There’s a lot going on, my portfolio is on fire (not the good kind), so let’s get into it.

But, stay cool.

If I can forecast anything, it is that we will have years in which we underperform and years where we over perform. Across all those years and all those markets, we will strive to eliminate the noise, keep our focus, maintain a long-term view, trade lightly, dig deep, and cover the ground.

-Rajiv Jain, Chairman, CIO & Portfolio Manager at GQG Partners

This Week:

New Buys

Portfolio Recaps

Around the Internet

1. New Buys

I took advantage of the great bear market of 2021 to do a little shopping.

A. Coinbase

Coinbase is a new favorite of mine. I spoke extensively about it in last week’s Memo. As discussed, this podcast was a real catalyst for me in understanding how meaningful Coinbase can become.

Here are my two quick buys. I can see this position getting bigger quickly.

Greg Tusar, Head of Institutional Product (featured on the podcast), penned a blog post this week announcing Coinbase Prime for institutions.

From the post:

We have been working tirelessly since our beta launch in May to ensure that Coinbase Prime is the most comprehensive platform for institutional investors. Today, we’re officially launching Coinbase Prime to all institutions. Coinbase Prime combines advanced trading, battle-tested custody, and financing in a single solution. Along the way, we’ve continued to add more venues to our smart router which allows clients to achieve the best available price, more assets to our custody capability, enhanced our post-trade reporting capabilities, and added to our post trade credit financing options.

Thanks to Josh for making sure I saw the announcement!

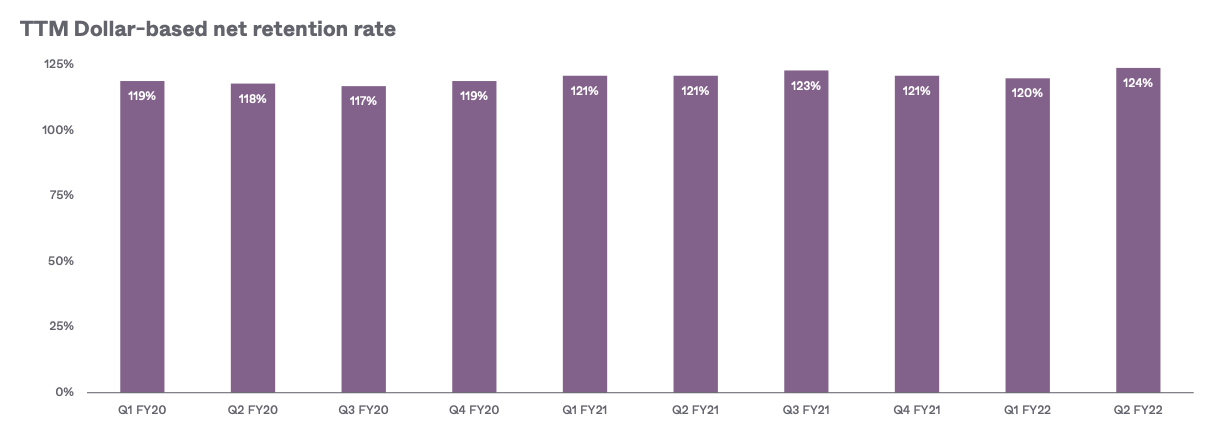

B. Okta

I bumped Okta up to a more meaningful position this week.

I first became interested in Okta last summer, writing a Deep Dive on it here.

