I’m interested in a COVID recovery play. That’s not a secret.

It’s a challenging nut to crack.

A) You could look at airlines or airplanes. 🛫

But I find airline businesses difficult to study. Take a look at the 2019 operating expenses of United Airlines.

This just doesn’t spark joy.

Similarly, airplanes don’t do it for me. Sorry $BA and $ERJ. I’m allergic to heavy CapEx and you guys really crush it in that department.

B) You could look at restaurants or hotels. 🛎️

Hotels have never been my jam (although I do like staying in them!). Restaurants could be interesting, although it’s hard to identify where to even start.

C) You could look at travel booking platforms. 🖥️

$BKNG, $EXPE and $ABNB come to mind.

I studied $BKNG in 2016/2017. I liked the company. I liked the space. But it’s not without its problems.

For example, starting just last week, Google is making it “free for hotels and travel companies around the world to appear in hotel booking links.”

Not great if you’re Glenn Fogel, CEO of Booking. He addressed this very issue in last week’s earnings call:

Airbnb feels obvious. But Airbnb is richhhh. Should Airbnb doing 1/2 the business of of Booking but worth 2-3x? Shrug emoji.

D) You could look at Disney! 🎢

Or theme parks or cruises or any travel experience play.

I’m very much on the record for getting Disney wrong this year, so not looking to it again just yet.

E) You could even look at $SQ and $SNAP as reopening plays. 📱

Don’t laugh!

Look at Square’s Gross Payment Volume by industry.

Think the world opening will help Square? Me too.

And $SNAP?

On CNBC, here’s what CEO Evan Spiegel had to say on CNBC.

Despite our accelerating user growth, we actually view the pandemic lockdowns as a drag on our growth overall. We’ve seen people’s friend groups tend to get smaller, they make fewer new friends, they’re not out and about as much using our camera and posting snaps to their stories… For us, as we look at the end of the lockdowns and maybe the resumption of a slightly more normal life… it should be a tailwind for our other products, like our Map for example…

(Bonus: Check out our previous Deep Dive on $SNAP.)

But who are we kidding? I’m looking at more of a classic reopening play. I don’t think these guys really qualify!

The point is—there are lots of places to look. There will be many winners, certainly. But which ones check the most boxes?

Let me quickly tell you about two new names that have just surfaced for me.

Dufry and Sabre.

Typically, I’d like to dive into the numbers a little more. But the numbers here are just so weird (revenues getting cut ~75% due to a global pandemic?), it’s hard to make logical assumptions off of it. I have yet to initiate a position in either Dufry or Sabre, but I find the stories they represent compelling.

Here goes!

1. Dufry

I first heard about $DUFRY from Craig Lawson (@Nerd_Abroad).

And as you can see, he pointed me to this presentation by Brian McGough of Hedgeye.

So what is Dufry, exactly?

The Motley Food has said:

“Few businesses are as correlated with the travel industry as Dufry, a travel retail company that runs duty-free shops in airports and owns the Hudson chain of convenience stores inside travel hubs.”

“If you're looking for an under-the-radar option in the [travel] sector Dufry looks like an appealing choice. You've probably never heard of Dufry, but if you travel, you've likely been to some of its retail establishments, including Hudson convenience stores in travel hubs and duty-free shops in airports.”

2,300 stores. 400 locations. This is a travel play wrapped in brick and mortar retail.

Here are some 2019 charts that help illustrate the business, courtesy of their investor presentation.

90% of the business flows through airports.

A hair under 2⁄3 of the business is duty-free.

Geographic distribution feels internationally equitable, with room to run in China*.

*In October 2020 Alibaba took a 6% stake in Dufry, with the ability to go to 10%. I’d say the China runway (sorry!) here could be very interesting.

