I’ve got Danaher in three different accounts.

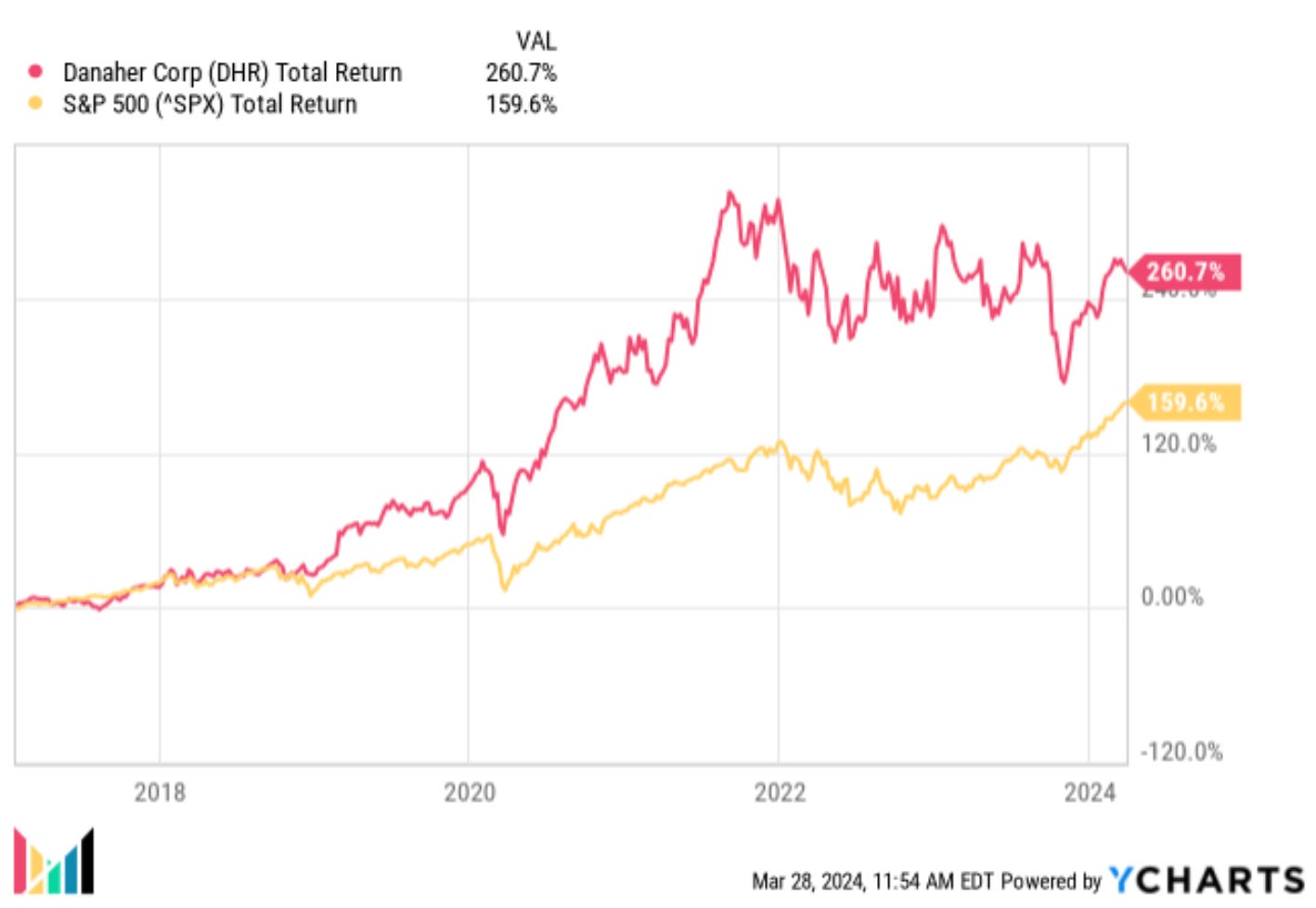

Account J: First buy 1/26/2017. Cost basis of $71.52. First tranche is up 249.46%. Blended return is up a more modest 31.82% (most of the capital was invested in 2023, whoops).