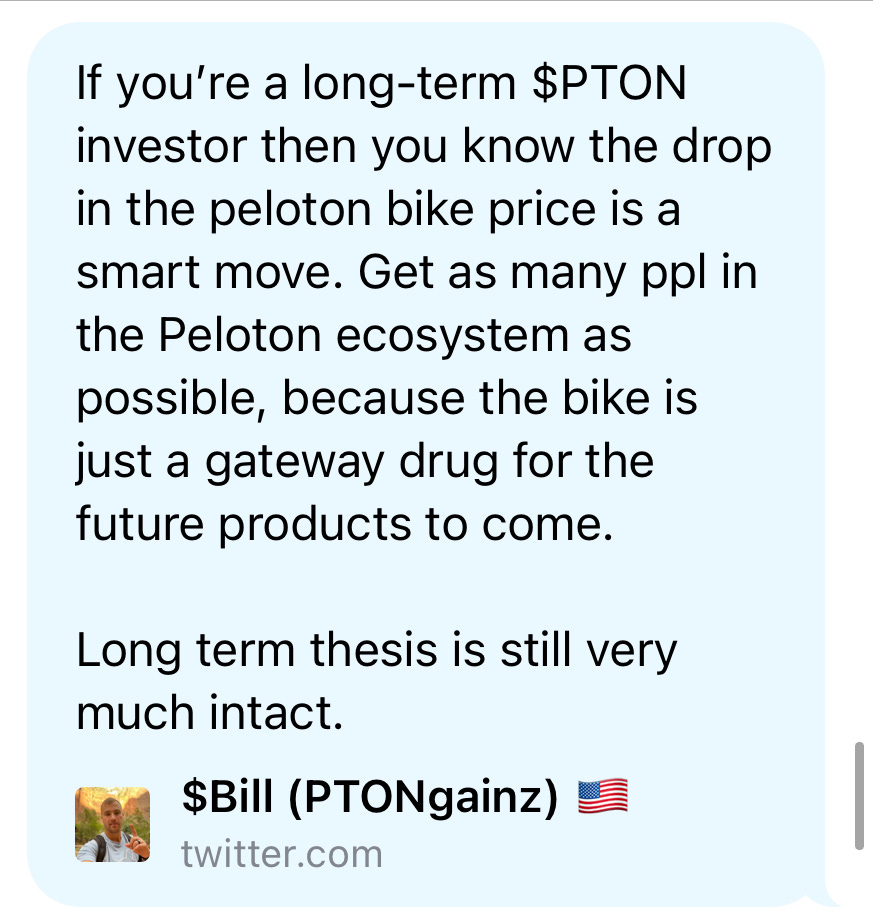

As you can see, up 37% from first the tranche is not spectacular, but perfectly nice.

Since breaking through $200, Okta has been trading in this $215-$280ish range.

Year to Date, we are exactly flat.

Here’s a chart I’m excited about:

Here’s a chart I’m less excited about:

Here are some additional charts from Okta’s Q2 Earnings Report I featured in Memo #7:

Revenue up 57% Y/Y

Net Retention at 124%

Total Customers up 46% Y/Y

*(1) Includes one time addition of 1,650 customers from Auth0.

Customers paying more than $100k up 55% Y/Y

*(1) Includes one time addition of 375 customers from Auth0.

From my original Deep Dive, I wrote:

In a lot of ways this is pretty simple: Founder-led business, operating in a growing market, with very strong dollar net retention. Don’t overcomplicate this.

I see this as a lower risk, fairly solid return play.

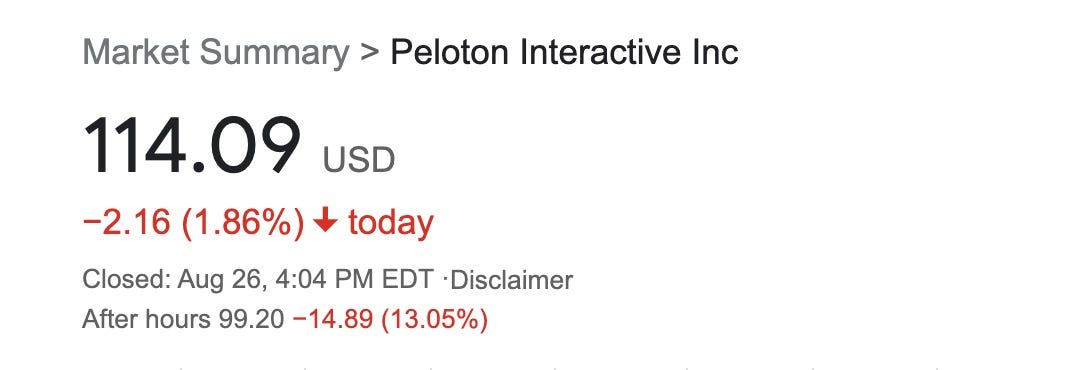

C. Peloton

What is going on with Peloton?

Since hitting a high of $167 in January, Peloton ain’t riding so hot.

In the last month alone, the stock has swung wildly, getting hit on Earnings…

…popping on the Private Label apparel announcement, then getting whacked again.

