On this day 24 years ago, I received two gifts.

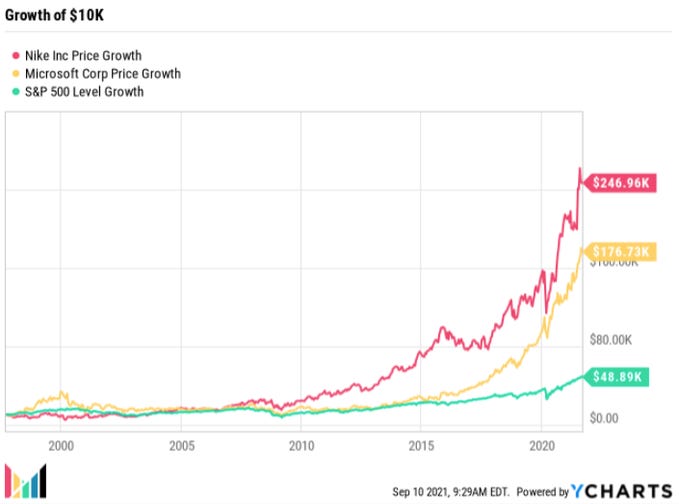

Microsoft:

And Nike:

As you can see, both positions have done okay.

Holding for a very long time is a particularly interesting activity.

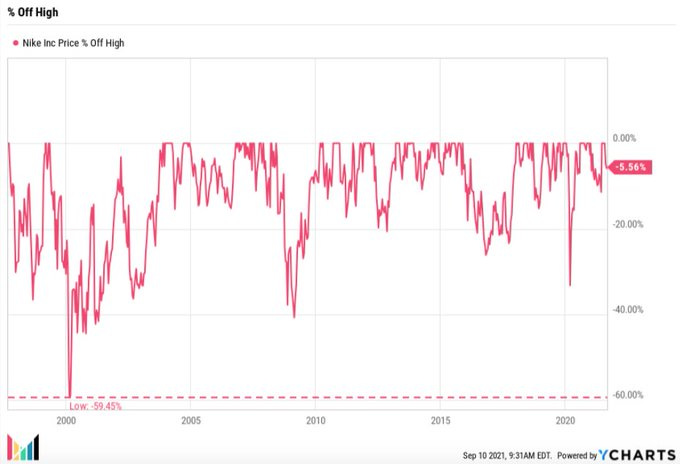

Nike dropped as much as 60% in Feb ‘00 before recovering in Jan ‘04, and apart from the quick crashes of 2009 and Covid, didn’t have any major setbacks.

Microsoft, on the other hand, hit a split-adjusted high of $59.56 on Dec 27 ‘99... and it would take UNTIL 2016 (!!!!!) BEFORE REACHING THAT HIGH AGAIN.

That is a crazy long time to be under water.

Compounding is never easy. But it sure is fun!

Every once in a while you’re asked to get your hands dirty with something you know nothing about.

And today, that something is used cars. Apart from having sold a car to CarMax two years ago, I don’t know much about the used car business. But I was asked to do some work on it. So let’s dive in.

Brief internet sleuthing tells me there’s really a big two, Carvana and Carmax, with an up and comer, Vroom. And maybe AutoNation (more on this in a minute).

High level data to get us in the mood:

1. Vroom

Off the bat, I’m unenthused with Vroom. 14% growth. No margins. Negative everything. Let’s take a quick peek before it’s an immediate cross-off.

IPOed in June 2020

Headquartered in New York, NY (so great they named it twice)

CEO since 2016 is Paul Hennessy, former CEO of Priceline.com

Their investor presentation doesn’t provide any financials or company metrics. It only shows slides like “massive market” and “ripe for disruption.”

This could be a good company, but who knows! This isn’t a YC Demo Day. Easy cross-off.

2. AutoNation

Founded in 1996, AutoNation is a more mature company, with legit Revenues, Net Income and Free Cash Flow.

But two items of note:

A) From AutoNation’s 2020 10-K, they break down revenue and profits for us:

They derive only 27.5% of their sales from used cars. So much for a used car player! It’s just a very different business than the others when half of your sales are new cars. Completely different supply-side economics.

And they derive a combined 70% of their Gross Profit from Parts & Service and Finance & Insurance. Again, not the used car player we’re looking for.

B) Oh no.

I don’t know what it would take for me to bet on a company that has meaningfully underperformed the market for most of my life. Sorry.

