Marketplace network effects businesses get more valuable as more people use them, i.e., as the liquidity in the marketplace rises. Rising prices at this clip is a sign of poor liquidity not sustainable pricing power.

The issue with Uber has always been whether scale of riders matched with incentivized drivers would lead to network effects that would keep the drivers coming back. Unlike other network effects marketplaces (like Amazon for instance), the supply side doesn’t currently scale.

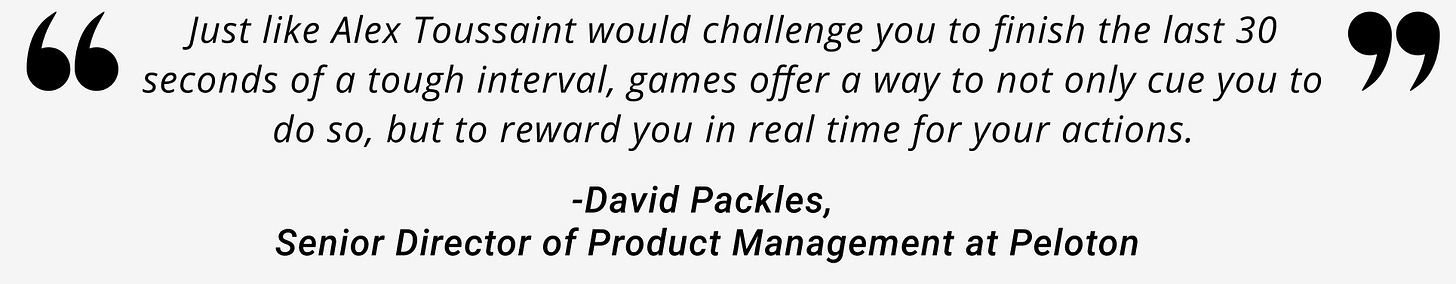

Peloton to Introduce Games

Peloton announced this week that they are in development on a game called Lanebreak. Right now, home riders have the option to take classes with an instructor (live or on-demand), ride through various settings in nature (beach, mountains, etc.) or “just ride.” Lanebreak will be Peloton’s first “game.”

This doesn’t strike me as a big deal for the business on its own. But I do like that Peloton is willing to be creative, willing to get weird, willing to experiment with concepts that may not be obvious. I don’t ever want to bet against a founder that is willing to “move fast and break things.” Go get it, Foley.

📓 In My Portfolio

Netflix Earnings

Sure, I could pull up “Netflix beats on subscriber growth” or “But subscriber estimates were already low!” or “Netflix misses earnings estimates” or some chart like this:

…but how interesting is that?

What’s more interesting, rather, is The Entertainment Strategy Guy’s take.

He breaks it down into two threads:

Thread 1 focuses on Netflix’s Strategy and Financials.

It's hard for me to see these down quarters and not think that growth in mature markets is definitely slowing.

Thread 2 addresses Netflix content.

This is probably as dark as it gets for Netflix… The bear case continues to be that they just aren’t making enough Original hits to justify their content spend. Frankly, their original titles haven’t really replaced the licensed content leaving the platform.

I keep racking my brain of whether to keep Netflix in my portfolio. As mentioned last week, I don’t think it’s going to hurt me, but I feel that most of the money to be made has been made.

Netflix returns over the last year:

As Netflix bulls will tell you, the TAM is still massive internationally, and the optionality is just getting starting (i.e., gaming.) Again, maybe.

Truth be told, I feel like I’d only be keeping it to not pay the capital gains taxes. Is that a good enough reason to hold? Or should I move to Hong Kong? I don’t know.

But I keep thinking to what friend of the program, StockNovice has told me: if it’s not a “best idea,” what’s it doing in your portfolio?

So with that, we exit stage right. Thanks, Joe.

Snap, Twitter & Evolution Gaming Earnings

Snap, Twitter and Evolution also reported earnings this week.

Well, rocket ships are back boys and girls!

Snap 🚀🚀🚀🚀🚀

Twitter 🚀

Evolution 🚀

#1 Snap

Holy moly. As of this writing, on Friday morning, Snap is up 24%, hitting an all time high of $77 per share.

By all accounts, Snap posted a very good quarter.