A story in three parts:

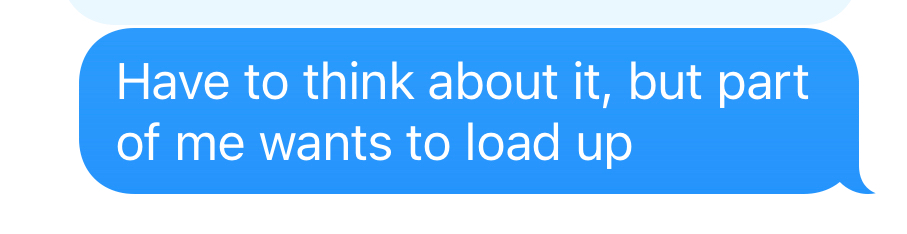

1) After the earnings drop, I texted a friend:

2) But before I knew it, the stock was up close to 20% to $114. That was fast!

3) Whack! Down again, I get my chance to buy.

Yet down 7% already since Tuesday!

Who said investing was easy!?

After the initial drop two weeks ago, Evergreen and Bill were tweeting words of encouragement.

I’m expecting a lot of short-term volatility here. But, if you have a long time horizon, I think there’s a lot to like.

D. Twilio

I’ve spoken at length on Twilio, most recently last week, answering if I felt now was a good time to buy.

Well, apparently!

E. Roku

Roku has quickly fallen out of favor, but is no stranger to a swift 30% fall from high.

This is a very long-term hold for me.

Gosh, should’ve bought more in March 2020, right?

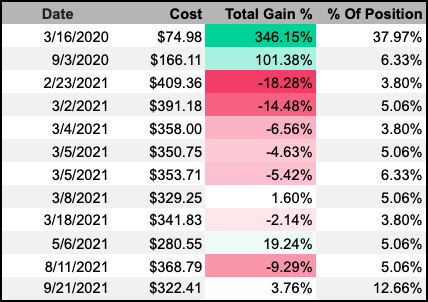

F. Amazon

Some charts on FAAMG.

A) In the last year, Amazon is the only one to underperform the market.

B) The only one whose valuation has become more attractive.

C) Yet it has not lagged in revenue growth.

D) Nor profitability.

What’s going to give?

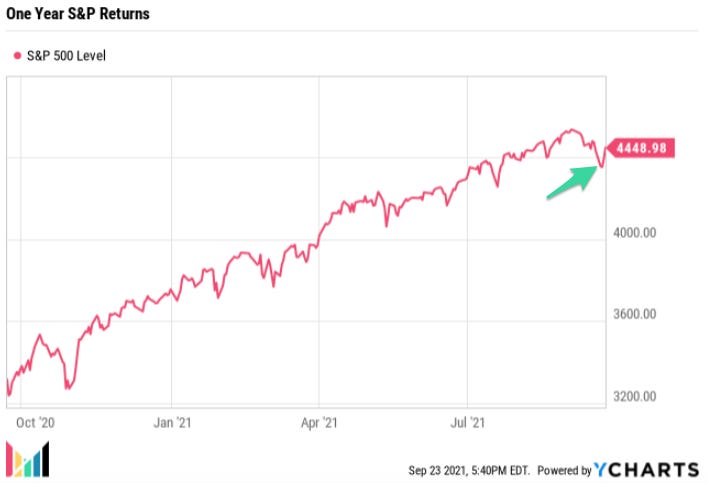

G. SPY

Look, I’m not a total monster, I’ve got some index funds!

If it’s good enough for Morgan Housel, it should probably be good enough for me.

H. ETH

I’m also not better than an occasional dip into crypto.

And I feel even better when I bottom tick it!

Three of my favorite pieces of content on Ethereum, and how to think about it:

1) James comparing it to AWS:

2) Packy writing in his piece “Own the Internet”:

What if I told you about a business with strong network effects and 200x YoY revenue growth that was preparing to offer a 25% dividend and implement a permanent share buyback program? Is that something you might be interested in?

That’s pretty much Ethereum. It’s one of the most fascinating and compelling assets in the world, but its story is obfuscated by complexity and the specter of crypto.

3) Justin Drake on Business Breakdowns with Patrick O’Shaughnessy:

2. Portfolio Recaps

I love reading portfolio recaps from some of my friends. StockNovice’s monthly portfolio updates are the gold standard.

