I’ve been thinking a lot about portfolio management.

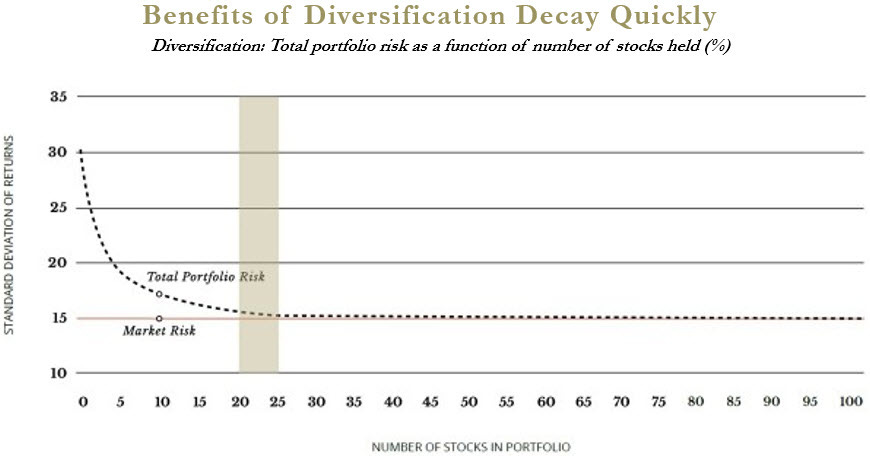

In 2019, the good folks at Ensemble Capital published a 7-part series on Position Sizing. Article #1 of the series, “How Many Stocks Should You Own In Your Portfolio?” leads with this chart:

With data from Burton Malkiel’s A Random Walk Down Wall Street, the Ensemble guys explain:

The chart shows that as the number of stocks in a portfolio reaches 20-25 names, the incremental volatility reducing benefits of diversification reach near zero. This is the sweet spot for portfolio size for an active investor seeking to outperform the market. At 20-25 stocks, you’ve captured almost all the benefits of diversification, yet the number of companies you need to “know thoroughly” is still manageable.

The key here is for an active investor seeking to outperform the market. Isn’t that what we’re trying to do? Buying more than 25 names, the authors describe, amounts to just buying an index. (Which is fine, if you seek market returns!)

But, they continue:

Do not dilute whatever outperformance generating insights you might have by adding your 100th or 200th best idea. This is a recipe for under performance and you might as well go buy index funds so you can at least earn market returns.

This is difficult for me.

I become enamored by shiny new names. Or paralyzed by paying capital gains tax. Or fear selling names before they go on a run.

All of these feelings may be valid. But none of them help me as an investor.

Investor Kevin Byun has said:

I’ve learned that finding great ideas and portfolio management are very different skills. Both are critical.

It’s time to cut the portfolio down and invest in conviction. And pay more attention to managing the portfolio. We are coach and General Manager.

This Week:

StoneCo Earnings

Okta Earnings

Veeva Earnings

Spotify’s Apple Workaround

Amazon Launching TV—Problem for Roku?

Hayden Capital’s Investor Letter

Dan McMurtrie on the Value Hive Podcast

1. StoneCo Earnings

On Monday, Brazilian payments powerhouse, StoneCo, reported earnings.

Shares have continued slipping, down close to 10% since.

In the Motley Fool, Dan Caplinger shares that StoneCo:

[Ran] into some execution mistakes, and that led to the company making a temporary halt to extending credit and boosting its loss reserves. Moreover, StoneCo thinks it could take three to six months before it can resume operations as normal.

Clinton Rezeki had a great breakdown of StoneCo’s earnings in this thread:

In early 2020, here’s what I knew about StoneCo:

High-level it was “Payments in Brazil.”

Uncharacteristically, Buffett had a stake.

And it had hit around $40 per share.

Not exactly due diligence, but I felt I knew it well enough to be opportunistic when I scooped up some shares on 4/1/20 at $19.35.

Looks pretty good if I end the chart this past February!

But I thought I’d be opportunistic again adding this past March in the $60s, on its way down from a February high of $94.

That hasn’t worked out as well.

In addition to these tranches, for reasons neither important nor interesting, I received a distribution of StoneCo shares on July 1.

Since then:

Not ideal.

I’m still in the green on the distribution, although that is one quick and healthy dive.

As of now, I’m up 48.48% on the position overall, broken down like this.

In Clinton’s thread, he points out more concerns, included a whopping 18.7% of StoneCo’s portfolio was via clients who could not pay principal nor interest in the last two months. I don’t know what comps look like, but that sounds terrible.

I asked Clinton if, despite these concerns, he was still long. He told me:

Yes, they’re facing significant headwinds with their credit portfolio. I believe this should be temporary (management said 3-6 months). The new card receivables registry system will be transformational as it creates the basis for a much bigger market for collateralized credit.

