I’m not here to make predictions. That’s not my style.

Although as investors, we inherently make predictions, don’t we? Isn’t that what stock picking actually is? If I hold Peloton (which I do), aren’t I betting (see: predicting) that the factors that have made Peloton successful will continue to make Peloton successful? Or if I hold Etsy (which I do), aren’t I predicting that the macro tailwinds that have propelled e-commerce forward will continue to do so?

So maybe as investors, we subconsciously are in the prediction business.

Look, I don’t think I’m really going out on a limb to say I don’t think we’ll repeat this kind of performance again in 2021 (a prediction!).

I mean, we could. But will we?

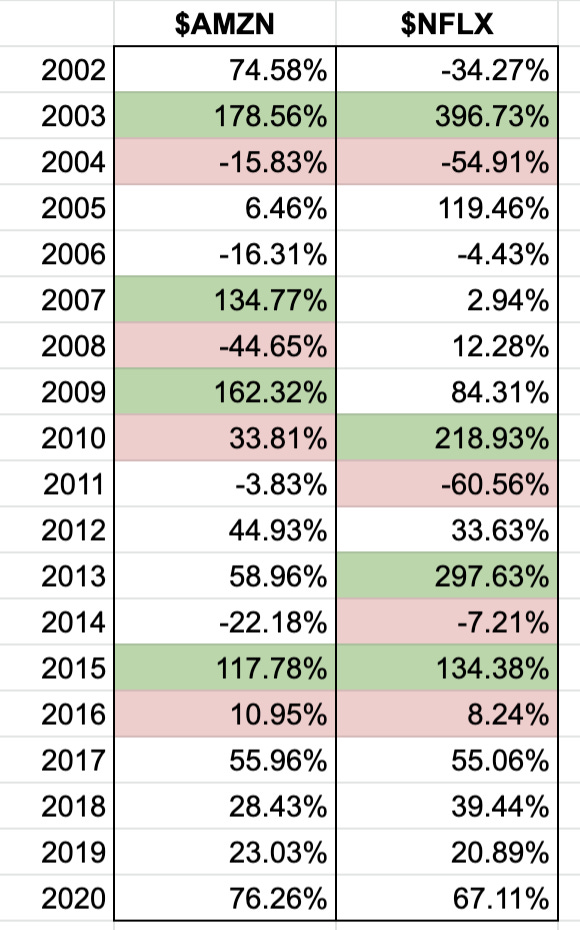

I went back and looked at Amazon and Netflix’s annual performance for the last 18 years (Netflix IPOed in 2002). Triple digit annual returns are highlighted green. The following year is highlighted in red. Can you spot a pattern?

Two of the highest growth names of this past generation cannot string consecutive years of monster growth.

But can it happen? Sure. Same exercise for The Trade Desk and Shopify.

Of course, it’s a different market than the early aughts. It’s certainly a different world.

Essentially, I’m making two points for the price of one. It’s hard to see these growth names repeating their insane performance again. But I’m also not much of a predictor.

Okay, let’s get into the quarter!

I only initiated two new positions during the quarter, Etsy and Facebook. Elsewhere, I just kept adding to winners (or in the case of Veeva, future winners).

Initiated Positions

Let’s start with the new guys on the block, $ETSY and $FB.

Etsy

From the March bottom to my first purchase date (10/30), $ETSY had been up *checks glasses* 283.7%!

But in the preceding two weeks, it had dropped 20% (I know, a drop in the bucket).

But for a $15.3B market cap company, that had most recently reported quarterly (Y/Y) growth of 128% (even with the masks!), there just had to be more.

So, like any investor of sound mind, I let my wife make the call.

I bought another (smaller) tranche the following week on November 9th.

I enjoyed studying the company so much that last month I put together an Oral History of Etsy. (Please give that a read if you haven’t had the chance—I think you’ll like it!)

Facebook

I’ve owned $FB in a smaller account for a few years (since 4/24/18 at $160.00). It’s not a hard business to follow. It’s everywhere. So why now? Here are some tweets that shape a narrative to give you an idea.