Account L: First buy also 1/26/2017. Cost basis of $71.49. Total return is 237.38% (never added, whoops again).

Account Z: First buy 3/10/2023. Cost basis of $211.89. Blended return 16.25%. SPX, meanwhile, is up 38.18% in the same timeframe.

At least in Accounts J & L, the position has beaten the market from that January 2017 purchase date.

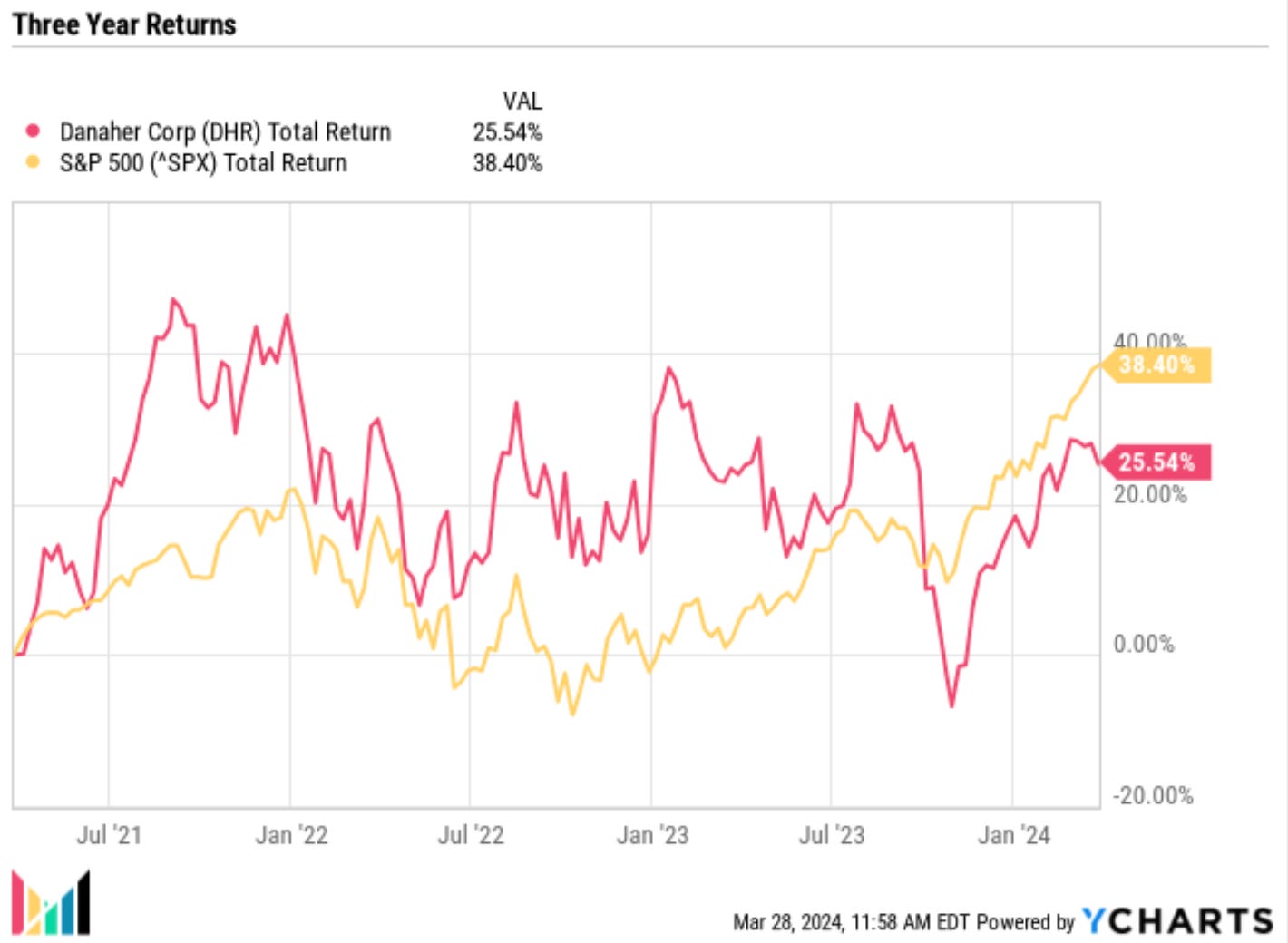

The last 1Y and 3Y periods haven’t been as kind.

