With Ted Lasso back this summer for Season 2, Jason Sudeikis graced the August cover of GQ.

In a wide-ranging, in-depth profile, Sudeikis is revealed as an amusing and thoughtful guy.

In particular, I loved this line:

“There’s a great Michael J. Fox quote,” Sudeikis [said], trying to explain the particular brand of wary optimism that he carries around with him… “ ‘Don’t assume the worst thing’s going to happen, because on the off chance it does, you’ll have lived through it twice.’ So… why not do the inverse?”

Optimism is an underrated trait. How many unhappy optimistic people have you met?

It’s also underrating in investing.

Personally, I like to think of myself as an optimistic person and investor.

Right on, IQ.

Let’s get after it.

📈 In the Market

China is Exhausting

On Monday night I’m minding my own business, and BAM:

Look, I’m no expert, but at some point we have to acknowledge this China business is getting silly.

Again, Tencent could be a great investment!

But does this spark joy?

Now, we can have a very thoughtful conversation about whether we are for or against “spiritual opium,” but ultimately, it takes a special kind of optimism to invest in China.

And I don’t know if I’m cut out for it.

📓 In My Portfolio

More Earnings!

Not as busy as last week, but still a doozy:

Let’s cherrypick a new list to discuss:

Square

Roku

Etsy

MercadoLibre

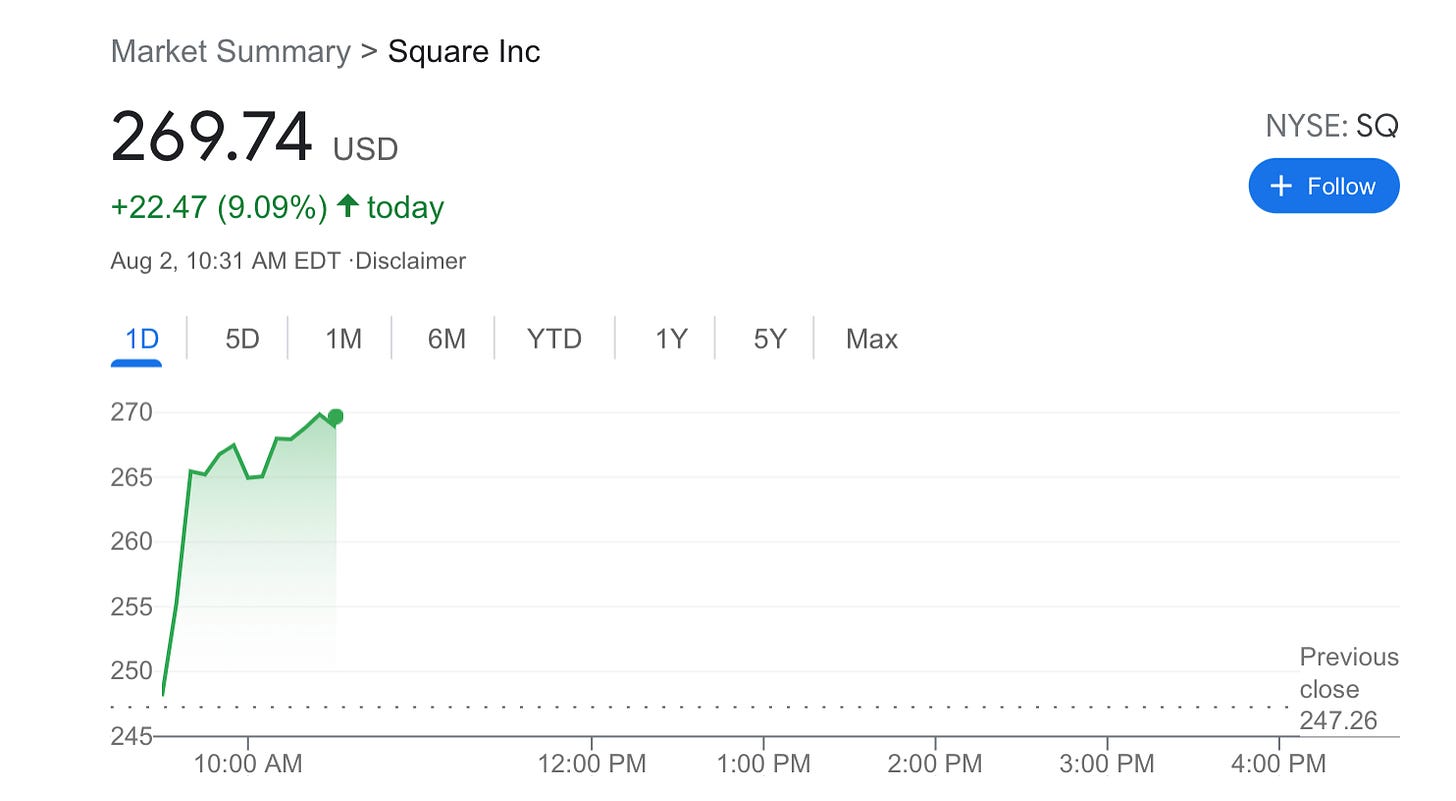

1. Square

In this week’s edition of “Markets Don’t Make Any Sense,” we’ve got Square.

