Week in Review -- August 7, 2020

$CRNC, $ATVI, $DIS, $LVGO...

After a week away, we're back in the saddle. And oh, what a week!

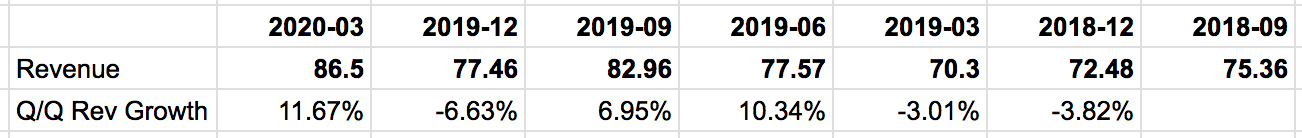

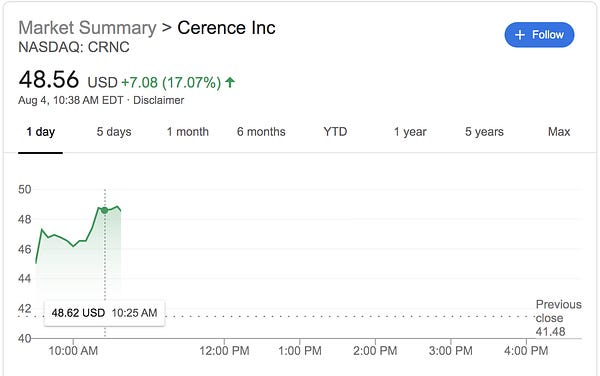

First up for me, not listed here, is a relatively new position that I’ve been a tad uneasy about, Cerence. I mentioned in our first recap, "for such a small company, this revenue growth is not my favorite."

And then I wrote, "$CRNC is under close watch until further notice."

I didn't do anything.

Then Monday afternoon:

And it's upward trajectory continued the rest of the week, up 32% since Monday.

I’m still concerned about the revenue growth, but if we say goodbye to Cerence, not a bad way to do it.

