Mazwood Memo #11

$CSU.TO $TOI.V $AMZN $FB $SHOP $SQ $ADYEY $MELI $TWLO $COIN $ROKU $TTD $ETSY $PTON

I went down the rabbit hole of BowTiedBull this week.

For the uninitiated, BowTiedBull is a brand/publication that focuses on “Crypto, Internet Businesses and Technology Stocks.” The writers have a “background [in] Technology Investment Banking, Affiliate Marketing and E-commerce.”

The BowTiedBull FAQ page gives a sense of their blunt style:

This website is not meant for soft people. The best way we can describe it is as follows “Better to be punched in the face with the Truth than kissed with a Lie”. Once you enter the real world (career/job/business) you learn that people tell you nonsense all the time to make you “feel” good. They try to trick you into believing you’re well paid, being treated equally etc. It is a lie.

There is a definite DeFi/Crypto slant, but their style and message might resonate, especially to those early in their career.

As our portfolios are getting hammered, a line from their email blast this week struck me:

We’d much rather be worth $1M and go back to being 30 years old than be 70 years old with $100M. The value of time is significant. You can’t get it back.

-BowTiedBull, September 29 2021

Again:

The value of time is significant. You can’t get it back.

This Week:

Constellation Software and Topicus

Portfolio Activity

Around the Internet

1. Constellation Software and Topicus

Late last year Dr. C.J. Oppel put one of Canada’s finest companies, Constellation Software, on my radar.

And more recently, C.J. introduced me to Constellation’s spin-off, Topicus (TOI). As Q-Cap explains:

$CSU.TO and $TOI.V are now independent companies, each listed in Canada (CSU on the Toronto Stock Exchange, TOI on the TSX Venture Exchange). Today, I’m studying them in tandem.

The 10th Man put out two insanely good pieces on each company.

1) On Constellation:

Mark Leonard started Constellation Software (CSU) in 1995. Since then, he’s been on a 25-year acquisition bender of vertical market software (VMS) companies. Today, CSU is a collection of independently managed VMS businesses across dozens of verticals: hospitality, education, healthcare, banking, marine management, libraries, transportation, publishing, utilities, logistics, construction, retail… and the list goes on… In total, I estimate that CSU owns 500 VMS businesses that collectively serve hundreds of thousands of businesses and public sector customers.

Mario Gabriele also had a great thread on Constellation:

2) On TOI, here’s The 10th Man again:

TOI is effectively a carbon copy of CSU, with a nearly identical decentralized organizational structure, decentralized M&A process, sticky customers, and strong reputation as a perpetual owner of VMS businesses. Even the board of directors has meaningful overlap. As such, TOI should also benefit from low customer churn and sustainably high incremental ROIC on acquisitions.

He continues that “despite these similarities, four obvious differences stand out.”

“TOI is roughly the size of a 2010-vintage CSU. They’ve reset the clock on M&A, and it should be much easier for TOI to scale the number of acquisitions they complete in a year by five-fold than it will be for CSU today…”

“The directors appointed by CSU… are more likely to approve of large acquisitions… than they were at CSU from 2010-2020…”

“The vast majority of TOI’s revenue does and will come from Europe over the foreseeable future, and it’s my view that Europe has: a significantly more fragmented VMS market…”

“…TOI is likely to have higher organic spending, and the data from Topicus.com shows that this organic capital earns a ROIC that’s fairly close to that of acquisitions.”

On why TOI achieves higher organic growth, In Practice interviewed a former Director at Topics:

So in CSU and TOI, we have Vertical Market Software conglomerates, at different stages of their lives (CSU: mature, TOI: newly formed spin-off), serving primarily different markets (CSU: North America, TOI: Europe), with carbon copied decentralized structure and DNA.

To be honest, I’m intrigued by both.