A few, quick, self-reflective questions:

For Accounts J & L with 2017 purchases, why did I add to the position in one and not the other?

In Account J, when I finally did add to the position, why was the bulk of the capital added in 2023? Did I have better things going on in the six previous years?

So what’s the plan? With a few years of underperformance, is now a time to add? To cut bait? To still do nothing?

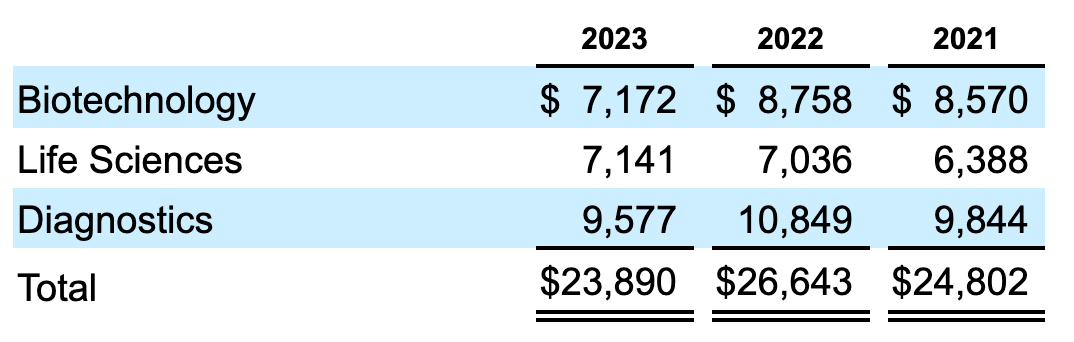

Let’s look at some high level numbers:

Okay, they do a lot of spin-offs and Covid was weird, but you can’t love decelerating revenue growth to negative revenue growth. That doesn’t necessarily inspire confidence. It leads to lower EPS, lower FCF. Then we’ve got shrinking profitability metrics and margins and it’s not like I look at this and want to shout “I love you!” Right?

What does Danaher have to say about revenue declines? From the 2023 10-K:

Consolidated revenues for the year ended December 31, 2023 decreased 10.5% and core sales decreased 10.0% as compared to 2022 primarily due to the decline of demand for COVID-19-related products, and to a lesser extent declines in demand for other products and services.

Covid stuff is wonky, will give them that. But additionally, to experience “declines in demand for other products and services.”

And moving forward?

The Company expects the impact of reduced demand and reduction of customer inventory levels to continue into the first half of 2024. Additionally, the Company expects core revenue for the bioprocessing business to decline for the full year 2024, as core revenue declines in the first half of 2024 more than offset a gradual improvement to core revenue growth by the end of 2024. Core sales in the discovery and medical business decreased year-over-year due to lower demand for lab filtration, medical and diagnostics and genomics product lines, partially offset by increased demand for protein research products.