As noted in the graphic above, Square was supposed to report yesterday after the bell. But wouldn’t you know, news dropped Sunday night that Square was acquiring Australian fintech player, Afterpay. And earnings leaked, too!

Response to the acquisition was mixed:

Down on it, Evergreen Capital:

Rihard and From value, not so down:

The acquisition was paired with Square releasing earnings:

So how did the market respond?

Pre-market, a little nervous:

What good are headlines anyhow?

Here’s what actually happened in the first hour of opening on Monday:

Not too shabby.

I first bought Square in May 2019, intrigued by the little white credit card reader servicing restaurants. I never developed deep conviction nor disdain. It was fine.

When it got Covid crushed in March 2020, I scooped up some more.

I’ve since added in a few smaller tranches, up a cool 217% overall.

It’s a position I expect to be rocky, but ultimately, outperform.

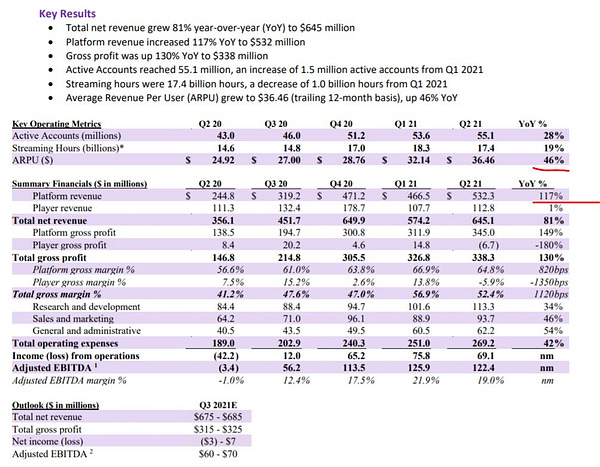

2. Roku

I don’t like to play favorites, but I do have a soft spot for Roku.

I’ve been a customer since *checks notes* 2012.

I looked in my email to see what I may have said to friends years ago.

Apparently I was into the product in late 2008!

And in 2011, I was calling the device a “no-brainer.”

But I didn’t think about it as investment (to be fair it didn’t IPO until September 2017). I just thought it was a little dongle to watch Netflix. Like Sonos was a nice speaker to access Spotify.

I didn’t realize at the time how substantial Roku’s ambitions could become.

