With the following companies reporting this week, who’s got time for an intro?

Deep breath, go:

Tesla, Apple, Microsoft, Alphabet, Visa, Teladoc, Starbucks, Shopify, McDonald’s, Spotify, Facebook, Paypal, ServiceNow, Amazon, Pinterest, Twilio, UPS, GE, 3M, JetBlue, Waste Management, Boeing, Pfizer, Ford, Merck, Upwork, ExxonMobil, P&G… and more!

Let’s get into it.

📈 In the Market

Oh, China

On Monday morning, I log into my brokerage.

I’m greeted by a few of my Chinese friends. Hi friends!

Eek.

What’s going on?

Calm, measured Liviam Capital is selling.

Cathie is dumping!

Others are adding.

What’s a reasonable investor to do!?

On the one hand, there are plenty of wonderful stocks in the universe not under constant regulatory threat of, shall we say, a less than democratic government.

On the other hand, it’s a bit hard not to be seduced by the scale of China.

I’ve got positions in the Big Three (I had briefly flirted with Baidu at one point).

Here’s how they’ve done the last three years:

Alibaba seems broken. That’s crazy underperformance for three years. At some point “undervalued monster” just becomes “monster.”

JD has obviously had a good run. But I don’t have a strong enough feel for it to necessarily warrant a “best idea” in my portfolio.

Tencent is the one here that I don’t want to quit yet.

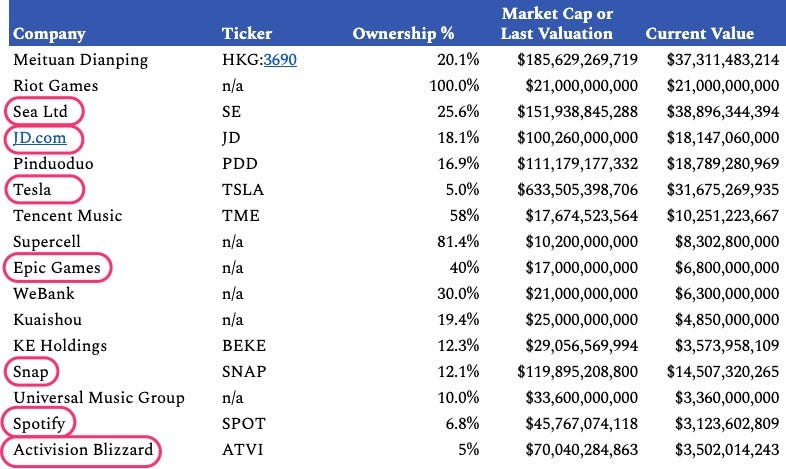

For those unfamiliar with Tencent, I’d suggest starting with Packy’s two part series, Part I — Tencent: The Ultimate Outsider and Part II — Tencent’s Dreams. And if you don’t have that kind of time (who does?), just glance here:

This sheet was put together a) in August 2020 and b) by Packy, so some of the numbers may be wrong or dated. But sheesh, this at least gives you some context to how they operate. A holding company of innovative international tech? Cool.

And that’s just a tiny sliver of their investments.

Their core business?

Can I interest you in a 37B segment of online gaming and social networking, another 11B in online advertising and another 18B in fintech?

That is a juicy premise, is it not?

Your local butcher says “now is your chance!”

But Convexity Cowboy reminds us, “why do investors torture themselves?”

Crystal clear, as always.

Oh, China.

📓 In My Portfolio

Earnings!

As mentioned, lots of interesting names reported earnings this week:

For a high level recap, check out this actual 39 part thread from John Street Capital:

Let’s cherrypick a few names to discuss:

Pinterest

Twilio

Shopify

Teladoc

Amazon

1. Pinterest

I dig Pinterest.

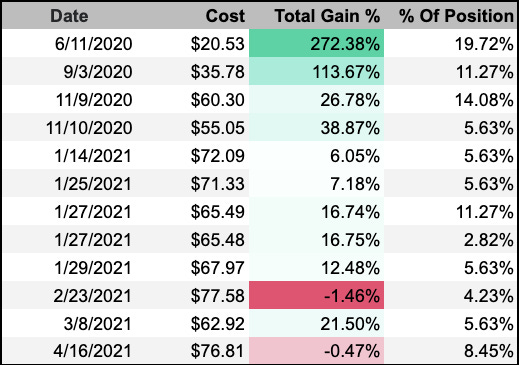

I started buying last summer and kept it up. Here are all my purchases before yesterday’s earnings release:

Not bad.