Here’s yesterday’s full investor presentation.

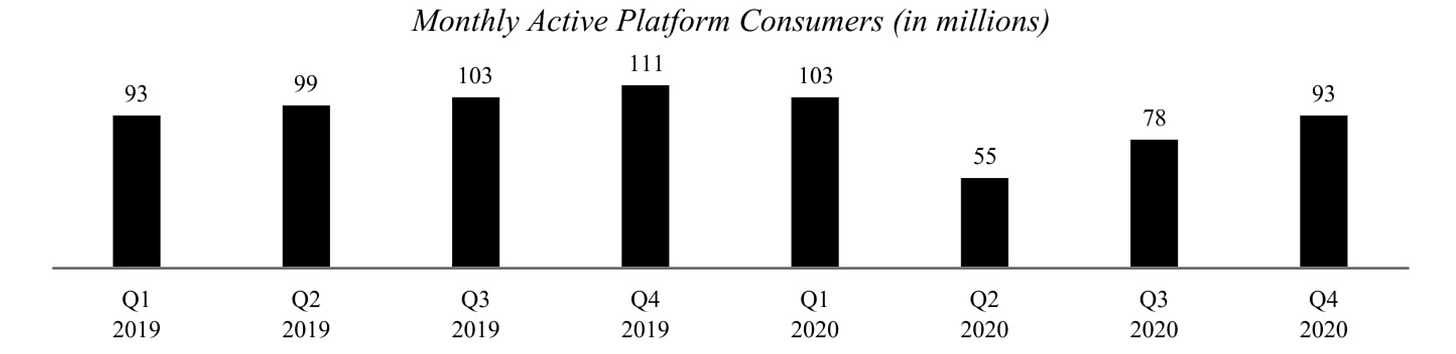

I’m struck by the Daily Active Users slide from the presentation. Something has just clicked. (Red and green lines are mine).

It’s no secret I really like Snap. In fact, Snap was my very first deep dive here.

Bringing Turner Novak back into the chat:

“A platform (Apple) with content (Disney) and advertising (Google).” Yes!

And trust me, I’ve added to SNAP.

Now, I don’t want to be a party pooper here. Snap has been a great investment for me, and I continue to love the product roadmap for what it can become.