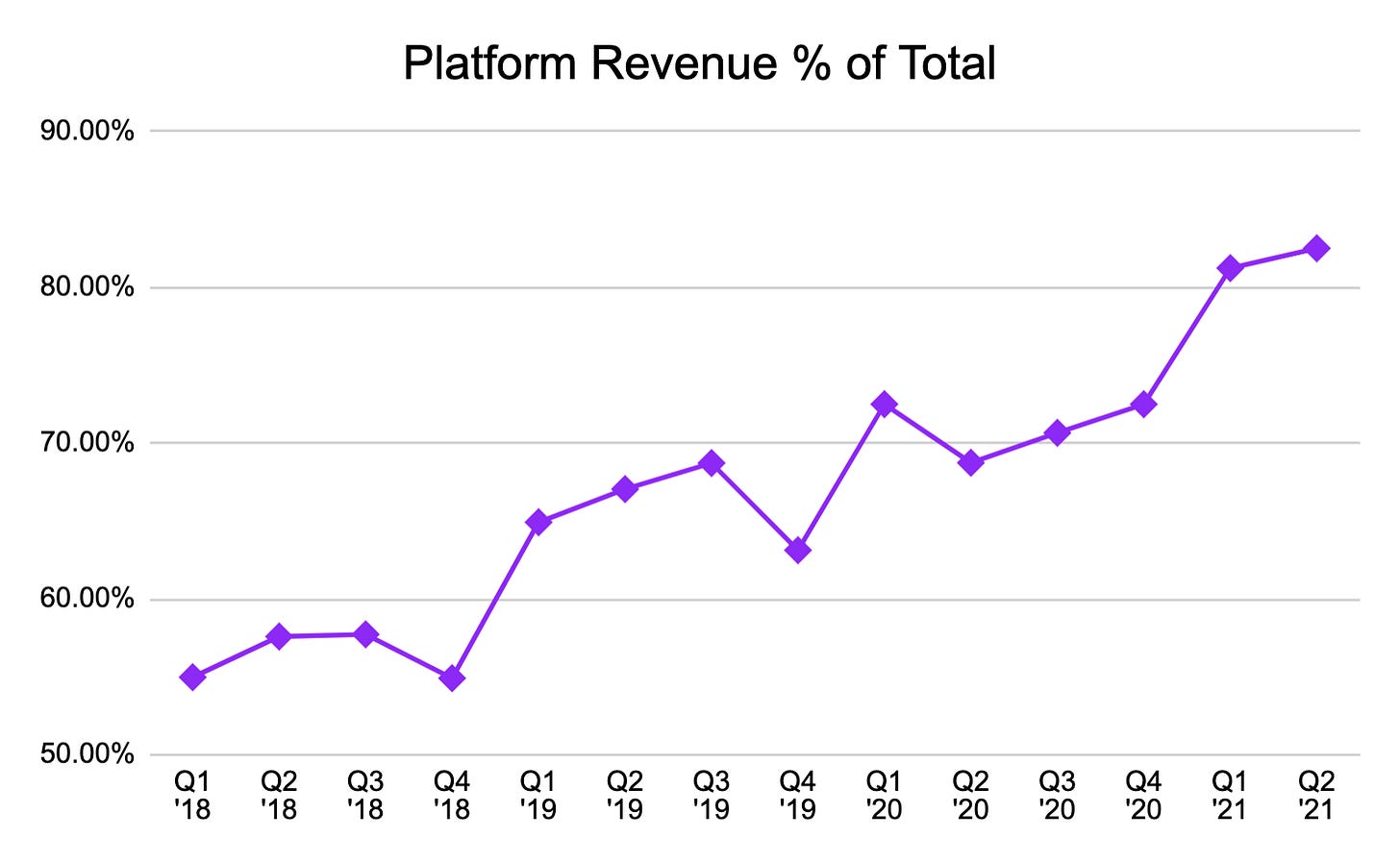

Roku breaks down their revenue into two segments: Player Revenue and Platform Revenue.

Player Revenue represents hardware sales (those little dongles).

Platform revenue represents the rest of the Roku business including advertising, licensing, content distribution and more.