An investment in Constellation isn’t going to sneak up on anyone:

On the other hand, The 10th Man says of TOI:

TOI trades at ~45x 2021 FCF (on fully diluted shares). Back in 2010, if you had purchased CSU at 45x FCF, you would have earned an astounding 18%/year over the proceeding 11 years. At 95x FCF, a CSU investor in 2010 would have earned 10%/year for more than a decade. If you ignored all the rest of my analysis, but believe TOI will follow even remotely in CSU’s footsteps, this indicates that the risk-reward on TOI is fairly compelling.

The 10th Man published his piece on March 3, just weeks after the spin-off. It’s had quite a run!

Jerry Capital with the succinct bull case:

I hope to join my Canadian friends in one of these positions soon.

2. Portfolio Activity

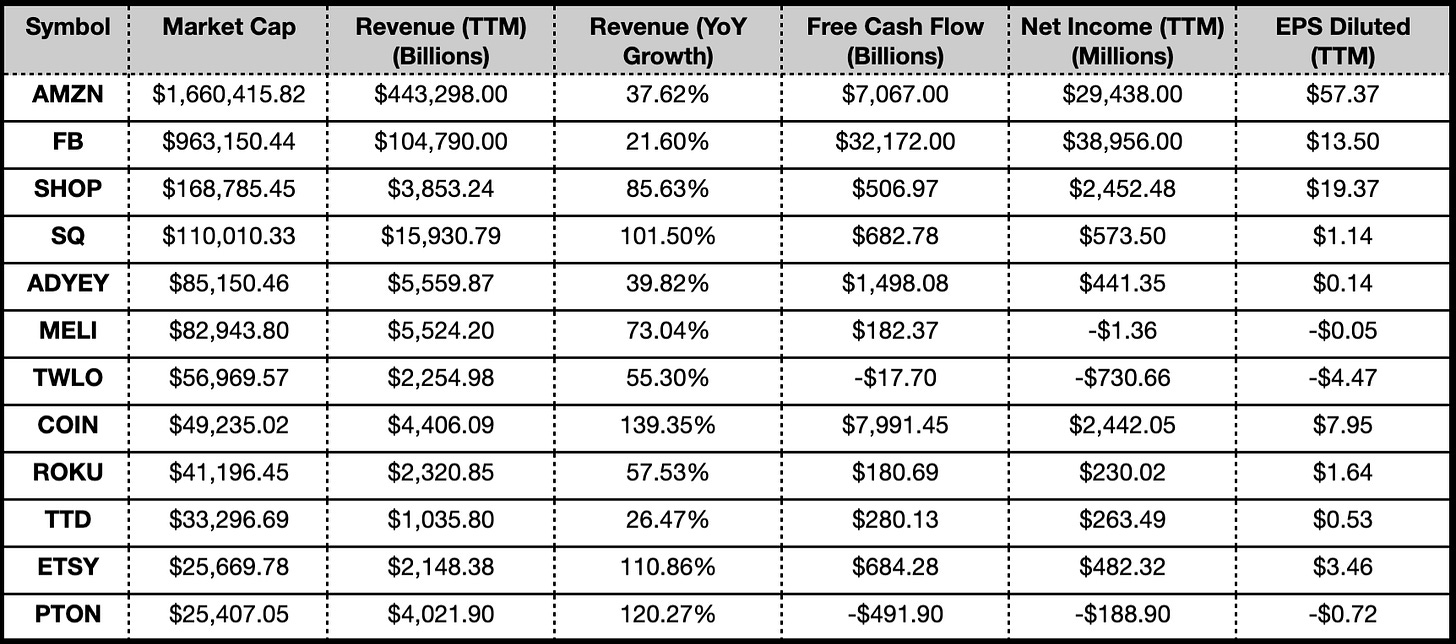

Like last week, I try to capitalize on down days and add to names I like.

Let’s look at these stocks using some key metrics:

For those stocks above $80B market cap, One Year Performance and % Off Highs:

One Year Performance sees every name in the green.

Percent Off High sees no drawdown greater than 18%.

For those stocks below $80B market cap, One Year Performance and % Off Highs:

One Year Performance sees every name in the red.