Okay, now that Vroom and AutoNation are out, let’s get into it, for real.

Used Car Wars: CarMax vs. Carvana.

3. CarMax

Here’s some fun trivia for you.

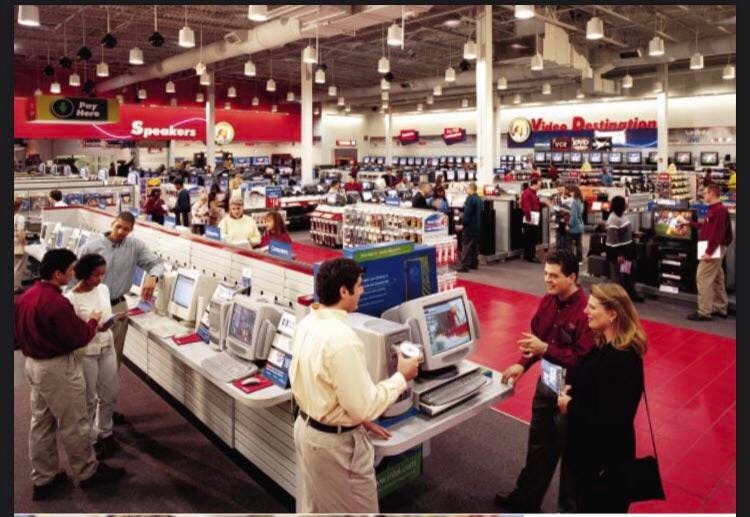

The first CarMax store opened in Richmond, VA in 1993, under the ownership of CircuitCity! Bet you didn’t have that on your Bingo Card.

CarMax operated under the CircuitCity umbrella for a solid ten years, before finally spinning off on its own on October 1, 2002.

At around this time (February 2003), CarMax operated 40 “superstores” and had sold 200,000 vehicles in its trailing Fiscal Year.

Here’s a snapshot of financial highlights looking back from FY 2003:

Gosh, what a time!

It’s not a fancy tech name up 20,000% (cough Netflix, cough Amazon), but since the October 2002 spin-off, you could’ve done a lot worse than an investment in CarMax:

Let’s now fast forward a quick 18 years and see what we’re working with.

CarMax has grown into a ~$20B business.

Growing revenue mid single digits pre-Covid.

Having crossed the 1,000,000 Total vehicles sold per year mark in FY 2016.

With 220 locations nationwide.

*By comparison, Costco operates 800 locations:

Despite the success of the last two decades, an investment in CarMax over the last ten years would have just produced market returns.

Unsurprisingly, the narrative must change for the next ten years to look different.