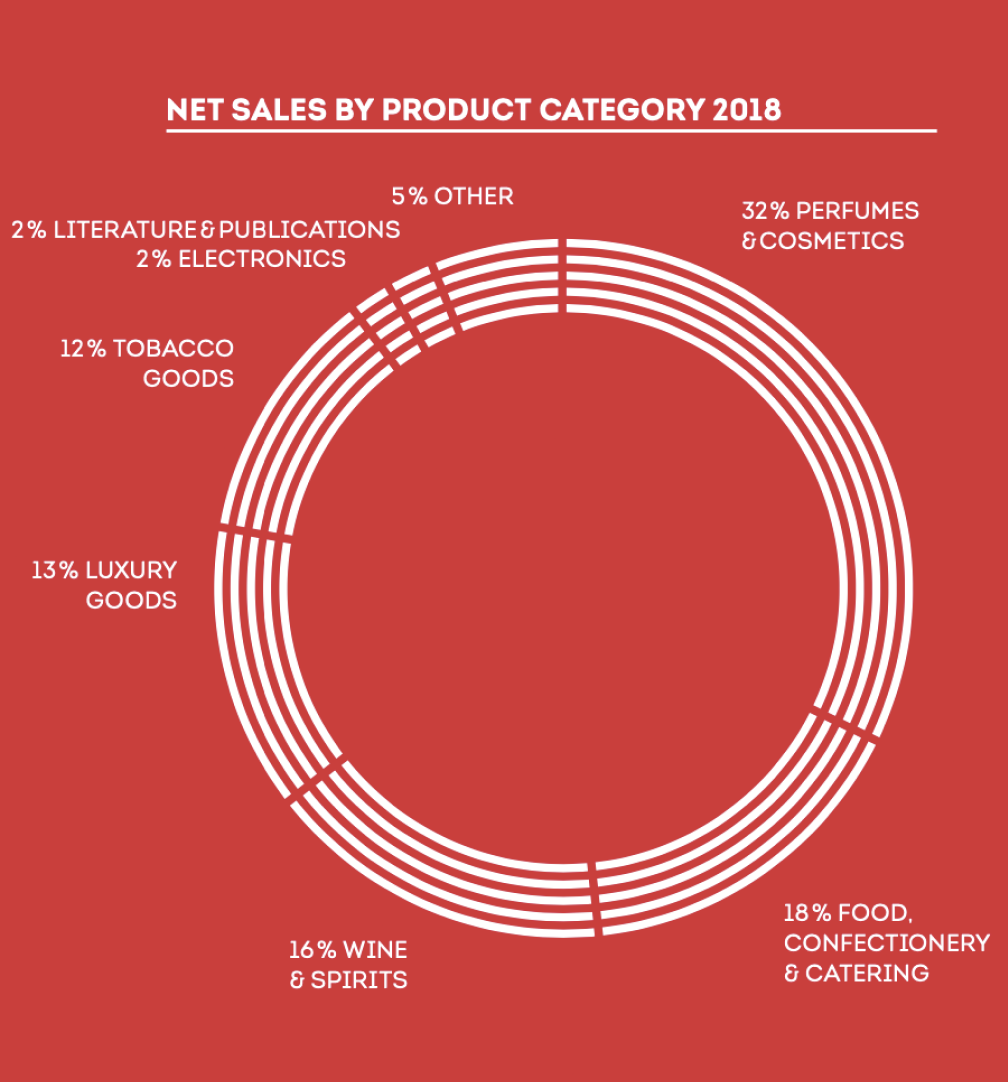

And product breakdown. 1⁄3 of sales are via perfumes/cosmetics (i.e. higher margins!).

Pre-Covid, Dufry was a fine $8B business, not growing exceptionally well.

Showing how they crashed in 2020 isn’t surprising, or indicative of their efforts, obviously.

But with 2021 analyst estimates hovering at ~$5B, I think Dufry could surprise.

2. Sabre Corporation

I can’t believe I hadn’t heard of Sabre either.

Travel tech, you say, Johannes Jibs??

Let’s allow Sabre to introduce themselves.

We are a software and technology company that powers the global travel industry.

I’m listening…

We power mobile apps, airport check-in kiosks, online travel sites, airline and hotel reservation networks, travel agent terminals, aircraft and crew scheduling systems, and scores of other solutions.

Keep going…

Every day millions of consumers and employees interact with our technology, enabling business travelers to close the deal, delivering cargo shipments to stores and factories, and giving excited travelers the honeymoons and family vacations of a lifetime – all while making the journey easier, faster, safer and more personal.

I’m into industry specific software. I was immediately reminded me of this tweet:

Sabre breaks down their business into two segments: Travel Solutions and Hospitality Solutions.

Hospitality Solutions is simply a “SaaS platform for hotels to manage pricing, reservations, and retail offerings.” They service 42,000+ properties in 180 countries. Not bad, but a tiny part of the business.

Travel Solutions is where Sabre pulls their weight.

This is a tiny snippet of an exhaustive list of products offered.

As you can see, Sabre powers travel.

Their revenue obviously “is highly dependent on the global travel industry, particularly air travel from which we derive a substantial amount of our revenue, and directly correlates with global travel, tourism and transportation transaction volumes.” Their revenue is the travel industry.

And the signs are there for Sabre to take-off. (Sorry!)

In the first three quarters of 2020 (not exactly a banner year for travel), Sabre inked 1,400 new customer deals.

In Q4 2020 alone, Sabre inked 2,100 (!) new deals.

And with people gearing up to travel again, I think Sabre could be ready to soar. (Sorry!)

Thanks to everyone for giving this Covid Recovery Play on Travel a read. Please let us know what you think!

And if you’re new here, don’t be shy! We’d love to have you subscribe to Musings by Mazwood. Past Deep Dives include: Snap, Okta, MercadoLibre, Lululemon, Veeva and Unity.

We aim to be respectful of your inbox and post portfolio updates, company deep dives, and more. We hope you’ll join us!