A lot of us are selling.

Hell, I went on a huge selling spree last week.

And I’m going to be selling more.

But remember:

You never want to be emotionally in a position where you pull the rug out from under yourself. You don’t want to let your own fears or emotions to cause you to sell at the wrong time.

-Warren Buffett, Maybe You’ve Heard of Him

I want to take a moment and say a quick welcome to all our new subscribers! If you’re reading this but haven’t subscribed, please consider joining our curious and thoughtful corner of the internet here!

This Week:

Facebook Goes Meta

Snap Tanks

Twilio Also Tanks

Teledoc Surprises

Is Visa On The Chopping Block?

Shopify Misses, But The Market Doesn’t Care

Short-Term Pain For Amazon?

1. Facebook Goes Meta

Facebook reported earnings on Monday. Pretty good.

But who cares about earnings, when you have a once in a generation rebrand!

In the video below, Zuck explains:

I’ve been thinking a lot about our identity as we begin this next chapter. Facebook is one of the most used products in the history of the world. It is an iconic social media brand. But increasingly, it just doesn’t encompass everything that we do: Instagram, WhatsApp, Messenger, Quest—now Horizon… and more.

Building our social media apps will always be an important focus for us. But right now, our brand is so tightly linked to one product, that it can’t possibly represent everything that we’re doing today, let alone in the future. Over time I hope that we are seen as a metaverse as company. And I want to anchor our work and our identity to what we are building towards.

I need to establish how I actually feel about Facebook—err—Meta. I have a decent position here. But it’s neither big enough, nor small enough, just noodling around in middle-of-the-pack. Doesn’t this feel like a name you have to really believe in or not.

EITHER: Zuck is generational Founder/CEO. They are synonymous with best-in-class social apps: Facebook, Instagram, WhatsApp, Messenger. And they are literally building the Metaverse.

OR: Facebook poisons our society and the Metaverse (IF any part of works), will only make that worse.

It’s very me, but I sit in the middle of this! Shouldn’t I take sides?!

2. Snap Tanks

Remember the Pinterest nosedive?

Well, Snap was feeling left out.

I’ve spoken very highly of Snap, writing a bullish Deep Dive last year.

Since then, there is obviously nothing to complain about.

A quick and speedy 30% drop, however, is at least something to look at. Did something break? Is the market just rerating an unbelievable run?

Ultimately, when the valuation triples in a little more than 18 months, a little rerating can’t shock anyone.

I see myself buying more.

While we’re on the topic of the Metaverse, don’t rule out Evan Spiegel and Snap.

3. Twilio Also Tanks

So it’s not as bad as Snap or Pinterest, but a 17% drop is pretty steep!

What happened?

Doesn’t sound like 17% drop territory, right?

From what I gather, there are a few reasons for the drop:

COO George Hu resigning

Y/Y Organic growth decelerating from 50% to 38%

Lower Q4 EPS guidance

KZ Capital has a great breakdown:

So, what’s the plan?

In Memo #9, I said the following of Twilio (when it was trading at $352 per share):

I think if it gets to the low $300s again, I’d be a big buyer. Around these levels [~$350], I think incremental buying is prudent.

Load. Up. The. Truck.

4. Teledoc Surprises

Here’s the truth. I wasn’t supposed to be here.

I passed on Teledoc the first time I studied it. It was 2018, and I put it in the “too difficult” pile.

However, I bought a bunch of Livongo in Spring 2020.

When the Teledoc/Livongo merger took place, I didn’t know what I didn’t know. On the one hand, I liked and knew Livongo. On the other hand, I had passed on Teledoc, but that was two years earlier, and COVID clearly was changing things.

So at first, I froze. Apart from a small buy in December, I said let’s wait and see.

Here’s how Teledoc performed from the date the merger closed (October 30, 2020) through its high in February 2021.

Pretty good!

The market had spoken! So when it started dropping, I scooped up shares in late February, and then again in March as it continued to dip.

But then it kept dipping. And dipping. And dipping.

Something still feels amiss.

Earnings, however, were positive yesterday!

Here’s IQ with a bomb diggity thread.

If I’m being honest with myself, I still don’t think I belong here.

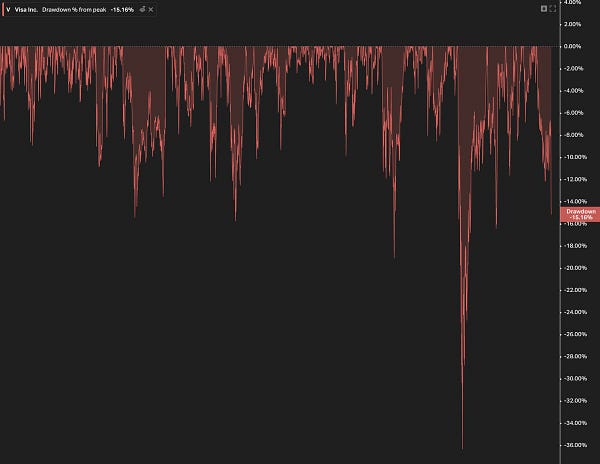

5. Is Visa On The Chopping Block?

I bought a bigger starter position than usual in Visa on February 20, 2020.

It took more than a year to climb out of its hole, then went on a decent 20% run from March through July of this year, and now is going in the wrong direction.

Wednesday’s earnings were not kind to Visa.

Feels like a pretty big haircut for what I perceive to be a slow and steady compounder that takes a slice of all economic activity? It’s supposed to be a safe bet, right?

Liberty knows what I’m talking about.

Look, Visa isn’t going anywhere. But I’m beginning to wonder, given my newfound excitement in Coinbase (as discussed here in Memo #9), that if I’m betting on crypto being disruptive to financial institutions, maybe my financial exposure should be in Coinbase. Of course, owning Visa and Coinbase are not mutually exclusive. They both can win. But we’re taking bets, right? Show me a great investor that hasn’t taken calculated bets.

I think Visa will continue to win as well, but if I want to build a more concentrated portfolio, maybe it’s not necessarily a “best idea.”

6. Shopify Misses, But The Market Doesn’t Care

This is simple and you’ll see why investing is easy.

Shopify missed earnings.

Apparently it’s Shopify’s first-ever revenue miss.

The market must’ve whacked it.

Oh, up 7%. Jk.

Told you, easy peasy.

7. Short-Term Pain For Amazon?

Earnings miss. Revenue miss. Guidance drop.

Not great. Down 4% after hours yesterday.

Always love MBI’s takes:

There’s a lot going on here.

If you look at the one year returns of FAAMG, Amazon ain’t doing too hot.

If you look at the one year valuation change of FAAMG, Amazon (and Facebook for that matter) are falling.

Should Amazon be dropping like this? Especially against their Mega Cap peers?

Let’s take a quick peak at Y/Y growth of Amazon’s operating units released yesterday.

Online stores, huge deceleration. The holiday season could reverse this, although it’s not like world shipping is firing on all cylinders.

AWS, however, is crushing.

Short-term, things aren’t great.

Long-term, Clueless reminds us:

Short-term pain. Long-term gain?

That’s it for Mazwood Memo #13. Thanks for sticking around!

We’ve written Deep Dives on DigitalOcean, Adyen, Snap, Okta, MercadoLibre, Lululemon, Veeva and Unity. And now Mazwood Memos!

Have a great weekend!