But I’ve been feeling a tad uneasy with some of their metrics, mainly:

Poor ARPU internationally (despite strong international growth) and

No USA growth

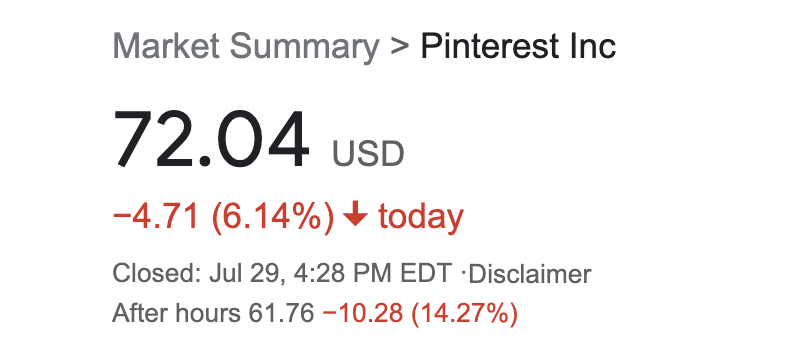

Well, let’s just say earnings didn’t go great:

Updated position as of this morning:

Eek.

Plant breaks it down simply:

Rihard Jarc hits on something many of us have been feeling. Like any consumer platform, at first the market cares about growth. Once you achieve growth, then what is your story?

This is my issue with Netflix. With Spotify. If the growth stories have concluded, what does the next chapter look like?

For Pinterest, all indications are that it should be e-commerce.

Last year, Pinterest launched a partnership with Shopify. Great. What is the plan here? When will that start to meaningfully impact their business?

With that being said, Rich Greenfield tells us to chill:

From Growth to Value is with Rich:

KnowHow brings us back to earth and points out that user growth and ARPU growth are two different stories and command two very different multiples.

Typically, if a portfolio company I like takes a 15% after-hours haircut, I’m an early buyer. Right now, there’s just a lot to digest. No quick moves for me.

2. Twilio

By all accounts, Twilio is still going strong.

I first talked about Twilio in a weekly recap last summer. At the time, I said:

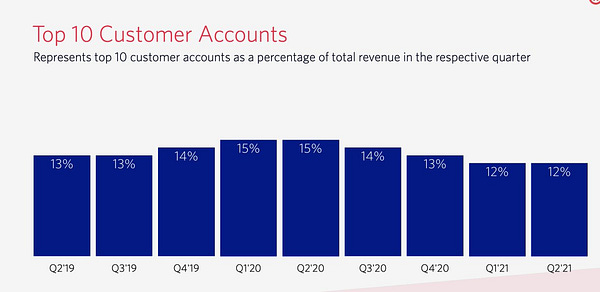

Here, we’ve got a founder-led business, literally off-the-charts net dollar retention (see chart from Jamin Ball), a product made more necessary by Covid (cloud communications tools for companies to add messaging, voice, and video to web/mobile applications). Lots of good stuff.

This week, Daniel Joshua Rubin put out a deep dive calling CEO Jeff Lawson “the best CEO I have ever studied.”

He writes:

Twilio has a clear, simple, authentic story, world class CEO, is top dog in a mission-critical space (CPaaS or Communication Platform as a Service), fueled by smart, coherent acquisitions, has a humongous TAM, powerful moat, strong culture, deep bench, killer messaging, an actual heart and a marketing plan backed by a ten million-strong army of developers. For these reasons I consider Twilio to be the best run company of any we follow and if I could only keep one it would be them.

I believe in Twilio. But I can’t believe it was sitting there at $280 just a few short weeks ago.

If it heads south to $300 again, remind me to take my wallet out. A big if, I know.

3. Shopify

Shopify has been on a tear.

Q2 earnings continues their growth story, hitting $1B in a quarter for the first time.

Listen to Shopify President Harley Finkelstein:

The future of commerce is bright. Consumers really do want to buy from independent brands. And those brands are on Shopify.