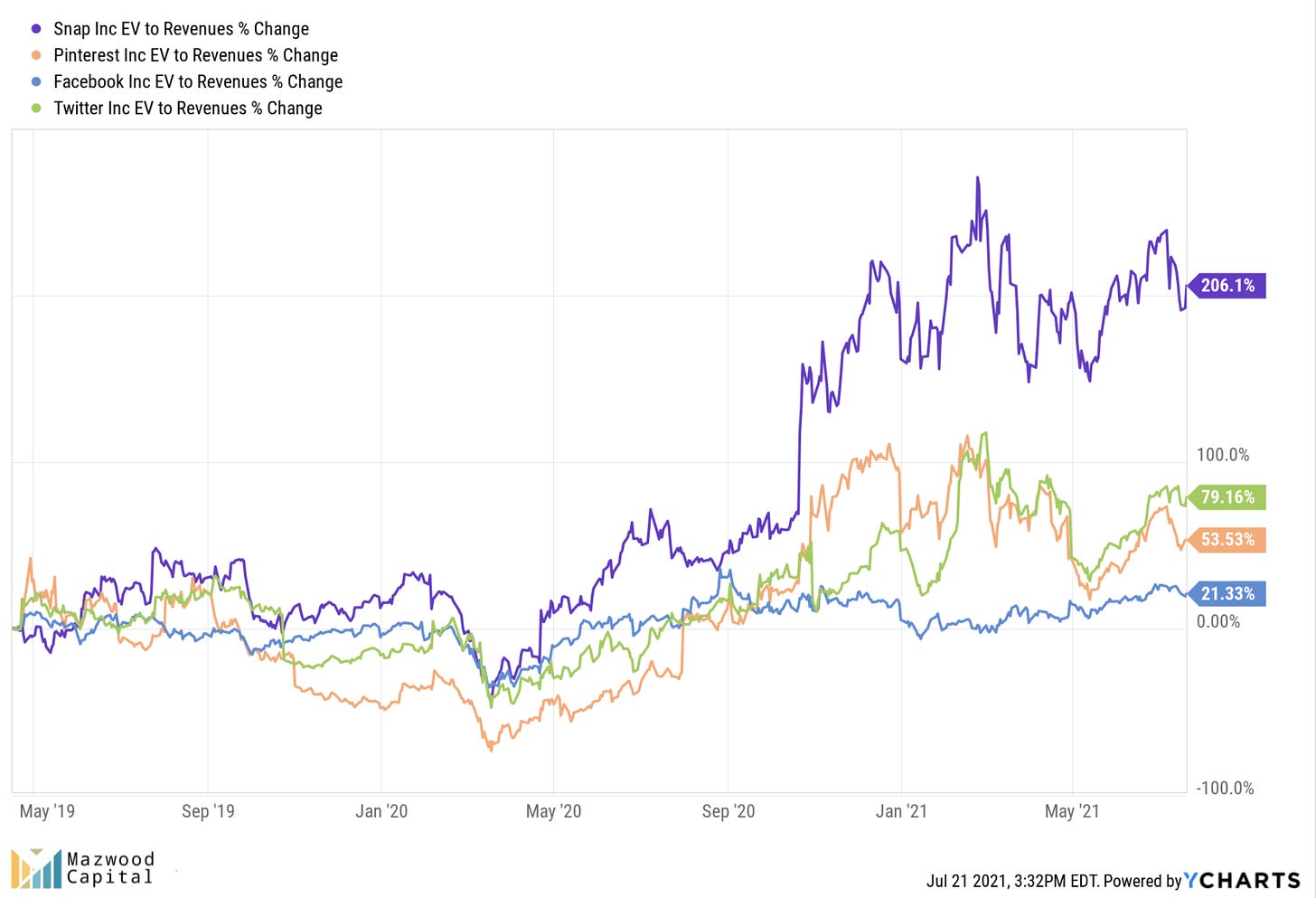

With all that being said, the Valuation Percent Change chart below gives me slight pause when I consider adding to Snap.

Talk about some serious valuation expansion.

Snap is a long-term hold for me. I just need to pick my spots wisely.

#2 Twitter

Oh man, Twitter. Where to begin?

Like Snap, Twitter beat on earnings. The market’s response is a tad more muted, but investors are still pleased.

Twitter is a very new, very small position.

After a brief pop to $67/share two months after its November 2014 IPO, the stock has finally returned to those highs.

That’s a long time of doing nothing, or worse, underperforming.

There is this sense, that after years of… (how do I say this nicely)… not really innovating at all, Twitter is waking up. Their ad business hasn’t moved the needle, but it appears that The Times They Are a-Changin.

Truthfully, I’m seduced by all the new product development.

Two threads worth your time to understand the potential of an investment in Twitter.

The first from Long Short Value.

Twitter is the social graph for the world based on their self-selected interests, or rather, passions. That devotion, focus, and expert feedback is hard to get elsewhere.

I believe if Twitter, with the push from investors, can get its act together and monetize their user engagement they could be worth 5 times their currently market capitalization of $58B.

And from Julie Young.

I think Twitter’s network moat will become more and more powerful as Gen Z continues to age into the professional world. Linkedin is... Linkedin, and at this point I rarely link to anything but someone’s twitter when sending an intro email.

Twitter has not been good at monetizing with ads, but their graph is BEST suited for soooo many high ARPU revenue streams like paid newsletters, podcasting, live audio, and virtual events.

But, of course, there could be some incredible bias. Those of us on fintwit love us some fintwit.

I’m certainly bullish on consumer social as a category. But do I really need to own $SNAP, $FB, $PINS and $TWTR? Kind of feels like a no, when you say it out loud. Although the markets do love when narratives change…

For the extra curious, here is Twitter’s Head of Consumer Product, Kayvon Beykpour, discussing Twitter’s product future in a conversation from March. (RIP fleets).

Transcript can be found here.

#3 Evolution Gaming

Like Twitter, Evolution Gaming is also a new position.