The wonderful thing about writing in public is it can serve yourself and your community. You can’t help but learn a lot from people that are open with their time, thoughts and insights.

This week, I learned from Sean and Brad as they each debuted their own versions of a quarterly update.

A. Jiggy Capital Newsletter

In his Jiggy Capital Newsletter, Sean presented his “Q3 2021: My Portfolio and What I Learned.”

He explains:

The goal of this newsletter was something very similar: to force me to become a better investor through being vulnerable and articulating my thoughts.

He shares insightful analysis into what he’s bought, sold and why.

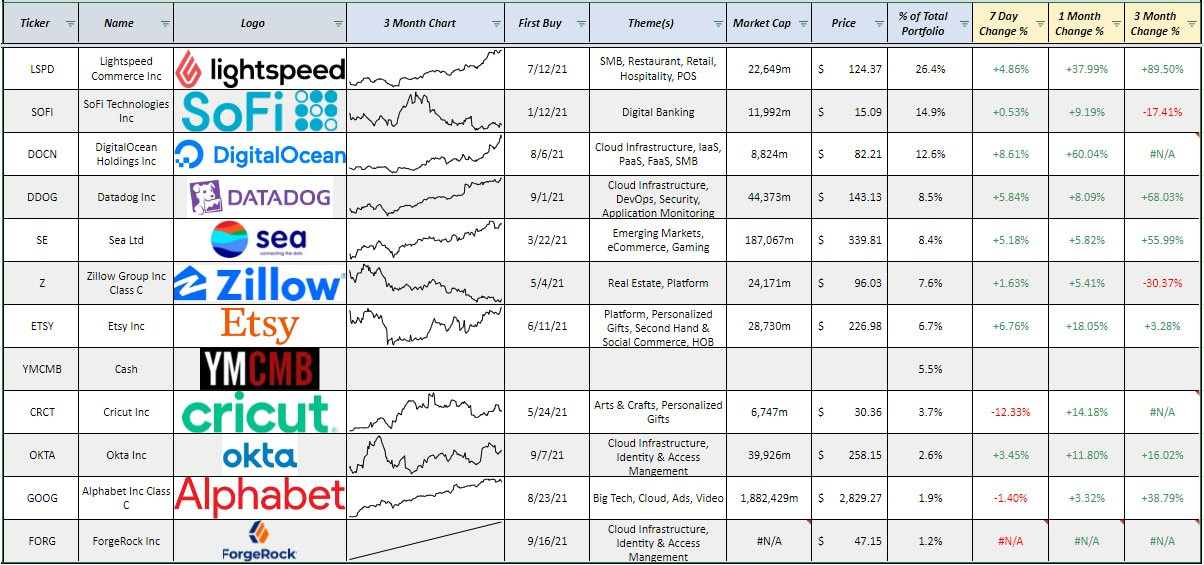

Here is Sean’s portfolio:

B. Stock Market Nerd

In his eponymous newsletter, Stock Market Nerd, Brad presented his “Post Earnings Season Portfolio Update.”

He breaks down his portfolio into High Growth Disruptor and Mature Value.

See if you can guess which is which!

Brad further breaks down his positions in buckets: The Stand Out, The Good, The Fine, The Bad and The Rest.

3. Around the Internet

A. The Mona Lisa

I’m sorry, the Mona Lisa was stolen in 1911? Wait, what… it wasn’t found for 28 months!?

A little bit more on the story:

B. Time with Tim Urban

This week, popular blogger and brilliant thinker/writer, Tim Urban posted the following thread on time.

Here are the first few graphics presented as one, from his original article years ago.

It gets much longer!!

We are just tiny specks in the vastness of time.

C. Dude Perfect on How I Built This

This week, Guy Raz hosted Cory Cotton and Tyler Toney, 40% of Dude Perfect, on How I Built This.

Here’s the episode:

For the uninitiated, here’s a video from a few years ago to give you a sense of their vibe.

Dude Perfect now has ~20 employees and does around ~$30M in sales.

I admire the grind, humility, and enthusiasm they bring to work.

We should all be so lucky.

That’s it for Mazwood Memo #10. Thanks for sticking around!

We’ve written Deep Dives on DigitalOcean, Adyen, Snap, Okta, MercadoLibre, Lululemon, Veeva and Unity. And now Mazwood Memos!

Have a great weekend!