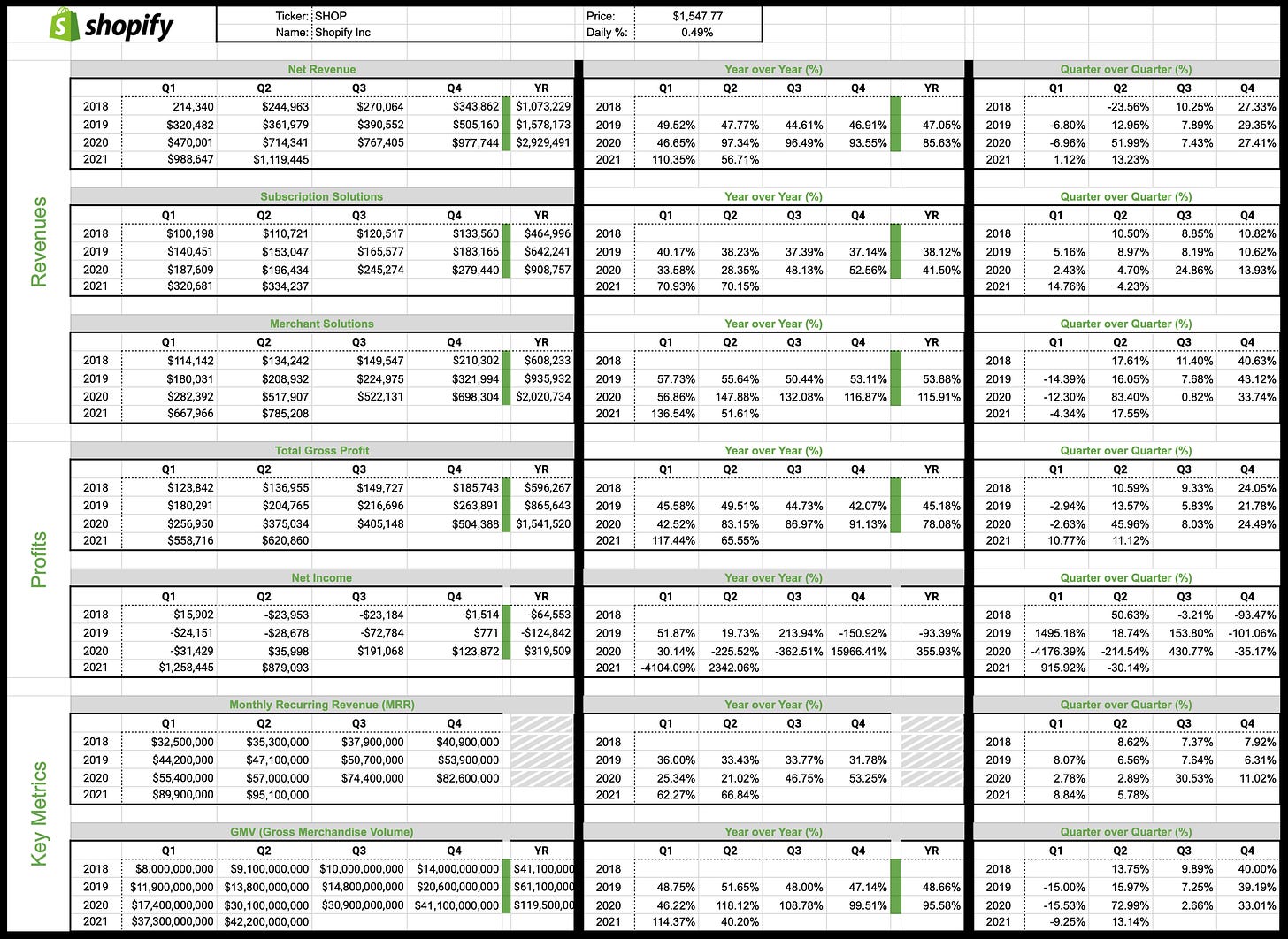

I spoke about my position in Shopify in Mazwood Memo #1. I’m comfortable with the position, but wanted to dive into the business a little deeper.

Last summer, StockNovice published a post detailing how he tracks metrics of his portfolio companies.

I’m trying to put in that kind of work. Great artists steal, right? Thanks, Joe.

Here is the breakdown of Revenues, Profits and Key Metrics of Shopify. A lot to like!

4. Teladoc

Earnings looked pretty good:

However, the market was not impressed, down as much as 10% after hours.

But by lunchtime the following day, we were already back! Talk about much ado about nothing.

So what’s going on here?

North Bluff Capital points out that Teladoc often gets hit immediately after earnings.

Well, let’s check it out.

North Bluff ain’t wrong!

Before this week’s earnings, after eight of the last 11 earnings reports (and five in a row), Teladoc took a brief dip. Now, make that six in a row!

So what’s the plan? Ryan and Satoshi are into it.

Me?

I first passed on Teladoc in 2018:

Fast forward two years… I started gobbling up some Livongo beginning on May 26, 2020, and in two more tranches last summer. Livongo was a great investment for me.

When Teladoc acquired Livongo, I had three options:

Sell, take the gains. Move on with my life.

Hold, watch how the acquisition plays out.

Buy, add Teladoc shares, continue on the telehealth train.

Let’s just say, as of now, I got it wrong.