Percent Off High sees every drawdown greater than 17%.

Are larger cap names anti-fragile?

3. Around the Internet

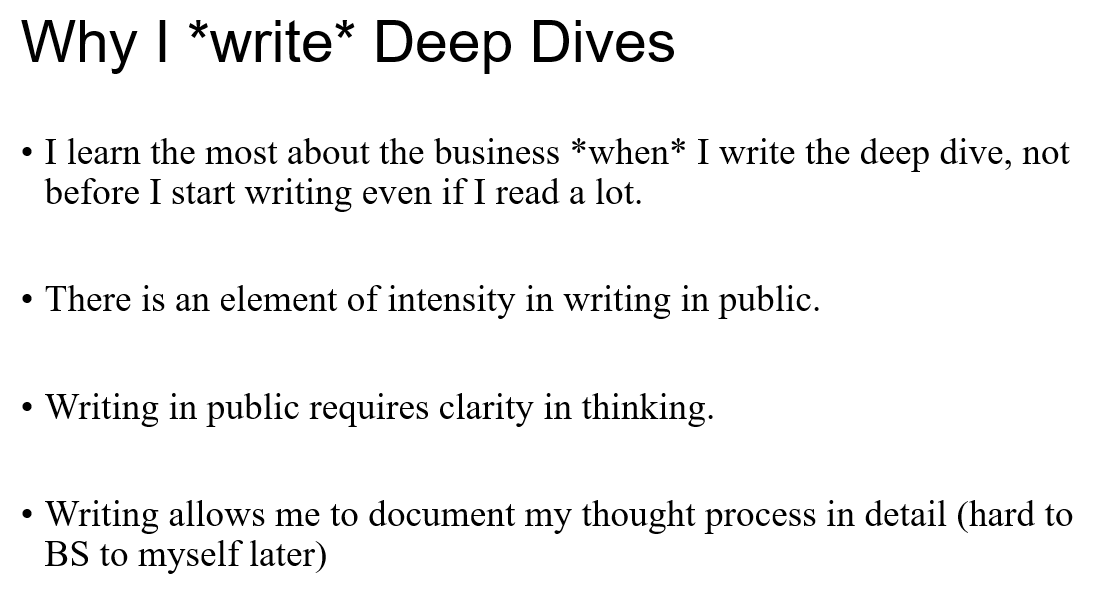

A. MBI Shares his Research Process

As someone writing about stocks in public, his “Why I write Deep Dives” resonated hard.

B. Interview with the BowTiedBull Crew

Harsh Strongman of Life Math Money interviewed the BowTiedBull guys this summer.

The group describes the BowTiedBull origin story:

Originally, it was just for fun until we realized the writing could create some positive changes for the younger generation. For example, college does not prepare people for the real world. And. We started writing about how life actually works..

Since then we have written about a ton of topics. We started with investment banking and gave away everything: correct resume format, interview answers etc. Anyone could follow the website and break into the industry without spending hundreds of dollars on a course…

In short, we’ve been writing for about a decade and a lot of this was honestly a bunch of luck. Technology investment banking (Wall Street), then forced to use and learn complex software… then learn about crypto which is a software designed to disinter-mediate the financial industry. Right place right time…

C. Interview with Todd Wenning at Ensemble Capital

I always enjoy Conor’s Guest Interviews.

Todd describes when he first got to Ensemble Capital in 2017:

I would present ideas to Sean [President/Chief Investment Officer] that I thought checked off all the boxes and he’d reply, “I agree that it’s a good company, but we’re looking for great companies.” We’re not after the top 10% or 20% of all publicly traded businesses in terms of quality, we’re after the top 1-2%. We run a concentrated portfolio of 15-30 companies and we have to be selective.