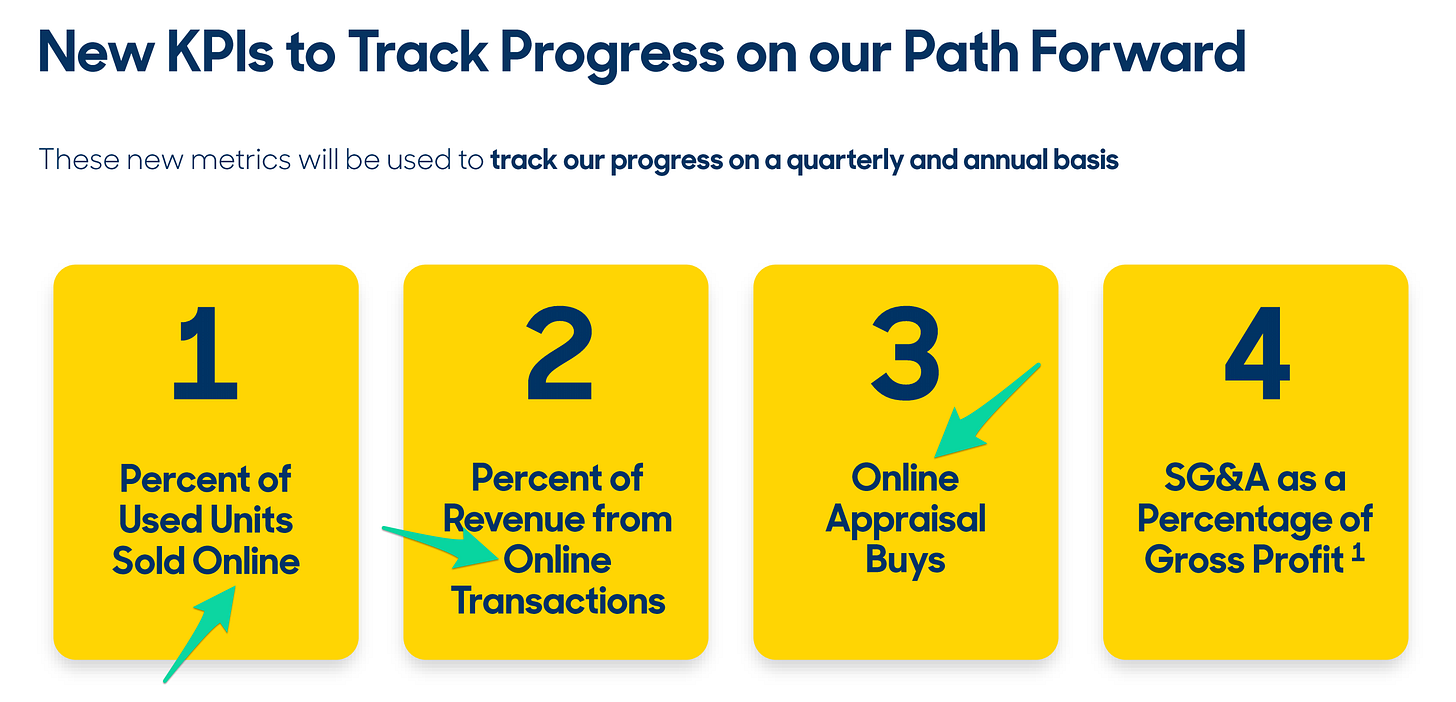

See if you can spot anything interesting from their May 2021 Analyst Day Presentation.

Looks like someone has heard of the internet!

In CarMax’s Q4 2021 earnings call on April 1, CEO Bill Nash reported that “about three-quarters of our customers advanced their transactions digitally with approximately 5% buying the vehicle online.”

Three Months later, on June 25th’s Q1 2022 call, he noted that “8% of our retail unit sales were online.”

A bet on CarMax suggests a mature company can find new life online. Certainly not impossible.

4. Carvana

Carvana is a whole different story. You can only buy a Carvana car online!

Sure, Carvana has 24 futuristic “vending machines,” but vehicles here have already been sold and are awaiting customer pickup.

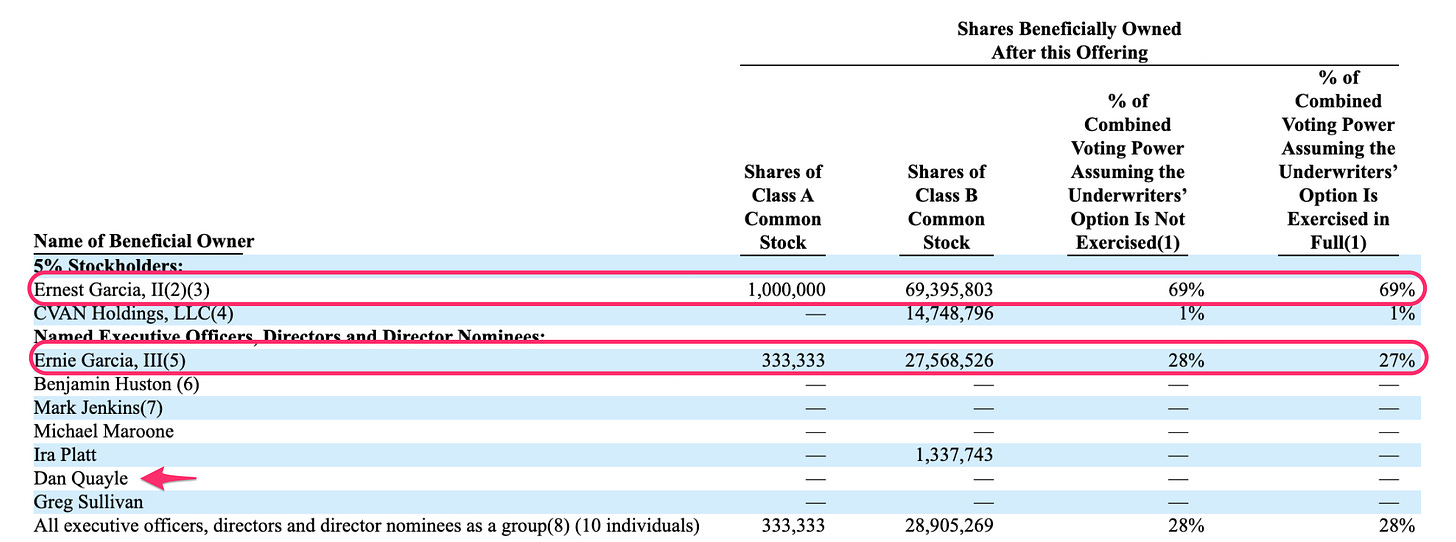

Carvana was founded in 2012 (CarMax sold 408,080 used cars in FY 2012) by Ernest C. Garcia III.