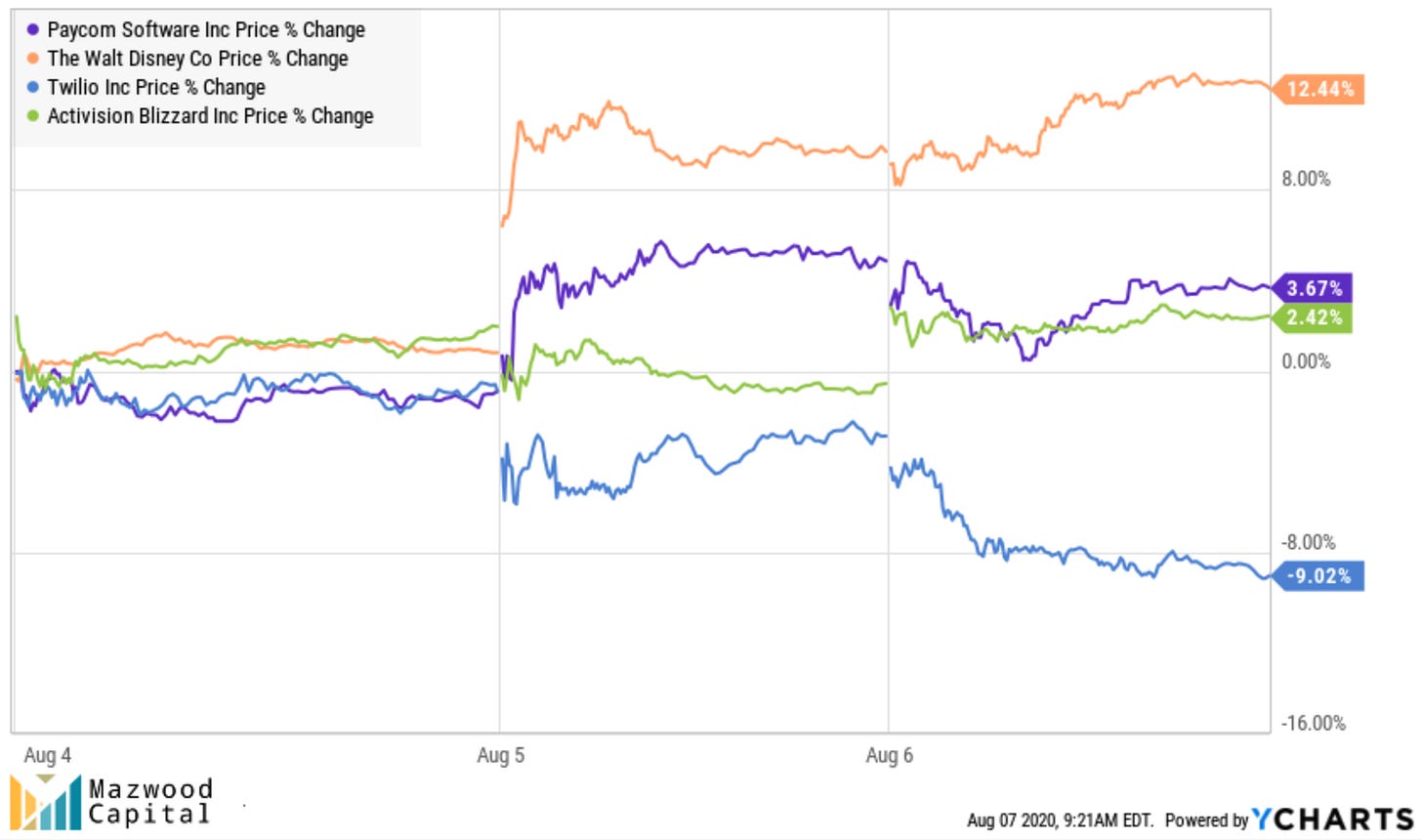

As for the Tuesday afternoon reporters, we saw a pretty interesting mix of results. Let’s check them out:

$PAYC

Paycom had been on my watch for a while in 2019, but I didn’t get active until February/March of this year. Turns out I bought way before the bottom, with an average cost basis of $267.47. It’s a medium-sized position. I like a lot about the company, but it is very much affected by COVID. From their earnings release:

The COVID-19 pandemic has resulted in, and may continue to result in, headcount reductions across our client base. Because we charge our clients on a per-employee basis for certain services we provide, decreased headcount at our clients negatively impacted our recurring revenue in the second quarter of 2020, and we expect that our recurring revenue in future periods will continue to be negatively impacted by such headcount reductions until employment levels among our existing client base return to pre-pandemic levels.

Not ideal. This feels like a “don’t touch it” position, for now.