I waited until December, then began adding to Teladoc. Those purchases? Not my finest work.

I’m still up on the total position, due to the size of the Livongo purchases (48% of the total). But it’s not like I feel good about it.

As of now, I’m holding. But this has been a big whiff. A lot to learn!

5. Amazon

Amazon got hit after hours yesterday, down as much a 7% before the market opened this morning.

What happened? Nothing terrible at all. MBI breaks it down:

I’ve got Amazon in a few different accounts.

In two small accounts, I have it at a cost basis of $807.75.

In a larger account, I have it at a blended cost basis of $1,410.67.

In another core account, I bought it a few weeks ago at $3,470.02.

It’s not that intuitive to add to a name at $3,400 when you’ve got a cost basis of $800, but I’m considering loading up on (what is likely) a relatively safe name that *should* continue to beat the market.

Amazon has only trailed the market in six of the last 19 years and two of the last nine. Annual returns below:

As East Cap notes, Amazon’s smaller, more profitable business units are growing at a faster clip than the larger online (and now offline) stores we know and love.

I’m in.

What say you, Magic 8 Ball?

🖥️ On the Internet

Twilio in Napkin Math

As discussed, I like me some Twilio.

Evan Armstrong (of Napkin Math) invited Byrne Hobart of The Diff to collaborate on Twilio, painting a wide-ranging portrait of Twilio’s background, M&A strategy, opportunity and challenges.

[Twilio] is a developer-focused business that allows anyone to quickly and easily set up communication channels with their customers via API. Their APIs give developers an easy way to build customer communications channels like texts, calls, chat, emails, and videos. They are an infrastructure play—similar to the work of Stripe with payments which Bryne has written brilliantly about. Twilio is focused on selling tools that allow developers to easily incorporate customer communications into their products. It is a business that is focused on selling components that allow customers to deliver an end service. In a retail housing boom, they are selling a power drill.

Check out the full article here.

Robinhood Goes Public

On their way back from shooting a Pantene Pro-V commercial, these guys took Robinhood public yesterday.

Marketwatch with a bit of an understatement:

For a cool 10,000 words on Robinhood’s S-1, check out the collaborative report in Mario Gabriele’s The Generalist.

Read part of the S-1 and you might expect a symposium on the democratization of finance held in a hedge funder’s brownstone. Read another and you’d imagine a Davey Day Trader fan meeting, spilled pitchers lacquering the tables of a local watering hole… Depending on where you look, Robinhood is animated by contrasting energies, trying to convince you of the intelligence and nobility of its endeavor at the same time that it assures you of its playfulness.

[The S-1] leaves the impression of a business unsure of whether it wants to be the most serious fun company or the most fun serious company… Is this an addictive social app with an economic agenda, or a bank with a sense of humor?

And then, Chris Bloomstran with a takedown of all takedowns.

If you’re into Chris roasting Robinhood, you might like last month’s undressing of Chamath:

Or if you’re into Chris not totally annihilating people, here he is on Invest Like the Best from 2019, where you get a feel for how much he cares about morality and values in business (might explain those takedowns).

Ideally, we’re trying to own businesses for a long time. And if you’re gonna own businesses for a long time, if you’re going to start a business with somebody...we better have a hell of a lot of respect for our core sets of values and our morals. And so I think we’ve just gravitated toward trying to identify these businesses that are run by folks that kind of share our value system.

Interview with Joe Frankenfield of Saga Partners

I always enjoy Investment Talk’s guest interviews.

The most recent, with Joe Frankenfield, dropped on Wednesday.

Joe on Diversification:

Diversification is really just a hedge against being wrong about your best ideas. It’s also a hedge against being right about your best ideas. It makes sense to diversify to a certain point depending on the opportunities at hand and the conviction surrounding those opportunities, but the benefits of diversification decline pretty significantly after holding just a few different opportunities.

On investing like a puzzle to solve:

While I initially started investing with the goal to grow my savings, it quickly became one big puzzle for me to solve. It was an intellectual game/exercise. Investing to me was like a murder mystery. At first, you can’t quite see the full picture, but you pick up all the different clues you can find, try to understand the different motives of each character from each angle, and then put all the pieces together to form an overall thesis of who the murderer was, how they did it, and why.

You can find the full interview here:

That’s it for Mazwood Memo #3! Thanks for sticking around.

We’ve written Deep Dives on Adyen, Snap, Okta, MercadoLibre, Lululemon, Veeva and Unity. And now, Mazwood Memos! Check out last week’s post.

Have a great weekend!

Amazing,thx for your insights!

Thanks for sharing and for your efforts! This is great