This feels like a name I’m holding because a) selling when something is down 50% in a few months doesn’t feel great and b) no thanks on the tax bill.

But if I’m going to pay more attention to managing the portfolio, this has got to be a name to go.

2. Okta Earnings

Like StoneCo, Okta dipped following earnings on Wednesday.

But unline StoneCo, Okta rebounded, even ending the day up yesterday:

Why the difference? Okta actually had good news!

I first became interested in Okta last year and have been slowly adding ever since.

I put together a Deep Dive on Okta last summer, where I said:

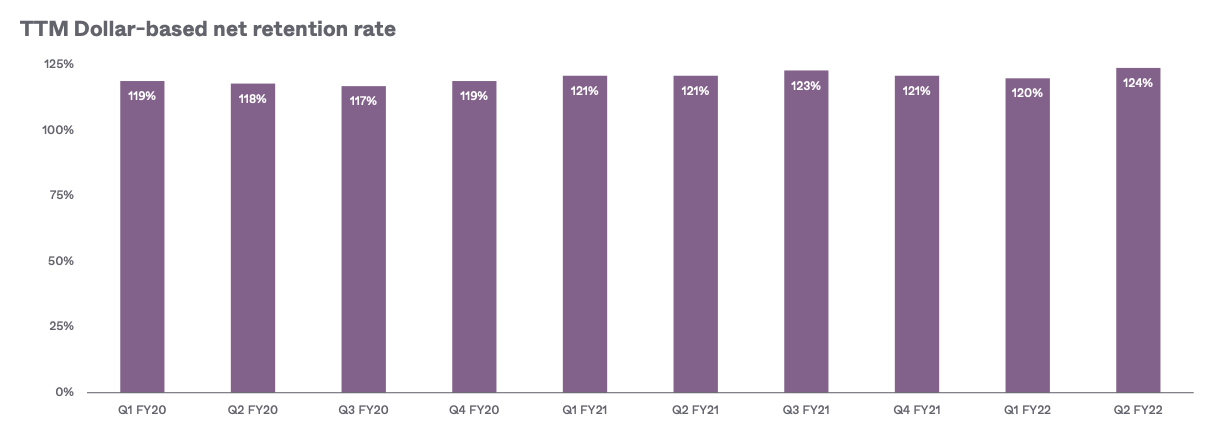

In a lot of ways this is pretty simple: Founder-led business, operating in a growing market, with very strong dollar net retention. Don’t overcomplicate this.

I still feel this way!

If I may, here are a few charts from Wednesday’s earnings presentation that might get you excited:

A) Revenue up 57% Y/Y

B) Net Retention at 124%

C) Total Customers up 46% Y/Y

*(1) Includes one time addition of 1,650 customers from Auth0.

D) Customers paying more than $100k up 55% Y/Y

*(1) Includes one time addition of 375 customers from Auth0.

There’s still a lot to like from this Founder-led, strong Net Dollar Retention compounder.

3. Veeva Earnings

While Okta rebounded, Veeva got hit.

Although at first glance, numbers looked good.

Like Okta, Veeva is another name I got into last summer, and have slowly added to:

And like Okta, I also wrote a Deep Dive on Veeva. In it, I said:

It feels as though Veeva can transition from growth juggernaut to quiet compounder, an industry-specific SaaS play in the footsteps of Autodesk.

I’m never going to feel comfortable owning pharma or biotech outright, but having exposure to the industry via enterprise SaaS is a place I feel good about.

Response to the earnings drop-off was mixed.

Financial Filings is buying.

Veuepoint is holding.

I haven’t had the chance to listen to the call yet, but perhaps the Quartr App guys uncovered a big reason for the drop. They asked:

Was it [the] talk about enterprise customer reductions during the conference call that sent the stock tumbling ~10% after-hours yesterday?

Hold uppppppp.

Enterprise customer reductions!?

On the earnings call, Veeva’s EVP of Commercial Strategy, Paul Shawah, said:

We started seeing some of the first reductions from a small number of our enterprise customers, and had some reductions that were a little bit out of the ordinary. So we just started seeing it this quarter, I expect we'll continue to see it through the second half of this year and also into next year.

I’ll have to dig deeper, but this is not my favorite piece of news.

4. Spotify’s Apple Workaround

In response to an investigation by the Japan Fair Trade Commission, Apple is giving up its stranglehold on the required 30% cut for “reader apps”. Reader Apps, as MacRumors describes, “allow users to browse previously purchased content or content subscriptions for digital magazines, newspapers, books, audio, music, and video.”

This will allow reader apps to link to their own sites to accept payment (as opposed to in-app), allowing the companies to circumvent Apple’s typical 30% in-app fee.

Ben Thompson sees progress!