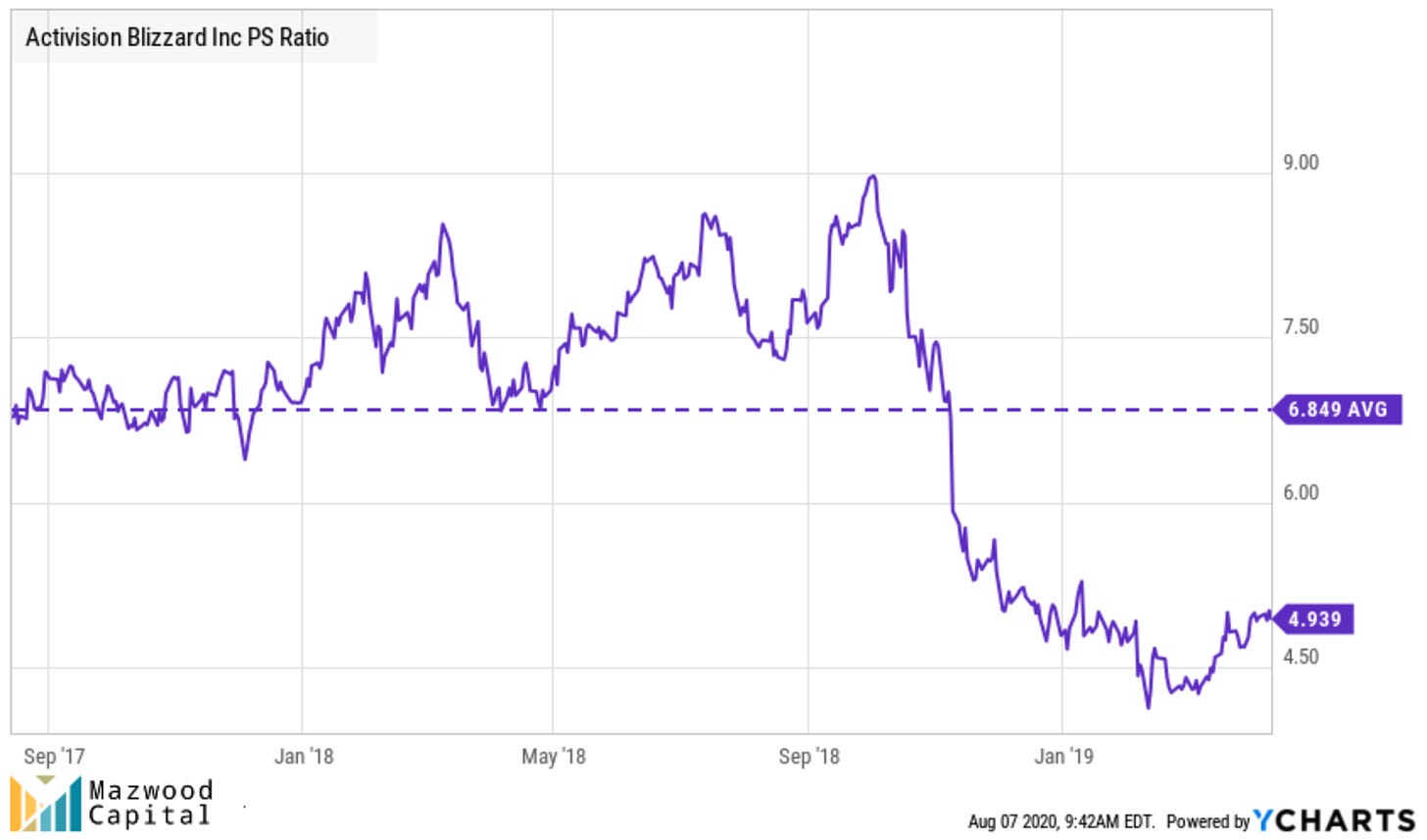

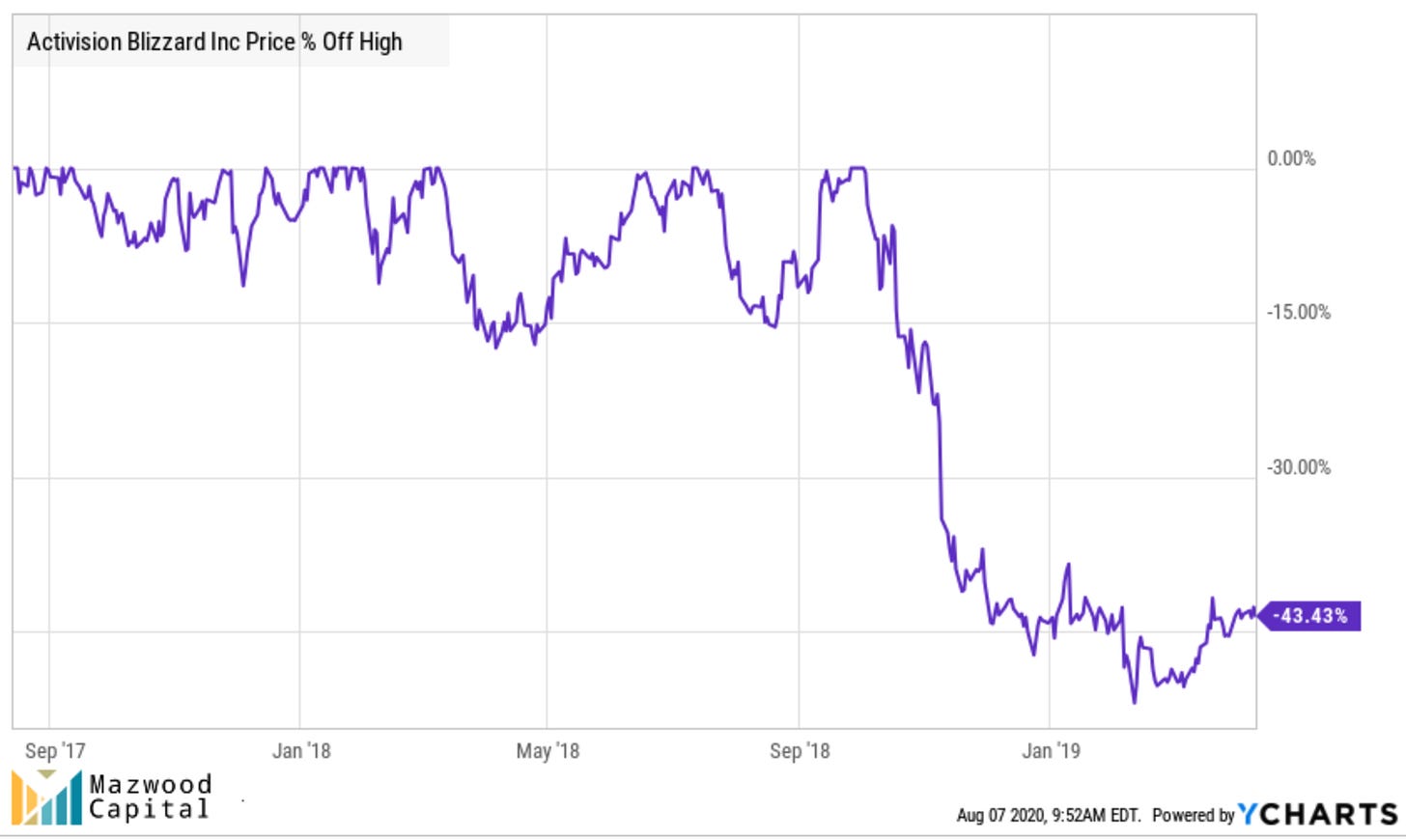

$ATVI

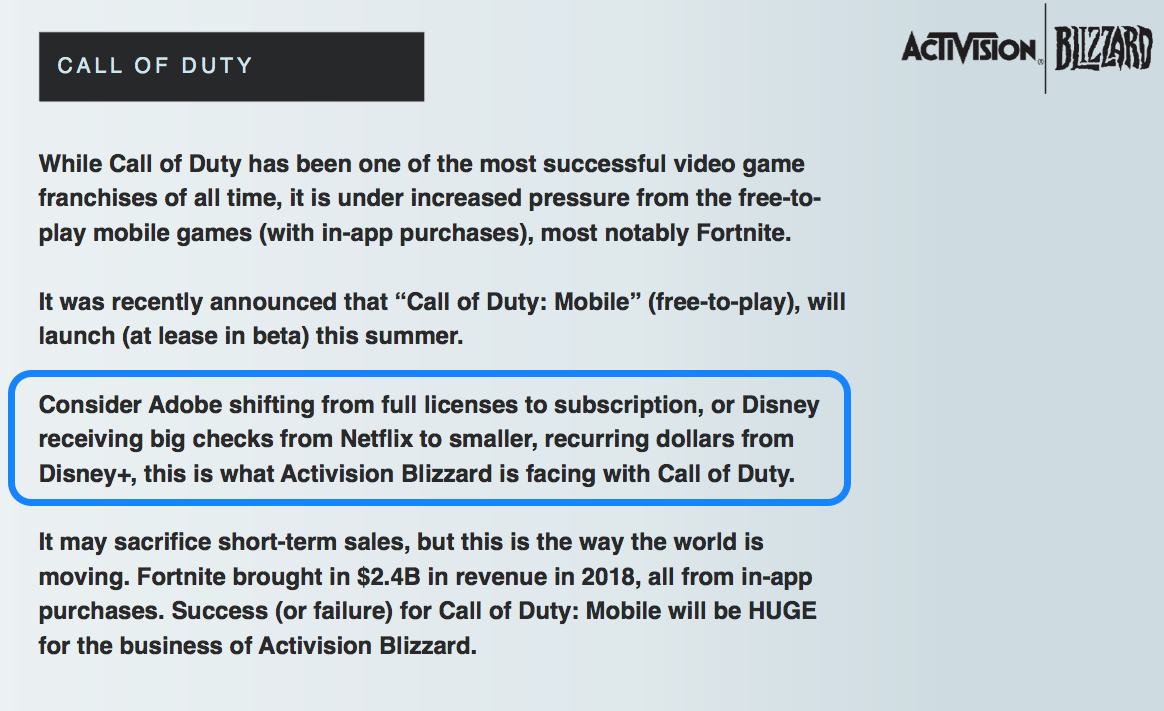

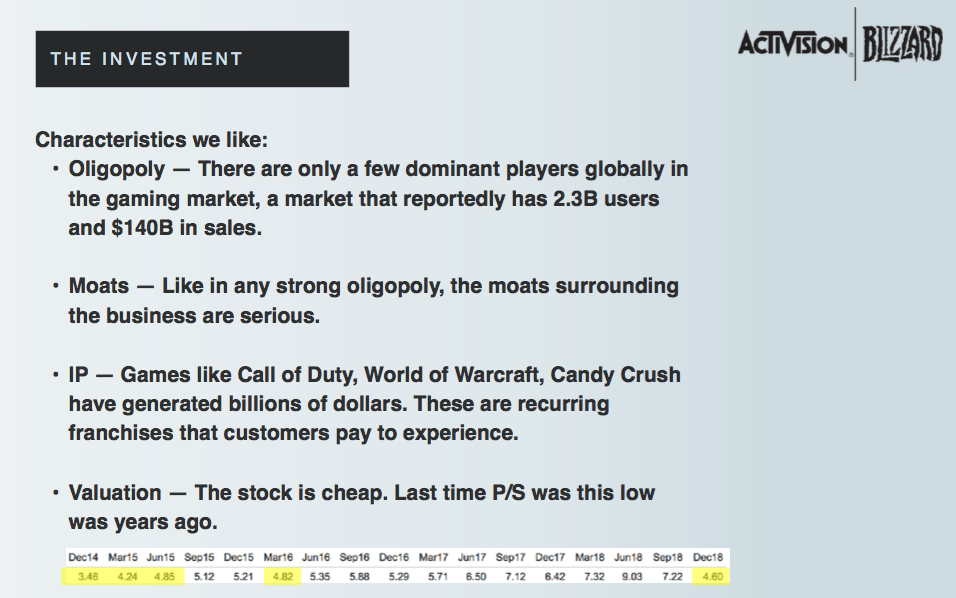

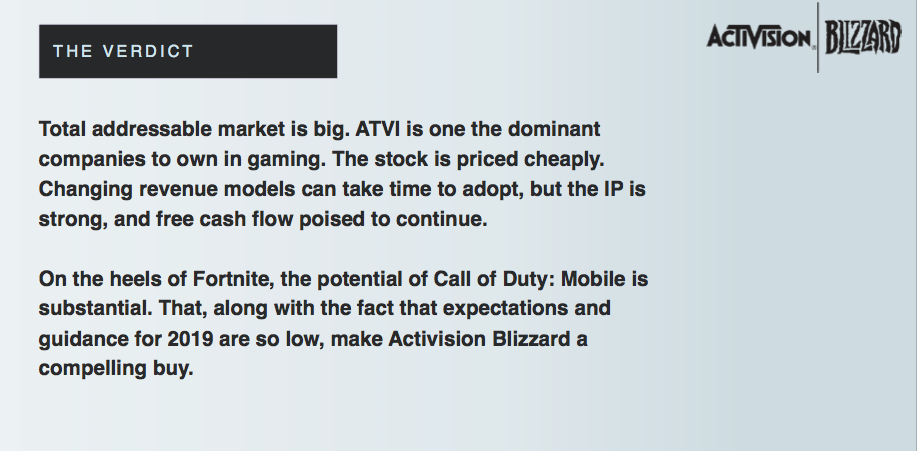

I first got into Activision Blizzard in April 2019. Here’s what I wrote at the time:

It was meaningfully undervalued…

And had hit a high of $83 in October ‘18, before pretty quickly coming down.

Well, this week it finally got back to that $83 high!

I added more to the position in March, so my average cost basis is $52.77 (gains of 57% total). I clearly should've been adding more. But I have a feeling there’s still time. Add to winners!

$DIS

I’m a little befuddled with Disney. I can’t for the life of me understand how it’s trading at ~$131 today. I'm on the record simultaneously loving the company, the IP, the opportunities… but also thinking it will be a drag on the portfolio for some time. In May, I wrote:

Let’s get into the weeds for a moment, if you don’t mind.

2019 Annual Report Numbers:

One by one, here we go:

Media Networks: Um, cord cutting? ESPN? Live sports? TV production schedules halted? This feels like a severely impacted category.

Parks: Uhhhh, yea.

Studio: They can't shoot movies. Or show movies. Feels like kind of a problem.

DTC: Yes, Disney+. Amazing acceleration in subscriber base. 100%. But doesn’t the other $62B worth of business matter to anyone else?

I can't figure this one out. Part of me wants to trim the position, because it feels like it should be a drag. But so far the market doesn’t agree with me. And I’m not really a trimmer.

$TWLO

Not much to see here. It’s had a big run up. Original thesis is unchanged. Will look to add more.

AND THIS ALL JUST BRINGS US TO TUESDAY AFTER CLOSE!!!

Some of our names that reported the rest of the week:

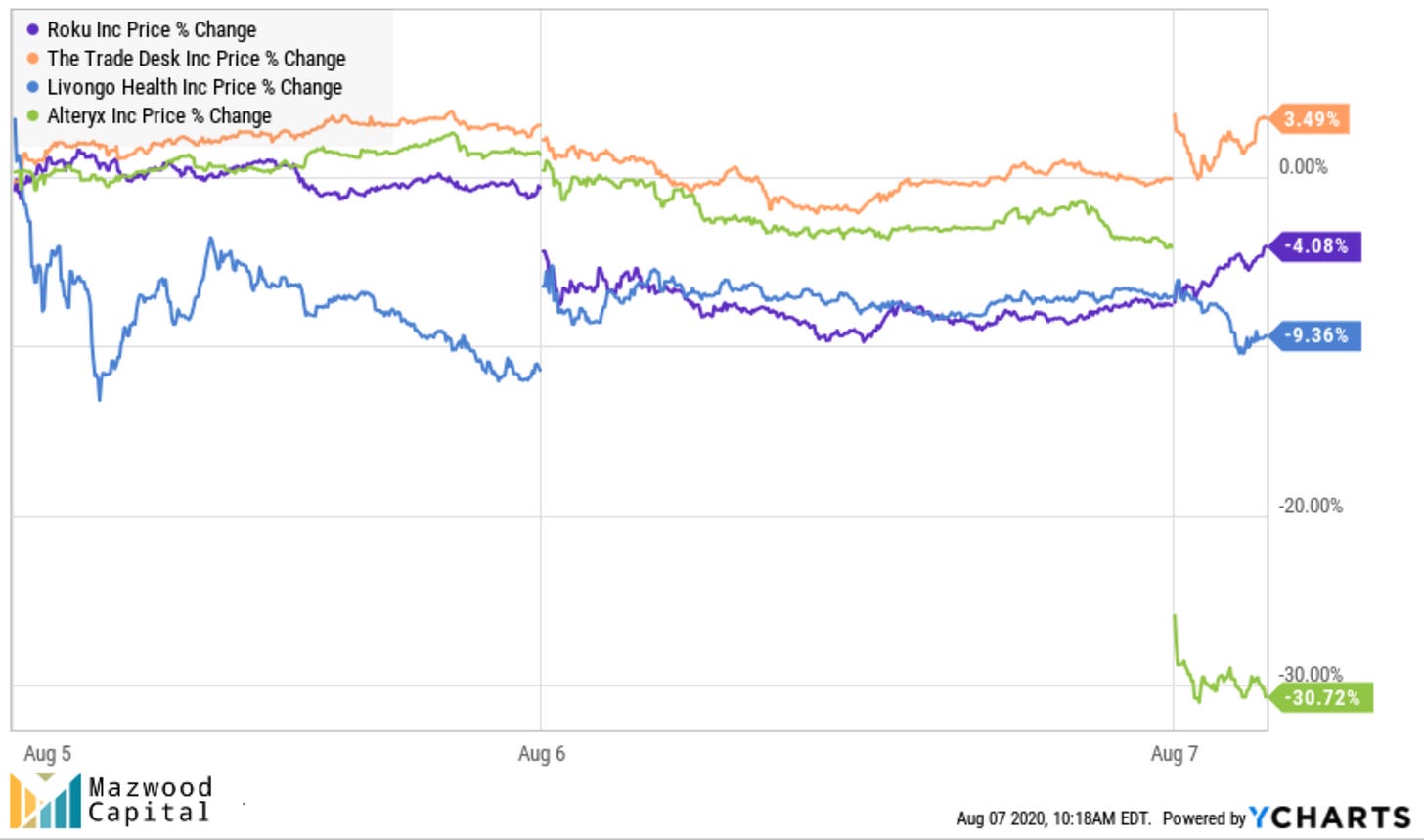

$LVGO $ROKU $TTD $AYX

$LVGO

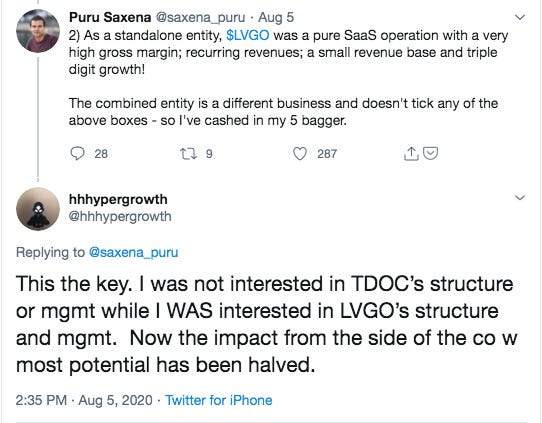

A lot as has been said about the Teledoc/Livongo acquisition/merger. I got into $LVGO with an average cost basis of $55.73. There had been a ton to love about the company. Simply, the merger is not my favorite outcome as a $LVGO shareholder—they just had a lot more room to run.

Now, I’ve never invested in $TDOC. And I’m undecided if I want to continue the journey as a $TDOC shareholder. This back and forth sums it up for me.

However, being on board the largest telehealth provider is certainly not an unreasonable position (given our current, you know, situation). But there’s a lot more work to do before deciding if it should be a core position.

$ROKU

It’s not the smoothest of rides, but a name I like, nonetheless. I’ll look to add.