Let’s see how the segments have performed the last ten quarters.

Oh hello Platform Revenue! Look at how the gap between the numbers has changed in just three and half years.

As a percentage of total revenue, the Platform business now represents more than 80% of the total pie.

And why is this important? Average Revenue Per User!

Not bad, huh?

Okay, back to earnings.

Eric Jhonsa lays it out simply:

The stock dropped 9% after hours from $420 Wednesday afternoon to $382 yesterday morning. Despite a quick sell-off, there were some hungry buyers, with the stock closing up to $403.

Overall, despite active accounts and streaming hours missing, Fintwit was happy.

The artist formerly known as The Mark Cooke:

Long Short Value:

And Dillon:

I dig the optimism!

But I wonder how long this will haunt me:

Buy companies you like when they go on sale!

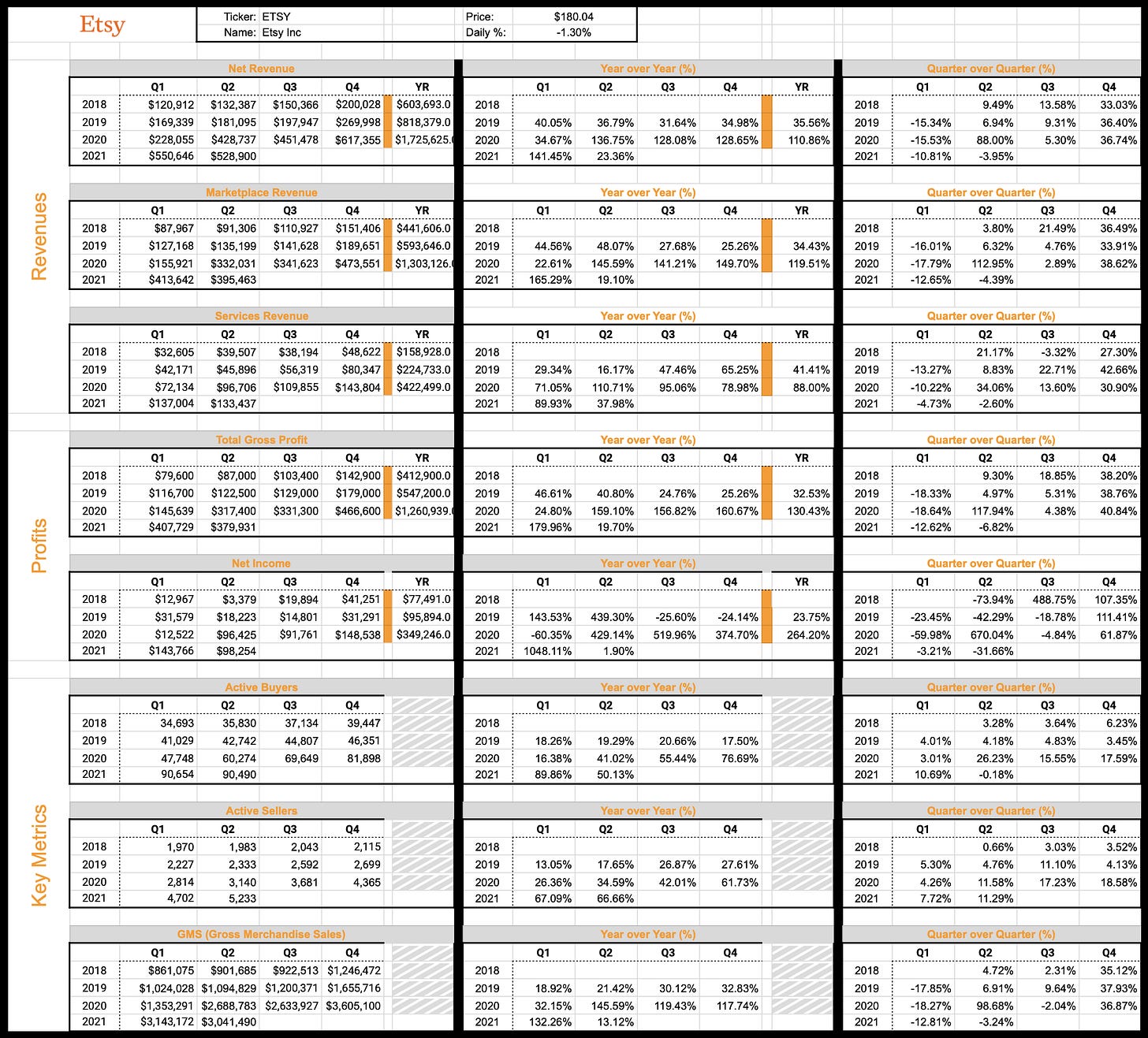

3. Etsy

I spoke about Etsy at length in Memo #1.

Now, I’ve had my reservations about Etsy in the past.

But at this point, I’m in.

I started buying in October of last year, and haven’t let up.

I even put together an Oral History of Etsy in December!

So how did earnings go?

Not great. Definitely worse than its buddy Roku.

The stock dropped more than 13% after hours, from $202 Wednesday afternoon to $175 yesterday morning. Then it was a little rocky, up 10% to $192, then down 5%, settling at $182. Where my day traders at!

What about the news itself?

Eugene Ng breaks down the numbers for us and shares:

The investment thesis was never about one-off face-masks / rapid growth, but in a global two-sided online marketplace for unique and creative goods. Yes there will be tough comps near-term, as long as sellers keep growing, buyers & GMS will return.

But there are very real concerns.

The GOAT of threads, Mr. MBI himself thoughtfully details them below:

Management outlined a wall of worry for 4Q’21 and 1Q’22. If you are not a long-term investor, this can get uncomfortable.

At first glance, Francis is not impressed!

But, Blaine is chillin.

There’s a lot to digest. I look forward to spending the next few weeks further combing through all the new information.

Ultimately, is this coming-out-of-Covid slowdown a mere blip, or are there more substantial issues at play?

Right now, like Pinterest, no moves for me. Investment decisions don’t need to be made hastily. They need to be made thoughtfully.

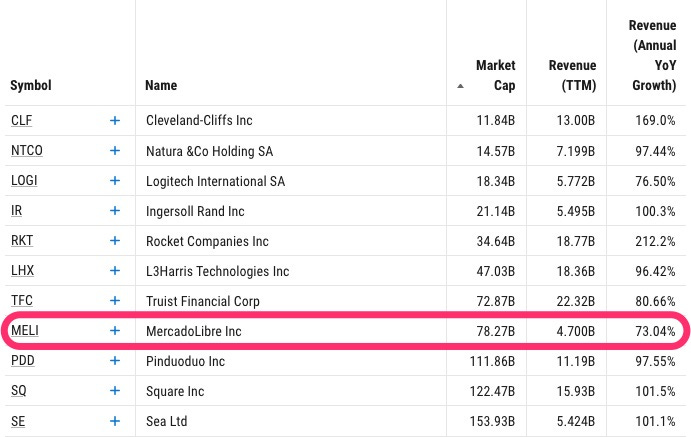

4. MercadoLibre

Where Roku faltered and Etsy sunk, MercadoLibre soared.

Eugene is back from his Etsy reporting to break down MercadoLibre for us!

The dominant LATAM E-commerce & increasingly FinTech powerhouse that keeps growing, delivering and compounding. Held since 2017, $MELI remains a strong core high conviction position of growth, profitability, optionality & large market opportunity.

I don’t know MercadoLibre as well as Eugene, but did spend some time with the company in September, when I put together a Deep Dive.

If you’re new to the name (or not), check it out. I go over a brief history of the company, talk a bit about their business, financials, valuation, opportunity and concerns.