Unsurprisingly, this is great for companies like Spotify, Netflix, Match Group and more.

I’ve got some Match Group from the IAC spin-off last summer.

Conor explains what it can mean for Match:

Maybe it’s time for me to take that Match Group position more seriously!

Regarding Spotify, it’s a small position I talked about briefly in Memo #2.

In that memo, I referenced a thread from CobraGlobal, where they say:

I’d much rather bet on something like a Peloton that has clear profitability today, and has optionality embedded in user base… I’d prefer to get on a plane that can clearly land and take-off like Peloton vs. something that is still figuring out the landing process in mid-air like Spotify.

I happen to agree with them.

Furthermore, my friend YoungHamilton put out a great piece on Spotify this week.

As Spotify becomes more mature, user growth inherently stalls. And with margins tied to negotiations with the labels, Spotify’s growth prospects lie within how Spotify can monetize podcasting.

Trust me, I like podcasts. But I’m not yet convinced monetizing podcasts warrants Spotify as a best idea.

Armed with this conviction, it’s nice to see it go green a bit before saying goodbye.

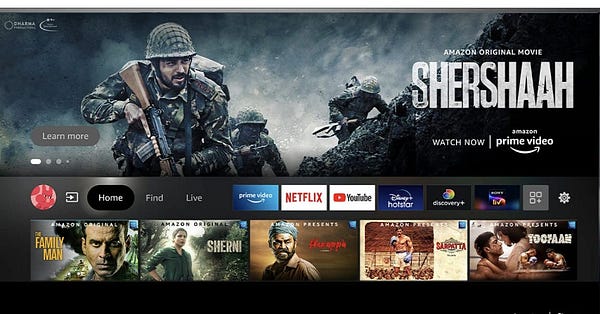

5. Amazon Launching TV—Problem for Roku?

First Kaushik unearths news that Amazon will launch its own TV in the U.S.

At first glance, Amazon launching its own TV looks like a threat to other TV manufacturers.

But, if we unpeel the onion, Roku powers the operating systems of many TV brands including: TCL, Insignia, Sharp, Hisense, Hitachi, RCA, Phillips, Element and JVC.

So while each of the TV manufacturers has a new competitor in Amazon, each TV OS also has a new competitor in Amazon. You didn’t think Amazon was going to use Roku to power their TVs, did you? No dice.

Via Digital TV Europe:

The TVs themselves are expected to be offered in sizes between 55-75 inches, while featuring Amazon’s Fire TV software and prominently placing the Alexa smart assistant within the OS.

Duh.

Commentary from Ophir:

From Clueless:

And from Harsh Mehta:

There’s a lot going on here. We’ll have to wait to see how big of a threat this is to Roku, or just a blip on the way for a long-term compounder.

6. Hayden Capital’s Investor Letter

I enjoyed reading Hayden Capital’s Q2 Investor Letter by Managing Partner, Fred Liu.

On investing, Liu writes:

The joy of this business and why I love it so much, is that as investors we’re given the freedom to learn about the world. Especially since our strategy is based on investing in change, we have to constantly push our mental boundaries and expose ourselves to new ideas…

The practice of investing is just one lens / framework to understand how the world works – to see how people, cultures, and preferences are evolving, and where resources (people & capital) are being placed to achieve a certain goal.

With 61% of his portfolio in Asian equities, I pay attention to what he says on China.

On investing in China, he writes:

Capital is meant as a tool (i.e. fuel) to enhance & accelerate society’s goals, not as an end-goal itself. Versus many Western markets, where it seems that the betterment of shareholders (and putting more money into their pockets) is often the end goal itself. If the well-being of capital must be sacrificed to ensure a better long-term direction of society (higher birth rates, affordable housing, protection of consumer data, a more free-thinking / creative education for kids vs. today’s heavy burden of rote-memorization) then in the Chinese government’s eyes, it’s a worthy trade-off.

Capital (and investors) will be rewarded when capital is needed as fuel to achieve the broader goals of societal and economic advancement in a harmonious and equitable manner. But when capital investment in certain sectors is at odds with these goals, don’t be surprised when it’s impaired.

7. Dan McMurtrie on the Value Hive Podcast

I first remember seeing Dan from the thread below where he discusses the “survival rate” of emerging managers like him. (Spoiler: it’s pretty tough).

He was recently on Brandon Beylo’s Value Hive podcast. After getting over the runtime, I decided to saddle up!

Here’s Clark Square Capital with some highlights:

Take a listen:

Or give it a read!

That’s it for Mazwood Memo #7. Thanks for sticking around!

We’ve written Deep Dives on DigitalOcean, Adyen, Snap, Okta, MercadoLibre, Lululemon, Veeva and Unity. And now Mazwood Memos!

Have a great weekend!

<3 love it, thanks!

Always an enjoyable read Maz!