🗓️ From May, 2020

🗓️ From June, 2020

🗓️ From November, 2020

$FB is obviously no longer a super-high growth name, but can it continue to be a solid out-performer that doesn’t hurt you? I think it can. (There we go predicting again!)

$FB’s annual returns the last eight years.

Added to Existing Positions

$VEEV: Put together a Deep Dive on Veeva last month.

It feels as though Veeva can transition from growth juggernaut to quiet compounder, an industry-specific SaaS play in the footsteps of Autodesk.

I clearly haven’t timed this one well, but that’s okay. Money in > Money out.

$SE: 400% returns in 2020 notwithstanding, Sea hits all the macro trends performing right now. Gaming. Online shopping. Payments.

$LULU: Deep Dive on Lululemon from October.

There’s a lot of momentum in SaaS right now. For good reason. I’m down with SaaS.

But I’ve been craving something else. A little diversification from Net Dollar Retention. A little diversification from PS levels through the roof. Something a little more… basic?

$PTON: It’s hard not to like Peloton.

✅ Great hardware.

✅ Great software.

✅ Cultish community.

✅ Low churn.

✅ Great Founder/CEO.

✅ Perfect company for our less-than-ideal times.

$PINS: Once they really unlock e-commerce, watch out.

$MELI: Deep Dive on MercadoLibre from September.

The investment opportunity for $MELI could be great. There’s a ton to love in the story, the products, the market, the leadership. But some off-putting numbers and the wildly unknown geopolitical risk make it hard for $MELI to be a core position.

For now, I’m comfortable taking a flyer.

Watching it closely. And treading carefully.

$BABA: I don’t know where Jack Ma is. I’m sure he’s fine (🤞). But I’m certainly having second thoughts on investing in China.

On the one hand, $BABA is an undervalued beast. On the other hand, aren’t there enough companies in democratic nations that would let me sleep easier at night?

$COST: I have similar thoughts about Costco as I do about Facebook. Mature company, likely won’t hurt me, will likely outperform.

Annual returns the last eight years:

Fun fact: $COST was my first-ever thread on Twitter ⬇️

I’ll touch very quickly on our sells for the quarter, Disney and Republic Services. I sold both positions fully on November 9th, each for a small gain.

I spoke about the decisions to sell them at the time here.

$DIS

Disney is just not built for COVID (Disney+ notwithstanding). Pfizer can say whatever they want, but COVID is still very much here, and affecting every part of Disney’s business. Such a bummer.

$RSG

I picked up some Republic Services on March 6 of this year. As the world was on the brink of shutting down, trash seemed like a good, reasonable, safe play. Right?

Well, not exactly. People not going anywhere = people not producing trash. Whoops. I took a small gain and am shifting the proceeds into names that better reflect my current investing philosophy and goals.

Since then:

Some technical analysis post selling:

$DIS: 😬

$RSG: 💪

My highlights from the last quarter were not $PTON or $PINS (although those were nice). My highlights have been building this little newsletter and meeting new people on #Fintwit. (DMs are open, come say hi!)

I recently listened to Patrick O’Shaughnessy on the Acquired podcast, hosted by Ben Gilbert and David Rosenthal. Towards the end of their conversation, Ben remarks about their respective podcasts and communities:

This is the thing we’re weird on the internet about. Come join us.

I felt the same way.

Thanks to all of you for joining me to wrap up 2020 (what a year!). I’ve really enjoyed being weird on the internet with all of you.

Thank you so much for reading this Quarterly Recap. You can find last quarter’s recap here. Let us know what you think by liking/commenting/sharing!

And if you’re new here, don’t be shy! We’d love to have you subscribe to Musings by Mazwood. We aim to be respectful of your inbox and post portfolio updates, market commentary, company deep dives, and more. We hope you’ll join us!

hey, great writeup - I'd love to chat...I run Wall Street Oasis (860k+ member community focused on careers in finance). can you ping me at Patrick@wallstreetoasis.com? not sure how else to contact you :-)