$TTD

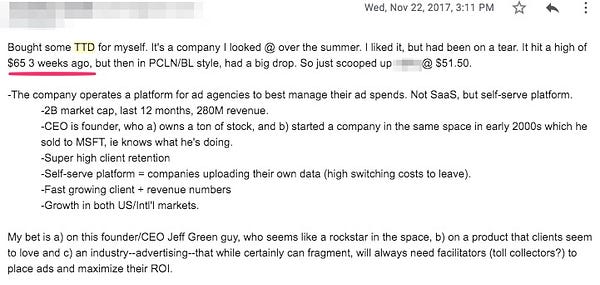

I have a long history with $TTD (this cost basis of $51.50 is from another account, but not too shabby).

In the big boy account, I have a cost basis of $213.74, good for 136% gains. The short story with $TTD is: I should’ve been adding to this guy every week for the last three years. Whoops.

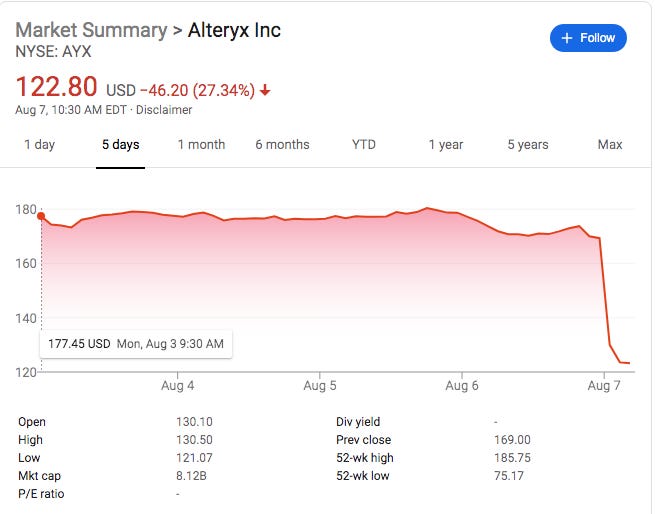

$AYX

Oy. Not good. Great buying opportunity? Broken thesis? Unclear.

From Around the Internet:

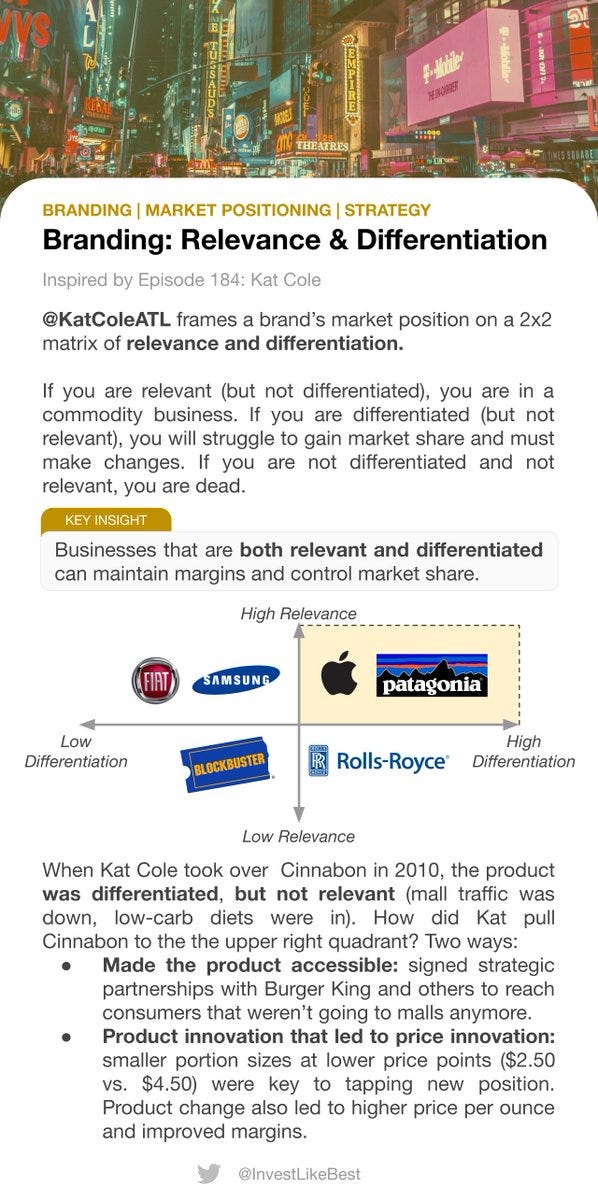

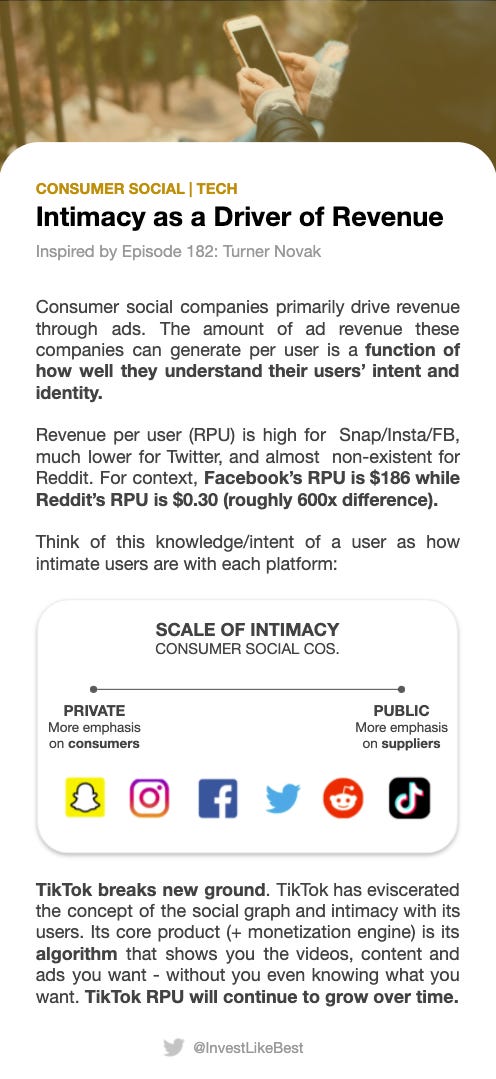

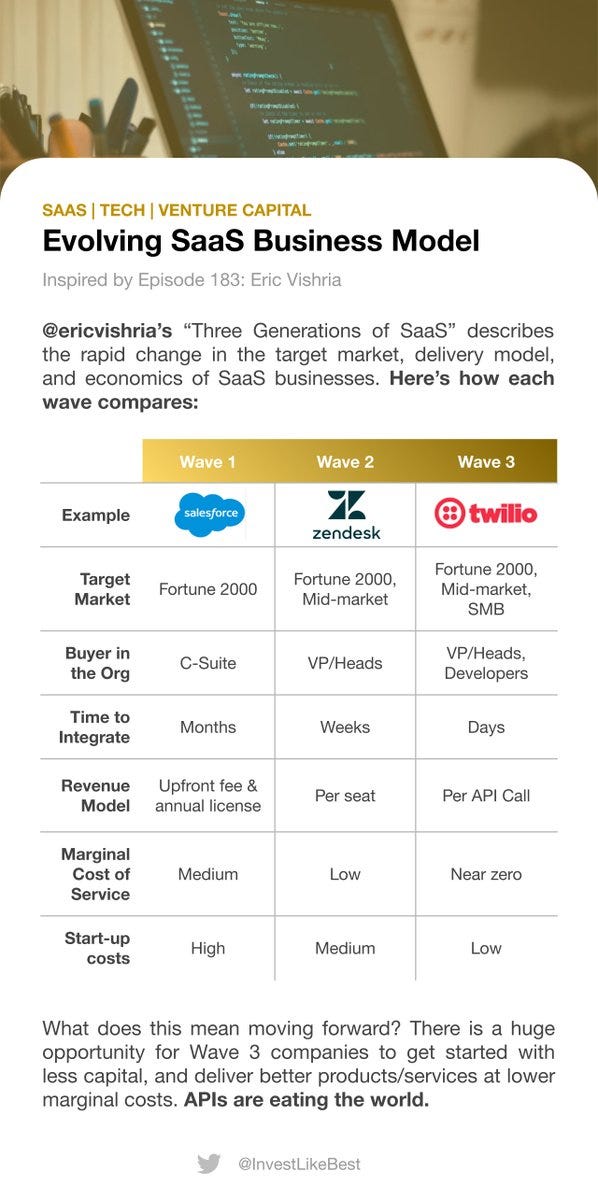

Here’s a great twitter follow for design nerds. And regular nerds.

Loving the new #bizcards templates that Patrick O’shaughnessy and his Invest Like the Best podcast (brand?) are putting out. Really cool way to dissect and disseminate information. If you’ve got any ideas for how we might be able to play with this format, I’d love to hear from you!

Thanks to everyone again for giving this weekly review a read. Please like/comment/share and have a great weekend!

~MazwoodCap