Here’s a chart I pulled at the time, with updated numbers:

There just aren’t a ton of companies with revenue greater than $4.5B, growing 70% YoY!

Of U.S.-listed companies, with a market cap greater than $1B, there are just 11.

That’s it. Here’s the list:

I know Covid did some wonky things to companies like MercadoLibre, but this is still pretty good.

In the Deep Dive, I said:

The investment opportunity for $MELI could be great. There’s a ton to love in the story, the products, the market, the leadership. But some off-putting numbers and the wildly unknown geopolitical risk make it hard for $MELI to be a core position.

For now, I’m comfortable taking a flyer.

Watching it closely. And treading carefully.

Wish me luck.

Overall, I’ve bought in four tranches, the first two obviously performing much better.

I could’ve been a buyer from March through June as the stock lingered below $1,500. Unfortunately, I was not.

But there’s nothing wrong with being patient and getting more information.

For example, Investing Lion looked at “the average multiple of every quarter from 2018-2019 vs. today, using the following metrics: EV/GP, EV/EBITDA, and EV/FCF”:

MercadoLibre is literally off the chart! While it has performed second best in this cohort (up 357%), it’s actually gotten cheaper (-6%).

As MercadoLibre continues to perform, I continue to be more confident in the position. Maybe it’s time to double down.

🖥️ On the Internet

Quarterly Recaps

Although the quarter ended in June, I saw a few Q2 letters published this week. I love reading these, learning about new positions, strategies, what is working for others and what is not—without the limits of 280 characters.

I particularly liked this Q2 Letter from Alta Fox, a Long/Short, small-cap focused fund out of Texas.

In it, Founder and Managing Partner Connor Haley reflects on his research process, specifically how his thoughts have evolved on investing in micro-caps (less attractive) and his desire to find “Wall of Fame” worthy CEOs (yes, please):

At Alta Fox, we are aware that it can often be difficult to objectively recognize a good investment process independent of a good outcome (and vice versa). However, we believe objective process reviews are critical to improvement as an investor over time.

What Quarterly Letters do you read? Let me know in the comments!

Compounding Crazy with Packy McCormick

Packy McCormick will make regular appearances in our Memos.

This week is no exception, regarding his essay, “Compounding Crazy.”

Craziness and high valuations invite snark. It’s how people respond to unfamiliar things, and it’s exceedingly easy to dismiss everything as a bubble, or as temporary froth, or as COVID-boredom-induced-adventure-seeking, or as a ponzi waiting to collapse. Being skeptical makes you look smart and responsible. A surefire way to get grown-up bonus points is to make fun of people who believe “this time is different.”

But this time is always different. Zooming out, and ignoring cycles and fluctuations, history looks like one big exponential curve…

The world will continue to get exponentially crazier.

From Jonathan Bales: “This is so good.”

From Andrei Brasoveanu: “Progress is exponential and innovation compounds, what a great essay from Packy.”

From Joe Stampone: “It’s impossible to read this post from Packy and not be fired up for the future.”

How Nike Stole the Olympics

With the Olympics coming to a close this weekend, check out this Netflix-worthy video, “Nike Stole the Olympics.”

Here’s a preview: Do you know which company was an official sponsor of the 2012 London olympics? Adidas. Not Nike.

But in a study following the 2012 Olympics, only 24% of people correctly identified Adidas as an official sponsor, while 37% considered Nike to be an official sponsor. 37%!

That’s it for Mazwood Memo #4! Thanks for sticking around.

We’ve written Deep Dives on Adyen, Snap, Okta, MercadoLibre, Lululemon, Veeva and Unity. And now, Mazwood Memos! Check out last week’s post.

Have a great weekend!

Outstanding. Loved the opening quote from Sudekis. I need to be more optimistic, and not live through a pessimistic scenario that doesn’t materialize.

Amazing as always! Thx!!