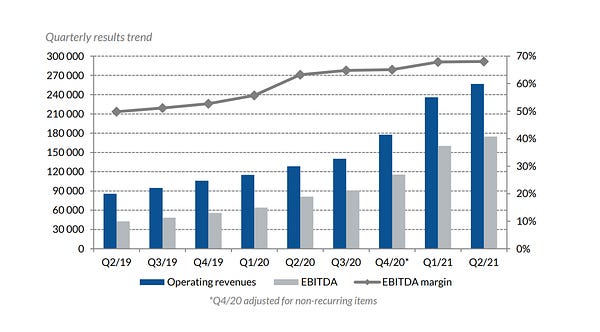

Quick recap of this week’s earnings, sponsored by Professor Kalkyl.

The gains here have been quick and massive, up a cool 500% from Covid lows.

There’s no reason to rush into this one, but certainly worth monitoring.

As Liviam Capital points out, it’s not like companies with 50% revenue growth and 50% operating margins grow on trees.

🖥️ On the Internet

Mark Zuckerberg on the Metaverse

I love learning about the Metaverse.

Anything Matthew Ball writes or says is a must listen.

Or if Packy McCormick writes about the Value Chain of the Metaverse or Tencent Investing in the Metaverse, I’m there.

Hell, I loved Ready Player One!

So no surprise I wanted to listen to Casey Newton’s interview with Mark Zuckerberg that dropped yesterday.

Zuckerberg’s honest-to-goodness-interesting-and-normal-sounding-vision for Facebook and their place in Metaverse was awesome.

(Transcript here, but listen to it.)

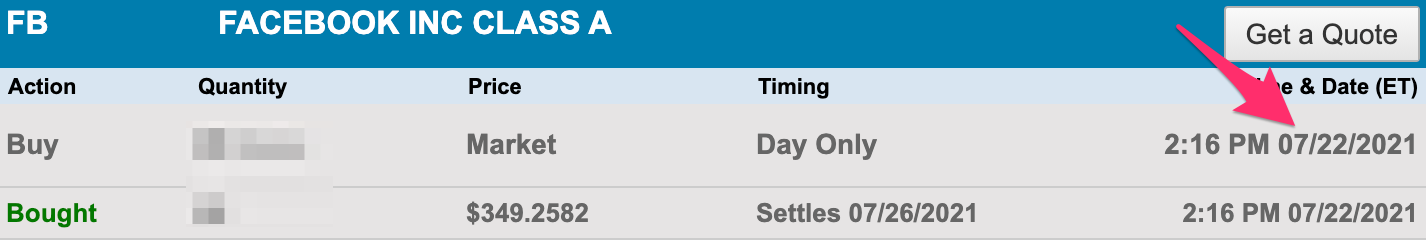

This interview inspired me to buy more $FB stock yesterday. Not a joke.

Steve Mandel on Invest Like the Best

Steve Mandel, Founder and Head of Lone Pine Capital (and former Tiger Cub) was on Invest Like the Best this week.

I love this line on what makes a good analyst, how we investors are “always dealing in shades of gray, probabilities.” (h/t to Clark Square Capital for flagging it on Twitter).

There are a lot of things, but one thing… I’ve learned is people can be unbelievably smart. But if they’re very linear thinkers, it will never work as an analyst. We are always dealing in shades of gray, probabilities. If somebody has to know the answer to a math problem or whatever, if they have to know the answer, there is never the answer in our world. Those people can be incredibly smart and might be winning Nobel prizes or whatever, but they can’t work in our world because our world is all about probabilities and weighing outcomes. If that makes you uncomfortable, it's just not going to work.

The Tokyo Olympics

How many people knew the Opening Ceremonies were televised this morning? Me neither.

It took a text from a friend’s Dad to even turn it on.

Poor Tokyo. Poor Olympians. Poor Peacock. The whole thing is a bummer.

With all the limitations, event organizers and producers will still try to put on a show.

For a look into the how the games got to Tokyo and how Tokyo prepared, I enjoyed this video deep dive from Wendover Productions.

That’s it for Mazwood Memo #2! Thanks for sticking around.

We’ve written Deep Dives on Adyen, Snap, Okta, MercadoLibre, Lululemon, Veeva and Unity. And now, Mazwood Memos! Check out last week’s inaugural post.

Have a great weekend!

Thank you! i appreciate it so much!

Greetings from Spain!