At the time of Carvana’s S-1 in April 2017, Garcia and his father owned 83% of Class B shares and 97% of the voting shares. That’s a lot of voting power for someone not named Mark Zuckerberg!

Also, Dan Quayle?!

The thing with Garcia II? Convicted felon.

Now that that’s out of the way, let’s take a look at the business.

Clearly a smaller business than CarMax, so the capacity to grow at a much faster clip.

I’m also struck at Carvana’s gross profit per unit. It looks very strong!

But if we unpack it further, it gets a little wonky.

We can see Carvana’s Used vehicle gross profit per unit is actually just $1,472, far below the $3,252 Total gross profit per unit figure.

The $3,252 Total gross profit per unit number includes $1,642 in “Other gross profit.”

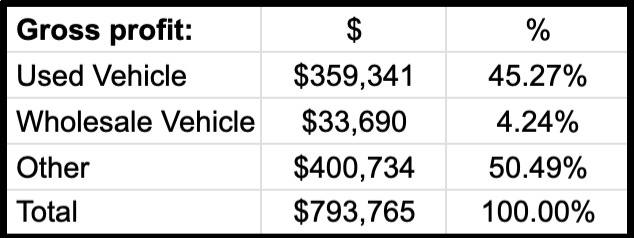

Here are the total gross profit figures per category:

Surprisingly, “Other gross profit” of $400,734 is more than the total combined gross profit on the sales of actual cars: Used ($359,341) and Wholesale ($33,690).

Okay, I’ll bite. What goes into this “Other gross profit” bucket?

Literally 100% gross margin products, like loans, financing and insurance.

Let’s look at the table again:

So used vehicle gross profit makes up 45.27% of total gross profit, while other gross profit makes up 50.49% (!) of total profit. Isn’t this a used car company?

While Carvana netted $1,472 gross profit per used vehicle sold in their last Fiscal Year, CarMax generated $2,113:

Here are CarMax’s gross profit totals:

Comparing Carvana and CarMax’s total gross profit figures side by side reveals more about this “other gross profit” bucket.

Has Carvana stumbled into high margin business disguised as a low margin business? Or is that $400,734 gross profit figure a red herring? One would think a used car company might generate profits from selling used cars, but what do I know! I’m puzzled, and do not know if this reflects the early stage of the Carvana business or something else.

Furthermore, in Carvana’s Investor Presentation, they project reaching $5,120 in Gross profit per unit by last week (Three months ended Aug ‘21).

I just don’t see it.

Valuation

Let’s take a look at valuation.

In its history, CarMax has never maintained a Price to Sales ratio of greater than one. Post Covid, Carvana has blown past it.

It’s even more stark if you look at the percentage change since Carvana’s 2017 IPO.

Of course, a PS Ratio is largely imperfect, and doesn’t take into account debt.

Holy Batman, Carmax.

You would expect a business like CarMax to carry a lot of debt, but this feels like a lot.

Here’s the list of companies that have a market cap of under $25B, yet carry $15B or more in debt. There are just sixteen.

(These are not my kind of companies.)

Enterprise Value to Revenue serves as a better valuation metric here than Price to Sales because it incorporates debt (debt is included in the Enterprise Value of a company; “Price” is not).

It’s not the 900% change we saw in PS, but Carvana still shows a pretty severe valuation pop since March 2020.

Verdict

Unsurprisingly, this is just not the industry for me. I didn’t expect it to be.

I prefer my companies that are asset light and margin heavy.

I think both CarMax and Carvana can both be substantial players in the used car market and hope those that invest have great insights and luck!

That’s it for Mazwood Memo #8: Used Car Edition. Thanks for sticking around!

We’ve written Deep Dives on DigitalOcean, Adyen, Snap, Okta, MercadoLibre, Lululemon, Veeva and Unity. And now Mazwood Memos!

Have a great weekend!