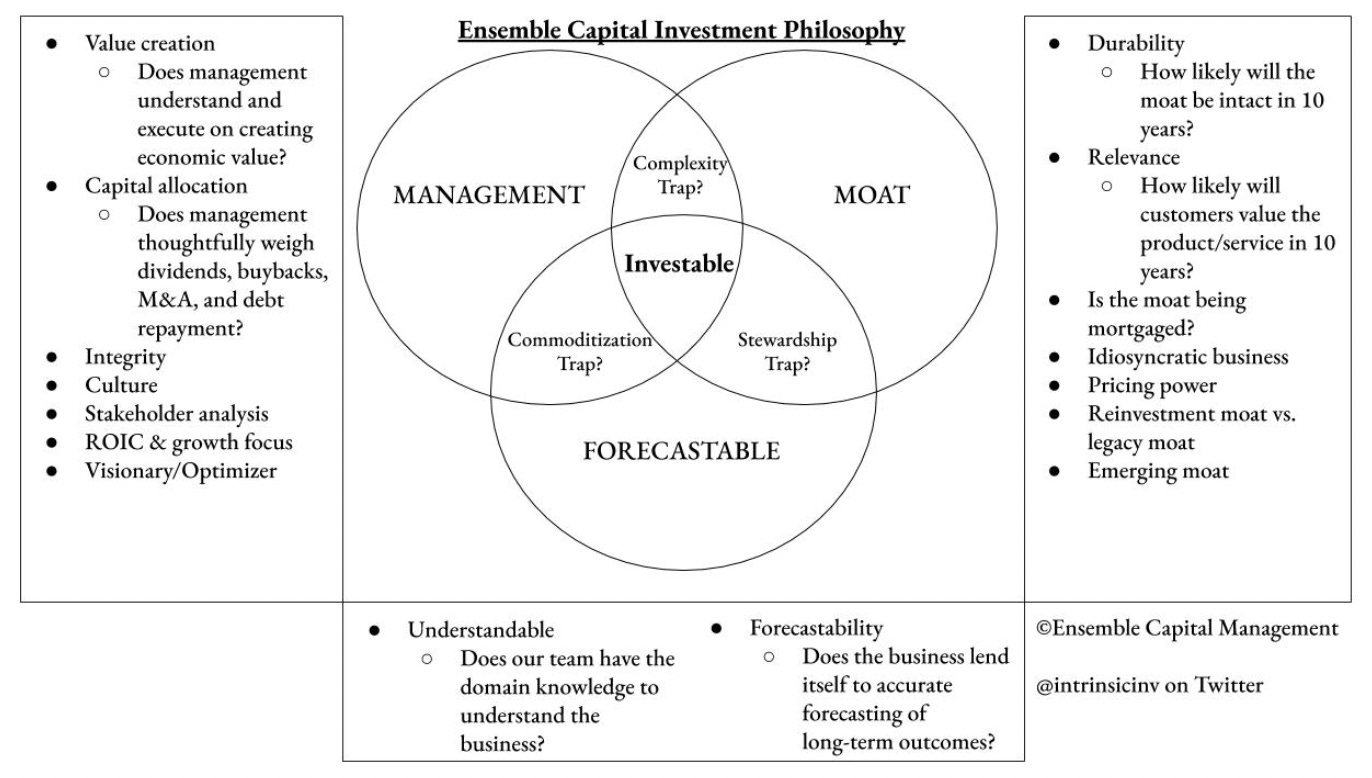

Conor also shares a graphic from a 2019 post, “Diagram of Ensemble’s Investment Philosophy.”

Todd explains the Venn diagram:

Any company we would consider for the portfolio has to have an economic moat, a great management team, and the business has to be forecastable. We came up with the Venn diagram as a graphical representation of our North Star. You can have these agreed-upon ideas in your mind as you’re looking through companies, but it helps to have a picture in your mind to refer back to and keep you accountable.

That’s it for Mazwood Memo #11. Thanks for sticking around!

We’ve written Deep Dives on DigitalOcean, Adyen, Snap, Okta, MercadoLibre, Lululemon, Veeva and Unity. And now Mazwood Memos!

Have a great weekend!

I’m a little late but amazing read as always, thx!!

love the article! csu and toi some of my biggest holdings. keep up the good work!