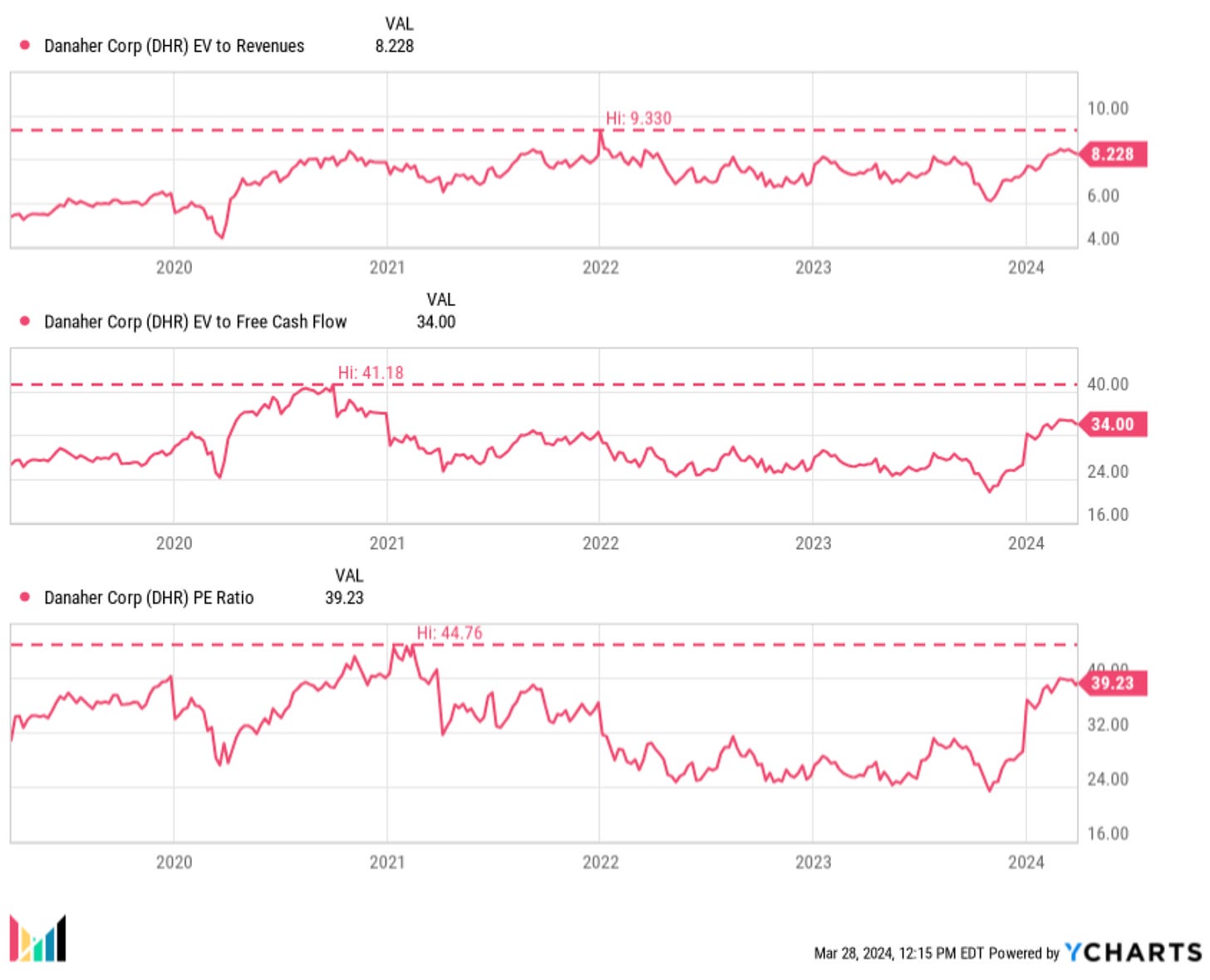

Well, at least it must be trading at a low to decent multiple due to this relative negativity?

Oh, what’s that? Valuation looks to be near all-time highs? Uhhh.

I like Danaher. I like family businesses! Founded by the Rales brothers, who still serve as Chairman of the Board / Chairman of the Executive Committee, the company operates three segments that are out of my comfort zone, so letting Steven & Mitchell take care of it for me has (theoretically) been nice.

Danaher describe themselves as “a global science and technology innovator committed to accelerating the power of science and technology to improve human health.” Comprised of 15+ companies, Danaher operates in three segments: Biotechnology, Life Sciences & Diagnostics.

The Biotechnology segment includes the bioprocessing and discovery and medical businesses and offers a broad range of equipment, consumables and services that are primarily used by customers to advance and accelerate the research, development, manufacture and delivery of biological medicines.

The Life Sciences segment offers a broad range of instruments, consumables, services and software that are primarily used by customers to study genomics and the basic building blocks of life, including DNA and RNA, nucleic acid, proteins, metabolites and cells, in order to understand the causes of disease, identify new therapies, and test and manufacture new drugs, vaccines and gene editing technologies.

The Diagnostics segment offers clinical instruments, consumables, software and services that hospitals, physicians’ offices, reference laboratories and other critical care settings use to diagnose disease and make treatment decisions.

Again, I like Danaher, but almost three years after last making a high, and with an October to present day bump of $185 to $250…

…maybe now is the time to say

…and look for market-beating returns elsewhere.

Happy shopping!